Finding Your Broker Tribe: Our Broker Classification System

Definitive guide to choosing a stock broker - Part 2

This is part 2 of Bankeronwheels.com’s Definitive Guide to choosing a Stock Broker.

Most comparison sites lump brokers together, as they don’t have an in-depth knowledge of how investors think about counterparty exposure and products. Most of the websites are also conflicted, often promoting brokers with the highest-earning commissions. We take a more professional angle. How would an institutional investor categorise them?

Discover the Bankeronwheels.com Broker Classification System developed internally by our team.

It’s your blueprint for navigating the brokerage landscape, though remember, not all fit neatly into boxes, and your locale might tweak the game.

KEY TAKEAWAYS

- Traditional Brokerage Arm Of A Bank – like HSBC or BNP Paribas, which are integral to global financial system. These brokers offer reliability due to their banking affiliation, but are high cost, and often don’t have depth of products as they are non-core to Bank.

- Direct Brokers Backed By A Banking Group – like Fineco, Boursobank, Fortuneo, are digital direct-to-consumer leaders, offer banking group affiliation – often with digital banking services – and the benefits of lower costs.

- Tier 1 Pure Players – like Swissquote or SAXO may hold banking licenses, but focus primarily on brokerage services. Banking is non-core, and they are typically not owned by a Bank. They offer competitive rates, and in-depth products. Some in this category – like Interactive Brokers – may be listed on a Stock Exchange and/or rated by a Rating Agency.

- Tier 2 Pure Players – like DEGIRO, Trading212 or other Neobrokers offer highly competitive pricing and user-friendly platforms with an international reach, making them attractive for beginners and a viable broker diversification option among more experienced investors, but the average balances remain low.

- Tier 3 Brokers – like eToro focus on expensive and speculative products like CFDs and cryptocurrencies, lack core ETF offerings for long-term investors, and potentially operate under less stringent regulatory oversight. For us, they are a no-go.

Here is the full analysis

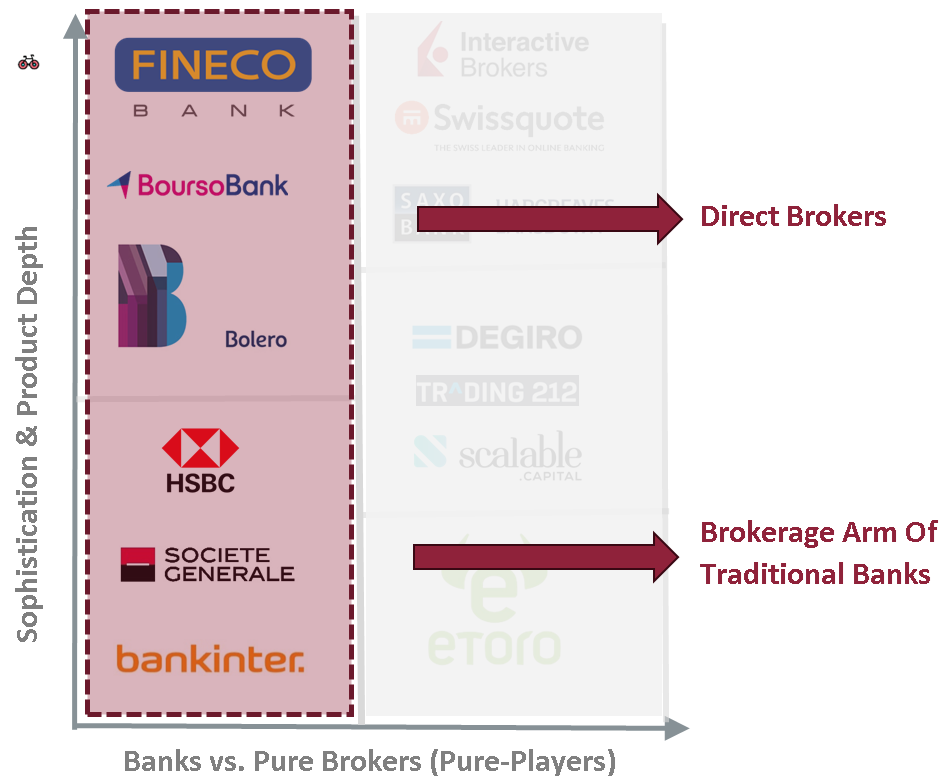

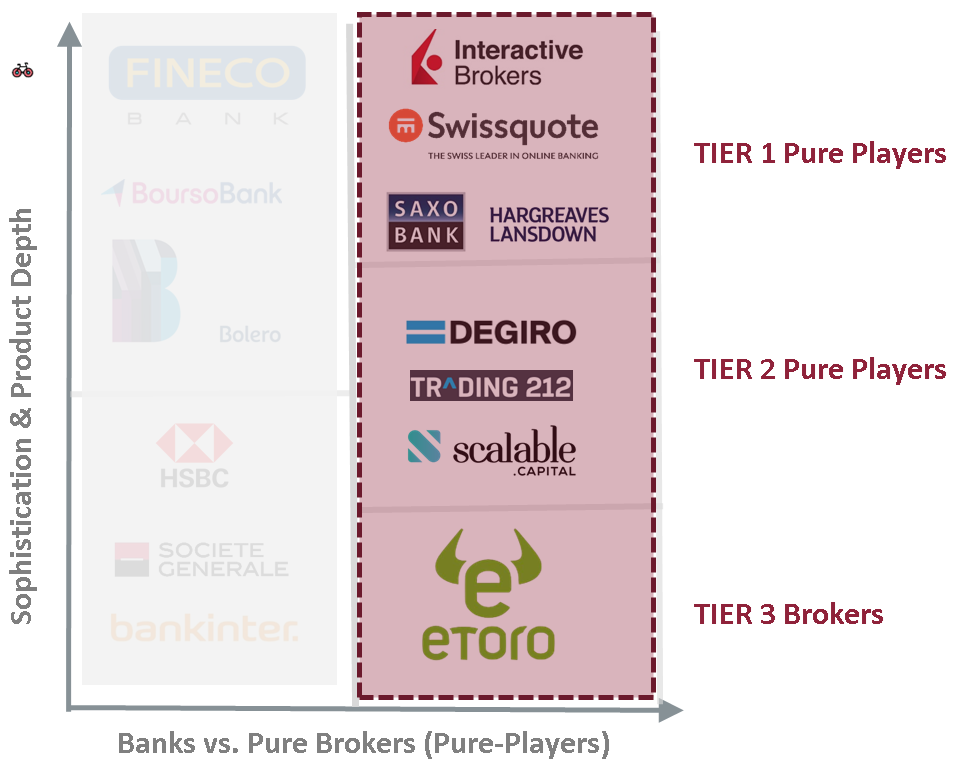

Our broker Classification system

What are the big differentiators?

Being Part Of A Banking Group, Fees And Products

5 Categories of Brokers

To categorise brokers we use two dimensions:

- Pure Players vs. Banking Group Brokers – Pure players (right side of graph) are independent from a Systemically Important Banking Group. They specialise in brokerage business. They may have a banking licence, but these activities are non-core to the business, and not systemically important. Then, there are Brokers that are part of a Systemically Important Banking Group (left side of the graph).

- Sophistication and Product-Suite – Pure players can be broken down into tiers. Tier 1 are the most sophisticated, and often have a portion of their revenues derived from Institutional Investors. Tier 2 are mostly neobrokers. The last Tier is incompatible with long-term investing. Brokers within a Banking Group can be broken down in two types – Traditional Broker Arms, for which Brokerage is a non-core activity and Direct Brokers – that have brokerage business at their core.

The Brokers in this article are illustrative, and not meant to be exhaustive. We use a few examples to show how we conceptually categorise them, including possible types of Brokers found across Europe and the UK. You can find the broker category in the upper right corner of each broker review. This framework is Pan-European. Not all countries have all category types.

1. Brokers Backed by A Banking Group

First, let’s have a look on the left side of our graph.

The Broker or its parent is often labelled as Global systemically important institution (G-SII). They are vital to the financial system in a country or Economic Area.

Two types of brokers within banking groups

1.1 Traditional Brokerage ARMs of Banks

HSBC, BNP Paribas, Société Générale, Bankinter, Barclays etc.

These brokers are part of an established, and usually Systemically Important Banking Group (G-SIB). They are often rated, listed on a Stock Exchange, and transparent. However, they have several drawbacks. They may be:

- Non-Core – these brokers are typically an auxiliary service to the established Banking Group.

- Relatively Expensive – they are usually not very competitive for long term investors.

- Lacking Depth Of Products – may miss access to some markets for advanced investors.

Examples include HSBC or Barclays (UK), BNP Paribas or Société Générale (France), Bankinter (Spain and Portugal).

Pros & Cons

- Likely Systemically Important Bank

- Most likely Rated

- Most Likely on Stock Exchange

- Most Likely Transparent

- May Need Banking Relationship

- May Not Be Fully Digital

- May Be Expensive

- May Not Be Sophisticated

Suitability

POTENTIALLY Suitable

PART OF a BANK, but EXPENSIVE

POTENTIALLY Suitable

good for broker diversification, Not versatile

Potentially Suitable

Bank Safety, but lack of products

1.2 Direct Brokers within a Banking Group

Boursobank, Fortuneo, Bolero, Comdirect, Fineco etc.

Brokers in this category have a direct-to-consumer (minimal traditional infrastructure) business model, often a modern and mobile-friendly approach to clients. They are typically part of banking groups of significant importance. The core difference with the first group is that they are:

- Modern And Independent Leaders – they could be pure players in their own right (some like Fineco are). Fineco or Boursobank even offer banking, advisory or asset management services. Most operate without branches, and have good mobile Apps.

- Relatively Cheap – while the first group was expensive, brokers in this group are very competitive for long term investors.

Examples include HelloBank (BNP Paribas), Fortuneo (Arkéa), Boursobank (Société Générale), Bolero (KBC Bank) or Comdirect (Commerzbank). Fineco is an exception as it is independent integrated financial group, and has a unique business model.

Pros & Cons

- Part of Banking Group

- Parent Most likely Rated

- Parent Most likely Systemically Important

- Parent Likely on Stock Exchange

- Most Likely Cheap

- May Enable Local Tax Reporting

- May Not Be Fully Digital

- May Not Be Sophisticated

Suitability

Suitable

PART OF BANKING GROUP, CHEAP

VERY Suitable

Usually Cheap AND VERSATILE

Potentially Suitable

may lack sophisticated products

2. Independent Brokers (Pure Players)

Now, let’s have a look at the right side of our graph.

Brokers in this group are focused on the Brokerage Business. They are not part of a Systemically Important Banking Group. However, Tier 1 Brokers in this group may still be of significant importance in certain countries, and can even have banking licences (but this is non-core to their business).

3 Tiers of pure players

2.1 Tier 1 Pure Players

Interactive Brokers, Swissquote, SAXO, Hargreaves Lansdown etc.

These brokers are independent, may have banking licences, which plays in the favour in our assessment, but their core services are around the Brokerage Business, so the revenue stream is not diversified. What makes them unique is that they:

- May Cater to Institutionals – The Sophistications of some of them makes them a credible counterparty to Institutional Investors. Also, brokers in this category like IBKR or SAXO often act as market access providers for Tier 2 Brokers.

- Are Industry Leaders – In at least one key developed market. Brokers in this group are usually competitive for long term investors, although prices in this category vary significantly – check before investing.

- Are Significant & More Transparent – Brokers are classified as a significantly important institution by regulators – which attracts more oversight – or/and have millions of customers. They are usually rated by a rating agency, or/and listed on a Stock Exchange. Average client balances are typically high.

Examples include Interactive Brokers (International), Swissquote (International), SAXO (International), Hargreaves Lansdown (UK) or AJ Bell (UK).

Pros & Cons

- Can be very sophisticated

- May Have Banking Licence

- Possibly Rated or/and Listed

- Possibly significant importance

- Most Likely Very Competitive

- Some May Enable Local Tax Reporting

- Some May Not Be Fully Digital

- Business Concentration Risk

- May be complex

Suitability

USUALLY Suitable

COMPREHENSIVE but may be complex

Suitable

Established, VERSATILE

VERY Suitable

very sophisticated BUT CHECK PRICES

2.2 Tier 2 Pure Players

DEGIRO, Trading 212, Scalable Capital, Trade Republic, Lightyear etc.

Brokers in this category include established brokers that are not the most sophisticated players in their market and neobrokers. Safety and transparency vary widely across this group. The leaders in this category – like DEGIRO – may have a banking licence, and are listed, but most are less transparent, VC-funded and are yet to prove to be consistently profitable. To overcome e.g. the ban on PFOF, they started expanding into banking activities, but they are not backed by an established Banking Group.

But, they have a few unique characteristics making them very attractive for beginners, and a potential broker diversification play for more advanced investors:

- Very Cheap – Most of them offer zero-commission ETFs and are overall very cheap for small and often also larger trades. They lead all categories in that respect.

- Industry-leading Platforms – Their platforms and mobile Apps are leading in terms of usability and interface design, high-level reporting and account opening process.

- International Presence – While Banking Brokers and some Tier 1 Pure Players may be local, Tier 2 players are usually present in most EU countries, and the UK.

Examples include DEGIRO, Trading212 Scalable Capital, Trade Republic, Lightyear.

Pros & Cons

- Top Notch Platforms

- User-Friendly

- International Presence

- Very Competitive Prices

- Some May Enable Local Tax Reporting

- Some May Not Be Fully Digital

- Evolving Business Models

- Usually Not Significant Institution

Suitability

Suitable

CHeap, intuitive but may need broker diversification

Suitable

Cheap, but needs diversification for medium & large portfolios

Potentially Suitable

not sophisticated, can only be a side-broker for Larger portfolios

2.3 Tier 3 Brokers

E.g. eToro

Brokers falling under this umbrella don’t resonate with our ethos. These platforms are for emotionally-driven uneducated investors (to put it bluntly – Investors that Wall Street defines as ‘Dumb Money’).

They usually have a:

- Speculative Business – As part of their core offering, including CFDs and Crypto products. This also includes aggressive ads that are at the opposite of evidence-based investing.

- Lack OF Core ETFs – Long Term Investors won’t find key UCITS ETFs.

- Opaque Pricing – Brokers are responsible for setting the price of their instruments and products. Prices will be different from the prices provided by other brokers and the market levels, as well as the current prices on other exchanges or platforms.

- Weaker Regulator – may be overseen by Tier 2 regulators with potentially lower expertise and/or and have a history of regulatory fines.

The silver lining? These brokers have only room to become better—or fold!

🤔 Behind-the-scenes Insight – As we are exploring this industry, we found that the reason these brokers are promoted by other – often conflicted – websites, is most likely that they offer the highest commissions (also known as affiliate fees) for new customer sign-ups (sometimes as much as 10x the commissions offered by Tier 2 platforms). We have no doubts why that’s the case.

⚠️ At Bankeronwheels.com, we steer clear of partnerships with these brokers.

Pros & Cons

- May Be Listed On Exchange In The Future

- May Give Access To Esoteric Products

- May Be Digital

- Risky Business Model

- Not Significant Institution

- Expensive

- Lack of ETF Offering

- Promotes Money-Losing Strategies

Suitability

UNSuitable

Promotes wrong values, Limited offering

UNSuitable

Risky business model, expensive, limited offering

UNSuitable

Risky business model, expensive, limited offering

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

WHat else you need to consider

While these are the broad Broker categories, your requirements may be unique.

Let’s have a look at all criteria in more detail, so that you can make your choice. In the next article, let’s look at safety considerations.

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – BlackRock Launches New iBonds, Truth About €1M Broker Insurance & BOW is 4 years old!

The Truth About €1 Million Broker Guarantees

4 Things I Learned In 4 Years Of Running A Finance Blog

Dodl By AJ Bell Review – AJ Bell’s Younger Brother

Vanguard LifeStrategy Review – A Retriever In A Babushka Doll

Why Do Portfolio Managers Care About Factors? It’s Not What You Think.

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.