Shape the Future of Bankeronwheels.com - 2022 Survey Results

Bankeronwheels.com started as a cycling and investing blog during the pandemic.

Raph spent 2019 cycling the world and received so much kindness that he wanted to give back. Given lockdowns, giving back took the shape of a blog by helping individual investors set up cost-efficient portfolios and promote sustainable ways of travelling.

Since then, the blog has grown substantially. 2022 marked the second full calendar year of Bankeronwheels.com.

To know what we do well and where we need to improve, we decided to get your feedback and launch a 2022 Year-end survey. If you missed it, make sure to keep up to date by signing to our newsletter for future updates.

Here are some takeaways from our survey. In this article, we also cover in detail parts of our plan for next year.

KEY TAKEAWAYS

- Our community comprises mainly European semi-passive investors. Many want to keep it simple by remaining fully passive, while others are intrigued by Factor Investing.

- You love our content and would like us to cover a wide variety of topics but focus predominately on investing guides and ETFs – with more visuals.

- Our content structure needs improvement. You would like us to focus on improving navigation as well. We got it!

- In 2023, as much as our resources allow us, we plan to increase the frequency of content, expand our team and community, and increase our social media presence.

Here is the full analysis

I think it's 'imperative' to scale Bankeronwheels.com (and make it multi-language). There are loads of high-quality content that can be helpful to millions of people.

Survey Feedback From Community Member

THANK YOU, GraZIE, MERCI, DZIEKUJE, danke schon, OBRIGADO, GRACIAS!

First, a big thank you to all our community members – without you, this website wouldn’t exist. Even as a passive reader, you encourage us to carry on!

This website is about sharing different perspectives, not only investment-related but also lifestyle- related. This wouldn’t be possible without our key members – Francesca, Kathrin and Romain.

Some of you express your enthusiasm more actively. And this means a lot to us. Whether it’s through suggestions, sharing our work on social media or responding to beginners’ questions on our community forum. Special thanks to, amongst others :

Leif Dahleen, Tadas Viskanta, Ben Carlson, Rui, Maciej, Rui G., Pedro, James, WillyFog, Lorenzo, Miroslaw, Federico, Mystery Buzu, Nicola Protasoni, Indeedably, Banker on Fire, Dale Roberts, Adam Smith and Roberto.

Thank you so much!

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

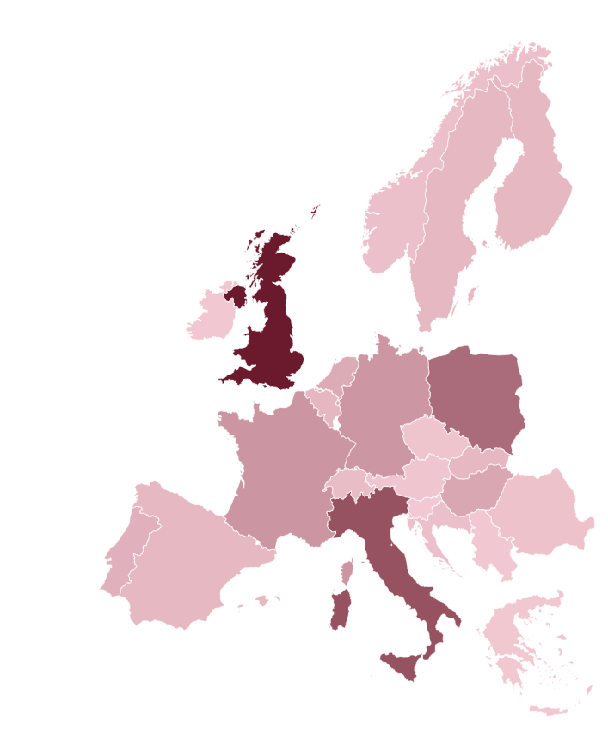

WHO ARE OUR READERS? Meet the community!

Where are You from?

What is your current Investing goal?

The majority of our readers have the main goal the accumulation of assets for retirement.

But a fifth, have in-parallel another goal either:

- Large Purchase (House) or

- Kids Education

Around 15% have short to medium-term live event goals like a wedding, travel or career change.

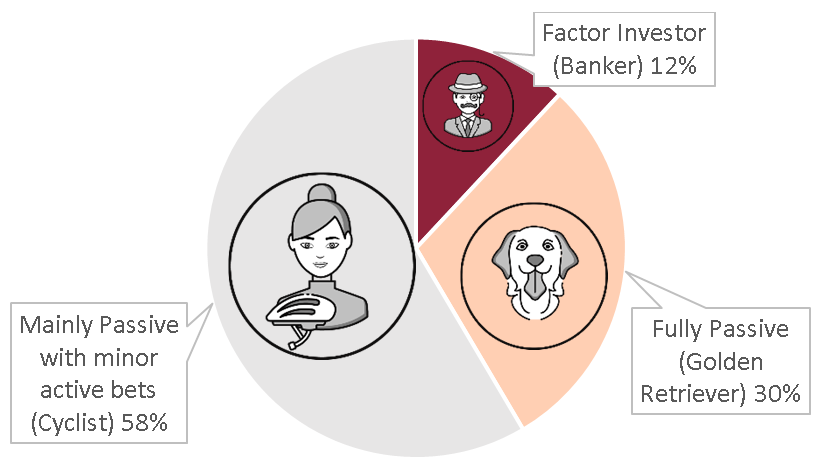

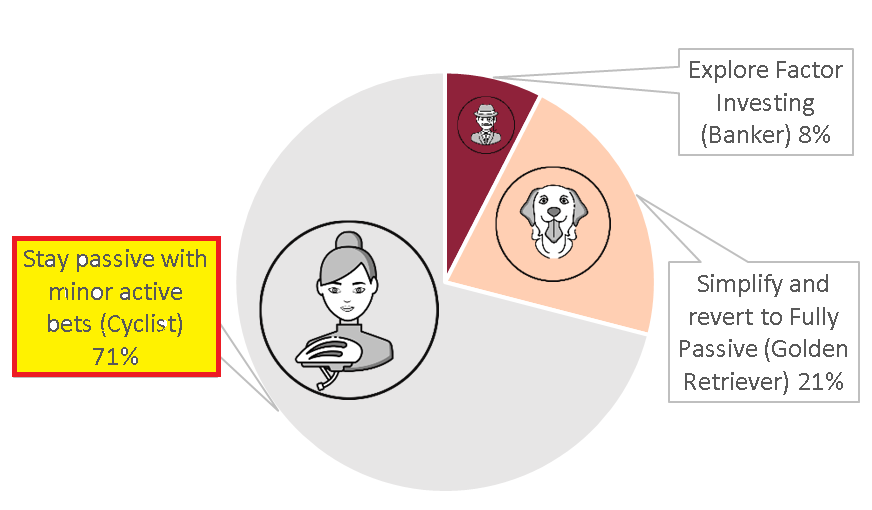

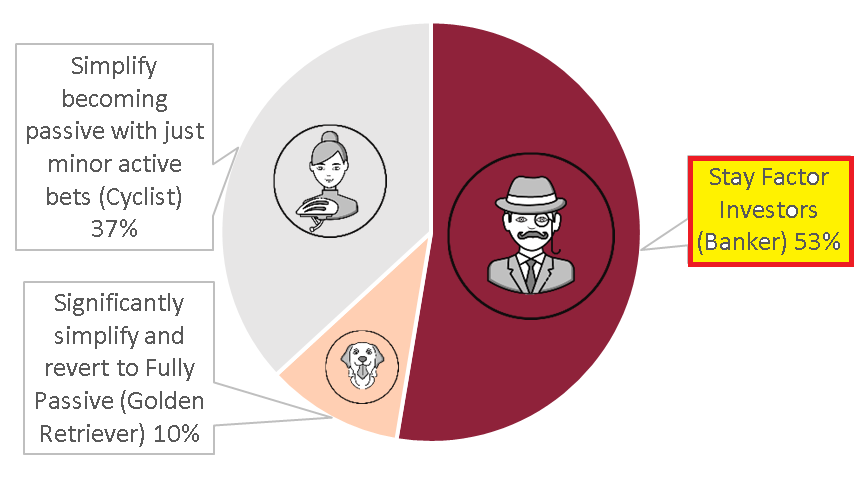

What is your current strategy?

Over the last couple of weeks, we have created a ‘how it works’ page that guides readers through our website. It also introduces the various types of investors we cover.

- The Golden Retriever, aka Wise Passive Investor – has the simplest and easiest-to-understand portfolio with minimum maintenance. Strategy is suitable for all investors.

- The Cyclist, aka Semi-Active DIY Investor – wants to incorporate some marginal high-level tweaks to her predominately index portfolio. Some level of knowledge is required.

- The Banker, aka Evidence-Based Investor – Uses Equity Risk Factors. Requires substantial research.

Current Complexity of Your Portfolio

- Golden Retrievers – About a third want to keep it extremely simple and efficient by using 1-2 ETFs for their entire portfolio.

- Cyclists – 58% of our readers are passive but are experimenting with tweaking their portfolio, including some active bets.

- Bankers – 12% are pretty advanced in implementing factor investing.

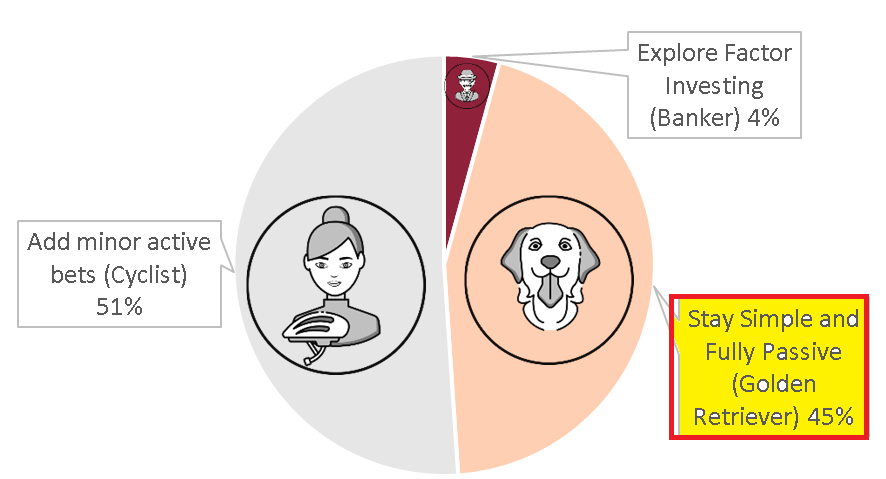

How do you want to change your strategy?

1. How do Golden Retrievers want to change their strategy?

2. How do Cyclists want to change their strategy?

3. How do Bankers want to change their strategy?

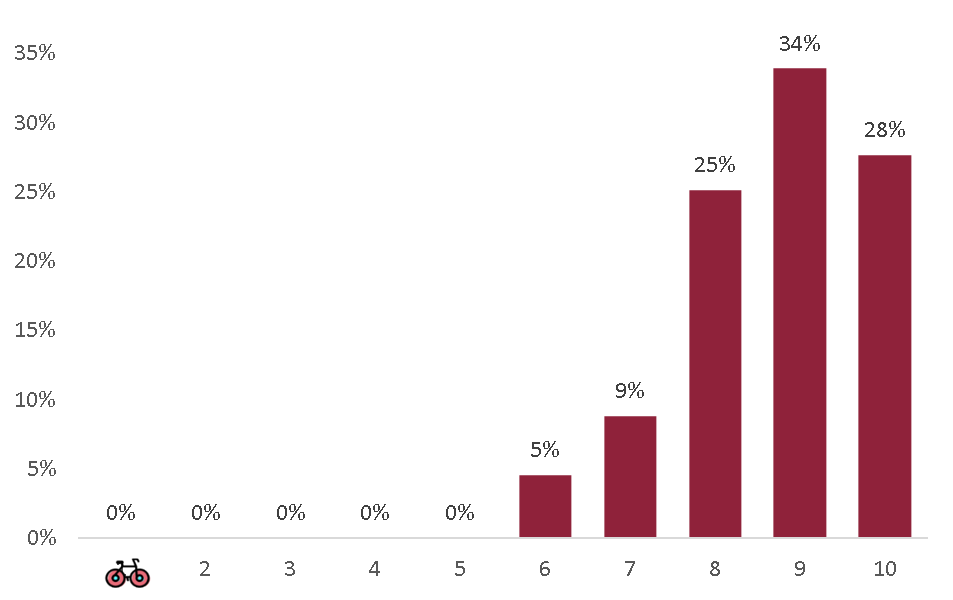

What about our content?

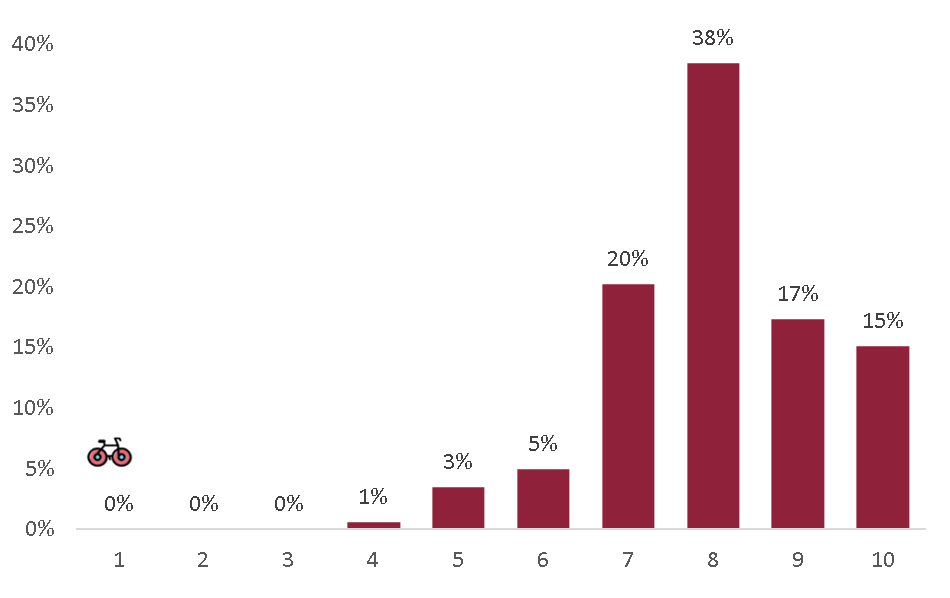

How do you like the quality of our content?

What Type of Content Do You Want To See?

Our priorities will align with yours – Investment Guides, ETFs and broker reviews – as these are the base to invest wisely. In addition, we will carry on reviewing documentaries and books, as we received positive feedback and since these are good ways to increase awareness.

Personal Finance is the basics to start investing – stay tuned for more content.

I like your page and your lifestyle. I have been sailing since 2003 on my sailing catamaran around the world, and I am happy to survive. Thank you for your excellent work.

Survey Feedback From Community Member

We have shared little about Lifestyle lately as we remain focused on the core part of the website , but we plan to do more in the coming months with some guides and tips to travel the less-known corners of the planet.

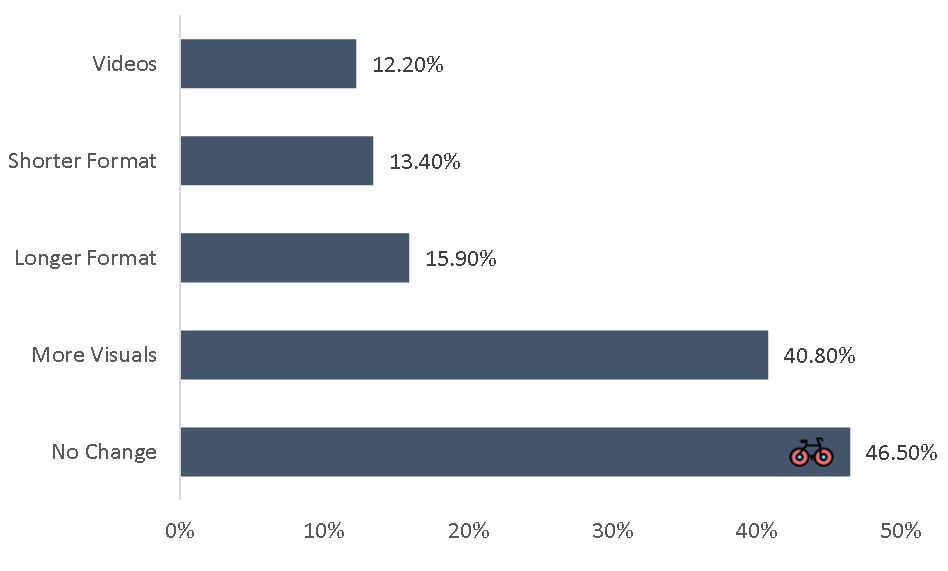

How Would You Like the format of our content to evolve?

We take your suggestions on board. More visuals – our loyal readers may have noticed this already in the last articles, but we will focus on it even more. Creating videos may come in due time. The length will stay similar or be shorter, and more digestible, but the content will be more interlinked to allow for expanded reading.

How do you like the Interface?

- More intuitive structure – Adding a sitemap and reorg of key sections to make it more intuitive, especially for beginners. Less cluttered and better-organized home page.

- Easier navigation – Especially on mobile.

- Title/thumbnails in our guides – To improve readability.

WHAT YOU CAN EXPECT - SOCIAL, FREQUENT CONTENT & FEEDBACK

Here are some of the things we want to focus on in 2023:

- Social Media – We plan to increase our presence on social media. Indeed, Social Media is not my forte. Please please do follow us for updates and content snapshots. Any help with sharing would be hugely appreciated.

- More Frequent Content – A few of you noted the ‘irregularity’ of our posts. This is about to change! We will try to release content weekly, but as you know, our priority is always quality over quantity.

- Friday Roundups – You can expect more newsletters on Friday night with fresh weekend reading.

- Q&As – We are thinking about potential investing Q&A sessions. The format is yet to be defined.

- More Surveys – We will be using more surveys and polls to receive feedback and align content to your needs. However, we are always open to improvements, suggestions, article ideas, collaborations and just contacts, so please feel free to contact us through email or our contact form anytime.

ARE YOU A BLOGGER?

Thanks for sharing the other websites that you consult – we can see that we are in excellent company!

A number of you only use Bankeronwheels.com – a special thanks for your trust :)

As you know, we promote other bloggers, the wider community and similar content in Europe. The financial media need a shake-up. If you’re a blogger, don’t hesitate to reach out.

For all our readers – we will introduce the option to submit interesting content to be promoted in our weekly roundups.

This blog started during Covid-19 to contribute to society and give back the kindness received. We dedicated 2.5 years to this endeavour.However, it reached a point where a pool of volunteers could not grow anymore.

KEY CHANGES IN 2023

As you see, we plan a few changes, and we hope to expand our base significantly.

This project started during Covid-19 in a way to contribute to society and give back the kindness received. We dedicated 2.5 years to this endeavour.

However, it reached a point where this very small team and pool of volunteers available could not grow anymore, and the resources risked remaining very hobby-like and infrequent.

We decided to dedicate ourselves to the website and make it grow to benefit the wider audience as much as we can.

We do that because we believe in this project and that our skills can be more impactful to wider society than in our prior careers.

Therefore we aim to introduce some revenue streams to cover the technical aspects and administrative tasks. We do it in complete transparency.

This will be a very challenging task, in the middle of a bear market, and we really count on you support!

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

HOW YOU CAN SUPPORT OUR PROJECT

We are very small website, but a strong and high-quality community.

In order to make wise investing more impactful, your support can be financial and non-financial.

A couple of financial support options are:

- Setting up a coaching session.

- Buying us a coffee.

Some other non-financial contributions include:

- Helping us spread the wise investing message on social media.

- Giving us early feedback on our to-be-released resources and assisting new members with their questions on our community forum.

- Signing up for broker accounts using our affiliate links, at no cost to you.

Thank you again for your support and do not hesitate to reach out privately, or on the forum!

We wish you a Happy New Year and a great start to 2023,

Raph and Team

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – BlackRock Launches New iBonds, Truth About €1M Broker Insurance & BOW is 4 years old!

The Truth About €1 Million Broker Guarantees

Dodl By AJ Bell Review – AJ Bell’s Younger Brother

Vanguard LifeStrategy Review – A Retriever In A Babushka Doll

Why Do Portfolio Managers Care About Factors? It’s Not What You Think.

Money Market Funds: Are ETFs The Best Bang For Your Buck Or A Risky Ride?

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.