INTERACTIVE BROKERS REVIEW

Our take: Our interactions with hundreds of investors including during our coaching sessions revealed two trends: Index investing forms the backbone of their portfolios, and Interactive Brokers emerges as the go-to platform for a majority of investors.

Overall, Interactive Brokers is a Top Tier platform:

- Passive Investors – Will appreciate very competitive ETF trading commissions and FX rates and no ongoing platform fees. Family subaccounts and the ability to put investing on autopilot using monthly standing orders largely justify opening an account. The beginners amongst them might find its interface and features complex, though.

- Semi-active Investors – Will find that the platform is a treasure trove to invest in a variety of assets, including Emerging Market Equities and Bonds, as they scale the learning curve.

- Advanced Investors – For investing geeks, it opens the door to running a family hedge fund by unlocking access to U.S. markets including Factor ETFs, advanced portfolio management techniques including synthetic leverage or margin loans – although some subject to meeting MIFID requirements. However, as with all brokers – as sums grow larger, Broker counterparty risk exposure diversification may be recommended.

By using the link above, you can get up to $1,000 of IBKR Stock for free.

This article contains affiliate links. We provide full transparency on how it works.

Pros & Cons and suitability

Pros & Cons

- One of the most sophisticated brokers

- Listed on NASDAQ and Rated by S&P

- Strong Reputation

- Very competitive fees

- Account Opening Process Is Long

- Tax Reporting In Certain Countries Not Automatic

- Platform Is Complex for Beginners

- Understaffed Customer Support

Suitability

Usually Suitable

Cheap, automated but Complex

Suitable

Family subaccounts, versatile

VEry Suitable

Margin loans, US ETFs, Derivatives

Availability Checker

Check if the broker is available in your country

Broker Snapshot

Why Is Interactive Brokers A Tier 1 Broker?

We view IBKR as a Tier 1 Broker. Interactive Brokers has a $39 billion Market Cap and is a leading Global Broker.

Large Market Cap, Externally Rated & reputable regulator supervision

IBKR and is listed on the NASDAQ with its founder – Thomas Peterffy being the majority shareholder. It has an Investment Grade Rating from S&P. In 2022, S&P Global Ratings raised its rating by one notch, citing a less complex business model. The company is regulated across developed countries. In the EU, customers sign up with the Irish entity and benefit from the €20k Irish Investment Compensation Scheme. In the UK, customers benefit from a £85k Financial Services Compensation Scheme.

Company Info

| Characteristic | IBKR |

|---|---|

| Inception Date | 🛈 1977 |

| Headquarters | 🛈 Connecticut, USA |

| Key Owner | 🛈 IBG Holdings (74.6%) |

| Bank Affiliated | 🛈 No |

| Listed on Stock Exchange | ✅ NASDAQ: $39 bn (IBKR) |

| Parent Rating | ✅ S&P: A-/BBB+ |

| Net Income | ✅ $1.8 bn |

Regulation

| Feature | IBKR |

|---|---|

| EU Entity | 🛈 Interactive Brokers Ireland Limited |

| UK Entity | 🛈 Interactive Brokers (U.K.) Limited |

| Key Regulators | ✅ US, UK, Ireland, Japan, Singapore, Hong Kong |

| EU Regulator | ✅ Ireland |

| UK Regulator | ✅ UK (FCA) |

| EU Guarantee | 🛈 90% of Net Loss (Max. €20k) |

| UK Guarantee | 🛈 Max. £85k |

Very competitive fees, multicurrency and margin accounts

Interactive Brokers provides access to UCITS ETFs (for all Europeans) and US ETFs (for elective professional clients). It offers multicurrency accounts and ability to use leverage with margin accounts. Most currencies are supported. It provides access to all major exchanges and only marginally relies on external PFOF. Internalisation of trades can be switched off. Fees are very competitive, and Security Lending is rewarded at 50% through the Yield Enhancement Program.

Features

| Feature | IBKR |

|---|---|

| Key Base Currencies | 🛈 All Major Currencies |

| ETF Availability | ✅ Very high |

| Multicurrency | ✅ Available |

| Cash Interest | ✅ Competitive |

| Margin Loans | ✅ Very Competitive |

| Exchanges | ✅ All Major |

| External PFOF Reliance | ✅ Low |

Fee Structure

| Feature | IBKR |

|---|---|

| Custody Fees | ✅ None |

| Inactivity Fees | ✅ None |

| ETFs Dealing Fees | ✅ Low |

| FX Fees | ✅ Competitive |

| Deposit Fees | ✅ None |

| Withdrawal Fees | ✅ Low |

| Security Lending | ✅ 50% of Profits |

By using the link above, you can get up to $1,000 of IBKR Stock for free.

I. Company

Ownership and Transparency

Interactive Brokers was founded in 1977 in the U.S. As a NASDAQ-listed company, IBKR offers transparency through regular financial reporting. Around 25% of the company is floated, the rest held privately, with the largest share held through a holding company by the founder – Thomas Peterffy. As of Jan. 2024, the Market Cap is $39bn. At a HoldCo level, the company is rated BBB+ by S&P Ratings, which in 2022 upgraded the rating by one notch citing very strong risk-adjusted capital and high profitability.

Safety Considerations

At a subsidiary level, the rating is A-, which means the estimated probability of default is very low, as measured by 10-year peer cohort probability of default. Based on historical data, 1 out of 100 similarly rated financial companies went out of business over a 10-year period. While not formally listed as a systemically important entity, IBKR may be large enough to possibly increase chances of some form of state intervention in case of bankruptcy, but it is not a guarantee.

Regulation & Investor Compensation Schemes

- US and Swiss Investors (Interactive Brokers LLC, regulated by FINRA/SEC) – the protection is up to $500,000 (with a $250,000 cash limit). Swiss Investors may open a US or a UK account, but will benefit from US protection levels.

- UK Investors (Interactive Brokers U.K. Limited, regulated by the FCA) – clients are protected up to £85,000.

- EU Investors (Interactive Brokers Ireland Limited, regulated by the Central Bank of Ireland) – offers a protection amount of €20,000. Applies to Eastern Europe following recent IBKR Irish and Hungarian Entity Merger. This protection is low, and valid for most EU Brokers. Learn more about broker bankruptcy protections.

- Other Investors – Canadians are protected up to CAD 1m. In Australia, India, Japan, Hong Kong, or Singapore, the respective financial authorities regulate local entities.

Share & Cash Custodians

For your shares, Interactive Brokers is your direct custodian. The broker owns and operates safekeeping depositories in almost all global markets they offer. Exceptions include Japan or Singapore, where partners are acting as local custodians. Your cash is held with major international banks.

Reputation

Interactive Brokers has a great reputation, as one of the best brokers. However, the track record is not perfect, as it did have a few regulatory fines in the past, including in 2023 due to record-keeping irregularities.

II. Fee structure

Platform fees

There are no annual account fees or inactivity fees.

Trading Commisions

Interactive Brokers offers two pricing plans – Tiered Pricing and Fixed Pricing. In both cases, trading commissions are extremely competitive. Working out the cheapest solution may be complex if you are trading across different markets (Tiered fees can be different for each Stock Exchange). As a rule of thumb, if you’re buying mainly EUR ETFs on Xetra, then the Tiered plan often comes out cheaper due to a €29 cap. Conversely, given the lack of such a cap for ETFs in GBP, the Fixed plan is generally cheaper on the London Stock Exchange, unless your trades are small. Euronext is generally cheaper with the Fixed Plan. Check the 🤓 Geeky Section below to understand the overall cost for different monthly trade volumes, including combined cost of all the components of the Tiered plan for the three main Exchanges in Europe.

Trading ETFs on German Exchange (XETRA)

If you’re trading ETFs in EUR on the XETRA Market, the Maximum €29 fee through the Tiered Pricing makes this plan cheaper for small and very large transactions. Medium to large sized monthly trade volume (e.g. €10-20k can be a bit more expensive with Tiered Plan).

XETRA - FEE STRUCTURE (<50M)

| Fee Type | Tiered | Fixed |

|---|---|---|

| Commission | 0.05% | 0.05% |

| Minimum | €1.25 | €3 |

| Max | €29 | No |

| Exchange fee | Yes | No |

| Clearing Fee | Yes | No |

| Regulatory Fee | Yes | No |

XETRA FEES - Monthly TRADE VALUE

| Volume | Tiered | Fixed |

|---|---|---|

| €500 | €1.30 | €3 |

| €2,000 | €1.34 | €3 |

| €5,000 | €2.69 | €3 |

| €10,000 | €5.35 | €5 |

| €20,000 | €10.67 | €10 |

| €50,000 | €26.63 | €25 |

| €100,000 | €32.23 | €50 |

Trading ETFs on French, Dutch or Belgian Exchanges (EuroNext)

If you’re trading ETFs in EUR on EuroNext whether in Paris, Amsterdam or Brussels, the Maximum fee of €29 through the Tiered Pricing means that the plan is generally cheaper for very large transactions. Medium and large-sized monthly trade volume (e.g. €5-50k are cheaper with the Fixed Plan). For smaller transactions the difference is less significant than with Xetra as the Exchange fee is higher, while the Clearing fees are similar.

EURONEXT - FEE STRUCTURE (<50m)

| Fee Type | Tiered | Fixed |

|---|---|---|

| Commission | 0.05% | 0.05% |

| Minimum | €1.25 | €3 |

| Max | €29 | No |

| Exchange fee | Yes | No |

| Clearing Fee | Yes | No |

| Regulatory Fee | Yes | No |

EURONEXT FEES - TRADE VOLUME

| Volume | Tiered | Fixed |

|---|---|---|

| €500 | €2.55 | €3.00 |

| €2,000 | €2.55 | €3.00 |

| €5,000 | €3.80 | €3.00 |

| €10,000 | €6.30 | €5.00 |

| €20,000 | €11.30 | €10.00 |

| €50,000 | €28.10 | €25.00 |

| €100,000 | €35.10 | €50.00 |

Trading ETFs on the London Stock Exchange (LSE)

If you’re trading ETFs in GBP on the LSE, the Tiered Pricing comes out cheaper only for smaller transactions, given the lack of a cap on fees in Tiered plan. Medium and large monthly trade volumes come out cheaper with the Fixed Plan.

LSE - GBP FEE STRUCTURE (<40m)

| Fee Type | Tiered | Fixed |

|---|---|---|

| Commission | 0.05% | 0.05% |

| Minimum | £1 | £3 |

| Exchange fee | Yes | No |

| Clearing Fee | Yes | No |

| Regulatory Fee | Yes | No |

LSE FEES - BY TRADE VOLUME

| Fee Type | Tiered | Fixed |

|---|---|---|

| £500 | £1.16 | £3.00 |

| £2,000 | £1.16 | £3.00 |

| £5,000 | £2.79 | £3.00 |

| £10,000 | £5.51 | £5.00 |

| £20,000 | £10.96 | £10.00 |

| £50,000 | £27.31 | £25.00 |

| £100,000 | £54.56 | £50.00 |

Overall Fee Simulation vs Competitors

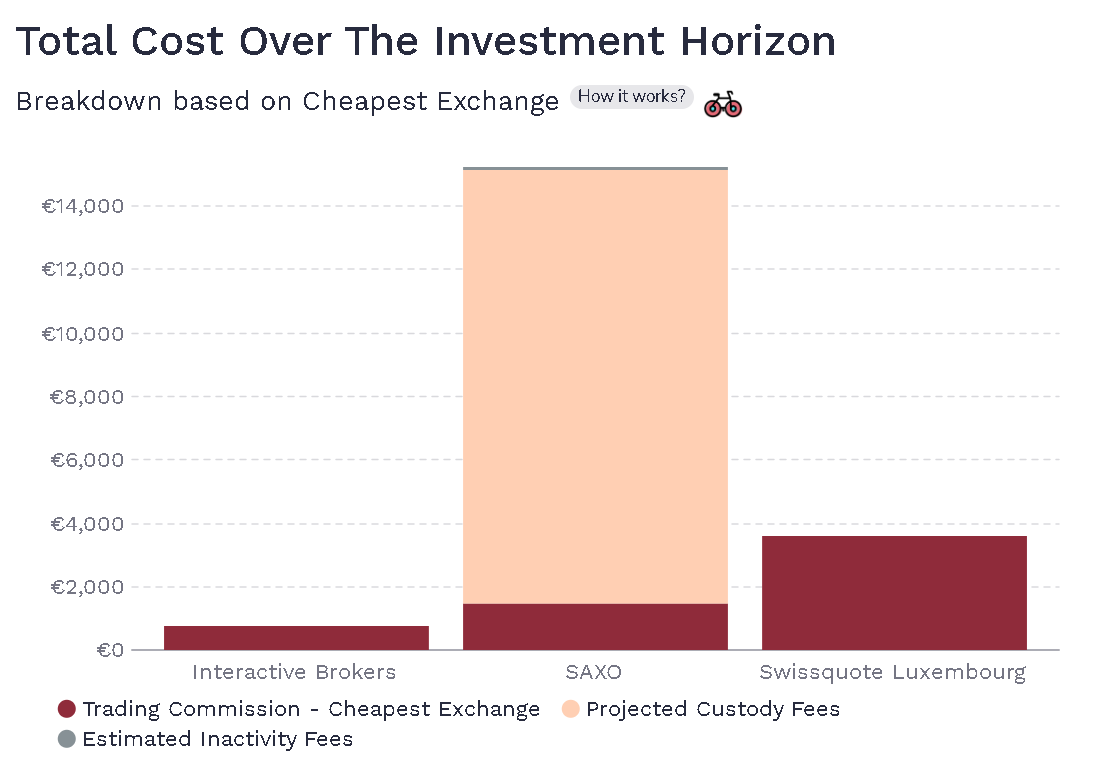

Most of our readers have simple Index portfolios. Using our Broker Total cost calculator, you can estimate the total cost of holding ETFs throughout the investment period. In the below simulation, a 20-year accumulation period broker bill comes out at €750 for Interactive Brokers. Two of its competitors in the same category are much more expensive. The cost is €3,600 for Swissquote Luxembourg, due to higher trading commissions and over €15,200 for Saxo Bank, largely due to ongoing custody fees.

Investor assumptions

| Model Feature | Assumption |

|---|---|

| Investor | EU Country |

| Instrument | UCITS ETF |

| Plan | Fixed Pricing |

| Initial Investment | € 100,000 |

| Monthly | € 1,000 |

| Time Horizon | 20 years |

| Gross Return | 8% |

Total Fees

Currency Exchange fees

Below $1m of monthly trade value the fee is a very competitive 0.2 bps with a minimum of $2. For a transaction of $100,000 or below, you will pay $2. Spread are as tight as 0.2 PIP or $0.2 for $10k.

Other fees

Deposits are free of charge. The first withdrawal per month is free of charge. All subsequents are charged €8 or £7. For Stock Lending, IBKR pays you 50% of a market-based rate through the Stock Yield Enhancement Program for accounts with equity greater than $50k.

III. Platform & Features

Interactive Brokers is a very sophisticated platform. A few of the features can be very useful. But, for the vast majority of investors, most of the additional features are not necessary to be successful in achieving their financial goals. Advanced investors may explore a few of them, including the ones listed in the Geeky section below – Margin Accounts, US Markets and Derivatives.

Account Opening Process

Opening an account is a straightforward, but lengthy process. You’ll provide personal information, and select the type of account (outside of US, the default is IBKR PRO) and its base currency. The next step requires financial information, where you disclose your assets and stock market experience, and choose your preferred investment instruments. You will often find that you are restricted in trading certain securities and may need to activate certain markets in account settings (Settings → Trading → Trading Permissions). Getting help from support may take some time, based on our experience. You’re then required to submit proof of identity and tax-related information. The final step is funding your account, after which it becomes operational.

account Features

Interactive Brokers offers several great features for Long-Term Investors:

- Multicurrency Accounts – May reduce e.g. FX fees on certain dividend payments.

- Family Sub-accounts: Capability to create subaccounts including joint-accounts, Trust or even company accounts. Particularly beneficial for those wishing to invest on behalf of their children.

- Standing Orders – Purchasing ETFs every month for a child can be neatly managed within its dedicated subaccount by automating your investments and setting up monthly standing orders.

Internalisation and PFOF

Interactive Brokers may internalise certain orders. “Internalisation” is when a broker acts as the counter-party to a customer’s order. Interactive Brokers gives you the option to opt out from it in the account settings. This is not the case for smaller brokers that may send all orders to one small single-market maker quote-driven venue without given the customer the option to opt out, or giving the option to trade through a large transparent multilateral Exchange. Interactive Brokers reliance on external PFOF revenue is marginal.

Cash Interest

Interest on cash is not the most generous in the market. A number of European brokers provide with market interest from 1€ balance. For IBKR the rates are attractive, provided your account is large.

Running A Small Hedge Fund

Interactive Brokers is sophisticated. It serves as a leading Prime Broker for smaller hedge funds that account for 27% of its commissions. Name any non-OTC instruments you may desire to trade, and IBKR probably has it readily available. It provides access to U.S. ETFs, Bonds, Asian Markets, Margin Lending or Synthetic leverage through options strategies like Box Spreads. Check the 🤓 Geeky Section below to learn practical applications.

Margin Accounts

Interactive Brokers offers two main account types – Cash or Margin:

- Cash Accounts – Cash accounts restrict trading to the funds you have available in the account. This is the account type we would suggest for the vast majority of individuals – including all Golden Retrievers and Cyclists.

- Margin Accounts – You may purchase securities using funds loaned by the broker. For example, with $10,000 in cash and a 5:1 margin ratio, you could trade with up to $50,000. Margin trading involves significant risks. In rare cases, it may be attractive for Banker-style Investors, e.g. with Risk Parity Portfolios. Margin financing rates are very competitive, e.g. 100k-1M has a total cost of Benchmark Rate +1%.

Access to U.S. Markets

PRIIPs is an EU rule that prohibits buying US-listed ETFs, including Factor ETFs from e.g. Avantis or Dimensional Fund Advisors. One of the reasons is tax implications. This rule also applies to UK Investors. In theory, high-net-worth or professional investors can bypass PRIIPs, allowing them to buy US-listed ETFs. This exemption is related to your ‘MiFID status’ being an Elective Professional Client. In practice, most brokers don’t give clients this option. Interactive Brokers is the only broker that effectively facilitates this.

To apply for an Elective Professional Client Status, you must meet two out of three criteria below:

- Professional Experience – Work in financial sector for at least one year in a professional position, which requires knowledge of the transaction or services envisaged.

- €500k+ Portfolio – The size of the financial instrument portfolio in investment accounts, defined as including cash deposits and financial instruments, exceeds €500k.

- High Volume Trades – (€200k+) on the relevant market at an average frequency of 10 per quarter over the previous 4 quarters; and at least €50k account equity at present.

Derivatives

Interactive Brokers provides access to Options and Future Markets, including the ability to create complex strategies or synthetic leverage using Box Spreads. Selling In The Money Puts may also allow indirect access to US ETFs through physical delivery.

IV. Taxes

Tax Wrappers

IBKR started offering tax-advantaged accounts in certain European jurisdictions. This includes:

- UK Investors – IBKR offers SIPPs and ISAs.

- Hungarian Investors – Interactive Brokers offers a tax-advantaged account called TBSZ for Hungarian tax residents.

Tax Reporting

For the vast majority of European Investors, taxes are managed through the reporting tool available with IBKR. But, it can be a drawback for investors in some countries – like Italy – where there is a trade-off, as IBKR is more sophisticated and cheaper, but a local Broker may sometimes be able to handle the taxation paperwork for you, which IBKR may not. Provided your portfolio is simple, taxes may not be very cumbersome.