DEGIRO broker Review

A Leader In Low-Cost Investing

4.0

/5

A Leader In Low-Cost Investing

Our take: DEGIRO stands out as an appealing option for those seeking an affordable broker. While it might slightly edge higher in costs compared to its rivals, it compensates with transparency— a rare find among many VC-backed direct competitors.

Is it suitable for you?

- Passive Investors – The platform’s user-friendly interface and straightforward account setup process are significant pluses. The option to select an account in one’s primary language is a distinct advantage. However, the somewhat restricted selection of ETFs outside DEGIRO Ireland, including many from Vanguard, could pose a challenge for some. Nonetheless, for English-speaking investors, DEGIRO Irelands is an alternative. A notable shortfall is the absence of automated investment options, and the platform would benefit greatly from introducing subaccounts for minors to enhance its appeal.

- Semi-active Investors – Might find DEGIRO’s Active Account particularly enticing, offering access to a broad spectrum of markets, more so for English speakers through the Irish entity. However, it’s worth noting that the platform does not offer interest on cash holdings and mandates participation in its securities lending program without profit sharing, which could be a deterrent for some.

- Advanced Investors – For seasoned investors looking to diversify their brokerage accounts, DEGIRO can be decent choice. The availability of margin loans and derivatives are notable features. However, the platform falls short in catering to more sophisticated needs, such as access to U.S. ETFs.

This article contains affiliate links. We provide full transparency on how it works.

Pros & Cons and suitability

Pros & Cons

- Simple to use

- Listed on A Stock Exchange & German Parent Bank licence

- Long Track Record

- Competitive Fees

- No Interest On Cash

- No Automatic Investing

- Mandatory Security Lending

- Limited ETFs Availability For non-Irish Accounts

Suitability

Suitable

NEED irish account for some etfs. No automatic investing.

Suitable

Versatile, But forced security lending.

SOMEWHAT Suitable

Margin loans & Derivatives but No US ETF Access.

Availability Checker

Check if the broker is available in your country

Broker Snapshot

Why Is DEGIRO A Tier 2 Broker?

We view DEGIRO as a Tier 2 Broker. DEGIRO shines in its category, leading its low-cost brokerage niche with substantial assets (up to 10x compared to many rivals) but not quite reaching Tier 1 levels. Boasting a 15-year legacy, DEGIRO is backed by a banking-licensed parent, Flatex, ensuring more stability and regulatory compliance. It has a robust presence in key European markets and transparent reporting.

However, it remains a medium-size company (€1bn Market Cap, with lower profitability than Tier 1 Brokers), does not cater to Institutional Investors, and has an average account size of just €20k. Its parent – Flatex – is not a systemically important institution, and not rated by a Rating Agency. Importantly, its main competitors are not Tier 1 Brokers that cater to high net worth individuals, but rather low-cost brokers like Trading 212 or Trade Republic.

Medium-sized Transparent Broker, Listed on a Stock Exchange

DEGIRO, established in 2008 in the Netherlands, was acquired by Flatex, a German bank, in 2020, leading to the rebranding as FlatexDEGIRO. By February 2024, the company manages just below €50 bn in assets across 2.7 million customer accounts. It is listed in Frankfurt, headquartered in Germany, while DEGIRO’s main office remains in the Netherlands. Post-merger, the primary regulator is BaFin, with the Netherlands Authority for the Financial Markets (AFM) also providing oversight. DEGIRO had low profitability in the past, but improved recently as it increased fees. Due to Brexit, DEGIRO lost its UK FCA license, and can’t open new accounts in the UK. Legacy accounts opened before the suspension are still operational and under FCA supervision.

Company Info

| Characteristic | DEGIRO |

|---|---|

| Inception Date | 🛈 2008 (Dutch Entity) |

| Headquarters | 🛈 Amsterdam, Netherlands |

| Key Owner | 🛈 Bernd Förtsch (Flatex founder) |

| Bank Affiliated | ✅ Yes |

| Listed on Stock Exchange | ✅ Xetra: Є1 bn (FlatexDEGIRO: FTK) |

| Parent Rating | ❌ No |

| Net Income | ✅ €80m |

Regulation

| Feature | DEGIRO |

|---|---|

| EU Entity | 🛈 DEGIRO B.V. |

| UK Entity | 🛈 DEGIRO B.V. |

| Key Regulators | ✅ Germany, Netherlands |

| EU Regulator | ✅ Germany, Netherlands |

| UK Regulator | ⚠️ Currently Suspended |

| EU Guarantee | 🛈 90% of Net Loss (Max. €20k) |

| UK Guarantee | 🛈 Max. £85k (only for legacy accounts) |

Competitive Fees and Margin Accounts

DEGIRO strictly adheres to the European PRIIPs legislation, offering only ETFs with documentation translated into local DEGIRO account language. This means that if you’re opening a French account, ETFs without KIID in French won’t be available to you. Certain leading ETF providers like Vanguard don’t translate documentation into most EU languages. For example, French DEGIRO entity customers won’t have access to Vanguard ETFs. The workaround is for EU residents to open an Irish Account instead of their local one. Multicurrency accounts are not available. Cash interest is not remunerated, and Security Lending is mandatory. DEGIRO also won’t share any Security Lending revenue with its clients. DEGIRO doesn’t rely on PFOF, and has a list of commission-free ETFs.

Features

| Feature | DEGIRO |

|---|---|

| Key Base Currencies | 🛈 All Major EU Currencies |

| ETF Availability | ❌ Low except Ireland |

| Multicurrency | ❌ Not Available |

| Cash Interest | ❌ Not Available |

| Margin Loans | ✅ Available |

| Exchanges | ✅ All Major |

| External PFOF Reliance | ✅ Low |

Fee Structure

| Feature | DEGIRO |

|---|---|

| Custody Fees | ✅ None |

| Inactivity Fees | ✅ None |

| ETFs Dealing Fees | ✅ Low |

| FX Fees | ↔️ Average |

| Deposit Fees | ✅ None |

| Withdrawal Fees | ✅ Low |

| Security Lending | ❌ Mandatory and No Fee Share |

I. Company

DEGIRO is very transparent compared to other Tier 2 Brokers, but has a history of regulatory fines (although risks were recently mitigated by higher capital requirements). Based on our conversations with the broker, its status in the UK is currently unclear.

Ownership & Transparency

DEGIRO, established in the Netherlands in 2008, was acquired by Flatex, a German bank and brokerage founded in 1988, and rebranded as FlatexDEGIRO. It is listed on the Frankfurt Stock Exchange with a market cap of €1.1 bn as of January 2024. Most of its shares (74%) are floated, but the Flatex founder (Bernd Förtsch) owns 19% of the company. Transparency is high, with regular quarterly reporting and coverage from Equity Research Teams across Europe. The group banking activities can be considered non-core, as two thirds of revenues comes from commissions.

Business Profile

FlatexDEGIRO has entities across 16 markets. 60% of customers come from three countries – Germany, Austria, and the Netherlands. The remaining part comes from Western Europe. Nordics and Eastern Europe customers are marginal to the business. It caters to beginners and intermediates, as users’ average account balance is around €20k. It does not offer CFDs which we view as positive.

Safety Considerations

In 2023, the required Tier 1 Ratio is a healthy 27%, but this was due regulator highlighting financial risks associated with loans it offers to investors. The increase in required capital is a good step forward because it helps lower the company’s risk levels and boosts its main financial safety measure (called the CET1 ratio), which is much higher than the required 15.4%. Flatex is not a rated Bank, thus it is difficult to estimate its probability of default. It is also not considered a systemically important Bank.

Regulation & Investor Compensation Schemes

- EU Clients and new UK Client – DEGIRO is regulated by the German Federal Financial Supervisory Authority (BaFin) and provides investors with a protection amount of €20,000. This level of protection – while standard among most EU brokers – is considered low. Learn more about broker bankruptcy protections.

- Legacy UK Accounts – clients that signed up before 2023 are protected up to £85,000. New clients fall into EU regulations, as the UK entity is currently suspended by the FCA.

Cash Custodians

Your cash is deposited into FlatexDEGIRO Bank. As with all regulated banks, if cash is held in your name it is protected up to €100,000.

Reputation

DEGIRO faced scrutiny from the European authorities over its IT infrastructure’s security, deemed inadequate in 2021, leading to an incremental €3 million capital reserve. Since then, DEGIRO has significantly upgraded its IT systems. Additionally, FlatexDEGIRO, DEGIRO’s parent company, was fined by BaFin for breaching banking supervisory regulations and faced increased capital requirements following the merger with DEGIRO.

II. Fee structure

DEGIRO is very competitive on fees, with the exception of FX.

Platform fees

There are no annual account fees or inactivity fees.

Trading Commisions

The platform offers competitive fees, especially for ETFs in what it calls its Core selection. This list is subject to changes and should be verified on DEGIRO’s website. Each month, one Core ETF purchase is charged at just €1 handling fee, contrasting with the standard €3 total fee. For subsequent Core ETF purchases, discounts apply to orders exceeding €1,000. Other ETF trading fees are consistent across markets, with a €2 purchase fee plus €1 handling charge. Very fee-sensitive clients may note that since the takeover from Flatex, DEGIRO has slowly increased some of its fees, which were previously considered to be the lowest in the market. Despite these changes, they still remain very competitive.

Overall Fee Simulation vs Competitors

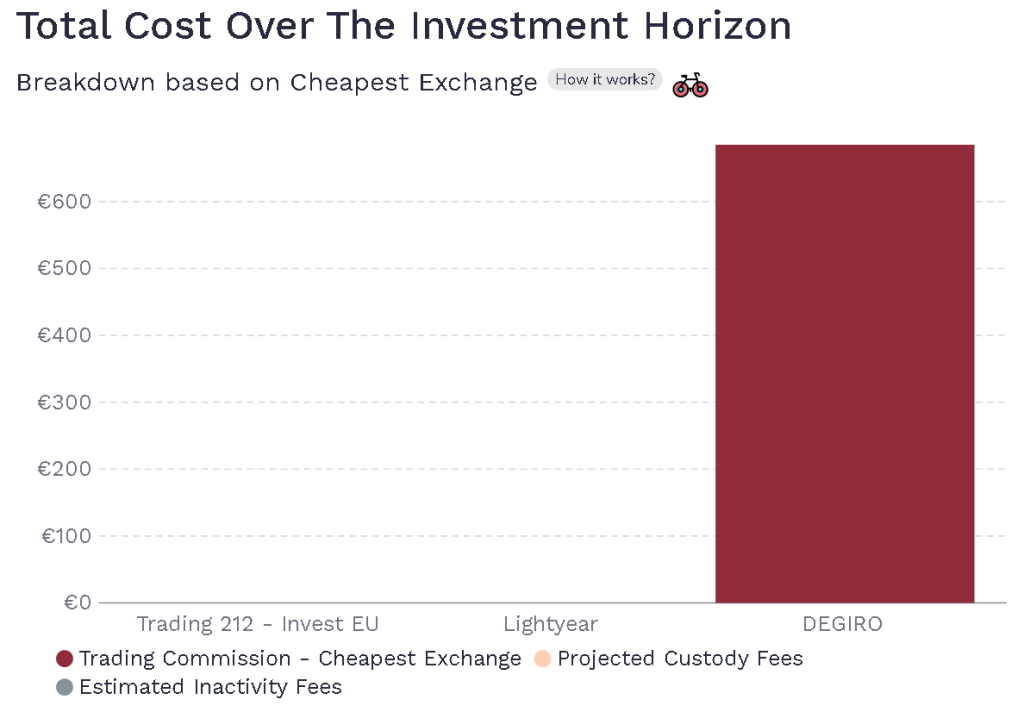

Most of our readers have simple Index portfolios. Using our Broker Total cost calculator, you can estimate the total cost of holding ETFs throughout the investment period. In the below simulation, a 20-year accumulation period broker bill is around €700 with DEGIRO. In comparison, smaller competitors – like Trading 212 or Lightyear – may appear to be more cost-effective. But, these businesses may also change their fee structure over such time horizon, and DEGIRO costs remain very reasonable. None of these peers employ Payment for Order Flow (PFOF), which may lead to additional costs for customers, through higher spreads, as explained in our PFOF guide (that’s the reason we didn’t compare against e.g. Trade Republic).

Investor assumptions

| Model Feature | Assumption |

|---|---|

| Investor | EU Country |

| Instrument | UCITS ETF |

| Plan | Fixed Pricing |

| Initial Investment | € 100,000 |

| Monthly | € 1,000 |

| Time Horizon | 20 years |

| Gross Return | 8% |

Total Fees vs Trading 212

Currency Exchange fees

Accounts can be opened in any currency of one of DEGIRO’s entities. Without multicurrency accounts, FX fees apply when trading ETFs in a currency different from your account’s. DEGIRO’s FX fees are average for the market (0.25%). In comparison, Trading 212 charges 0.15% and Lightyear 0.35%. Note that you can create subaccounts in other currencies (e.g. USD), and disable auto-conversion, but you still need to move your home currency into them and incur the 0.25% fee. If you opt for manual conversion, a €10 fee per transaction is added.

Other fees

Deposits and withdrawals are free. DEGIRO permits share transfers, charging €20 per position. Share transfers between DEGIRO accounts incur a €7.50 fee per position. Unlike some platforms, DEGIRO doesn’t share the earned fees for stock lending or pays interest on your cash. There is also a €2.5 annual Stock Exchange connection fee for all exchanges except your default one.

III. Platform & Features

DEGIRO’s platform is known for its intuitive and user-friendly interface, suitable for both novice and seasoned investors. It offers a comprehensive view of investment choices, straightforward navigation, and efficient trading procedures. The design supports quick market access, and effective order execution. DEGIRO provides access to all major exchanges for ETF investors. But, local entities don’t offer ETFs with KIIDs that are only in English, Cash in not remunerated, and most importantly – your Securities may be borrowed by other market participants, and there is no opt-out. It’s also difficult to set investing on auto-pilot, and manage accounts for your children.

Account Opening Process

Opening a DEGIRO account is generally quick and straightforward. Approval usually takes less than a day, but verification may take longer for non-European passport holders. Requirements include residency in an accepted country (36 in total as per our tool above) and a SEPA bank account. The process involves a selfie and ID scan through the app, with no minimum transfer amount. Response times for email inquiries at DEGIRO can vary by entity, with a minimum wait of 2 days for general questions. Online reviews indicate that resolution times for specific issues may take longer.

Country Availability

DEGIRO distinguishes itself by allowing account openings with each entity, provided your tax residency is in an accepted country and you have a SEPA banking account. The local websites are available exclusively in the respective languages, but accounts can be opened with any entity if the local language is understood. Currently, DEGIRO operates with 16 different entities in 36 countries. Norway, Hungary and UK entities have been suspended. However, whereas UK residents can still apply for an account through a EU entity, this is not the case for Hungarians and Norwegians.

Country Availability

The below table includes tax residencies:

- The Language Column – If local language is supported, it means that DEGIRO has a local entity that you can open an account with.

- Suggested Entity – You also have the choice to choose another entity e.g. Ireland, if you prefer the platform to be in English rather than your local language, and to have access to ETF with KIDs available in English.

- Belgian Residents – can open a French or Dutch account, or revert to Irish.

- Most Accounts are in EUR – except Denmark, Czechia, Switzerland, Poland, and Sweden.

- French DOM-TOMs – can open a French account, or any other including Ireland.

DEGIRO Entities and alternative accounts

| Country | Language | Suggested entity |

|---|---|---|

| Australia | No Local Entity | Ireland |

| Austria | German | Austria or Ireland |

| Belgium | No Local Entity | FR, NL or Ireland |

| Bulgaria | No Local Entity | Ireland |

| Slovenia | No Local Entity | Ireland |

| Czech Republic | Czech | Czech Republic or Ireland |

| Denmark | Dennish | Denmark or Ireland |

| Estonia | No Local Entity | Ireland |

| Finland | Finnish | Finland or Ireland |

| France | French | France or Ireland |

| French Guyana | No Local Entity | France or Ireland |

| Germany | German | Germany or Ireland |

| Greece | Greek | Greece or Ireland |

| Iceland | No Local Entity | Ireland |

| Ireland | English | Ireland |

| Italy | No Local Entity | Italy or Ireland |

| Latvia | No Local Entity | Ireland |

| Lichstein | No Local Entity | DE, AU, Swiss or IE |

| Lithuania | No Local Entity | Ireland |

| Luxembourg | No Local Entity | FR, DE, AU, Swiss or IE |

| Netherlands | Dutch | Netherlands or Ireland |

| New Zealand | No Local Entity | Ireland |

| Poland | Polish | Poland or Ireland |

| Portugal | Portuguese | Portugal or Ireland |

| Romania | No Local Entity | Ireland |

| Singapore | No Local Entity | Ireland |

| Slovakia | No Local Entity | Ireland or Czech Republic |

| Spain | Spanish | Spain or Ireland |

| Sweden | Swedish | Sweden or Ireland |

| Switzerland | German | Switzerland or Ireland |

| United Kingdom | No Local Entity | Ireland |

account Features

DEGIRO offers four account types. Only the first two are relevant for Long-Term Investors:

- Basic: The default option at sign-up, providing access to stocks, ETFs, bonds, and major exchanges without leverage or margin loans.

- Active: Upgradable via an online questionnaire, adding leverage products and margin loans alongside basic account features.

- Trader Accouts: Accessible through customer service, these accounts include all previous products with leverage, typically recommended for advanced investors.

Note that there is no option to open a joint account or an account for your children (anyone below 18 is excluded).

While direct debit transfers from your bank to DEGIRO are possible, DEGIRO lacks an automatic investment plan feature, requiring manual asset purchases.

Mandatory Security Lending

DEGIRO engages in securities lending. Previously, DEGIRO offered a “Custody” account option allowing users to opt out of this practice. However, this account type is no longer available, necessitating acceptance of the associated risks with securities lending when opening an account. Customers do not get any share of the security lending revenues.

Cash Interest

There is no interest on cash for clients. DEGIRO takes 100% of the interest generated.

Internalisation And PFOF

Since mid-2021, DEGIRO began routing some orders to Tradegate, a decision that raised concerns with the Dutch regulator. Following DEGIRO’s acquisition by Flatex, regulatory oversight shifted to Germany, where such practices are even more common. DEGIRO clarified that Tradegate is primarily used for after-hours trading, with an option for users to opt out. FlatexDEGIRO also stated that Payment for Order Flow (PFOF) orders about 1% of total orders, implying minimal impact from upcoming 2026 legislation on the company.

Advanced Features

For Active and Trading accounts, you may use margin loans that have relatively competitive fees: 6.9% or 5.5% as of February 2024. Also, these accounts provide access to Options and Future Markets, however there is no possibility to trade US ETFs. To learn more open the geeky section below.

Margin Accounts

Your borrowing capacity with a Margin Loan hinges on your portfolio’s worth and mix of assets. Active accounts qualify for loans up to 33% of portfolio value, while Basic and Trader accounts can tap into up to 70%, the latter granted to more seasoned investors meeting specific criteria.

- Basic Account: 70% margin, no derivatives.

- Active Account: 33% margin, derivatives included.

- Trader Account: 70% margin, derivatives accessible.

Derivatives

DEGIRO provides access to Options and Futures Markets through advanced accounts.

No Access to U.S. Markets

PRIIPs is an EU rule that prohibits buying US-listed ETFs, including Factor ETFs from e.g. Avantis or Dimensional Fund Advisors. One of the reasons is tax implications. This rule also applies to UK Investors. In theory, high-net-worth or professional investors can bypass PRIIPs, allowing them to buy US-listed ETFs. This exemption is related to your ‘MiFID status’ being an Elective Professional Client. In practice, most brokers don’t give clients this option. DEGIRO falls into this category.

IV. Taxes

Tax Wrappers

DEGIRO does not offer tax wrappers as February 2024.

Tax Reporting

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – BlackRock Launches New iBonds, Truth About €1M Broker Insurance & BOW is 4 years old!

The Truth About €1 Million Broker Guarantees

4 Things I Learned In 4 Years Of Running A Finance Blog

Dodl By AJ Bell Review – AJ Bell’s Younger Brother

Vanguard LifeStrategy Review – A Retriever In A Babushka Doll

Why Do Portfolio Managers Care About Factors? It’s Not What You Think.

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.