AJBELL REVIEW

Our take: AJBell is a Tier 1 broker with a good reputation, long track record and competitive fees. Only the most advanced investments are beyond the scope of the platform for many UK based investors it will be a top choice.

Is it suitable for you?

- Passive Investors: Good user interface and customer service combined with a wide range of ETFs and funds. Those running simple portfolios will find it straightforward to set up and manage accounts and automate investments at low cost.

- Semi-Active Investors: With hundreds of ETFs available, investors adding factor or sector tilts to their portfolios have their bases covered, although costs are a hazard for those placing multiple trades per month.

- Advanced Investors: AJBell provides access to enough ETF instruments to run more complex portfolios but doesn’t offer margin loans, derivatives or US ETFs. High FX fees also detract from the platform’s suitability for more active international investors.

This article contains affiliate links. We provide full transparency on how it works.

Pros & Cons and suitability

Pros & Cons

- Long Track Record, listed on LSE

- Great range of funds

- Complete set of tax wrapper accounts

- Great customer service

- Low cash interest

- search function non intuitive On Web Platform

- High commissions for non-regular ETF investing

- No margin loans or U.S. ETF access

Suitability

VERY Suitable

Low regular dealing fees, low custody and excellent fund range.

Suitable

tools FOR advanced portfolios, FAMILY ACCOUNTS.

Somewhat Suitable

Lack of margin, US ETFs and derivatives, high FX costs.

Availability

AJBell is Available in the UK

To open accounts with AJBell you’ll need to be a UK resident with a national insurance number.

Broker Snapshot

Why Is AJBell A Tier 1 Broker?

AJBell is a long established UK broker firm going back to 1995 and founded by Andrew Bell. It has offices in London and its headquarters in Manchester. The firm comprises two divisions, an Advisor platform allowing financial advisors to manage client portfolios and a direct to customer platform for retail investors to place trades and manage their own portfolios. Across these divisions AJBell has 484,000 customers and £76.2 billion assets under administration, £25.2 billion of which are held in retail investor accounts. Its size, customer base and average balances put it in the top bracket of UK firms with other names like Interactive Investor, Fidelity International or Hargreaves Lansdown.

Established, Listed and Profitable

AJBell is listed on LSE that experienced an increase profitability in the last few years. It is regulated by the FCA in the UK. Customers’ money and assets up to £85,000 per person are protected under the FSCS. Additionally, it has been a major player in the UK markets for almost 30 years.

Company Info

| Characteristic | AJBell |

|---|---|

| Inception Date | 🛈 1995 |

| Headquarters | 🛈 Manchester UK |

| Key Owner | 🛈 Andrew Bell (~20%) |

| Bank Affiliated | ❌ No |

| Listed on Stock Exchange | ✅ LSE |

| Parent Rating | ❌ No |

| Net Income | ✅ £87.7m 📈 |

Regulation

| Feature | AJBell |

|---|---|

| EU Entity | 🛈 N/A |

| UK Entity | 🛈 AJ Bell plc |

| Key Regulators | ✅ FCA, UK |

| EU Regulator | 🛈 N/A |

| UK Regulator | ✅ FCA, UK |

| EU Guarantee | 🛈 N/A |

| UK Guarantee | 🛈 Max. £85k |

Extensive ETFs Range, Competitive Fees

AJBell offers access to various European and international exchanges, along with a range of stocks and ETFs. The dealing fees for UK products are low mostly if you use the regular investing service. Interest on cash varies by account type. Custody fees are also competitive for ISA and very competitive for SIPP accounts. AJBell doesn’t provide multi-currency accounts or margin loans. FX fees are high, making international transactions quite expensive.

Features

| Feature | AJBell |

|---|---|

| Key Base Currencies | 🛈 GBP |

| ETF Availability | ✅ Excellent (3,521 ) |

| Multicurrency | ❌ Not Available |

| Cash Interest | ↔️ Average |

| Margin Loans | ❌ No |

| Exchanges | ✅ 24+ exchanges |

| External PFOF Reliance | ✅ None |

Fee Structure

| Feature | Freetrade |

|---|---|

| Custody Fees | ✅ Competitive |

| Inactivity Fees | ✅ None |

| ETFs Dealing Fees | ✅ Low |

| FX Fees | ↔️ Average |

| Deposit Fees | ✅ None |

| Withdrawal Fees | ✅ None |

| Security Lending | ✅ No |

I. Company

AJBell has a long history, sound finances and clear business model. It has avoided regulator intervention by maintaining high standards of customer service and continues to grow and retain its customer base by offering a good product.

Business Profile

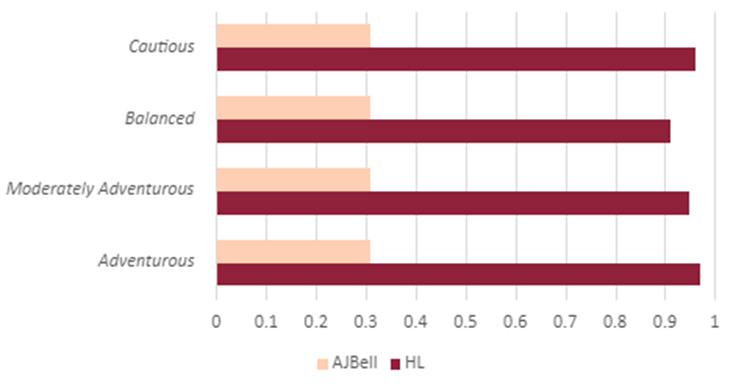

AJBell makes money in two core ways – the fees it charges on client activity (share and fund dealing commissions) and asset custody charges. AJBell is targeting a similar segment of the UK market as other Tier 1 brokers. Its customers have significant personal savings, but not so much as to be attracted to private banking or wealth management boutiques. The average customer is 42 years old and has a portfolio valued at £72k. Although not principally a fund manager or equity research shop, AJBell does manage a range of mutual funds pitched at different subjective risk profiles, from Cautious to Adventurous. These are reasonably priced versus those of key competitor Hargreaves Lansdown, at 31 basis points. But they remain more expensive than the cheapest index funds ETFs.

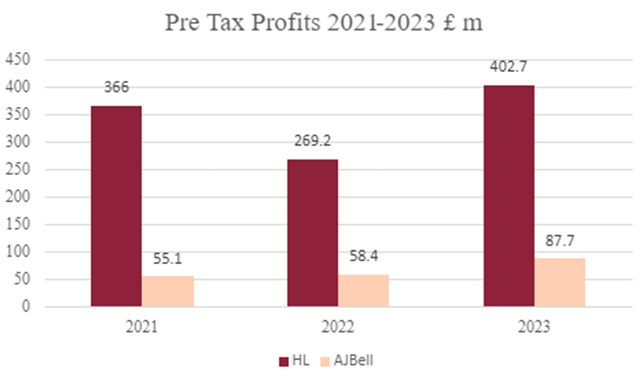

AJBell has been consistently and increasingly profitable over the past 3 years, posting a record pre tax profit of £87.7m for the year 2023. Profits are dwarfed by the scale of those much larger competitor HL, which posted £402.7 pre tax in 2023, but things are going in the right direction. The company looks healthy.

Mutual Funds Fees: AJ Bell vs HL

Pre Tax Profit: AJ BELL VS HL

MUTUAL FUNDS FEES: AJ BELL VS HL

PRE TAX PROFIT: AJ BELL VS HL

Ownership and Transparency

AJBell was a private company from inception in 1995 until its 2018 IPO which secured a valuation of £651m. As of March 2024, the market cap of the firm stands at £1.2 billion. Andrew Bell the co-founder retains approximately 20% ownership as of 3rd April 2024, followed by Liontrust Asset Management at 8.6% and investment trust specialists Baillie Gifford at 5.9%. As a listed company it provides extensive investor relations information detailing its activities. AJBell is unrated by credit ratings agencies, but this may be a by-product of the firm’s stated aim to be a “capital light and materially debt free business”, independent of the need to borrow from banks or issue bonds to raise money.

Safety Considerations

On paper, healthy revenues, capital and a clear business model can give investors more confidence that AJBell will stay afloat than they might have in unprofitable neo-broker startups. While large, AJBell is not deemed a systemically important financial institution or bank, we can’t assume it would receive special treatment in a crisis.

Regulation & Investor Compensation Schemes

The Financial Services Compensation Scheme protects up to £85,000 per institution in event of firm failure. Importantly this is per customer per institution. A customer with £85,000 in an ISA and £85,000 in a SIPP would only be able to seek up to £85,000 total compensation in case of firm failure.

Share & Cash Custodians

AJBell holds all customer cash divided across several major banks (including Lloyds Corporate Markets, Investec, Qatar National Bank) with a maximum of 35% of any customer’s cash being held with any given bank. Client shares and funds are held in ring fenced nominee accounts separate from AJBell’s own assets.

Reputation

AJBell has a good reputation, having grown from a small brokerage in the 1990s to a major UK platform with nearly half a million customers, £71 billion in assets under administration. Unlike some competitors it has not been subject to scandal around heavy handed fund recommendation or pushing for clients to take expensive advice. It also does not heavily feature equity or fund research on its platform, which aligns with the values of wise, long term rather than trading driven investment.

II. Fee structure

If used carefully AJBell is competitive both on custody and commission charges. It is strongest as a SIPP platform, coming up less expensive than industry giant Hargreaves Lansdown. It also does well against Interactive Investor, which works on a purely flat fee model.

Platform fees

Custody Fees

| Account | ETFs, Shares & Trust Fees | ETFs, Shares & Trust Cap | Mutual Funds Yearly Fees |

|---|---|---|---|

| General & ISA | 0.25% | £3.50 per month | <250k 0.25%, 250-500k 0.10%, >500k 0% |

| SIPP, Junior SIPP | 0.25% | £10 per month | <250k 0.25%, 250-500k 0.10%, >500k 0% |

| Junior ISA | 0.25% | £2.50 per month | 0.25% |

| LISA | 0.25% | £3.50 per month | 0.25% |

Trading Commisions

AJBell Trading Costs are as follow:

- UK & International Trading : Placing a trade on an ETF will cost £5.00. These costs also apply to individual shares and investment trusts.

- Regular Investing (only UK Funds): This drops to £1.50 for monthly regular investments.

- Mutual Funds Trading : Fund dealing always costs £1.50 per deal, regardless of scheduling.

Overall Fee Simulation vs Competitors

Most of our readers have simple Index portfolios. Using our Broker Total cost calculator, you can estimate the total cost of holding ETFs throughout the investment period. For our simulated scenarios:

- General Accounts – AJBell is average

- ISAs – AJBell is competitive

- SIPPs – AJBell is very competitive

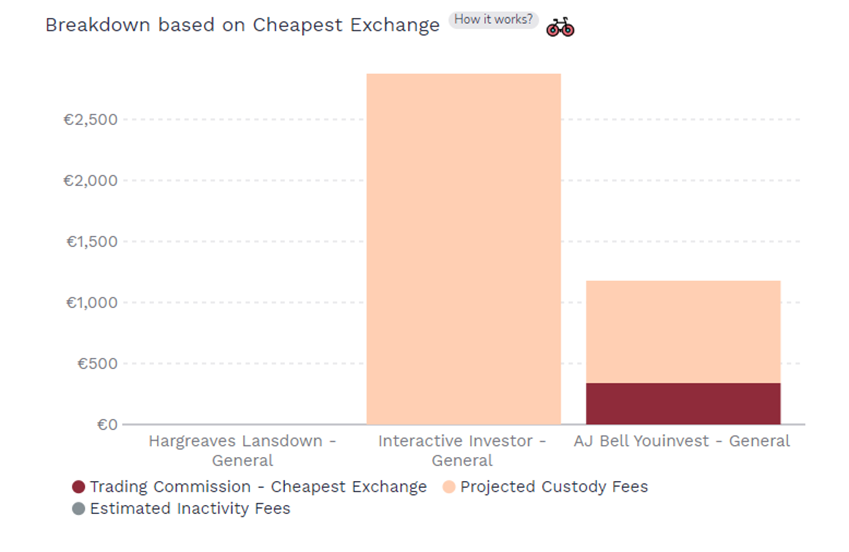

Fee Simulation For General Accounts

AJBell beats flat fee broker Interactive Investor by a wide margin when investing regularly into a general investment account with total costs of £1,182 against Interactive Investor’s £2,878. But the combination of zero commission regular ETF dealing and zero custody charges for ETFs at HL means HL undercuts AJBell since HL is effectively offering a free investing service in the General Investment Account.

Investor assumptions

| Model Feature | Assumption |

|---|---|

| Investor | UK |

| Instrument | UCITS ETF |

| Account | General |

| Initial Investment | £ 100,000 |

| Monthly | £ 1,000 |

| Time Horizon | 20 years |

| Gross Return | 8% |

Total Fees

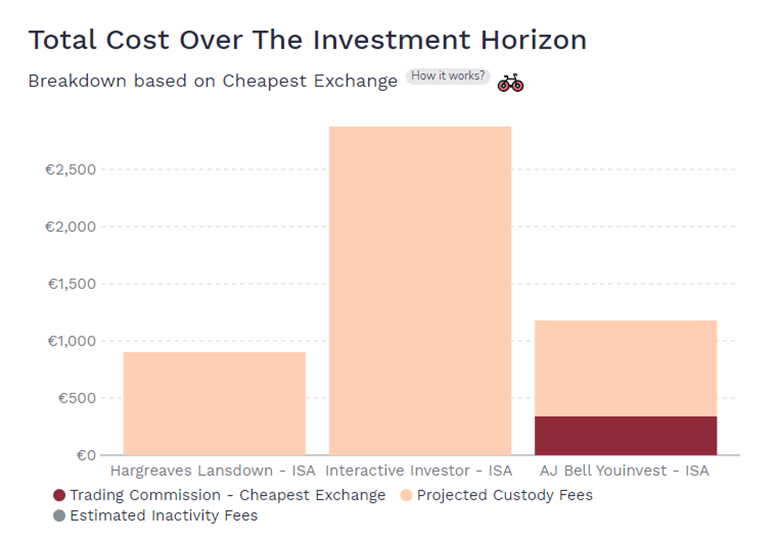

Fee Simulation For ISAs

In our ISA fees simulation AJBell was more expensive than HL but less expensive than Interactive Investor. We can see that the monthly impact of dealing fees leaves AJBell behind HL at £1,182 in total expenses versus HL’s £900 over the same time period. AJBell remains a better platform for ISA investors than ii, which despite offering free monthly investing a flat fee which leaves its clients worse off in this product at £2,878 in costs.

Investor assumptions

| Model Feature | Assumption |

|---|---|

| Investor | UK |

| Instrument | UCITS ETF |

| Account | ISA |

| Initial Investment | £ 100,000 |

| Monthly | £ 1,000 |

| Time Horizon | 20 years |

| Gross Return | 8% |

Total Fees

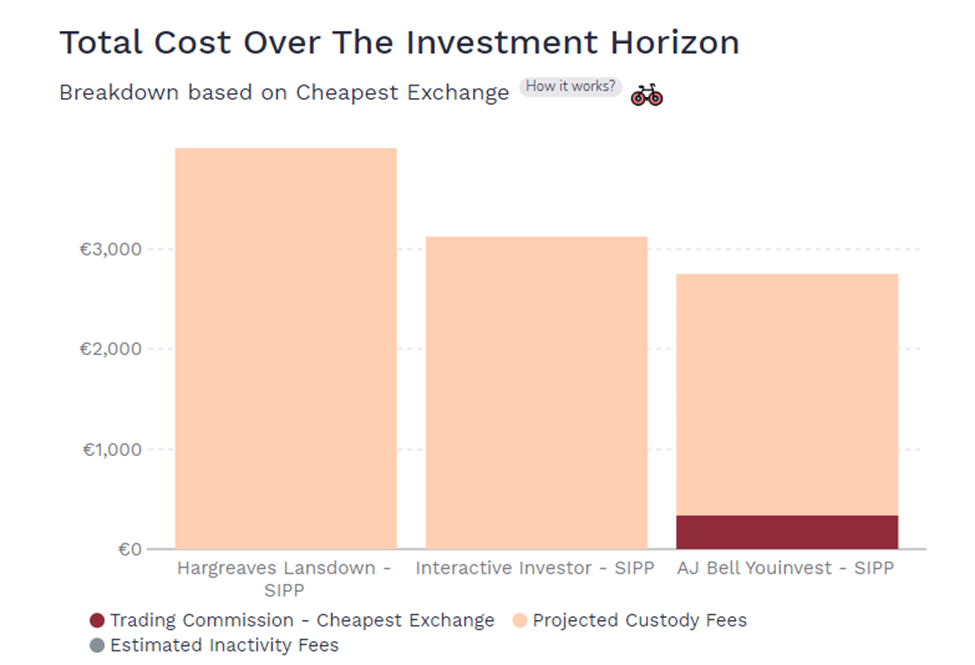

Fee Simulation For SIPPs

AJBell emerges as the most cost effective option of the big three Tier 1 brokers for SIPP services. Although both ii and HL can offer commission free regular trades to build a SIPP up, their custody fees are higher than AJBell. HL will charge £4000 in custody fees over the 20 year investment horizon used in our simulation, compared to £2,742 for AJBell. II will charge £3,118 in custody, against AJBell at £2,742.

Investor assumptions

| Model Feature | Assumption |

|---|---|

| Investor | UK |

| Instrument | UCITS ETF |

| Account | SIPP |

| Initial Investment | £ 100,000 |

| Monthly | £ 1,000 |

| Time Horizon | 20 years |

| Gross Return | 8% |

Total Fees

Currency Exchange fees

When trading in foreign currency denominated investments, you’ll be hit with high FX charges below 20k and average charges above 20K:

- First £10,000: 0.75%

- Next £10,000: 0.50%

- Over £20,000: 0.25 %

No information is available on spreads but assuming that most investors will be placing individual trades well under £10,000 in value, a 0.75% charge is high and would represent a loss of at least 1.50% of the value of your initial investment to enter and exit the position. AJBell shouldn’t be your first choice if you want to make trades on individual stocks funds overseas. Compared to the best in class for FX fees, Interactive Brokers, which charges just 0.2 basis points for FX, the UK brokerage environment looks extremely costly in this respect.

Other fees

Deposits and withdrawal are free of charge.

III. Platform & Features

As a Tier 1 platform, AJBell is not the most intuitive, however grants access to a very wide numbers of ETFs and other financial products. Cash is remunerated, but the rate is competitive just for SIPPs accounts. However, the platform lacks advanced trading instruments and features.

Account Opening Process

Opening an account is straightforward, requiring a UK national insurance number, proof of ID and proof of address. An account can be set up in just a few minutes. You don’t need to deposit money or place a trade to open the account, but contributions start at £5 minimum and regular investing services start at £25.00 per deal. Our experience of AJBell’s customer service both by email and phone has been exemplary.

account Features

AJBell’s platform interface isn’t the most smooth and intuitive and takes some getting used to. The search function in particular sometimes seems slow. The range of share and fund choice is massive, with 3500+ ETFs, 400 investment trusts, 4000+ funds, and over 15,000 shares available to deal in. If it’s in an ETF or OEIC, AJBell almost certainly has it for you. If you’re into factor tilts you’ll have access to them and if you’re into REITS or commodity spot price trackers ETCs you’ll find those too.

- Discounted Transaction. A good proportion (500 ETFs) of these securities can be invested in on an automated monthly basis with low dealing fees of £1.50 rather than the £5.00 usually incurred for placing ETF trades.

- Regular Investing Service. You can set up regular investing orders plus a direct debit from your bank account to put the investing process on autopilot for long periods without needing to log in.

If the average AJBell customer is middle aged and middle class then family friendly features are desirable:

- Junior Accounts. For those looking to manage family finances in one place AJBell offers Junior ISA and Junior SIPP accounts so you can invest for your children.

- Family Accounts. AJBell offers you the ability to link, view and execute on accounts held by other family members after completing forms to show you are the designated nominee.

Internalisation and PFOF

As with all UK based brokerages, FCA regulation has banned PFOF practices and all orders are handled. The best outcome for the customer is priority in selecting order execution venues.

Cash Interest

Interest is paid on a tiered basis and is not standardised across accounts. The rates are low relative to the Bank of England’s SONIA rate which stands at 5.19% on 4th of March 2024 and better rates are available in cash savings accounts, so investors with a substantial cash portion of their portfolio will want to consider carefully where they deploy this.

CASH Interest

| Cash Balance | SIPP | ISA | GIA |

|---|---|---|---|

| £0–£10,000 | 3.49% AER | 2.52 % AER | 1.96% AER |

| £10,000-£100,000 | 4.01 % AER | 2.88 % AER | 2.47% AER |

| Above £100,000 | 4.52 % AER | 3.55 % AER | 2.47% AER |

Advanced Features

AJBell is catering to an audience who want to build portfolios out of various equity and bond fund mixes and for the most part steer clear of more complicated investment strategies. You won’t find the ability to invest in US based ETFs. AJBell doesn’t offer any facility for taking on margin loans or lending securities in your portfolio and has no derivative contracts like futures and options. You can access commodity markets via ETCs after taking a suitability survey.

Features

| Investment Type | Availability |

|---|---|

| ETFs | ✅ |

| Stocks | ✅ |

| Bonds | ✅ |

| Funds | ✅ |

| Options | ❌ |

| Derivative | ❌ |

| Futures | ❌ |

| CFDs | ❌ |

| Forex | ❌ |

| Crypto | ❌ |

| Commodities | ✅ via ETCs |

IV. Taxes

AJBell scores highly on tax administration, providing investors the ability to plan in a tax efficient way for most of life’s eventualities – from saving for a house (LISA) to saving for the distant future for your children (J-ISA, J-SIPP). This gives AJBell an edge over some peers like Interactive Investor who offer a more limited range of tax advantaged accounts.

Tax Wrappers

The platform provides the full range of UK tax efficient investing accounts for those UK tax residents aiming for tax relief (SIPP) or capital gains and income tax shielding (ISA, LISA).

- ISA

- LISA

- SIPP

- Junior ISA

- Junior SIPP

Tax Reporting

For those clients who invest outside a tax wrapper in a dealing account, AJBell will provide an annual tax summary to help with filing.