Live and Let Buy: Which Bonds For Your Objectives?

The Definitive Guide to Bond Index Investing - PART 2

Welcome to Part 2 of Licence to Yield – Our Definitive Guide to Bond Index Investing.

Whether you are investing for the Short or Long Term, Bonds are a key component in a portfolio.

Today, we will spotlight the bond categories that we will explore in this guide. We will also go through bonds you may want to avoid, to accomplish your goals. Let’s dive in!

KEY TAKEAWAYS

- Fixed Income Fund Types Should Be Aligned With Your Goals – There are eight categories that you may use in portfolio construction.

- Long-Term Investors In Accumulation Phase – often choose Government or Aggregate Bond ETFs, as they reduce the portfolio volatility. For such funds, most Investors tend to hedge currencies. Inflation Bond ETFs can provide further protection, but their long-duration can be problematic in certain European countries.

- Retired Investors – often use Investment Grade Corporate Bond ETFs or Mortgage Bond ETFs which de-risk Equity portfolios, while adding incremental yield.

- Short-Term Investors – can choose Money Market Funds, Short Duration Government or Investment Grade Corporate Bonds.

- Bonds To Avoid For Most Investors – Include more volatile segments like Emerging Markets or High-Yield Corporates. Both exhibit a stronger correlation with risk-on assets, limiting their utility in simple portfolios. But sometimes they are useful in retirement. NPL Funds – while high yielding – are a great addition, as they are decorrelated. But they are rarely accessible to individual investors.

Here is the full analysis

BOND ETFs: Asset Accumulators' SECRET WEAPON

1. Aggregate and Government Bond ETFs

making 10+% per year with bonds?

You may be surprised to learn that Bond prices can be quite volatile. But that’s not necessarily a bad outcome for your portfolio. Consider the following examples:

- 12% Return in 2008 – In June 2007, the 10-Year US Treasury yield stood at 5%. Over the following 18 months, the S&P 500 lost almost 40%. Yet, US Bonds returned 12%.

- 34% Return between 2000 and 2003 – During the Dot Com crash, 10-Year Treasuries returned 34% over 3 years, while their starting annual yield was only 6.5%.

How was this possible? Wasn’t the yield on Bonds supposed to be fixed? We will have a look at the mechanics in the next article. But first, what are the prerequisites to benefit from bonds in stressful scenarios?

Learn Market Mood Swings: Risk-On and Risk-Off

Here’s the deal. Apart from sideways markets, there are two states of play in Financial Markets – Risk-on and Risk-off:

- In Risk-on Environments – investors flock to Equities, Emerging Market Bonds or Commodities, or countries exporting them.

- In Risk-off Environments – investors seek safe havens like US Treasuries, German Bunds, the US Dollar, Gold or the Swiss Frank.

To leverage the negative correlation with risk-on assets, you need bonds from the risk-off category.

We’ll dive into how to pick those Bonds in a detailed article soon. For the limitations of risk-on bonds, read on.

Risk On & Risk Off Asset Classes and Currencies

| MARKET ENVIRONMENT | ASSET CLASSES | CURRENCIES |

|---|---|---|

| Risk ON | Equities, Emerging Market Bonds, High-Yield Bonds, Commodities | EM Currencies, AUD, CAD, NZD, GBP |

| Risk OFF | US Treasuries, German Bunds, Gold | USD, JPY, CHF |

Should You Always Hedge Currencies?

For most investors, hedging Bond currency is preferable.

But there could be exceptions. Some advanced investors with a willingness to take additional risk may remain unhedged. Especially if they are based in countries that are in the ‘risk-on’ category. We will explain why in a dedicated article.

What about the Euro? It’s a tricky one The Euro funds carry trades, but at the same time is vulnerable to scenarios like 2011/2012. This has an impact on hedging strategy.

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

Inflation Protection: FOR most europeans, No silver bullet

2. Inflation-Linked Bond ETFs

Inflation hedge? often Only on paper.

Nominal Bonds can sometimes let you down when inflation rears its head. That’s where Inflation-Linked Bonds step in – their coupons and principal are tied to inflation, serving as a potential counterbalance.

Watch Out For Pitfalls

However, Inflation-linked bond ETFs often have a higher duration, meaning they are more sensitive to changes in interest rates. If rates rise, the price of these ETFs can fall, potentially leading to losses for investors. This is particularly relevant for most European and UK investors.

These Bonds also won’t help when Inflation is already priced-in. There is also a more personal issue. Inflation-Linked Bonds protect against officially reported inflation, but if an investor believes this does not accurately reflect their personal cost of living increases, these instruments may not provide full protection.

Are Inflation-Linked Bond ETFs right for you? We’ll tackle that question in another article.

3. Corporate Bond ETFs

It's A sweet deal.

Corporate bonds usually offer a higher yield than government bonds.

This can provide a retiree with a larger stream of income to support tax-efficient spending. The performance of corporate bonds is tied to both general economic conditions and the health of individual corporations, which can be somewhat different from the factors that influence government bond prices.

We will learn how to triage between good and bad bond quality.

4. Mortgage-Backed Securities ETFs

Get over it. It's 2024, not 2008.

One issue with this market segment is that MBS get a bad rap from their role in the financial crisis, and investors are unwilling to take them on. That’s totally fair, but it completely ignores how the market has changed over the past 15 years, and how to analyse these Bonds.

They could be interesting yield-enhancers for some investors. We will cover why.

Bonds For Near-Term Goals

5. Short-Term Bond ETFs

Best hedge against inflation?

Short-term Bond ETFs are not only a great way to park your cash if you save for a house deposit, a wedding or any other short-term goal, but they also are one of the best ways to hedge against inflation.

We will cover risk/return trade-offs with Short-term Bond ETFs.

Why do Bond Investors Shy Away from The Highest Returns?

High Yield (HY) and Emerging Market (EM) Bond ETFs, while in theory promising higher returns, have two major flaws:

- Correlation – As Risk-On assets, they are highly correlated with Equities.

- ‘Diluted’ Yield – At times, they suffer substantial losses. The actual yield is not as good as it may look.

6. High-Yield Bond ETFs

Almost as risky as Equities - you better get the timing right!

- Spreads before January 2020 – before the full impact of the pandemic, the ICE BofA US High Yield OAS stood at around 3.5%.

- Spreads in March 2020 – As the pandemic intensified and equity markets declined, the high-yield bond spread surged to 11.5%.

That translated into a price drop of over 20% for HY ETFs, before the FED stepped in. From January to March 2020, the S&P 500 plummeted by around 25%.

- Spreads in May 2007 – prior to the full impact of the crisis, the high yield bond spread stood at approximately 2.7%.

- Spreads in December 2008 – As the crisis unfolded, the OAS surged. By December 2008, it had reached a peak of around 21%.

That translated into 45%+ price declines. The S&P 500 index experienced a sharp 40% decline during this period.

Don't Be Fooled by Yields

Typically, Yields are a good proxy for Bonds’ Expected Total Return, as we explain in the next article. However, this is not the case for HY Bonds:

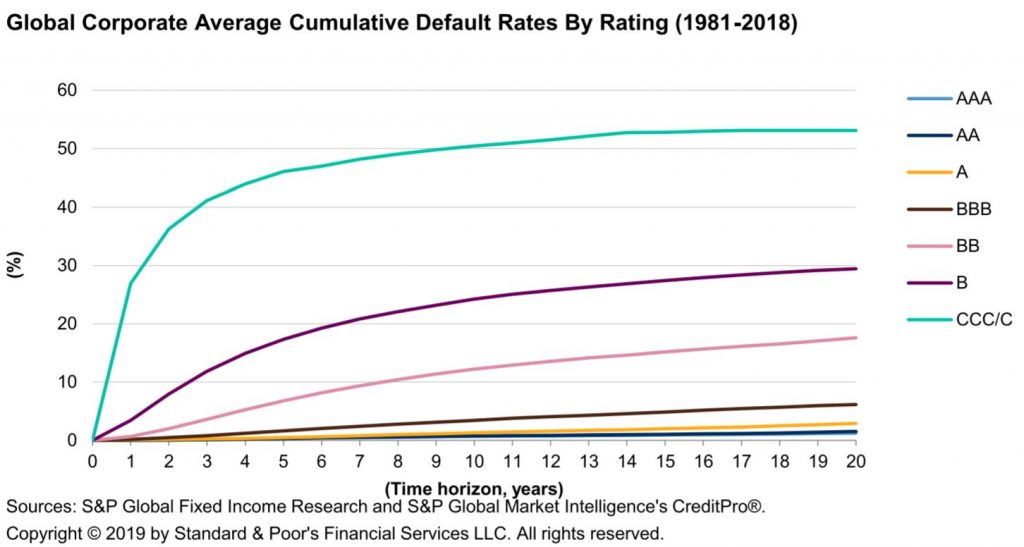

- Bankruptcies – The long-term average HY default rate based on data from 1987 as collected by S&P is around 3.5%.

- Losses – It’s not unreasonable to assume 40-70% LGDs, as these Bonds rank junior to IG Bonds.

This means that between 1.4% and 2.5% of the yield may not be recovered, depending on where we are in the economic cycle. Whether you are adequately compensated is another story and depends on the pricing and realised defaults. For some investors it can be an interesting asset class, but for most simple portfolios – it isn’t.

Default Rates Based On Credit Rating

7. Emerging Market Bond ETFs

You're not a Hedge Fund Going After a Sovereign State

Now that you are familiar with the dynamic of HY Bonds, Emerging Markets (EM) Debt behaves similarly with respects to correlation and bankruptcies.

You may not like the stats of some defaults (table below), unless you invest in a Vulture Fund, from the likes of Elliott Management. The fund bought discounted Argentine debt following the country’s 2001 default and then engaged in a long legal battle to be repaid in full.

This included an audacious move to have an Argentine naval vessel impounded in Ghana as collateral.

These Hedge Funds are in the last – very interesting fixed income category (read on) – but your ETF will probably just sell the securities at the wrong time given the constraints it has. The damage will be proxied by the expected loss given default these securities have, and according to S&P, 50%+ losses are to be expected in over 50% of cases!

To summarise – today, Emerging Countries are rarely rated above BBB. From the worst ones, a couple of countries improved their Credit Ratings over time, but most remain speculative and have been for long periods in a state of default or restructuring over the past century. And a few have been almost constantly in a 40%+ inflation regime.

External Debt Defaults and Country Risk: 1824-2001

| Country | Rating | Defaults | % Defaults | Inflation |

|---|---|---|---|---|

| Argentina | CCC- | 4 | 26.1% | 47% |

| Brazil | BB- | 7 | 25.6% | 59% |

| Chile | AA- | 3 | 23.3% | 19% |

| Columbia | BB+ | 7 | 38.6% | 1% |

| Egypt | B | 4 | 12.5% | 0% |

| Mexico | BBB | 8 | 46.9% | 17% |

| Philippines | BBB | 1 | 18.5% | 15% |

| Turkey | B | 6 | 16.5% | 58% |

| Venezuela | CCC+ | 9 | 38.6% | 12% |

| Group average | - | 5.2 | 27.4% | 25% |

Where Active Investing is King

8. NON-Performing Debt Funds

But if you have acces to them, it's a sweet deal.

And speaking of non-performing debt, there are other vehicles that specialise in this type of investing, but with higher volatility.

I have spent a few years managing some Non-Performing Debt Portfolios whether related to Corporates, Mortgages or other types of issuers. Some of the largest players in this field include Oaktree Capital or Apollo Asset Management.

It’s unlikely that have access to these funds – they are also not in ETF format – but in case you do, performance can be significant (15-20%), and what’s best – negatively correlated to the Economic Cycle!

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

Next Steps

Now that you have a grasp of what’s important and which Bonds you may use for your portfolio, let’s start with the most surprising property of Bonds – they are pretty volatile.

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – BlackRock Launches New iBonds, Truth About €1M Broker Insurance & BOW is 4 years old!

The Truth About €1 Million Broker Guarantees

4 Things I Learned In 4 Years Of Running A Finance Blog

Dodl By AJ Bell Review – AJ Bell’s Younger Brother

Vanguard LifeStrategy Review – A Retriever In A Babushka Doll

Why Do Portfolio Managers Care About Factors? It’s Not What You Think.

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.