UCITS vs U.S. ETFs – Pros and Cons for Non-US Investors

UCITS ETFs: A Strategic Move for Latin America, Asia & the Middle East

ETF Domicile is not very glamour. And something that most new investors won’t pay attention to. While fees and index tracking frequently steal the spotlight, the domicile’s pivotal role in portfolio performance cannot be overstated.

Some of our readers from Latin America, Asia and the Middle East know how to optimise their tax bill.

But here is what most investors ignore, and may pay a heavy price for it.

KEY TAKEAWAYS

- Key Choice: The domicile of an ETF is crucial, impacting tax obligations and investment returns, with UCITS ETFs offering a strategic alternative for non-U.S. investors.

- US ETFs Have Better Liquidity And Lower Costs: While US ETFs boast higher liquidity and lower costs due to the U.S. market’s size, UCITS ETFs may face more liquidity challenges due to European market fragmentation but are catching up, providing global accessibility with slightly higher expense ratios.

- Not all investors can invest through U.S. ETFs – Most European Investors can’t access US ETFs unless they apply to be elective professional clients with their Brokers.

- Tax Benefits For Non-U.S. Investors Outweigh Higher Costs: UCITS ETFs often offer more favourable tax treatments, lower withholding taxes on dividends, no U.S. estate tax, and simplified tax reporting, in most cases outweighing the cost considerations.

- Latin American, Asian or Middle Eastern Investors Can Access Them Locally – UCITS ETFs are listed on Stock Exchanges in Singapore, South Africa, Israel, Saudi Arabia, Brazil, Chile, Mexico or Peru, but they are also often accessible through European Stock Exchanges.

Here is the full analysis

What are Main two ETF types?

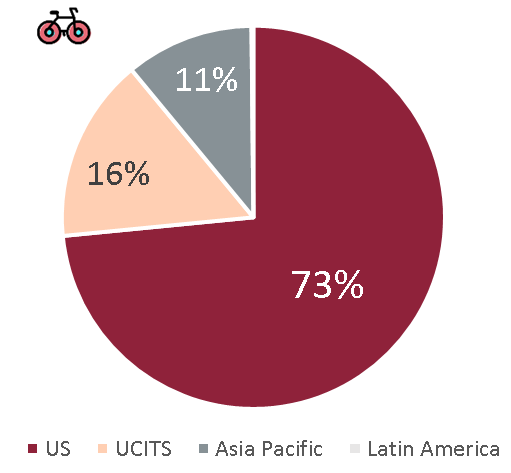

U.S. and UCITS ETFs represent 90% of The Global ETF Market

US ETFs and UCITS ETFs present distinct features, catering to diverse investor needs globally.

- U.S. ETFs – Governed by the SEC, they operate primarily within U.S. markets under the Investment Company Act of 1940 and Securities Act of 1933, offering favorable taxation for U.S. investors. These funds typically distribute income and have greater access to leverage, with fewer restrictions on securities lending.

- UCITS ETFs – regulated by ESMA and compliant with the UCITS Directive (Undertakings in Collective Investments and Transferable Securities), focus on global markets with a significant presence in Europe, also providing tax efficiency for other non-U.S. investors. They have stricter rules regarding securities lending and leverage, and they can either distribute or reinvest income. UCITS ETFs are domiciled mainly in Luxembourg or Ireland, offering a broader global accessibility with currency hedging options and compliance with stringent investor protection and risk diversification standards.

US vs UCITS ETFs

| Characteristic | US ETFs | UCITS ETFs |

|---|---|---|

| Regulatory Body | U.S. Securities and Exchange Commission (SEC) | European Securities and Markets Authority (ESMA) |

| Primary Legislation | Investment Company Act of 1940 & Securities Act of 1933 | UCITS Directive |

| Geographical Focus | Primarily U.S. markets | Global markets with a strong presence in European markets |

| Investor Protection | Strong, with emphasis on disclosure and transparency | Strong, with comprehensive rules on diversification, risk, and investor protection |

| Taxation | Favorable for U.S. investors | Often more tax-efficient for non-U.S. investors |

| Distribution Policy | Generally distribute income | Can either distribute or reinvest income |

| Securities Lending | Permitted with fewer restrictions | Permitted but with stricter collateral and transparency requirements |

| Fund Domicile | United States | Typically Luxembourg or Ireland |

| Access to Investors | Global, but mainly targeted at U.S. investors | Globally accessible, passportable within the EU |

| Currency Hedging Options | Available | Widely available with multiple currency share classes |

Niche ETF Markets include Asia-Pacific, Latin America & South Africa

- Japan – represents just below 5% of all ETFs

- Asia-Pacific ex-Japan – representing just over 6%, including markets like Australia

Global ETF Market by Domicile

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

Who can ACCESS U.S. AND UCITS etfs?

U.S. ETFs

Investing in U.S. ETFs is not limited to U.S. citizens

There are no specific laws prohibiting non-U.S. citizens from investing.

Both the Securities and Exchange Commission and the U.S. government encourage foreign investments in U.S. equities and debt markets to fund the U.S. capital markets and economy.

But As European You Will Likely Need A €500k Portfolio

However, the situation is different for investors in Europe due to regulatory changes. Since 2018, individual investors in the EU have been restricted from investing in U.S. ETFs.

This is due to regulations that require ‘Key Information Documents’ (KIDs) to help them better understand the products they are buying. U.S.-registered ETFs do not contain this document, which led to the restriction on trading U.S.-registered ETFs in Europe.

As European, you can get around this restriction in becoming an elective professional client. There are certain criteria to fulfil, but in practice you must often have €500,000 in your financial portfolio. Alternatively, certain U.S. Brokers may offer access to them.

UCITS ETFs

Outside the U.S., any Global Investor Can Access UCITS ETFs

Investors in Asia, South America, or the Middle East can invest through European products.

UCITS ETFs are listed, amongst others, on Stock Exchanges in Singapore, South Africa, Israel, Saudi Arabia, Brazil, Chile, Mexico or Peru. But non-US Investors can also often access them directly through European Stock Exchanges.

For example, in South Africa investors can access iShares funds through 1NVEST feeder funds.

How do ETF Markets compare?

US ETFs typically exhibit higher liquidity and larger average daily trading volumes, primarily due to the substantial size and depth of the U.S. financial markets. The competitive landscape in the U.S., with numerous market makers and a broad range of sectors and strategies covered, further enhances liquidity and lowers expense ratios through economies of scale.

Conversely, UCITS ETFs, while diverse, face challenges in liquidity and trading volumes due to market fragmentation in Europe. This fragmentation stems from UCITS ETFs being listed on multiple exchanges across various countries, leading to divided market participation and visibility.

Costs, liquidity and lack of fragmentation

| Characteristic | US ETFs | UCITS ETFs |

|---|---|---|

| Liquidity | Often higher due to the size of the U.S. market and the presence of many large, established ETFs | Liquidity can be lower compared to their US counterparts, though this varies between funds |

| Average Daily Trading Volume | Generally higher, leading to tighter bid-ask spreads | Typically lower than US ETFs, which may result in wider bid-ask spreads |

| Market Participation | High participation from both institutional and retail investors | Institutional investors dominate, with growing participation from retail investors |

| Exchange Presence | Traded on few major U.S. exchanges with high visibility and accessibility | Listed on multiple exchanges across Europe and internationally, with varying levels of visibility and accessibility |

| Access to Investors | Global, but mainly targeted at U.S. investors | Globally accessible, passportable within the EU |

| Expense Ratios | Typically lower due to competition and economies of scale in the U.S. market | Generally marginally higher as compared to US ETFs due to various factors including tax treatments and operational costs associated with cross-border transactions |

U.S. Funds have Lower costs

Although they offer international accessibility, the expense ratios in UCITS ETFs are generally marginally higher. This can be attributed to operational complexities and costs arising from the need to navigate through the diverse and fragmented European financial markets, as well as the taxation structures inherent to each jurisdiction.

For the most liquid asset classes (S&P 500) differences are minimal while Bonds may have larger discrepancies (difference of 0.22%).

Fund Total Expense ratio comparison

| ETF Tickers | Asset Class | Coverage | US TER | UCITS TER |

|---|---|---|---|---|

| VT/VWCE | Equities | Global | 0.05% | 0.22% |

| VOO/VUSA | Equities | S&P 500 | 0.03% | 0.07% |

| BND/SUAG | Bonds | US Bonds | 0.03% | 0.25% |

| VASGX/V80A | Fund of Funds | Equities & Bonds | 0.14% | 0.25% |

U.S. Funds have more product variety and Factor Investing issuers

The variety of products available in the U.S. financial markets is superior. The U.S. markets offer a broader selection of Exchange-Traded Funds (ETFs), including an extensive range of factor ETFs that are designed to capture specific risk factors or investment styles, such as value, size, volatility, momentum, and quality.

Niche issuers of factor ETFs in the United States include American Century Investments (Avantis), Dimensional Fund Advisors or Alpha Architect.

UCITS ETFs have stricter rules, although it's usually not problematic

In theory, UCITS ETFs have a number of other restrictions, including asset concentration or investment restrictions.

In practice, Europeans also have access to other funds:

- ETC and ETN Funds – that invest in commodities or cryptocurrencies.

- REITs that invest in Real Estate.

UCITS Restrictions

| Requirements/Features | UCITS Funds | US Funds (General Mutual Funds & ETFs) |

|---|---|---|

| Domicile & Management Location | Must be based in a tax-neutral European country. | Typically based in the US. Offshore funds also exist but are less common. |

| Redemption Options | Offer double redemption within a single month. | Redemption policies vary; often daily redemption is available. |

| Asset Liquidity & Investment Restrictions | At least 90% liquid assets; no exposure to short selling, real estate, or commodities. | Varying levels of liquidity requirements; some funds might invest in illiquid assets, short sales, real estate, or commodities depending on their strategy. |

| Asset Concentration Rules | No asset more than 10%; holdings of more than 5% cannot in aggregate exceed 40%. | Diversification rules vary; mutual funds often have different standards, and some ETFs might be highly concentrated. |

| Borrowing Limits | Temporary borrowing not allowed for investment purposes. | Funds may engage in borrowing, with limits outlined in the 1940 Act and specific fund policies. |

| Investor Documentation & Information | Key Investor Information Document and prospectus must be provided. | Funds must provide a prospectus and, for ETFs, additional information in the form of a Summary Prospectus or Statement of Additional Information. |

| Pricing Information Disclosure | Must inform investors promptly of pricing changes related to transactions. | Must disclose NAV daily, and ETFs usually have intraday indicative values available. Pricing transparency requirements for transactions vary. |

TAXES - The crucial differentiator

Advantages of UCITS ETFs

UCITS ETFs Have a Unique Global Status

EU nations have streamlined fund regulation with UCITS, enabling a seamless cross-listing of funds and ETFs across member states. But UCITS isn’t just a European sensation—it’s a global trailblazer.

UCITS has become a well-recognized regulation standard for mutual funds and ETFs, and some countries in South and Middle America, as well in Asia, allow UCITS funds to be cross listed and sold to local investors.

There is no other regulatory framework competing with UCITS that allows funds to be distributed globally (other countries have only bilateral agreements).

Most Non-US Investors have tax advantages with UCITS ETFs

From a non-U.S. investor’s tax perspective, UCITS ETFs often present a more favourable tax environment compared to US ETFs.

When you invest in US ETFs you may face:

- Higher Withholding Taxes – US ETFs typically incur a 30% withholding tax on dividends, which can sometimes be reduced through tax treaties

- Estate Taxes – US ETFs may also expose non-U.S. investors to U.S. estate taxes and potential capital gains taxes in the U.S.

- Complex Tax Reporting – for US ETFs can also be complex for non-U.S. investors.

Conversely, UCITS ETFs usually enjoy:

- Lower Withholding Taxes – on dividends due to favourable treaties with countries where they are commonly domiciled, like Ireland and Luxembourg.

- No Estate Taxes – They pose no U.S. estate tax exposures

- Simplified Tax Reporting – They offer simplified tax reporting.

- Further Tax Optimisation – With the flexibility of choosing between distributing and accumulating share classes. This structure often results in efficient tax growth and potentially favourable capital gains tax treatment, depending on the investor’s country of residence.

TAxes - Why it pays to invest through UCITS etfs

| Characteristic | US ETFs | UCITS ETFs |

|---|---|---|

| Withholding Tax on Dividends | Often subject to 30% withholding tax (though it might be reduced based on tax treaties) | Lower withholding taxes; often 15% for many countries due to favourable tax treaties e.g. Ireland |

| Estate Tax Exposure | Non-U.S. investors might be subject to U.S. estate taxes | No exposure to U.S. estate taxes |

| Tax Reporting Complexity | May require complex tax reporting in investor's home country | Simplified tax reporting due to international standards accommodated by UCITS directive |

| Capital Gains Tax | May be subject to capital gains tax in the U.S., depends on the investor's tax status and residence | Capital gains tax treatment varies, typically levied in the investor's country of residence |

| Accumulation/Distribution | Generally do not offer accumulating share classes; dividends are usually distributed | Offer both distributing and accumulating share classes, allowing for tax-efficient growth |

| Tax Treaty Benefits | Limited benefits for non-U.S. investors, depending on existing tax treaties | Multiple double taxation treaties due to the domiciles in Ireland and Luxembourg, often resulting in favorable tax outcomes for international investors |

Advantages of U.S. ETFs

U.S. Investors have tax advantages with U.S. ETFs

Conversely, the main reason why U.S. Investors might prefer U.S. ETFs is to avoid local tax complications.

Investing in U.S. ETFs allows U.S. investors to avoid the complications and stringent reporting requirements associated with PFIC regulations. U.S.-based ETFs typically offer a more straightforward tax treatment, making them more attractive to U.S. investors.

U.S. ETFs are structured in a way that is compliant with U.S. tax laws, and the tax reporting is more straightforward. The dividends and capital gains from these ETFs are subject to U.S. tax laws, which investors and their tax advisors are usually more familiar with.

Certain European Investors may have tax advantages with U.S. ETFs

It is a rare situation. But there are certain European countries that have protection against US Estate taxes (please verify before investing) and allow investors to buy US ETFs, potentially offsetting withholding taxes against local dividend taxes.

For example, some investors in the UK (assuming you meet the €500k eligibility criterion) and Switzerland may fall into this category. We have a dedicated guide to reducing withholding taxes for Europeans Investors.

Overall impact - For Which Investors is UCITS more advantageous?

South America, Middle East and Asia - Investors Should consider UCITS ETFs

There are two cases when UCITS ETFs can be particularly useful:

- For countries without an income tax agreement with the U.S.

- For countries with an income tax agreement but with a weak Estate Tax protection.

For Countries without income tax agreement with the US

Additional 15% Dividend Withholding Taxes apply to all countries without a tax agreement with the US.

According to KPMG, certain countries are particularly exposed to tax leakage, including:

- Asia: Singapore, Malaysia or Vietnam.

- Middle East: Oman, Qatar, Saudi Arabia or United Arab Emirates

- South America: Most countries, including Argentina, Brazil and Chile.

- Africa: Almost all countries.

- Europe: Croatia, Liechtenstein, Macedonia, Malta, Monaco, Montenegro, Serbia.

For Countries With an income tax agreement with the US- Will You Hold More Than $60,000 In U.S. ETFs?

Even with an income tax treaty between the U.S. and another country, non-U.S. investors in U.S. ETFs might still navigate challenges like potential U.S. estate taxes.

US estate taxes begin at just $60,000 of US holding for non-resident aliens and apply at rates of 26-40% of assets above that level without a US estate tax treaty.

Only sixteen countries have estate tax treaties with the US:

- Asia – Japan, Australia.

- Europe – Austria, Belgium, Denmark, Finland, France, Germany, Greece, Ireland, Italy, Netherlands, Norway, Switzerland and the UK.

- Africa – South Africa

However, not all of them are structured favourably. A poor US estate tax treaty does not increase the US estate tax exemption for non-resident aliens to more than the standard $60,000 amount.

In contrast, investing in UCITS ETFs alleviates these concerns as they’re domiciled outside the U.S., often in jurisdictions like Ireland or Luxembourg, eliminating U.S. estate tax liabilities for foreign investors and, in certain cases, reducing administrative hassles related to U.S. tax documentation and reporting.

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

Conclusion

Consider your personal situation

In conclusion, while US ETFs generally offer superior liquidity and lower costs due to the vast size and depth of the U.S. financial markets, non-U.S. investors should closely consider UCITS ETFs due to significant tax advantages. The tax benefits of UCITS ETFs, coupled with no U.S. estate tax exposure and simplified tax reporting processes, often outweigh the marginally higher expense ratios they might carry.

But, there could be exceptions. Understand your individual circumstances before buying ETFs.

With the continuous growth and development in the UCITS ETF market, the gap in liquidity and investment options compared to US ETFs is narrowing, making UCITS ETFs an increasingly attractive and competitive investment vehicle for international investors.

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – BlackRock Launches New iBonds, Truth About €1M Broker Insurance & BOW is 4 years old!

The Truth About €1 Million Broker Guarantees

4 Things I Learned In 4 Years Of Running A Finance Blog

Dodl By AJ Bell Review – AJ Bell’s Younger Brother

Vanguard LifeStrategy Review – A Retriever In A Babushka Doll

Why Do Portfolio Managers Care About Factors? It’s Not What You Think.

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.