Weekend Reading – How to survive the next market crash

Weekend Reading is a collection of Investment Research and Lifestyle topics from all corners of the Web.We source the highest quality insights from Wall Street and Main Street that you may apply to your investment process. Unlike the rest of Bankeronwheels.com, this series is provided without additional guidance. As usual, everything is to be used at your own risk. Below is the type of content we shortlist.

Invest Wisely section is dedicated to research on how to invest for the Long Run using Passive Investment Strategies. Read Topics related to (i) Portfolio Construction and Asset Allocation (ii) Acting wisely by avoiding behavioural traps and also (iii) publications that help understand how financial markets work.

Active Investing section relates to improving your knowledge about active investing. If you decide to sin, then sin only a little. Given ample evidence, combined active bets should be ideally a relatively small fraction of your portfolio. This section also includes Sustainable Investing. You can invest in a Socially Responsible way, but there are many ESG traps. Learn how to invest sustainably, and what it means for expected returns, with our definitive guide to sustainable investing.

Personal Finance section is dedicated to UK and European Products. It can also touch on other European jurisdictions outside the Euro-zone.

- Recommeded Reading

- Youtube (Required watch time)

- Podcast (Listening Time)

- Academic Research - May require intermediate/advanced knowledge

- Noteworthy Twitter Thread

I would never be 100 percent in stocks or 100 percent in bonds or cash

Harry Markowitz

INVEST WISELY

CONSTRUCT YOUR PORTFOLIO

The Stock Market is a powerful money-making machine that can make you rich and financially independent. But Stock Market Crashes are part of the game. The next one may be around the corner. But if you see a Grizzly Bear, it’s too late to run away. It swims, climbs trees and runs at 60 km/h. Potential Bear encounters need to be prepared for. The same applies to Bear Markets. But, while a trip to Alaska is optional, market crashes are not. They are guaranteed to happen.

- Correlations and returns: What happens if inflation remains elevated (Vanguard)

- What Role Should Cash Play in Your Portfolio? (Morningstar)

- How Should You Judge Your Investment Performance? (A Wealth of Common Sense)

- EU agrees deal on securities rules that includes ban on broker commission (Reuters)

- Commodities diversification: is it worthwhile? (Monevator)

- You no longer need access through an approved advisor to access DFA's brainpower as firm set to launch two critical ETFs (Fortunes & Frictions)

UNDERSTAND FINANCIAL MARKETS

Pozsar discusses his next career move & gives us an update on his Bretton Woods III thesis, or the idea that the global financial system is going through a “monetary divorce” from US dollar hegemony and becoming more multi-polar.

Also he has something to add to the recent banking crisis and what it means for global funding markets going forward.

HOW TO INVEST

- Financial Decisions for Normal People - In conversation with Prof Meir Statman (Rational Reminder - 1 hr 12 min)

- The disposition effect messes with you (Joachim Klement)

- The Most Important Thing(s) - Making decisions under a cloud of uncertainty & where past performance maybe misleading (Behavioural Investment)

- Inaction Is Not Inactivity & why is it an investors friend (Best Interest)

You may not know, but Harry Markowitz, a Nobel Prize-winning economist, helped shape Index Investing as you know it by showing that diversification could reduce investment risk while maximizing returns. He recently passed away, aged 95. Robin Wigglesworth has written an excellent book about the Indexing Revolution, including how Markowitz contributed to it. We highly recommend it if you haven’t read it already.

Active Investing

FACTOR investing

- Why Value Investing Works (Morningstar)

- Diving Into the Performance of Factors (Alpha Architect)

- Sources of Return - Value and profitability offer complementary exposures. (Verdad)

- Is the P/B Ratio Still Relevant in the Modern Day? (Value Investing Substack)

- The Intangible Value Factor (Alpha Architect)

- Is Strategic Beta the Best of Both Worlds? (Morningstar - 6 min)

Sparkline Capital founder Kai Wu wrote a paper recently titled “Intangible Value: A Sixth Factor”. The discussion focuses on his research on the importance of intangible assets, how to measure them and turn them into a value factor, the benefits of intangible value to a multi-factor portfolio, and how he used it to construct a 6-factor model.

discretionary investing

AI Winners, Losers and Wannabes: Valuing AI's Boost to NVIDIA's Value (Aswath Damodaran - 45 Min )

NVIDIA has been able to post high growth in a maturing business by being in the right place at the right time – gaming, crypto and now AI, and in Aswath’s story/valuation of the company is built on the presumption that it will continue to be an opportunistic growth company, that delivers premium operating margins. He finds the company overvalued, though it is possible to map out pathways to get to a trillion dollar value.

ALTERNATIVE ASSET CLASSES

WALL STREET

How Congress gets rich from insider trading (Johnny Harris - 30 Min )

Does congress get rich from Insider Trading?

Evidence is mounting that US senators and members of Congress are using insider knowledge on major policy decisions and looming crises to game the stock market.

And they think it’s totally okay.

SUSTAINABLE investing

crypto

We want to hear from the regulators: Larry Fink (FOX Business - 18 Min)

“We do believe that if we can create more tokenization of assets and securities – that’s what bitcoin is – it could revolutionize finance,” (…) “Instead of investing in gold as a hedge against inflation, a hedge against the onerous problems of any one country, or the devaluation of your currency whatever country you’re in – let’s be clear, bitcoin is an international asset, it’s not based on any one currency and so it can represent an asset that people can play as an alternative”

BAD BETS

Stocks

- Seeking Persistent Growth in Technology Investing with Deepwater’s Gene Munster and Doug Clinton (Excess Returns - 56 min)

- Nvidia joins the trillion dollar club - Visualisation (Visual Capitalist)

- The AI Arms Race - Who's Winning? (Morningstar)

- Apple's new headset won't bag millions of customers (Morningstar)

- Can Chat GPT help you read financial statements? (Alpha Architect)

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

PERSONAL FINANCE

Wealth Management

The importance of taking action and making changes in your life to not only achieve FI, but also improve your life overall. While we know changes don’t happen overnight, it’s important to remember that sometimes the best thing you can do is take action little by little. Whatever the changes you wish to make or habits you want to create are, remember, it’s never too late to begin!

Early Retirement

FINANCIAL PRODUCTS

COST OF LIVING

OUR Community

Question of the week

Personal Development

- To get more done, do less (Joachim Klement)

- Why You Believe The Things You Do (Collab Fund)

- Be Generous & Unique - A wide ranging conversation with Kevin Kelly (Invest like the best - 1 hr 7 min)

- Peak Performance - in the field or in the market - in conversation with Dr. Gio Valiante (Meb Faber - 58 min)

Health & Wellness

CAREERS

- AI Is a Lot of Work - As the technology becomes ubiquitous, a vast tasker underclass is emerging — and not going anywhere. (The Verge)

- Robert Kiyosaki, author of Rich Dad, Poor Dad, and Raoul Pal come together, focusing on how AI is about to majorly upend everything we know (Real Vision - 42 min)

- AI, automatization and retirement (Joachim Klement)

Travel

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

miscellaneous

OUR Community

Last Week We asked you

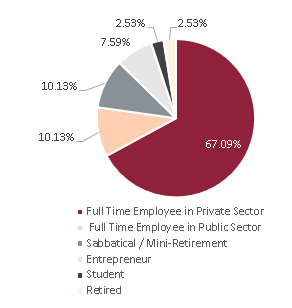

How would you describe your current life situation?

SUGGEST AN ARTICLE

Thank you for reading.

Good Luck & keep’em* rolling!

(* Wheels & Dividends)

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – Global Shocks: How Do Stocks Perform?

Trading 212 Review: Pros & Cons

Cash Is Not Enough: Why Hold Bond ETFs Despite Price Rollercoasters.

The Truth About €1 Million Broker Guarantees (Updated With Trading 212 Cap)

Halifax Share Dealing Review – Similar To Lloyds With SIPP On Top

Lloyds Share Dealing Review – Old School But Ticks The Boxes For Golden Retrievers

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.