Cycling In Japan – 2 Secret Maps, Best Islands and Seasons.

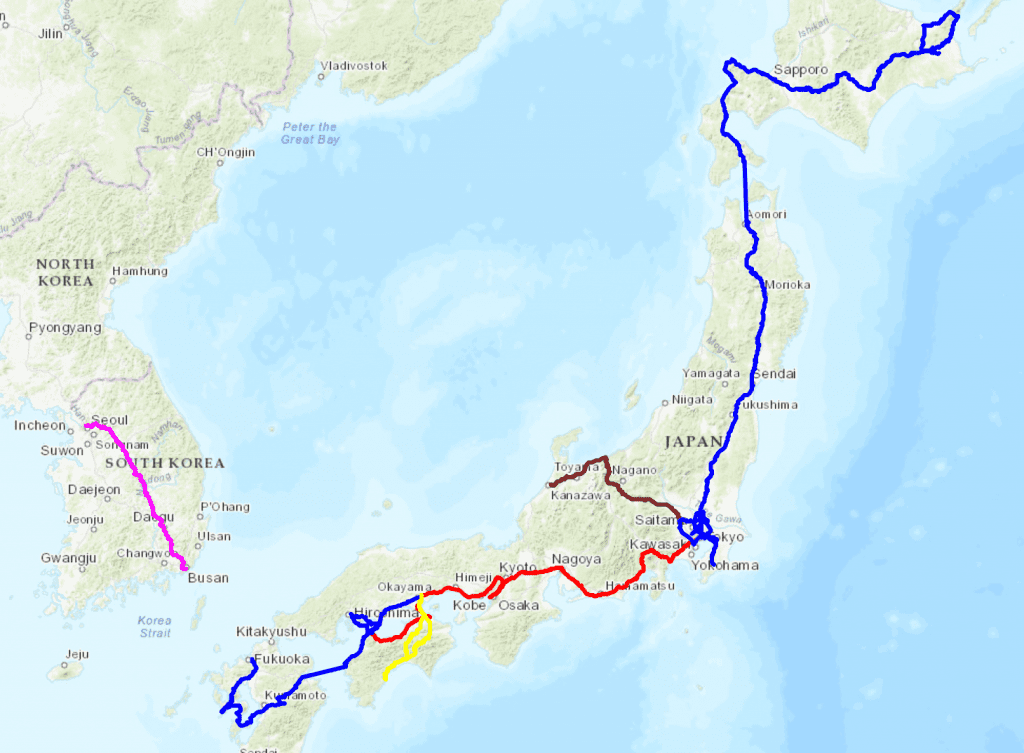

Between 2019 and 2023, I spent close to a year in Japan. I cycled over 4,000 km from Hokkaido to Okinawa. Here are some tips on how you can make the best of your trip to the country of the rising sun.

SOME HIGHLIGHTS

- When to go – Target April/May and Autumn for most Islands except Hokkaido, where the weather resembles that of Europe. In the North, including Tohoku, summer is a great season as well.

- Where to go – Choose rural Japan. Hokkaido, Tohoku or the South of Japan, like Shikoku or Kyushu. For a cyclist, they are much more enjoyable than Honshu. There is a trade-off between exploring the best cultural centres and great cycling.

- Avoid Natural Disasters – Earthquakes are largely unpredictable, but the main danger comes from rare Tsunamis. Apps, like Yurekuru can help. For most islands, August and September are the peak Typhoon season.

- Navigation Is Easy – Maps.Me works great. Google Maps is getting better these days, but is still problematic in rural Japan. It has the best offline maps for cheap accommodation.

- Learn A Bit Of Japanese – A few words in Japanese will get you a long way. A few months of studying will unlock ‘real Japan’ for you. It’s really worth it.

- Travel Cheaply – Post-Covid, Japan is relatively cheap. For Okinawa or other remote islands, use Japanese Airlines ‘Japan Explorer Pass’ or All Nippon Airways ‘Special Fares’. Eat lunch in restaurants, but get evening Sushi -60% deals at the supermarkets. Use the secret Google Maps with Minshikus, Michi-no-eki’s and Onsens!

Here is the full analysis

When to Go?

Target Spring And Autumn, Except the North

If you go cycling to Japan try to target two seasons – Spring and Autumn.

There is some magic in Japan in April. Hokkaido and North of Tohoku are exceptions – weather is a bit different a more aligned with typical northern European patterns). Escaping the typhoon season at the start of Autumn is more an art than a science, but by the end of September, cycling is assumed safe. Here are some nuances, based on the regions:

Mainland Japan

- Spring (Mar to May): Cherry blossoms and mild temperatures. Ideal cycling weather.

- Summer (Jun to Aug): Hot and humid. Summer brings the rainy season (except North).

- Autumn (Sept to Nov): Cool, dry, and colorful foliage. Perfect for long rides.

- Winter (Dec to Feb): Cold with snow in many regions. Challenging but scenic.

Hokkaido

- Summer: Cool and dry, best time for cycling.

- Winter: Cold with heavy snow, making cycling tough.

Okinawa

- Winter (Dec to Feb): Mild and sunny. Great for cycling.

- Summer: Hot, very humid, and prone to typhoons.

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

Earthquakes and typhoons

How To avoid Natural Disasters

Fairly Predictable Typhoons

Once the rainy seasonis over, typhoons start. They usually last until late September.

The one pictured below (Hagibis) above was on my phone radar (Windy App). It hit mainly Honshu, but I still struggled massively that day on Kyushu Island.

Typhoon Hagibis on my Phone App

Earthquakes. Or How To cycle The Ring of Fire.

I spent over 6 months in 2019 on the Ring of Fire – countries including US/Canadian West Coast, New Zealand or Japan.

I witnessed a 4/7 magnitude Earthquake in Taiwan. In 2023, I was in Tokyo four times. I experienced earthquakes three times. One of magnitude 5/7, on the 15th floor.

Fortunately, I was prepared due to having undergone the below training that I filmed in Ikebukuro, North of Tokyo.

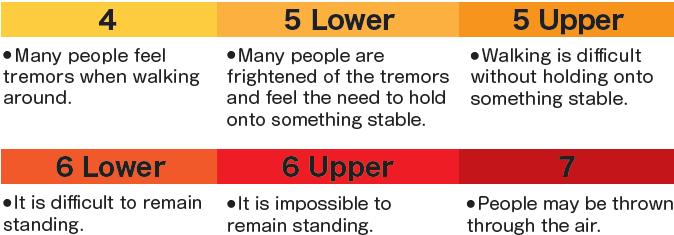

It simulates the most extreme shakes that Japan witnessed in 2011 (7 out of 7 on Shindo Scale – which, I think, is much more relevant than the Richter out of 10 scale used in the West).

Shindo Scale

The Tsunami combined with winter weather made the most damage in 2011.

There are approximately 5,000 minor earthquakes recorded in Japan per year, with over 160 earthquakes of significant ones. Chances are you will experience one.

Japanese people are prepared for them, so follow their instructions and most likely everything will be fine.

Get the Yurekuru Call app that has immediate notifications.

Japan Tohoku 2011 Earthquake Simulator

How Japan is Divided

Japan's Four Main Islands and Key Regions

Regions: Japan is primarily divided into eight regions, which serve mostly for geographical purposes. From north to south, these regions are:

- Hokkaido: Comprising the northernmost island, it’s known for natural beauty.

- Tohoku: Located in the northeastern part of the main island, it’s a realm of mountains, hot springs, and rich history.

- Kanto: Home to Tokyo, this region is the political and economic heartbeat of Japan.

- Chubu: A diverse region with Japanese Alps, the city of Kanazawa, and industrial areas.

- Kinki or Kansai: A cultural treasure trove, with ancient capitals like Kyoto, and Nara.

- Chugoku: The westernmost part of Honshu, it’s characterized by mountainous terrains and the scenic coast along the Seto Inland Sea.

- Shikoku: The smallest of the four main islands, it’s famous for its 88-temple pilgrimage.

- Kyushu: The southernmost region is known for its active volcanoes, beaches, and historical sites.

Prefectures: Further administrative division breaks down the country into 47 prefectures. Each prefecture has its own capital and distinct characteristics. These prefectures are like states or provinces in other countries, with each having its own local government and governor.

Where to Cycle?

My First Trip to Japan in 2019

🌸 Honshu: From Tokyo’s neon-lit streets to Kyoto’s historic shrines, Honshu is ideal for cherry blossoms. The best cycling is in Tohoku and Nagano (Chubu). Otherwise, Honshu is great for cultural immersion. Main sites are connected through the ‘Shinkansen Tourist Track’. But they can be traffic-heavy and industrial, at times. There is a trade-off between exploring the Cultural centres and peaceful riding. Cycling Experience: 3.5/5.

🌋 Hokkaido: Wild and untamed, the Japanese Alaska is cycling at its best. With cooler climates and vast lavender fields, this northern gem offers smooth rides through Bear Country and magnificent coastal routes. Experience hot springs, and unique wildlife. Cycling Experience: 5/5.

🌊 Kyushu: A geothermal wonderland! Cycle beside active volcanoes, through lush forests and along coastal routes. Enjoy a dip in natural hot springs after a long ride and savor the island’s spicy cuisine. Cycling Experience: 4/5.

⛩ Shikoku: The spiritual spin! As home to the famous 88-temple pilgrimage, cycling this island is like turning the pages of a living history book. Get lost in its green valleys, bridges, and coastal routes. Some gems are Shimanami and Tobishima Kaidos. You may avoid the North, which is a bit industrial. Cycling Experience: 4/5.

🏝️ Okinawa: Ride the Japanese Hawaii! Okinawa’s main island presents coastal highways with ocean views on one side and dense jungles on the other. But it’s fairly small, so it’s more of a relaxing destination. Other Islands, like Miyakojima, are great for surfing. Cycling Experience: 3/5.

Ferries and Planes. plan your island hopping.

The Problem with Honshu

Cycling in cities is extremely slow – escaping Tokyo takes a whole day (just above 80 km) with lots of traffic lights.

Tunnels are the most difficult part in Japan. There are lots of them and they rarely have cycling lanes. I usually used the pedestrians part but make sure your rear light is fully charged.

Choose quiet rural roads (Maps.ME is good for that).

Cycling in Honshu - Traffic lights and tunnels

You will take quite a few ferries

Given the overall safety level, you can stay on the deck without much worry for your bike, unlike in other countries.

Trains, including Shinkasen, can transport bikes but you need special bags (called Rinko bags or standard card box – much harder to find in Japan due to smaller bike sizes).

Fixing the Bike on a Ferry

Japan is a country of over 125 million people. Even though it has a reputation of being expensive, most people have ways to reduce costs.

The guidance to slash costs would be long, but here are my three top tips.

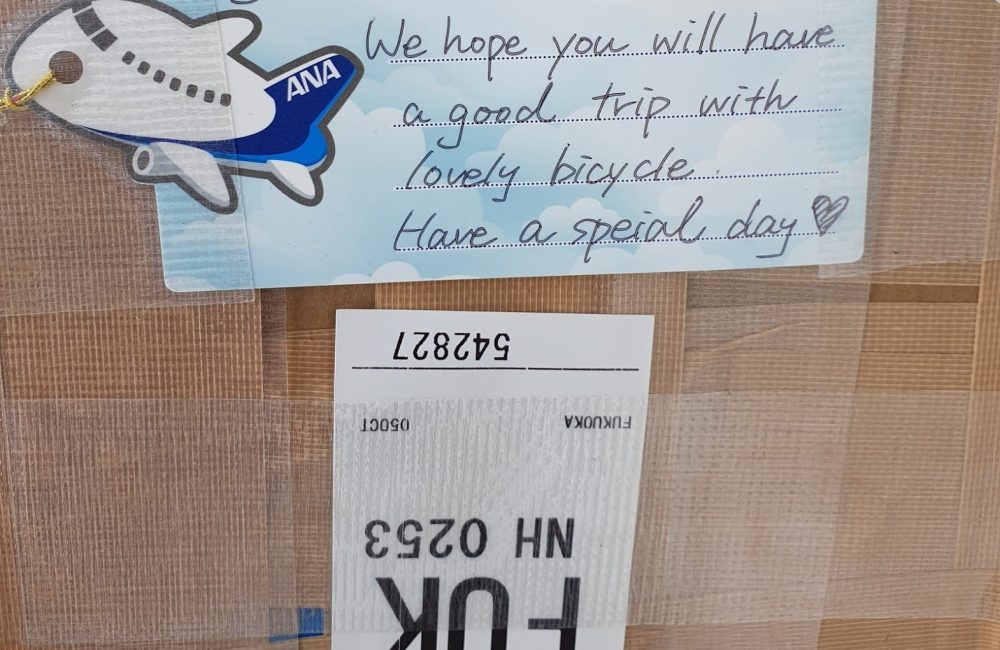

#1 Flights - You will love Positive Price Discrimination

ANA Remains the most cyclist-friendly Airline I traveled with

There is a lot of price discrimination in Japan.

Sometimes men pay more than women. In tourist places, there are special prices for foreigners.

But what’s most interesting, and widely unknown, is that national fares are capped for foreigners! That’s positive discrimination at its best.

Any one-way ticket does not exceed about $100 (11,000 Yen)!

This is a great way of moving quickly to remote areas. Thinking of flying from Tokyo to Taiwan? Why not stopping in Okinawa for $100 and then taking Eva Air to continue your journey from Naha?

Best Flight Deals In Japan

Here are the links to the Airline Special Fares:

#2 Cheap Food after 6pm

Strive for excellence is built into the Japanese Culture. The food is no different. Seafood is top quality and needs to stay fresh.

You can take advantage of that by stopping at a supermarket after 6pm to grab discounted food.

Sushi goes as cheaply as -60% or -70%.

#3 Sleep in Minshukus Or capsules

Save down this map - it will save you a lot of money!

Types of Accommodation

There are eight main accommodation types in Japan:

- Campgrounds Budget-friendly and nature-immersive. Great

- Cycling Hotels: Near Shimanami Kaido. Rare, expensive but amazing.

- Minshukus: Traditional Japanese B&Bs. Homey, local experience. Great.

- Capsule Hotels: Space-saving, budget-friendly. Great for solo cyclists.

- Ryokans: Authentic Japanese inns. Tatami rooms and onsen baths. Amazing, but expensive.

- Warmshowers: Connect with locals, often free stays. Rare.

- Manga Cafes: Private booths, 24/7. Overnight option in a pinch. Bike is a problem.

- Business Hotels: Affordable, basic amenities. OK. Bike can be a problem.

Onsen, Campsite & Supermarket Sushi Daily Routine

Business hotels are usually north of $50 per night. Hostels are between $20 and $30. They are usually spotless, but you may want to target bike-friendly ones.

In big cities like Tokyo or Osaka I also used capsule hostels, but you need to find a way to store your bike overnight (these are targetted at Japanese customers, e.g. in Tokyo where last trains can be as early as 11pm)

Outside big areas consider this cycling routine (i) stopping at a supermarket for discounted sushis for around $5 per pack (ii) relaxing in an Onsen and taking a shower for around $5 and finally (iii) finding a nice camp spot – for free.

Two Secret Maps - Best Sleeping Spots In Japan

Below are Google Maps Links that you can save down on your phone:

Language

While this is not a post about cultural experiences, take note of one thing.

Learning Japanese will unlock doors to real Japan, unavailable to tourists.

Can’t stress how my experience of Japan changed when I learned some Japanese. Some apps for that include AnkiDroid or italki.

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

Navigation

Japan is one of the easiest countries to navigate.

Maps.Me or RidewithGps will be more than enough.

Google products work, but Japan is a Yahoo country, so their apps are more accurate. But this is changing as Google Maps become more accurate nowadays.

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – BlackRock Launches New iBonds, Truth About €1M Broker Insurance & BOW is 4 years old!

The Truth About €1 Million Broker Guarantees

4 Things I Learned In 4 Years Of Running A Finance Blog

Dodl By AJ Bell Review – AJ Bell’s Younger Brother

Vanguard LifeStrategy Review – A Retriever In A Babushka Doll

Why Do Portfolio Managers Care About Factors? It’s Not What You Think.

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.