How to Get Rich (Netflix Series Review)

In Personal Finance, what one would consider Common Sense Is relatively Uncommon.

The Netflix Series “How to Get Rich” is based on Ramit Sethi’s work, including the New York Times Best Seller Book “I Will Teach You To Be Rich”.

Today, let’s have a look at why most people are so bad at managing their finances and where you and your loved ones can start to change it. With this series, we are also glad to see Index Investing hitting Netflix in a big way.

KEY TAKEAWAYS

- Broken down into eight episodes, the show follows Sethi crisscrossing America to coach individuals from all walks of life on having, first and foremost, a vision for their personal financial situation.

- Sethi then identifies what they are doing wrong and the corrective path to take in search of that vision.

- There are five personal finance themes from the show that help expand on why having a vision of what your rich life is will answer the show’s titular question, that is, How To Get Rich?

- Writing down what is a rich life is a great starting point for fulfilment and happiness. Smartly reducing spending is another one.

- This is a must-watch show for certain people. First, for those who are new on a journey to optimise the thinking on a quest to achieve a rich life. But also, for those that are minimising all spending to postpone a rich life, that may never come.

Here is the full analysis

How To Get Rich | Official Trailer | Available on Netflix

"Annual income twenty pounds, annual expenditure nineteen six, result happiness. Annual income twenty pounds, annual expenditure twenty pound ought and six, result misery"

Charles Dickens

Snapshot

The quote above is from Dickens’ novel, David Copperfield, published in 1849 and has transcended time, borders & almost two centuries of human advancement to be still relevant today.

It is generally believed that this novel was a work of personal inspiration & experience. We can conjecture, thus, that given its transcendental nature, and the fact that Dickens had no formal training in personal finance, this statement is a universal truth that the Victorian author was subject to.

It is this universal truth which forms the basis of Ramit Sethi’s, author of the New York Times Best Seller “I Will Teach You To Be Rich”, new Netflix docuseries provocatively titled “How To Get Rich”. Fair warning to anyone expecting a super secret formula to untold riches, there is nothing of that sort here.

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

How To Have a Rich Life in 5 Steps

Part 1 - What you bring in determines the kind of lifestyle you can have

What's Your Excuse?

The level of income an individual makes is central to Dickens’ universal truth about happiness. If your vision for yourself is to have that dream condo, pay off your debt, retire your parents or even yourself, you’re not going to get far if you’re not making enough to start with.

Ramit does an excellent job of also dwelling on the inertia that people exhibit in leaving low-paying dispositions or those with variable and/or exploitative compensation structures.

In most cases, this mental block prevents us from acknowledging our own skill set and qualifications. The end result is that we stay where we are and build a web of protective cover around us to unreasonably justify our lack of action.

Part 2 - Control your spending, or your spending will control you

But Live Your Rich Life Now

The second part of Dickens’ universal truth is to control expenditure. Again, if your vision is to have savings that you can draw on for a rainy day or invest for retirement, you are not going to get far if you are throwing parties, ordering stuff online that you don’t need or over-allocating to expenses when less could do.

It was fascinating to see that Sethi is not frugal in his approach and actually encourages guilt-free spending on things we need and are passionate about. What he preaches, rightly so, is to cut down the excess.

This is a refreshing perspective, especially for those, including some in the Financial Independence Retire Early (‘FIRE’) community, that ‘postpone’ living.

Part 3 - Be Disciplined or Face the consequences

Atomic Habits

An interesting aspect of personal finance improvement is discipline. This has always applied to big ticket things like savings and investment, but Sethi’s model has a unique application to little things as well. For example, he hates paying late fees on anything and preaches that you get your bills out of the way as soon as possible.

That money lost to paying late fees is a steak you could have had, a debt you could have run down, or an extra contribution to your retirement fund. The message here is that these atomic habits compound into big gains with the passage of time.

As a sub-theme, Sethi also explores delinquency that impacts your credit score. Your lack of discipline in obtaining and servicing leverage will lead to higher financing costs all else equal. Thus, you’re better off paying on time now than being disciplined by paying more later.

Part 4 - Trap debt before debt traps you

Is it relevant to Europeans?

The first milestone for people struggling to pay their debt is to acknowledge there is a problem. Then comes the plan to pay it down. Deleveraging is essential to be able to design a sustainable lifestyle, and knowing you have a problem is when you start making a difference.

The show reserves a special focus on coaching to avoid the debt trap. This is primarily geared towards credit card debt as it ties in well with poor lifestyle & career choices explained in the earlier three highlights.

That said, Sethi attacks over-allocating to expensive housing and vehicles as well with fair arguments. While Credit Cards are less of a problem in Europe (we explained some reasons why) the last two are something some Europeans also struggle with.

Part 5 - Wise Investing Or Home Ownership

Index Investing Finally Hitting Netflix

Last but not least, if you bring in more than you spend, you’re going to be left with a little extra every month. If you don’t have any debt to run down, you can save it the old-fashioned way by keeping it under the pillow, or you could do the modern thing and invest it.

Investing it makes your money start working for you and is the optimal choice. However, the paths that one takes to investment are quite different and vary from person to person.

The message though is not to buy the stock of the week. In fact, Sethi, preaches the old Bogle routine with an emphasis on growing the honeypot every month instead of looking to bet the house. At the risk of sounding cliché, the message is going slow, stay steady & be boring to win the race.

So much so, that at one point he comes all out with his love for low-cost passive, which made us happy to know he’s a fellow boring investor. We’re happy that more people will hear this message through channels like Netflix.

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

So Why Is Common Sense So Uncommon?

Where to Start?

As you can see, none of what Sethi preaches is rocket science. On the contrary, most of the content is focused on building common sense approaches to money, like Charles Dickens from 1849. This prompts the question as to why people lack common sense in the first place.

The answer, in our humble opinion, lies in the lack of a vision for your personal financial situation.

Wealthy vs Rich Life

This is what Sethi tackles by targeting our relationship with money from a behavioural aspect, seeking to answer why the lack of a vision and acting on it, makes us fall into the trap of doing the things we do and why we don’t do the things we should:

- The first homework – he gives any of his clients is to write down what their rich life is. The focus here is on the rich and not the wealthy. Such goal quantification is essential to help understand what is important and then start taking corrective action to get there.

- His second homework – kicks in, that is, writing down your conscious spending plan. If you have a clear idea of what your spending needs are and what you actually spend, you are going to be able to cut down expenses or come to the realisation that your goal achievement is only possible if you increase your income.

In the end, everything circles back to Dickens’ and the universal truth of happiness.

This is a must-watch and exciting show that will help you explore your own relationship with money and optimise your thinking on your quest to achieve your rich life.

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – BlackRock Launches New iBonds, Truth About €1M Broker Insurance & BOW is 4 years old!

The Truth About €1 Million Broker Guarantees

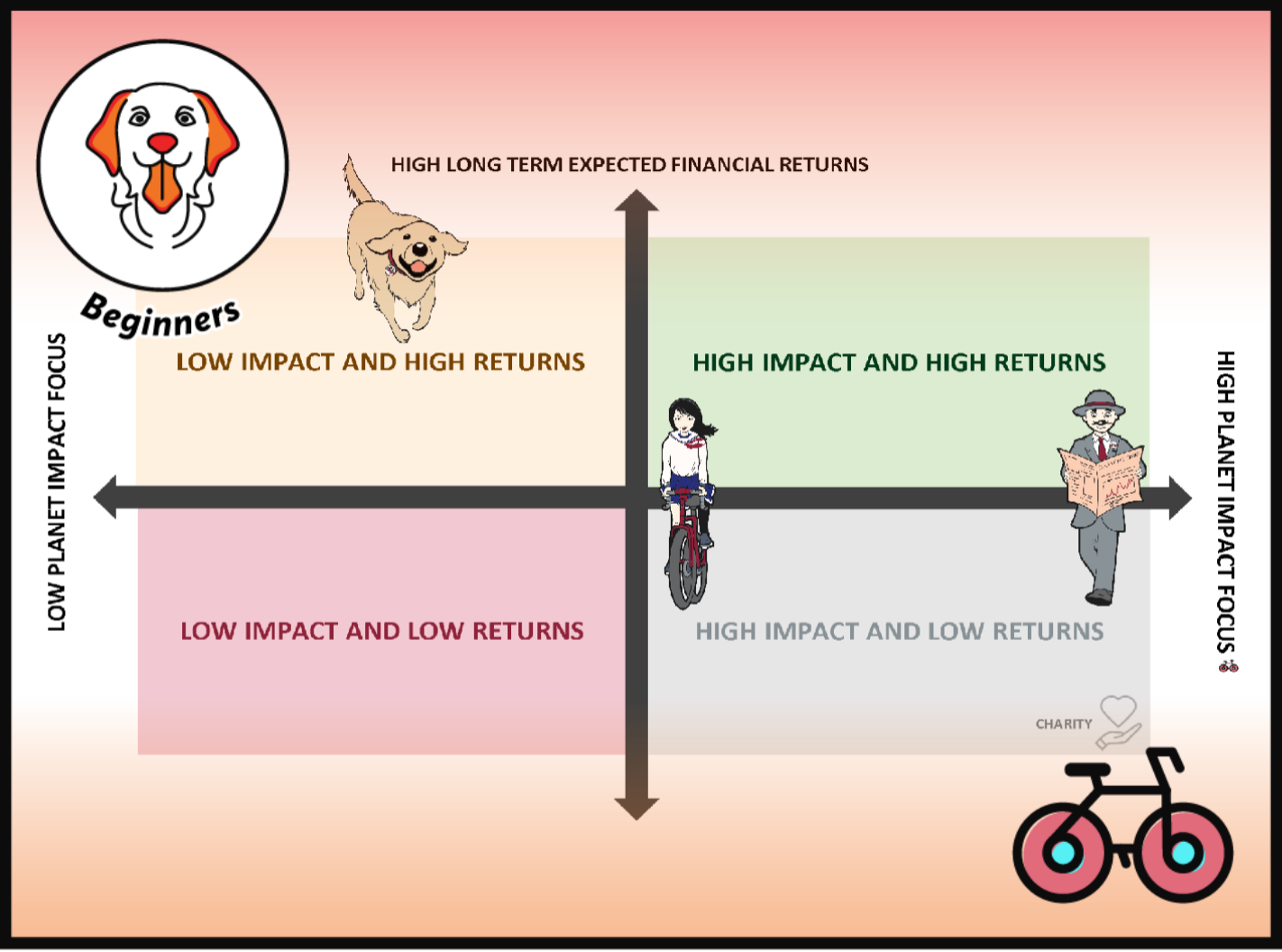

Three Sustainable Investing Strategies That Actually Work

ETF Fees – How They Work & How to Minimise Them!

How Much Should You Pay For An ETF?

4 Things I Learned In 4 Years Of Running A Finance Blog

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.