Weekend Reading – Avantis Launches Small Cap International Stock ETF

Weekend Reading is a collection of Investment Research and Lifestyle topics from all corners of the Web.We source the highest quality insights from Wall Street and Main Street that you may apply to your investment process. Unlike the rest of Bankeronwheels.com, this series is provided without additional guidance. As usual, everything is to be used at your own risk. Below is the type of content we shortlist.

Invest Wisely section is dedicated to research on how to invest for the Long Run using Passive Investment Strategies. Read Topics related to (i) Portfolio Construction and Asset Allocation (ii) Acting wisely by avoiding behavioural traps and also (iii) publications that help understand how financial markets work.

Active Investing section relates to improving your knowledge about active investing. If you decide to sin, then sin only a little. Given ample evidence, combined active bets should be ideally a relatively small fraction of your portfolio. This section also includes Sustainable Investing. You can invest in a Socially Responsible way, but there are many ESG traps. Learn how to invest sustainably, and what it means for expected returns, with our definitive guide to sustainable investing.

Personal Finance section is dedicated to UK and European Products. It can also touch on other European jurisdictions outside the Euro-zone.

- Recommeded Reading

- Youtube (Required watch time)

- Podcast (Listening Time)

- Academic Research - May require intermediate/advanced knowledge

- Noteworthy Twitter Thread

The game of professional investment is intolerably boring and overreacting to anyone who is entirely exempt from the gambling instinct; whilst he who has it must pay to this propensity the appropriate toll

John Maynard Keynes, father of modern macroeconomics

INVEST WISELY

CONSTRUCT YOUR PORTFOLIO

- Investment portfolio examples: asset allocation models for beginners (Monevator)

- Avantis Launches Small Cap International Stock ETF [Non UCITS] (ETF Stream)

- 7 steps to a better portfolio (Rational Reminder )

- For bond investors, near-term pain but long-term gain (Vanguard)

- In conversation with ReSolve Asset Management CIO on his approach to portfolio construction for individuals (Excess Returns - 1 hr 13 min)

- Replicating Investment Perforance with S&P 500 & Cash (CFA Institute)

- Is Cash the Best Insurance Asset? (Discpline Funds)

- Let the Flowers Bloom: Eight Ways You Can Maximize the Power of Compounding (Validea)

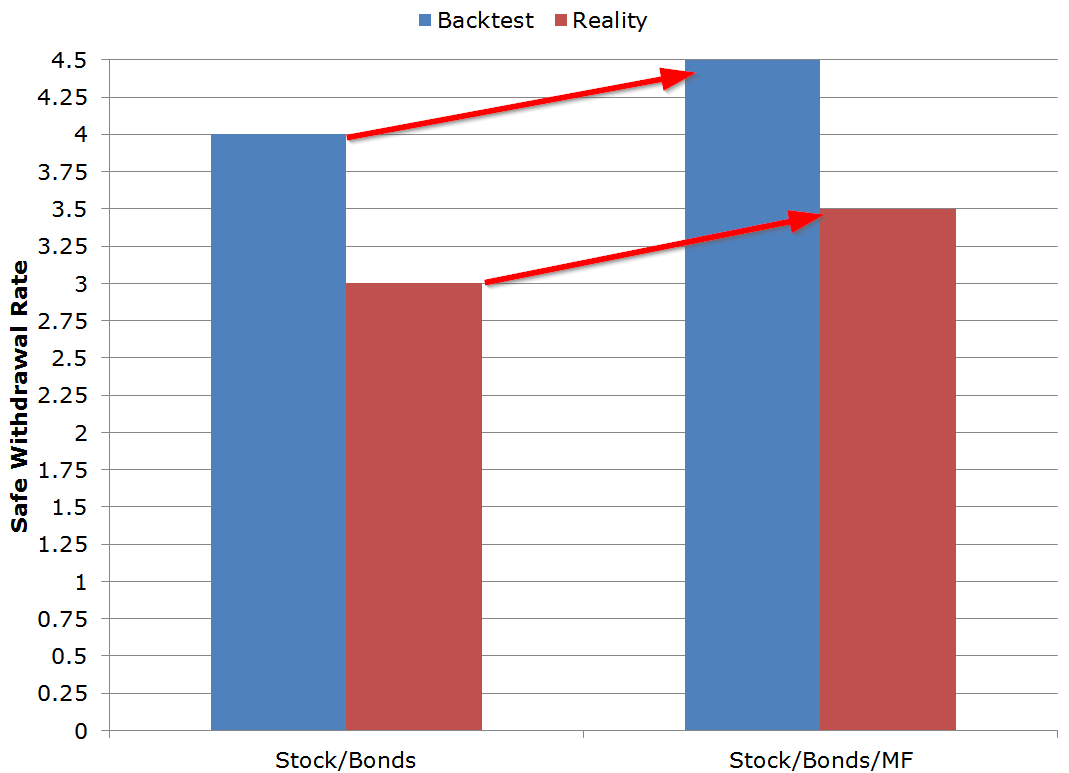

The primary purpose of bonds is to reduce the overall volatility of the portfolio, but as we saw in 2022, that doesn’t mean they can’t lose money. In fact, 2022 was the worst year for bonds in US history. And now that we’re in a new period of higher interest rates on money market funds, CDs, and short-term Treasury bills, its quite noticable that an increasing number of people are wondering whether they should hold cash instead of bonds.

UNDERSTAND FINANCIAL MARKETS

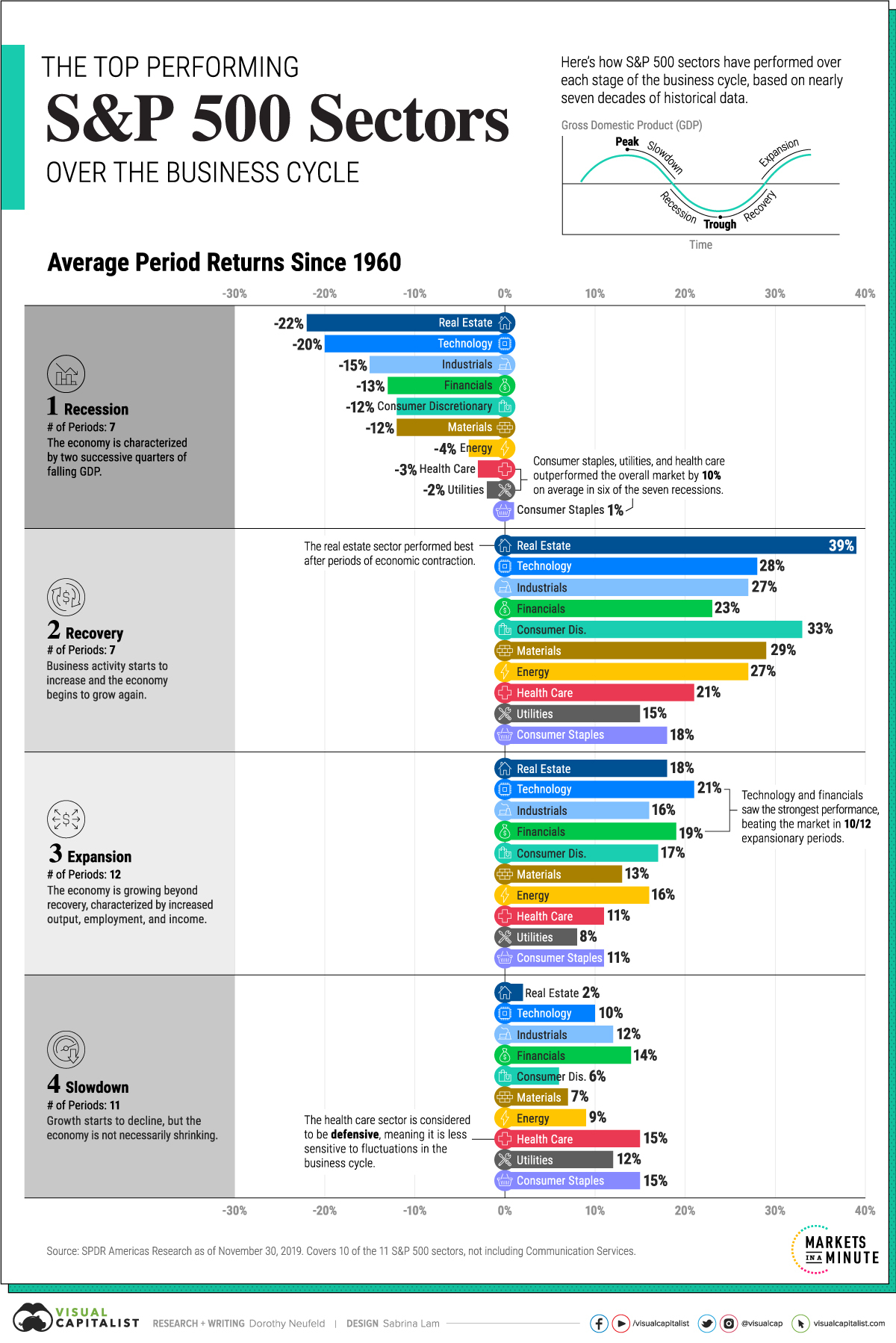

The Top Performing S&P 500 Sectors Over the Business Cycle (Visual Capitalist)

The business cycle fluctuates over time, from the highs of an expansion to the lows of a recession, and each phase impacts the performance of S&P 500 sectors differently. And though affected sectors have different levels of average performance, any given period may see the outperformance of certain sectors due to external factors, such as technological advancements or high-impact global events (i.e. global pandemics, international conflicts, etc.)This graphic uses data from SPDR Americas Research to show the top performing sectors through the business cycle over almost 70 years. Overall from December 1, 1960 to November 30, 2019, the dataset covers: 7 recessions, 7 recoveries, 12 expansions and 11 slowdowns.

Read more on Visual Capitalist

- Country Risk: A July 2023 Update (Aswath Damoradan)

- G7 vs. BRICS by GDP (PPP) (Visual Capitalist)

- Global Debt Projections (2005-2027P) (Visual Capitalist)

- what makes a secular bull market so strong, pervasive, long-lasting, and resilient (Ritholtz - 1 hr 2 min)

- Are the Markets Stacked Against the Little Guy? (A Wealth of Common Sense)

- Vanguard's hard pass on a soft landing (Bloomberg - 39 min)

HOW TO INVEST

Active Investing

FACTOR investing

- Regression is a tool that can turn you into a fool (Alpha Architect)

- Index Investing your way into managed futures (CAIA Association)

- On trend following with Jerry Parker (Trend Following Radio - 57 min)

- Reconciling Individual Stock Returns and Factor Portfolio Returns (Alpha Architect)

- Systematic Investor Series ft. Andrew Beer & Jerry Parker (Top Traders Unplugged - 14 min)

In a very simplistic way, one can think of your portfolio, like a baseball team:

Stocks would be your home run hitter who strikes out a lot and play first base — they can produce some great offense, but not much with respect to defense.

Bonds are like a great defensive shortstop: mediocre at hitting, but they are on your team to play defense.

Read more on Alpha Architect

discretionary investing

We’re in the midst of an AI mania of sorts. In public markets, investors are placing bets on the companies perceived as being the winners of this new wave of computing. Companies that aren’t even in “tech” are touting their AI bonafides. And of course, in private markets, every venture capitalist suddenly seems to be pivoting to AI in some way or another. But who will actually win?

ALTERNATIVE ASSET CLASSES

WALL STREET

SUSTAINABLE investing

crypto

BAD BETS

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

PERSONAL FINANCE

Wealth Management

Early Retirement

FINANCIAL PRODUCTS

COST OF LIVING

OUR Community

Question of the week

Personal Development

Naval Ravikant - The 6 BIGGEST Middle Class Habits Keeping You in the Rat Race (Naval Ravikant)

Naval digs deep into psychology of status, materialism, beliefs and much more that is keeping you down.

- How To Live an Asymetric life (Graham Weaver - 33 min)

- Finally Learn to Say No (Art of Manliness - 44 min)

- How To craft a life worth living (Good Life Project - 1 hr 3 min)

- Avoiding the Trap of Upgrading Your Lifestyle (Vestpod)

- How To reduce anxiety & polish the lens of consciousness (The Tim Ferris Show - 2 hr 25 min)

- Exploring your capacity to overcome anything (The daily stoic - 50 min)

Health & Wellness

CAREERS

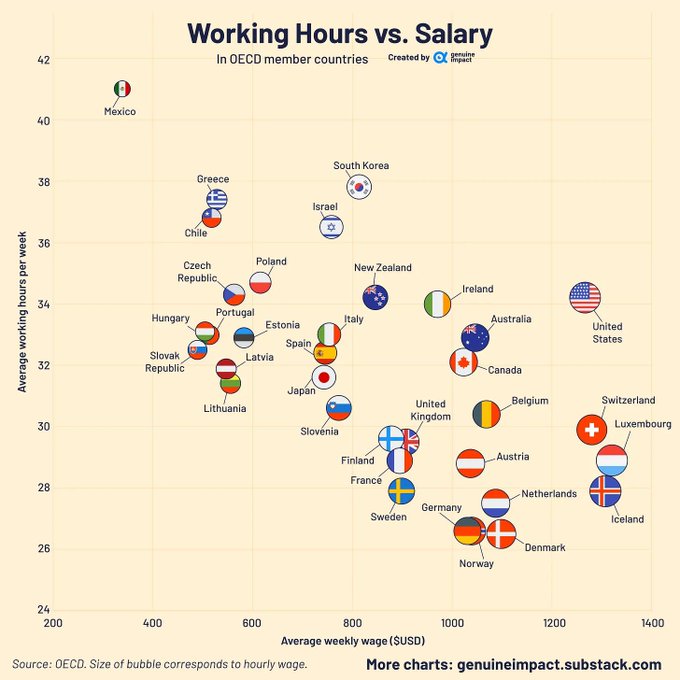

At the top is Mexico, where the average worker clocks over 2,000 hours per year. This reflects the country’s labor dynamics, which typically involves a six-day workweek. For context, 2,128 hours is equal to 266 eight-hour workdays. The only other country to surpass 2,000 annual hours worked per worker is Costa Rica, which frequently tops the World Economic Forum’s Happy Planet Index (HPI). The HPI is a measure of wellbeing, life expectancy, and ecological footprint. Looking at the other end of the list, the two countries that work the fewest hours are Germany and Denmark. This is reflective of the strong labor laws in these countries as well as their emphasis on work-life balance.

More on PBS

Travel

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

miscellaneous

Why Oppenheimer deserves his own movie (Veritasium - 33 min)

“If you want to learn more about Oppeheimer, I strongly recommend the book “American Prometheus” By Kai Bird and Martin Sherwin. It is a remarkable book, very much deserving of the Pulitzer prize it received”

OUR Community

Last Week We asked you

How would you describe your current life situation?

SUGGEST AN ARTICLE

Thank you for reading.

Good Luck & keep’em* rolling!

(* Wheels & Dividends)

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – Global Shocks: How Do Stocks Perform?

Trading 212 Review: Pros & Cons

Cash Is Not Enough: Why Hold Bond ETFs Despite Price Rollercoasters.

The Truth About €1 Million Broker Guarantees (Updated With Trading 212 Cap)

Halifax Share Dealing Review – Similar To Lloyds With SIPP On Top

Lloyds Share Dealing Review – Old School But Ticks The Boxes For Golden Retrievers

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.