FREETRADE REVIEW

Our take: Freetrade markets itself as an ETF-friendly platform with very competitive pricing for SIPPs and General accounts. It caters well to investors who want a simple portfolio as well as investors that may be interested in trading on European and U.S. exchanges. More advanced investors may find limitations depending on their sophistication and needs.

Is it suitable for you?

- Passive Investors: They’ll find the platform’s ETF trading account fees competitive for General & SIPP Accounts. The choice of major ETFs is attractive and the forum a nice support to get help in how to use the platform an getting started.

- Semi-Active Investors: There is decent access to foreign stock exchanges although investors may find limiting the lack of multicurrency and junior accounts.

- Advanced Investors: Freetrade falls short in providing leverage and advanced features like access to U.S. ETFs or Bonds (with the exclusion of UK Treasury Bills) for those looking to push their investment strategies further.

This article contains affiliate links. We provide full transparency on how it works.

Pros & Cons and suitability

Pros & Cons

- Cheap for General Accounts & SIPPs

- Good Selection of ETFs and Stocks

- User Friendly Web And Mobile Apps

- Straightforward Business Model

- Limited Cash Interest

- Limited Tax wrappers

- Unprofitable

- No advanced features

Suitability

VERY Suitable

Good ETF offer. low feeS REgular Investing.

Suitable

EU & U.S. Equity Markets but no family accounts and limited tax wrappers

Somewhat Suitable

No advanced Features and markets except equities/etfs

Availability

Freetrade is Available in the UK and Sweden

In 2020, Freetrade created the Swedish entity as first step towards a broader European expansion.

Broker Snapshot

Why Is Freetrade A Tier 2 Broker?

Freetrade, one of the first low-cost brokers in the UK, started its operations in 2016. Like most Tier 2 rivals, it is not listed or affiliated with any bank, but focuses on user-experience/platform and low fees. In 2020, the company began its European expansion by establishing a Swedish entity, and by the end of 2023, it had £1.6 billion in Assets Under Administration, with an average account balance of £4k for about 700K funded customers. Its main competitors include other Tier 2 UK brokers like InvestEngine or Direct Brokers like iWeb, targeting investors in search of low-cost providers.

Simple business Model, Regulated in the UK & Sweden

Freetrade is regulated by the FCA in the UK and protects customers’ money and assets up to £85,000 per person under the FSCS. In 2020, Freetrade expanded into Europe, where it’s regulated by Sweden’s Financial Supervisory Authority, offering investors around €20K in protection (the actual amount is in local currency).

Company Info

| Characteristic | Freetrade |

|---|---|

| Inception Date | 🛈 2016 |

| Headquarters | 🛈 London |

| Key Owner | 🛈 Not Known |

| Bank Affiliated | ❌ No |

| Listed on Stock Exchange | ❌ No |

| Parent Rating | ❌ No |

| Net Income | ⚠️ -£ 40 mn (2022) |

Regulation

| Feature | Freetrade |

|---|---|

| EU Entity | 🛈 Freetrade Europa AB |

| UK Entity | 🛈 Freetrade Limited |

| Key Regulators | ✅ FCA, UK |

| EU Regulator | ✅ Finansinspektionen (Sweden) |

| UK Regulator | ✅ FCA, UK |

| EU Guarantee | 🛈 Max. SEK 250K |

| UK Guarantee | 🛈 Max. £85k |

Very Competitive Fees

Freetrade offers access to various European exchanges, along with a wide range of stocks and ETFs. There are no dealing fees across all accounts. In addition, there are no account fees for general accounts. However, there are monthly subscription fees for ISA and SIPP accounts, which also unlock additional products and features compared to the General accounts. Interest on cash varies by account type. It doesn’t provide multi-currency accounts or margin loans. FX fees are relatively high, unless you have higher paid subscription.

Features

| Feature | Freetrade |

|---|---|

| Key Base Currencies | 🛈 GBP |

| ETF Availability | ✅ Good |

| Multicurrency | ❌ Not Available |

| Cash Interest | ✅ Yes |

| Margin Loans | ❌ No |

| Exchanges | ✅ LSE, Nasdaq, Major European |

| External PFOF Reliance | ✅ None |

Fee Structure

| Feature | Freetrade |

|---|---|

| Custody Fees | ✅ Very Competitive |

| Inactivity Fees | ✅ None |

| ETFs Dealing Fees | ✅ None |

| FX Fees | ↔️ Average |

| Deposit Fees | ✅ None |

| Withdrawal Fees | ✅ None |

| Security Lending | ✅ No |

I. Company

Freetrade is a fairly established, but still unprofitable low-cost broker. Its business approach is simple and transparent, aimed at delivering value to investors. As with all Tier 2 brokers, Investors should strongly consider regulatory protections and investment compensation schemes.

Business Profile

Freetrade specialises in commission-free trading for stocks and ETFs, granting access to UK, US, and European markets, including fractional shares. Their revenue model hinges on monthly subscription fees for premium services, FX and interest on uninvested cash.

As per 2022, 43% of the revenue was coming from the subscription plans, 30% from AUA revenue including interest, and 36% from FX transactions. The company estimates over the years a decrease of revenue from the subscription plans and an increase from the FX fees that are estimated to be roughly 50% of the total revenue.

The average amounts held in the accounts per customer varies based on subscription type, being as little as £1k for Basic and up to £30K for Plus.

Ownership and Transparency

Founded in September 2016 by Adam Dodds and Davide Fioranelli, Freetrade’s growth has been fueled by a blend of crowdfunding and venture capital. Notable financing rounds include a $15M Series A with Molten Ventures in 2019 and a $69M Series B led by Left Lane Capital in 2021. However, in 2022, the company faced challenges in securing additional funds at a higher valuation, resorting to a convertible loan and another crowdfunding campaign, coupled with a reduction in staff. Employee ownership is promoted with share distributions.

Safety Considerations

Filings indicate a loss of £40 million for 2021-22, representing a significant increase from the previous year (-£17m). Despite a surge in valuation to £650 million during a crowdfunding round in November 2021 at the peak of the market, subsequent fundraising challenges led to a revised valuation of £225 million as of June 2023, in line with prior valuations from October 2020. This valuation makes Freetrade a small to medium-sized player, much larger than the smallest rivals like InvestEngine, but still about 5x smaller than Tier 1 players like AJ Bell.

Given that Freetrade is a unprofitable Tier 2 player, the Financial Services Compensation Scheme (FSCS) protection of £85k for UK customer and of €20K guaranteed from Finansinspektionen are an extremely important consideration for investors.

Regulation & Investor Compensation Schemes

In the UK, he Financial Services Compensation Scheme protects up to £85,000 per institution in event of firm failure. Importantly this is per customer per institution. A customer with £85,000 in an ISA and £85,000 in a SIPP would only be able to seek up to £85,000 total compensation in case of firm failure.

In Sweden, the regulator is the Finansinspektionen that guarantees up to SEK250K (approximately €20K) per investor. This level of protection – while standard among most EU brokers – is considered low.

Share & Cash Custodians

Customer cash is safeguarded in institutions termed ‘safe banks,’ with Freetrade opting not to disclose their identities. Freetrade Nominees Limited serves as the custodian entity for UK stocks, along with ETFs with CREST. US stocks, on the other hand, are entrusted to a SEC-registered broker, who holds them within the DTCC framework.

Reputation

Freetrade’s reputation is generally positive, as reflected in customer reviews and expert analysis across various platforms. In January 2022, Freetrade received a supervisory notice from the UK Financial Conduct Authority (FCA), instructing the removal of all paid influencer advertisements on social media platforms found to be misleading regarding investment returns. Although these requirements were voluntary (VREQ), Freetrade agreed to implement them and it has since then implemented a stricter internal financial promotions review process.

II. Fee structure

Freetrade has highly competitive fees for General and SIPP accounts, although its fee structure for ISAs is comparatively less competitive. Notably, the absence of transaction fees enhances its appeal to investors who engage in frequent investing. The platform has diverse execution partners. Freetrade’s FX fees are high to very high. While they may seem similar to UK Tier 1 brokers, direct Tier 2 competitors have typically lower FX charges.

Platform fees

In the UK, Freetrade offers three different types of subscription that give access to different types of accounts and features:

- Basic – General Investment Account and access to about 4,700 stocks and shares (including US fractional shares). You have also access to have access to European stocks listed in Paris, Amsterdam, Brussels, Vienna, Frankfurt, Lisbon, and Helsinki. For ETFs, they provide access to all Vanguard, iShares and Invesco ETFs. This account is free of charge.

- Standard – In addition to the basic features, you can have an ISA account and access to the full range of financial products (over 6,100 instruments). Additionally, you can set up automated orders and limit orders. It costs £5.99 monthly or £59.88 if billed annually.

- Plus – it offers access to a SIPP account, priority customer service and access to Freetrade Web beta. It costs £11.99 a month or £119.88 if paid annually.

Account types

| Subscription Type | Account Type | Annual Fee | Stock and ETF products | Advanced Order Features | Foreign Exchanges Access |

|---|---|---|---|---|---|

| Basic (UK) | Geneal | £0 | 4,700 | ❌ | ✅ |

| Standard (UK) | General & ISAs | £5.99 or £59.88 if paid annually | 6,100+ | ✅ | ✅ |

| Plus (UK) | General, ISAs and SIPPs | £11.99 or £119.88 if paid annually | 6,100+ | ✅ | ✅ |

| ISK (Sweden) | General | 0 SEK | 6,100 + | ✅ | ✅ |

Trading Commisions

Freetrade operates on a commission-free model. Their order execution prioritises price and cost. Execution involves a range of market makers, brokers, and venues, with the flexibility to execute orders beyond UK or EU venues. As of 2020, the top 5 executing partners for ETFs were: Winterflood Security LTD, Peel Hunt LLP, Flow Traders B.V. Investec Bank PLC and Stifel Nicolaus Europe Limited. Winterflood Securities was by far the largest (about 66% of all ETFs transactions) followed by Peel Hunt with about 28%. Winterflood Securities is an execution party for large Tier 1 Brokers in the UK, including Hargreaves Lansdown and Interactive Investor.

Overall Fee Simulation vs Competitors

Most of our readers have simple Index portfolios. Using our Broker Total cost calculator, you can estimate the total cost of holding ETFs throughout the investment period. For our simulated scenarios:

- General Accounts – Freetrade is very competitive

- ISAs – Freetrade is not competitive

- SIPPs – Freetrade is very competitive

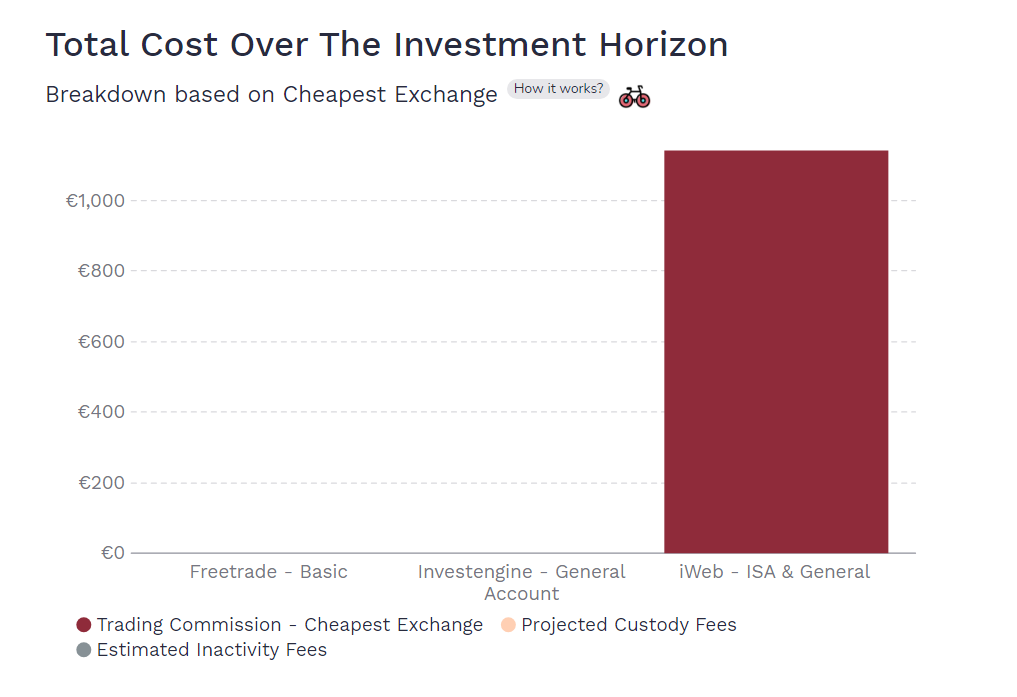

Fee Simulation For General Accounts

In the simulation below, for a 20-year accumulation period, the broker bill for a General Trading account amounts to £0 for Freetrade, matching the cost of one of its direct competitors, InvestEngine. Conversely, iWeb is a significantly more expensive option, with a total bill of £1,140. It’s important to note that for iWeb, the costs are entirely accrued from dealing fees, as there are no custody fees.

Investor assumptions

| Model Feature | Assumption |

|---|---|

| Investor | UK |

| Instrument | UCITS ETF |

| Account | General |

| Initial Investment | £ 100,000 |

| Monthly | £ 1,000 |

| Time Horizon | 20 years |

| Gross Return | 8% |

Total Fees

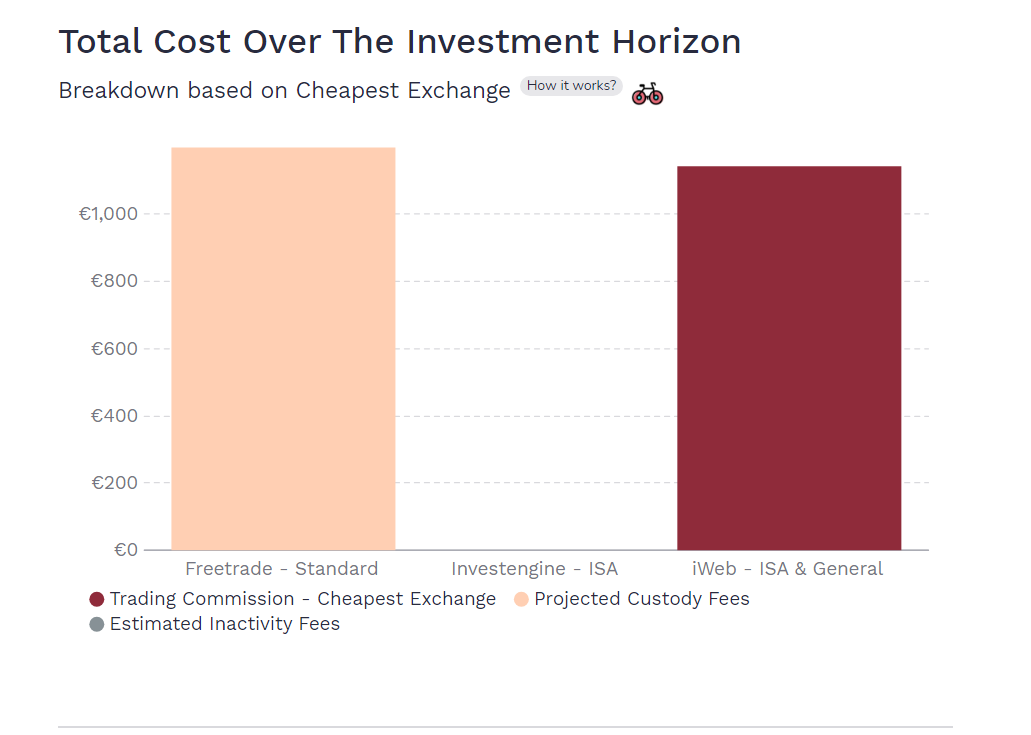

Fee Simulation For ISAs

In the simulation for a 20-year accumulation period, the broker bill for an ISA account is £1,198, assuming the investor opts for the annual charge. This is much more expensive that InvestEngine for which is £0 and just slightly above iWeb, which totals £1,140. It’s important to note that iWeb’s costs stem entirely from dealing fees, as there are no custody fees, therefore if you do not trade much, it may result more competitive than Freetrade.

Investor assumptions

| Model Feature | Assumption |

|---|---|

| Investor | UK |

| Instrument | UCITS ETF |

| Account | ISA |

| Initial Investment | £ 100,000 |

| Monthly | £ 1,000 |

| Time Horizon | 20 years |

| Gross Return | 8% |

Total Fees

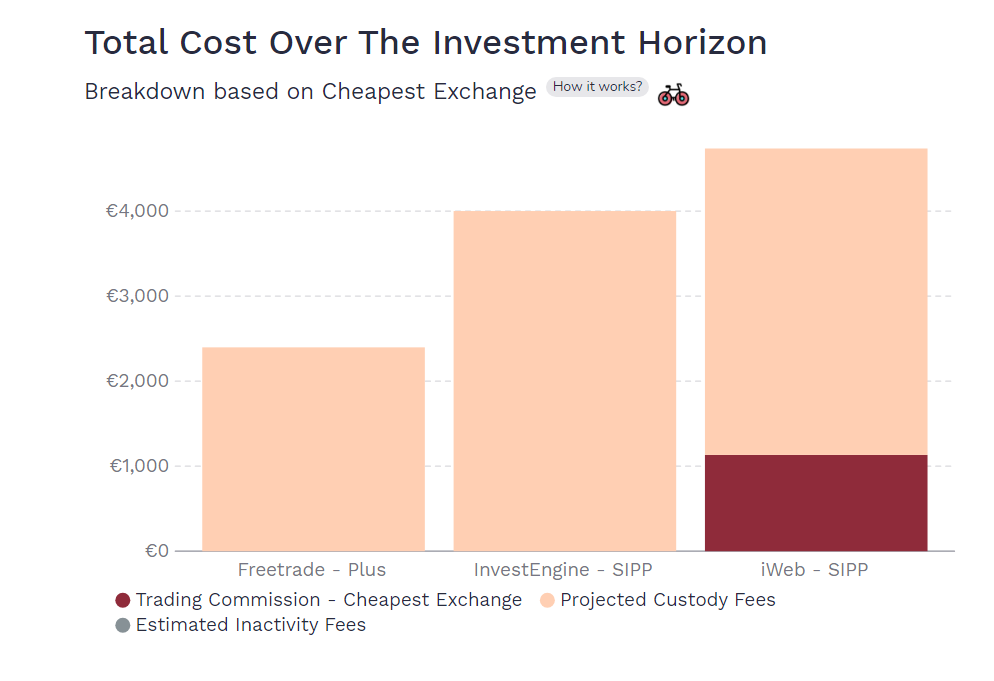

Fee Simulation For SIPPs

In the below simulation, for a 20-year accumulation period, the broker bill for a SIPP account is the cheapest at £2,398, assuming that you opt for the annual charge. In comparison, InvestEngine charges £4,000 and iWeb is even more expensive, totaling £4,740.

Investor assumptions

| Model Feature | Assumption |

|---|---|

| Investor | UK |

| Instrument | UCITS ETF |

| Account | SIPP |

| Initial Investment | £ 100,000 |

| Monthly | £ 1,000 |

| Time Horizon | 20 years |

| Gross Return | 8% |

Total Fees

Currency Exchange fees

In the UK, Freetrade FX fees are high to average, and vary based on the subscription that you chose:

- Basic – 0.99%

- Standard – 0.59%

- Plus – 0.39%

Other fees

Deposits and withdrawal are free of charge.

III. Platform & Features

As a Tier 2 platform, Freetrade competes with an intuitive and user-friendly interface, granting access to a wide array of ETFs and stocks including the Nasdaq and major European Stock Exchanges. While cash in the account receives partial remuneration, the rates are not always competitive and limited up to £3k. However, the platform lacks advanced trading instruments and features.

Account Opening Process

Freetrade has a very low thresholds for investing. You can place an order with a minimum value of just GBP £0.10 for US, UK, and EU ETFs. Freetrade offers customer support primarily through an in-app messaging system.

account Features

The Freetrade website and app provide all the essential tools needed to find and execute ETF investments:

- Automated Investment Service Rolled Out – Freetrade offer a regular investment service for Standard and Plus accounts.

- Cheap Share Transfer – It’s possible to transfer your shares if you decide to close your account. UK securities can be transferred for free, but transferring US securities incurs a £17 fee per holding to cover service provider charges.

- No Security Lending – They planned to add security lending as a feature in 2021; however, the new functionality was stopped shortly before the planned launch in 2022.

- Standard and Plus Tiers – access to European Stock exchanges and Nasdaq.

- Active Community – Freetrade has one of the most active UK forums.

Internalisation and PFOF

Freetrade’s Conflicts of Interest policy explicitly states that they do not receive any financial or non-financial benefits from any trade execution venues or counterparties in return for sending customer orders to them, a practice commonly known as ‘payment for order flow’ (PFOF). In addition, in the UK PFOF is not allowed.

Cash Interest

In the UK, Freetrade FX fees vary based on the subscription that you chose:

- Basic – 1% AER on £1,000, then 0%.

- Standard – 3% AER on £2,000, then 0%.

- Plus – 5% AER on £3,000, then 0%.

Advanced Features

Freetrade offers ETFs, Shares and Mutual Funds. It does not offer Bonds but you can invest in UK treasury bills. You won’t find margin loans, derivatives, futures, options, or CFDs. Below is a summary of the available investment types:

Features

| Investment Type | Availability |

|---|---|

| ETFs | ✅ |

| Stocks | ✅ |

| Bonds | ✅ (UK treasury bills only) |

| Funds | ✅ |

| Options | ❌ |

| Derivative | ❌ |

| Futures | ❌ |

| CFDs | ❌ |

| Forex | ❌ |

| Crypto | ❌ |

| Commodities | ❌ |

IV. Taxes

Tax Wrappers

Freetrade offers the basic UK tax efficient accounts for those aiming for tax relief (SIPP) or capital gains and income tax shielding (ISA).

- ISA

- SIPP

Tax Reporting

For those clients who invest outside tax wrapper accounts, Freetrade will provide consolidated tax certificates to help with filing tax reports annually