What’s the Future for Bankeronwheels.com? 2023 Year-End Survey Results.

Bankeronwheels.com, born during the COVID pandemic, began as a personal blog blending cycling with investing insights.

With limited ways to assist others during the pandemic, Raph, inspired by the kindness experienced during his global cycling journeys, aimed to share his financial knowledge and cycling experience. Raph’s mission? Teach readers how to efficiently earn in a relatively passive way, enabling them to focus on more important aspects of life – like sustainable travel.

By 2023, the blog had exceeded any growth expectations he had. Today, we want to make the blog the most impactful to our readers. And there is no better than asking your opinion on how to bring it to the next level. Here are some takeaways from our last month’s survey.

KEY TAKEAWAYS

- Our very high-quality community comprises investors from Europe, the Americas and the Far East. Many keep it simple by remaining fully passive, while others are intrigued by more sophisticated strategies like Factor Investing.

- We get lots of engaged readers from the UK, Italy, Germany, Poland and Northern-Europe. We grow by word of mouth – an unusual way in an increasingly connected world! And last year our traffic grew more than the NASDAQ!

- You love our content because it’s different and would like us to focus on investing guides and ETFs in 2024. In a world with short attention span and an average time spent on websites counted in seconds, you stay with us on average about 4 minutes each time!

- Expect more – we have high standards, but we aim to provide you with even better insights and tools in the coming year!

- We work on improving our odds of being around tomorrow – the blogging world has been disrupted in 2023 with GenAI. That’s why we want to double down on our human and simple approach in writing and our community.

Here is the full analysis

In 2022, we launched the first year-end survey to know what we do well and where we need to improve. In 2023, we spent a lot of time improving the navigability of the website, making it even more visual and appealing. We also launched a few new guide series, and tested new tools.

In December, we relaunched the survey to receive suggestions on the direction for the next couple of years. If you missed it, make sure to keep up to date by signing to our newsletter for future updates.

Congratulations on all you have achieved so far, and a big thank you for helping people like me understand investing in a such a sound, principle-guided way.

Survey Feedback From Community Member

THANK YOU, GraZIE, MERCI, DZIEKUJE, danke schon, OBRIGADO, GRACIAS!

First, a big thank you to all our community members – without you, this website wouldn’t exist. Even as a passive reader, you encourage us to carry on!

This website is about sharing different perspectives, not only investment-related, but also lifestyle-related. This wouldn’t be possible without our key members.

Some of you express your enthusiasm more actively. And this means a lot to us. We are fuelled by your coffees (Ko-Fi) or sharing our work on social media.

Thank you so much! ❤️

Thanks for the great work and content you provide, I do recommend your blog / coaching service to friends as the best way to get started! Keep up the great work!

Survey Feedback From Community Member

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

Where are you from? Meet the community!

We have a trully Global Audience

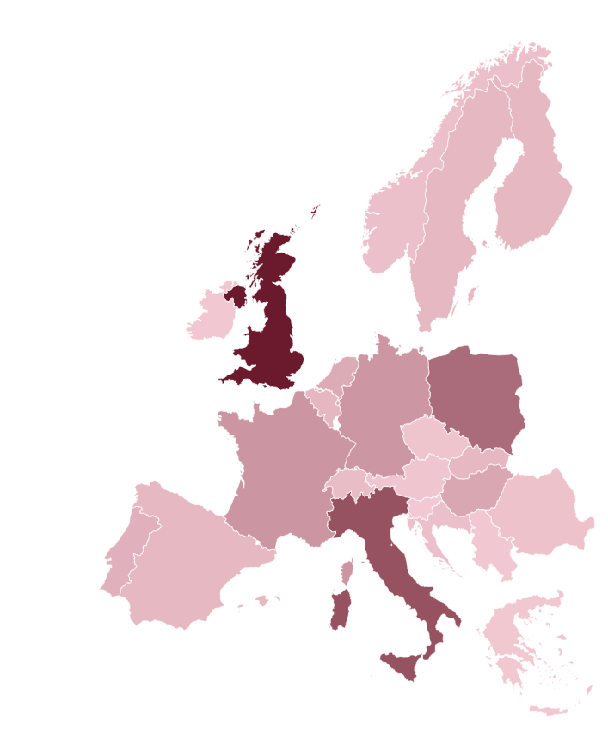

People worldwide consult BoW for guidance, but Europe and North America are the main traffic sources. U.S. and Canadian readers are regularly visiting us, probably to contrast with their local home-bias. We also get some readers from South America and the Far East. In 2023, our strongest European footholds were:

- The U.K. – yup, the language helps!😊

- Italy – with some of the most engaged readers (highest response in our survey!)

- Germany – Europe’s core.

- Poland – where wise investing is spreading more than in other countries.

- Portugal – lots of international folks!

- Benelux & the Nordics – where financial education is more advanced.

What keeps you busy?

The majority of our readers are employed (60%) followed by freelancers. We are also followed by entrepreneurs, students and retired people. The top sectors include:

- Tech (including E-commerce) – since you are more tech-savvy, you found us faster.

- Finance – we have lots of followers that are in Wealth Management.

- Broader Manufacturing and Healthcare – with other occupations also significant.

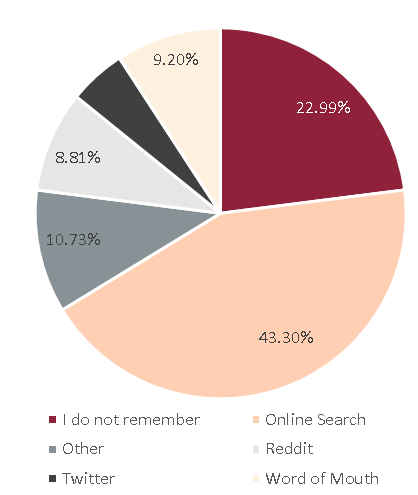

The answer surprised us!

Many of you do remember where you heard about us first. Google is the biggest driver – with AI, we wonder for how long.

We are really proud that the second-biggest traffic driver is offline – word of mouth! And this percentage is even higher in some countries!

The social channels where you follow us the most are Twitter and LinkedIn. But let’s face it – overall, our Social media presence has to improve significantly. Please keep on sharing and helping us there 🙏 and if you do not do so yet, please start following us. We will post quick social updates that are not suitable for the website.

Traffic sources

There aren't many European focused websites available, because of all the different taxation in all the countries. That's why I'm so happy with BoW!

Survey Feedback From Community Member

What is your current portfolio?

What Is Your Current Investing Goal?

There were no changes to the main financial goals of our readers, accumulation of assets for retirement or financial independence (or both) are still the main target. But a fifth of you, have also short-term goals, as well: Large Purchase (House) or Kids Education.

What is your current strategy?

Last year, we created a ‘how it works’ page that guides readers through our website. It also introduces the various types of investors we cover. You probably are familiar with them now but we are reintroducing them for you here:

- The Golden Retriever, aka Wise Passive Investor – has the simplest and easiest-to-understand portfolio with minimum maintenance. The strategy is suitable for all investors.

- The Cyclist, aka Semi-Active DIY Investor – wants to incorporate some marginal high-level tweaks to her predominately index portfolio. Some level of knowledge is required.

- The Banker, aka Evidence-Based Investor – Uses more advanced techniques like Equity Risk Factors or Risk Parity Strategies. It requires substantial research.

How much do you know about investing?

The majority of our readers (60%) have either a good level of financial knowledge, and are aware of the possible traps in investing.

Beginners and Experts – Finance Professionals – each represent around 20% of our readers.

Some of you noted that the 100% Beginner content volume we wrote in 2023 was lower than intermediate/advanced materials. We are working to ensure that we are producing more of it, although keeping on the production of Cyclist/Banker insights is one of our distinctive marks. You can also expect the factor series started in 2023 to continue!

Current Portfolio Complexity

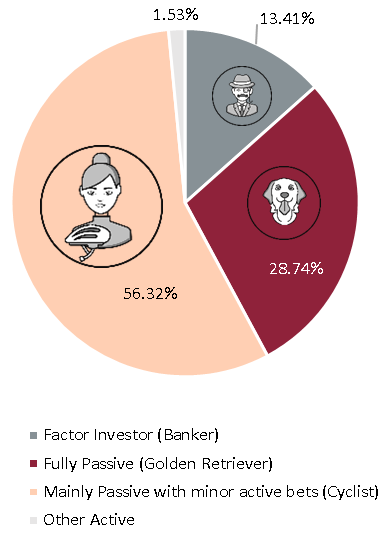

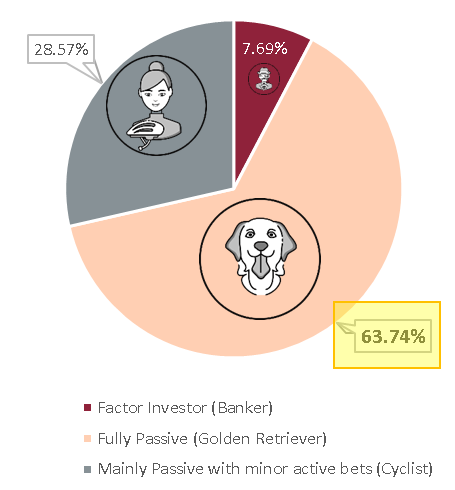

So, how are your portfolios set up? It’s either Cyclists or Golden Retrievers. You believe in some form of market efficiency:

- Golden Retrievers (29%) – Close to a third want a simple and efficient strategy.

- Cyclists (56%) – Represent the majority of our audience.

- Bankers and other active strategies (15%) – a growing audience with focus on Factors or Risk Parity portfolios.

How do you want to change your strategy?

Sticking with your guns, once you have a strategy is important, but some of you are not there yet. The initial setup and tweaking

1. do Golden Retrievers want to change their strategy?

Next step for retrievers

We asked whether you want to change your portfolio going forward. Current Golden Retrievers want:

- Remain Golden Retrievers (64%) – More than half of our readers will remain simple and efficient. These readers enjoy our lifestyle and link collection series.

- Become Cyclists (29%) – About a third want to become cyclists.

- Become Bankers (8%) A smaller percentage, although almost double than last year, wants to move to be a factor investor.

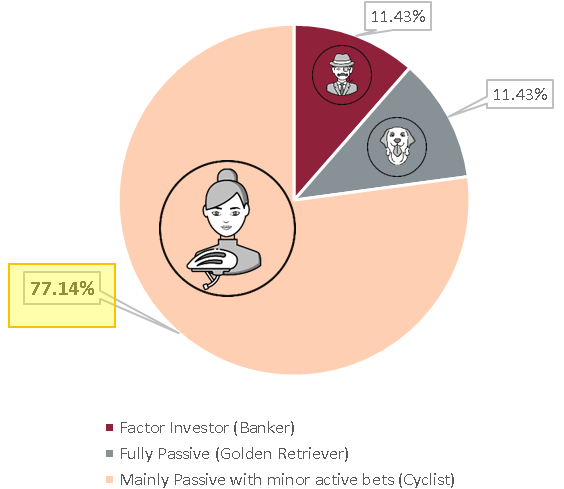

2. How do Cyclists want to change their strategy?

What about Cyclists? They like their setups, as they want:

- Remain Cyclists (77%) – The vast majority of Semi-Passive Investors want to remain as such, but may want to optimize their portfolios even further.

- Become Retrievers or Bankers (11.5%) – Exactly the same percentage wants to become either banker or move to a more relaxed Golden Retriever strategy.

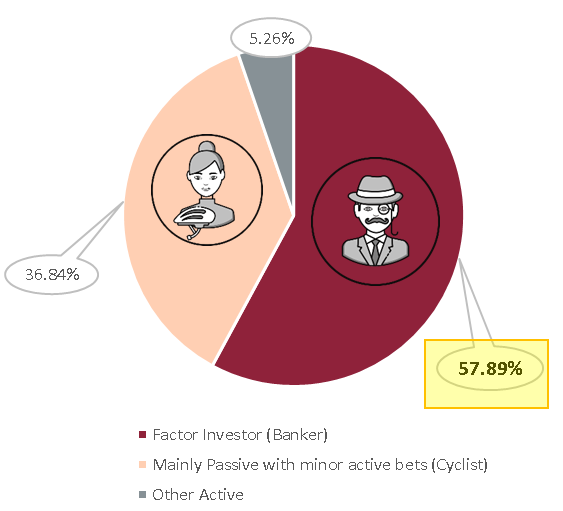

3. How do Bankers want to change their strategy?

What about Bankers? They like it complicated!(no Retrievers there). They want:

- Remain Bankers (58%) – The most advanced group wants, for the most part, to stick to factor investing or leveraged portfolios.

- Becoming Cyclists (37%) – Over a third want to make it somewhat simpler – this may partially be the result of factors underperforming for long periods and is the tricky part of factor investing.

You’re simply the best on the web for a European investor. I appreciate a lot the huge work you did, guys. Because of the vast materials you produce, I would suggest improving again the sitemap and the path to follow.

Survey Feedback From Community Member

What about our content?

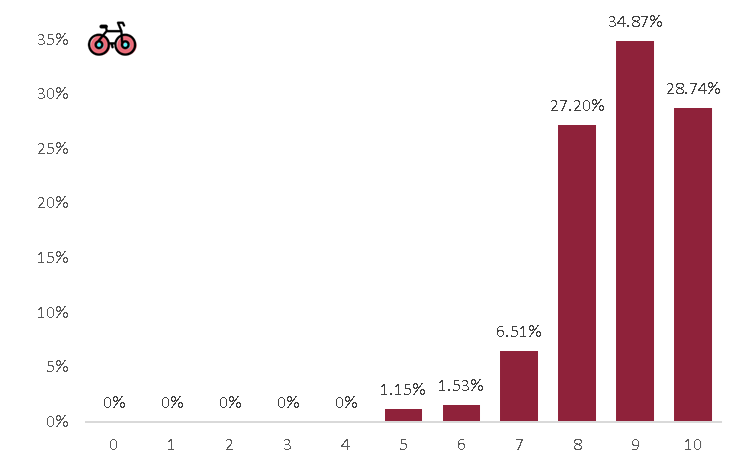

How do you like the quality of our content?

Firstly, thank you so much for this overwhelmingly positive feedback – we are thrilled to see that you love what we are producing. The overall rating has increased from 8.6/10 in 2022 to 8.8/10 in 2023 . There is also a clear lack of consensus regarding your favourite article. But we take it as a compliment. We are pleased that every section has managed to attract readers, indicating a diverse range of interests among our audience.

Enjoyed Too Much to pin down one/or a few pieces!

Survey Feedback From Community Member

What Type of Content Do You Want To See?

Our priorities will align with yours – Investment Guides, ETFs and Broker Reviews – as these are the base to invest wisely. In addition, we will carry on reviewing documentaries and books, as we received positive feedback and since these are good ways to increase financial awareness.

Personal Finance is the basics to start investing and the audience is really enjoying it – stay tuned for more content related to money transfers, expat insurances, cost of life in different countries, guides and tips to travel the less-known corners of the planet and much more!

A few of you express interest in taxes. While we do not feel to be able to offer tax advice, we will keep on producing guidance on general tax optimisation techniques e.g. Withholding taxes.

How Would You Like the format of our content to evolve?

Over 50% of you do not want any change! However, we will take on board your other suggestions, like more visuals. We are still considering creating videos, but it may come a bit later, and it doesn’t seem like your priority either. The length will stay similar, but the content will be more interlinked to allow for expanded reading.

How do you like the Interface?

The changes to the interface have been liked by from over 45% of you, and the other half did not notice a significant change. We hope that this reflects the effort that we made to improve navigation and site accessibility. Here are some of the things we want to focus on in 2023:

- Improve the visibility of our tools – Just one third of you is aware of all tools and features available on the website, like the broker fee calculator.

- Working on Navigation and Site Map: As we continue to work on the Navigation and Site Map, many of you have noticed the updates. However, due to the ongoing evolution of the site, these elements remain in a state of constant development. Please bear with us 🙏

This blog started during Covid-19 to contribute to society and give back the kindness received. We dedicated 3 years to this endeavour. However, it reached a point where a pool of volunteers could not grow any more.

What about the Site financial viability?

Will we be around tomorrow?

What's happening in the blogosphere?

In 2023, we had a number of discussions with fellow bloggers and folks in e-business – it’s a tough space.

Social Media – like X or Linkedin – want you to stay in their ecosystem hardly sending traffic. For the first time in a couple of decades, Google appears to be losing its edge and utility, resulting in rushed ranking updates. Algos are reshuffling search results and sending traffic to established brands, big media and forums at the expense of independent blogs. It’s a defensive strategy for Google given the volume of questionable AI-generated blog content that it can’t separate from human content anymore.

Blogs and websites alike are becoming rare, and tons of them are being entirely disrupted, with probably more to come given genAI ability to recycle human content and spit it out in a customised way. This shift leads to two critical questions: First, how will AI continue to learn when the high-quality human data it relies on becomes scarce, potentially hidden behind walls? Second, how will it prevent a decline in content quality – a sort of ‘quality-content entropy’ – if AI starts to primarily train on its own outputs?

Why we do this?

Blogging was always a tough space, and long-term survival rates are below 5%. But, we write, because we believe in this project and that our skills can be more impactful to wider society than going back to our prior careers.

We know the odds are not in our favour, but we’re ready to defy them! Now, how can we increase the likelihood of being around tomorrow?

How we may improve our odds

In the survey, you have expressed the understanding that in order for us to keep rolling, we’d need to make a few changes. A few of you suggested the willingness to pay for all our content, but I think our wider mission is to produce content for free. In 2024, we will test the following approaches and provide you with feedback:

- Content will remain Free – First, we will keep publishing most of our content for free. We will keep on spreading financial education to the wider society. But, we created a login feature to access some functionalities with a free account.

- Premium zone – We are working on creating a Premium zone. First, this will allow us to know you better, and get some revenues. Second, it will more safely remain out of reach of genAI which takes our content and uses it for the benefit of the corporations that run it. We also aim to build our a more engaged community around this zone. But, the access to the forum will still be available to previously active users.

- Coaching – As many of you probably already know, in 2023 we started to offer coaching sessions with Raph. We have received an amazing feedback from this service, and will carry on providing it.

- Broker Affiliate Programs – We aim to do it while maintaining methodological rigour and intellectual honesty. Although this is a tough way to monetise for us, given we’re internationally-focused, we hope to derive some referral fees to pay some of our fixed costs like server, data, apps, technical assistance or coworking space. We will remain fully transparent on the way we generate any revenues.

As you can see, we are also trying to get more help from the community, and we’ve been overwhelmed by the number of emails left in the survey, CVs and their quality. But of course, we could not expect any less from our readers!

WHAT YOU CAN EXPECT in 2024

Beyond what we mentioned, here are some of the things we want to focus on:

- Social Media – We plan to increase our presence on social media. Indeed, Social Media is not our forte. Please do follow us for updates and content snapshots. Any help with sharing would be hugely appreciated. If you are a marketing pro, please do reach out – we’d need some help!

- Frequent Content – we have been releasing consistent weekly content this year, but we hope to be able to work on a higher frequency, offering one finance and one personal finance article per week. However, our priority will stay always quality over quantity.

- Team Growth – A few of you may have seen we are recruiting! Yes, we are expanding the team to be able to offer a wider range of articles and other services. We also thank all of you who express interest in supporting the website in the poll. We will contact you in due course.

- Cycling. Of course, we will keep on rolling!

Keep cycling & investing! :) and happy new year!🥳

Survey Feedback From Community Member

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

HOW YOU CAN SUPPORT US

We’re always here to hear your feedback. If you would like to show us that you care, we have a buy us a coffee link where you can leave a public/private message and contribute to our future. Every contribution helps! Here is a dedicated page to all the ways you can help.

Thank you again for your support 🙏 and do not hesitate to reach out with ideas!

We wish you a great start to 2024,

Raph, Francesca and the BoW Team

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Cash Is Not Enough: Why Hold Bond ETFs Despite Price Rollercoasters.

The Truth About €1 Million Broker Guarantees (Updated With Trading 212 Cap)

Halifax Share Dealing Review – Similar To Lloyds With SIPP On Top

Lloyds Share Dealing Review – Old School But Ticks The Boxes For Golden Retrievers

DEGIRO Review: A Transparent Leader In Low-Cost Investing

Weekend Reading – BlackRock Launches New iBonds, Truth About €1M Broker Insurance & BOW is 4 years old!

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.