Dodl: AJBell’s

younger brother

Our take: If you’re just starting to pedal into the world of investing with small stakes, Dodl could be your ride partner, all while drafting behind its big bro, the Tier 1 brokerage powerhouse, AJBell. But while AJBell rides a well-marked route, Dodl seems a bit lost, like a cyclist without a GPS. And let’s be real—no other broker in the peloton charges a 0.15% custody fee. That’s like breaking away from the pack, but in the wrong direction!

Assessment: The absolute score comes out at 3.6, helped by backing of AJ Bell. The relative category score is lower at 3.4, as fees are very important for low-cost broker clients.

Is it suitable for you?

- Passive Investors: Dodl offers several low cost, widely diversified funds and ETFs which can act as set and forget portfolios. Schedule a monthly direct debit and investment instruction and you’re good to go. Dodl excels at serving this customer demographic. However, it may not be cost effective for large portfolios.

- Semi-Active Investors: Dodl includes fund offerings in gold, real estate and emerging markets, which are useful for anyone tilting their investments away from the market as a whole. If Dodl had a larger range of investments it would be appealing for those trading more often, given its no-commission model and Tier 1 backing. Unfortunately, its limited range makes it fairly unattractive for non-beginners and custody fees quickly bite into accumulated wealth.

- Advanced Investors: Without access to margin loans, share lending or derivatives, with a limited range of securities and high custody fees, Dodl isn’t the ideal choice for the most active of investors.

This article contains affiliate links. We provide full transparency on how it works.

Pros & Cons and suitability

Pros & Cons

- Low cost for small portfolios

- Backed by established brokerage

- Uncluttered, simple user interface

- Limited ETF range

- Limited range of family friendly tax efficient accounts

- Few advanced features

- Fixed percentage custody fees are expensive for large portfolios

Suitability

Suitable

Excellent basic range of investments, but problematic as your portfolio grows given custody fee

SOMEWHAT Suitable

some desirable ETFs missing and expensive for larger portfolios

UNSUITABLE

Limtied ETFs, derivatives, margin loans. High custody charges for large portfolios.

Availability

Dodl is only available in the United Kingdom

Dodl is not available to dual citizens. Sole British citizenship is required to open an account.

Broker Snapshot

Why Is Dodl by AJBell A Tier 2 Broker?

Dodl was announced in late 2021 and launched in summer 2022 by AJBell, the major Manchester based brokerage firm. As it is fully owned and controlled by AJBell, the relevant background financial details are those of AJBell itself. Founded 1995, the firm is listed on the London Stock Exchange with a market cap of £1.25 billion as of 28th of March 2024

The company is in solid financial shape with steadily growing revenues and profits over the past three years, posting a pretax profit of £87.7m GBP in 2023. The direct to customer (non-advised) portion of the company has over 300,000 customers and 22 billion GBP under administration. While Dodl has the support of a very significant player in the UK investment environment, it is competing in the low-cost segment, rather than against other Tier 1 players.

Regulated, with Listed Long Standing Parent

Launched less than two years ago, Dodl is fully owned by AJBell, listed on LSE and a a leading and very profitable financial institution in the UK. As all Brokers, it offers client protection up to £85k under the Financial Services Compensation Scheme and is regulated by the FCA.

Company Info

| Characteristic | Dodl |

|---|---|

| Inception Date | 🛈 2022 |

| Headquarters | 🛈 Manchester |

| Key Owner | 🛈 Andrew Bell (20%) |

| Bank Affiliated | ❌ No |

| Listed on Stock Exchange | ✅ LSE (Parent) |

| Parent Rating | ❌ No |

| Net Profit (2023) | ✅ £87.7m 🚀 (Parent) |

Regulation

| Feature | Dodl |

|---|---|

| EU Entity | 🛈 None |

| UK Entity | 🛈 AJ Bell Dodl |

| Key Regulators | ✅ UK |

| EU Regulator | N/A |

| UK Regulator | ✅ UK (FCA) |

| EU Guarantee | N/A |

| UK Guarantee | 🛈 Max. £85k |

Average Custody fees, Low eTF availability, No Cash Interest

Dodl, offers a limited amount of ETFs and no foreign exchange access. The fee structure is appealing mainly for smaller portfolios but it is quite expensive for larger ones. No interest is paid on cash, and foreign exchange fees are averaged.

Features

| Feature | Dodl |

|---|---|

| Key Base Currencies | 🛈 GBP |

| ETF Availability | ⚠️ Low (< 20) |

| Multicurrency | ❌ Not Available |

| Cash Interest | ❌ No |

| Margin Loans | ❌ Not Available |

| Exchanges | ✅ LSE |

| External PFOF Reliance | ✅ None |

Fee Structure

| Feature | Dodl |

|---|---|

| Custody Fees | ↔️ Average |

| Inactivity Fees | ✅ None |

| ETFs Dealing Fees | ✅ None |

| FX Fees | ↔️ Average |

| Deposit Fees | ✅ None |

| Withdrawal Fees | ✅ None |

| Security Lending | 🛈 Not Available |

I. Company

Dodl is part of a well-established and listed parent company. Furthermore, it has a clean record with no history of regulatory or compliance fines. We assessed the parent at 4.5, but notched down Dodl by 0.5 due to the subsidiary nature and standalone positioning against mostly unprofitable Tier 2 players.

Business Profile

The motivation behind the product is the leadership at AJBell responding to new, application-based investing firms like Robinhood, eToro, Trading 212 and FreeTrade. Although much smaller in the UK than Tier 1 broker power houses like Hargreaves Lansdown, AJBell or Interactive Investor, they may be able to onboard the current generation of investors more easily, with advertised low fees and user-friendly platforms. As Andrew Bell, the founder of AJBell put it to the FT: “We don’t want to wake up in 10 years’ time and find that these customers have gone somewhere else and we’ve missed the boat.”

Ownership and Transparency

As a product line provided by AJBell, the same background ownership structure applies, with Andrew Bell the co-founder retaining approximately 20% ownership as of 3rd April 2024, followed by Liontrust Asset Management at 8.6% and investment trust specialists Baillie Gifford at 5.9%. As AJBell is traded on the LSE there is a good degree of clarity as to its financial position and business strategy and extensive published investor relations information.

Safety Considerations

AJBell is one the handful of biggest retail investment firms in the UK and has been profitable over recent years. It might for that reason warrant special treatment from regulators in case of crisis and at could inspire more confidence in customers than unlisted and currently unprofitable start up brokers delivering a similar style of product.

Regulation & Investor Compensation Schemes

The FCA have regulatory oversight for AJBell and by extension Dodl. The Financial Services Compensation Scheme protects up to £85,000 per institution in event of firm failure. Importantly this is per customer per institution. A customer with £85,000 in an ISA and £85,000 in a SIPP would only be able to seek up to £85,000 total compensation in case of firm failure.

Share & Cash Custodians

AJBell holds all customer cash including that of Dodl account holders across several major banks (including Lloyds Corporate Markets, Investec, Qatar National Bank) with a maximum of 35% of any customer’s cash being held with any given bank. Client shares and funds are held in ring fenced nominee accounts separate from AJBell’s own assets.

Reputation

Whild Dodl is new on the scene and has little media coverage and no regulatory interventions to note, the parent company is reasonable proxy for how Dodl will be seen in this regard. AJBell has a good reputation, having grown from a small brokerage in the 1990s to a major UK platform with nearly half a million customers, and £71 billion in assets under administration. Unlike some competitors it has not been subject to scandal around heavy-handed fund recommendation or pushing for clients to take expensive advice. It also does not heavily feature equity or fund research on its platform, which aligns with the values of wise, long term rather than trading driven investment.

II. Fee structure

While Dodl advertises itself as a low-cost Broker, when you run the numbers it turns out to be relatively expensive, even against the larger traditional UK Brokers. So, fees are only attractive for commissions, before looking at the custody fee. Everything is standardized across ISA, GIA, LISA and SIPP accounts with each following an identical fee structure.

Platform fees

Custody fees are at 0.15% for all accounts. This fee is not tiered and does not reduce with portfolio size.

Trading Commisions

Trading is commission free and this is particularly attractive for those starting out with investing and investing smaller amounts where even moderate dealing and custody fees can eat into annual returns in a discouraging way. The high commissions charged by major brokerage houses in the UK have been the main argument in favor of the newer, app-based challengers, like Dodl.

Overall Fee Simulation vs Competitors

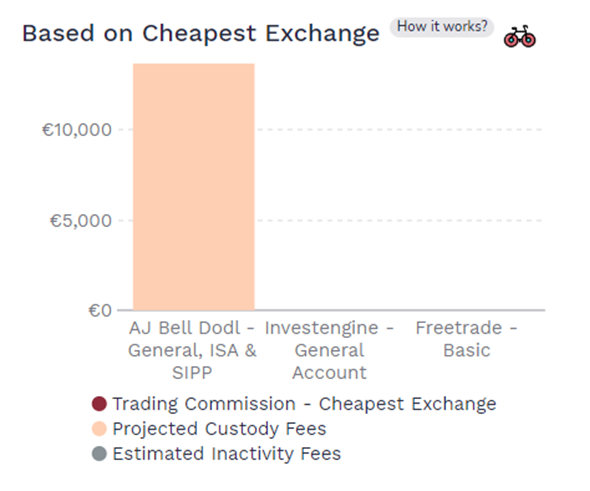

Most of our readers have simple Index portfolios. Using our Broker Total cost calculator, you can estimate the total cost of holding ETFs throughout the investment period. For our similuated scenarios:

- General Accounts – Dodl is not competitive

- ISAs – Dodl is not competitive

- SIPPs – Dodl is not competitive

Fee Simulation For General Accounts

As InvestEngine and FreeTrade charge zero commission or custody fees on their GIA accounts, Dodl’s custody charge leaves it looking expensive in comparison over a 20-year accumulation period at £13,689.

Investor assumptions

| Model Feature | Assumption |

|---|---|

| Investor | UK |

| Instrument | UCITS ETF |

| Account | General |

| Initial Investment | £ 100,000 |

| Monthly | £ 1,000 |

| Time Horizon | 20 years |

| Gross Return | 8% |

Total Fees

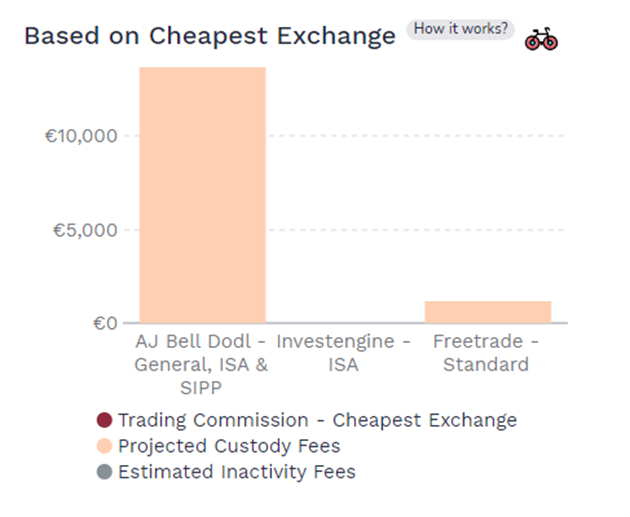

Fee Simulation For ISAs

In the below simulation, a 20-year accumulation period broker bill for an ISA account, we can see that Dodl is the most expensive of the three at £13,689, Freetrade Standard second at £1,198 and InvestEngine is the cheapest at zero. While it charges no trading commission and has low custody fees, these fees still stack up when the portfolio becomes sufficiently large. Dodl does not successively reduce and waive the custody fee on large portfolios, in contrast to its big brother AJBell or other UK brokers like Hargreaves Lansdown.

Investor assumptions

| Model Feature | Assumption |

|---|---|

| Investor | UK |

| Instrument | UCITS ETF |

| Account | ISA |

| Initial Investment | £ 100,000 |

| Monthly | £ 1,000 |

| Time Horizon | 20 years |

| Gross Return | 8% |

Total Fees

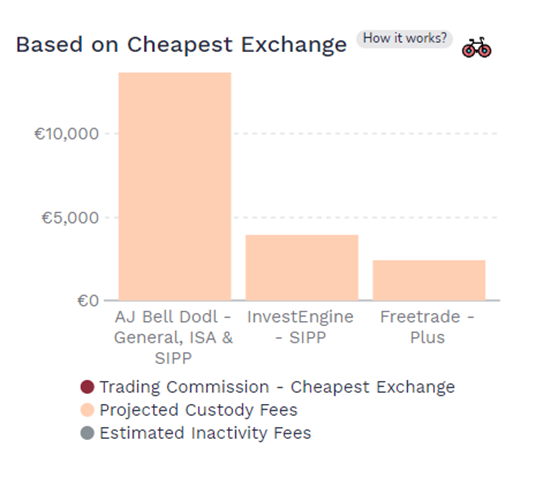

Fee Simulation For SIPPs

Dodl costs £13,689 in custody fees over the 20 year period, higher than InvestEngine at £3,958 and Freetrade Plus at £2,398. Again, this shows the impact of the percentage custody charge on larger portfolios over time.

Investor assumptions

| Model Feature | Assumption |

|---|---|

| Investor | UK |

| Instrument | UCITS ETF |

| Account | SIPP |

| Initial Investment | £ 100,000 |

| Monthly | £ 1,000 |

| Time Horizon | 20 years |

| Gross Return | 8% |

Total Fees

Currency Exchange fees

As Dodl only offers the capacity to deal overseas on US exchanges and at home on the LSE, the FX fees are relatively straightforward. They are high, so a trade in and out of a US share can stack up 150 BPS in costs. This is before the spread, which Dodl does not give information on.

However, this will impact only those who stray from the wise investing path and start trading individual stocks on a regular basis.

FX Fees

| Transaction Value | FX fees for US trade |

|---|---|

| <£10,000 | 0.75% |

| £10,000-£20,000 | 0.50% |

| £20,000+ | 0.25% |

Other fees

There are no other fees like withdrawal or deposit fees.

III. Platform & Features

Dodl is a mobile app only platform and keeps things simple. They cover the basics, but more advanced investors won’t find features they typically find with Tier 1 brokers.

Account Opening Process

This is straightforward and takes only as long as you need to download the app and input your details and proof of identity.

account Features

You can see your accounts and balances on the homepage then locate and set up monthly or individual investments into different funds or shares. Rather than being overwhelmed with pointless market information and news, the app has a clean appearance, and you will see more emojis than flashing tickers and graphs. If you run into difficulties, Dodl offers the same quality customer service to its customers as AJBell does to its traditional brokerage account holders.

One thing you’ll notice is the relatively small range of funds on offer. All the core essentials are there – global index trackers, US and European funds emerging markets options, government and corporate bonds. But you have limited choice in each category. In our view the range is good but could benefit from additions, particularly to allow those persuaded by the case for factor investing to add value, quality or small cap tilts to their portfolios.

Dodl’s fund range includes AJBell’s in house funds, which are somewhat more costly than other options at around 30 bps, but not extortionately so.

A potential downside of the thematic options Dodl offers (funds and ETFs in robotics, tech, infrastructure, ESG) lurks in the fact that taking naive sector bets is likely to lead to underperformance. As Joe Wiggins puts it:

“Popular thematic funds will almost inevitably have strong recent performance. When we invest we must be clear about what we think is not already understood by the market and priced accordingly.”

Including thematic options over more well proven factor ETFs (like value, quality or small companies) detracts from an otherwise excellent setup for beginner and intermediate investors.

The app makes it easy to set up a direct debit from your bank to Dodl, then select how much you want to regularly invest in a particular fund. You could easily do this then not open the app again for a year and let your money get to work in the markets.

Internalisation and PFOF

FCA regulation has acted to shut down any conflict of interest between brokers and customers over execution by banning payment for order flow in the UK. Dodl is no exception and does not make money from this practice.

Cash Interest

No interest is paid on cash deposits in Dodl accounts. Dodl’s website emphasizes the importance of getting your money invested as quickly as possible and it may be that this choice is a cross subsidy for the low fees charged elsewhere on the account. This means that it is critical for investors including cash as part of their portfolio to look elsewhere for a cash savings account. With the Bank of England SONIA benchmark at 5.19% as of 18th of April 2024 and the best cash savings accounts in the same ballpark, leaving cash uninvested in a Dodl is a significant lost opportunity.

Advanced Features

Dodl prioritizes simplicity and user-friendliness, with a focus on traditional investment products. As such, it does not offer advanced trading features like Futures, Options, Derivatives, and Margin Loans, catering more to investors looking for straightforward investment options. Below a summary of the available investment types:

Features

| Investment Type | Availability |

|---|---|

| ETFs | ✅ |

| Stocks | ✅ |

| Bonds | ❌ |

| Funds | ✅ |

| Options | ❌ |

| Derivative | ❌ |

| Futures | ❌ |

| CFDs | ❌ |

| Forex | ❌ |

| Crypto | ❌ |

| Commodities | ✅ (Gold spot tracker, via UCITS ETF) |

IV. Taxes

Tax Wrappers

- ISA

- SIPP

- Lifetime ISA

Tax Reporting

For those investing outside of the shelter of ISA or SIPP accounts, Dodl will automatically provide an annual tax summary.

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – Global Shocks: How Do Stocks Perform?

Trading 212 Review: Pros & Cons

Cash Is Not Enough: Why Hold Bond ETFs Despite Price Rollercoasters.

The Truth About €1 Million Broker Guarantees (Updated With Trading 212 Cap)

Halifax Share Dealing Review – Similar To Lloyds With SIPP On Top

Lloyds Share Dealing Review – Old School But Ticks The Boxes For Golden Retrievers

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.