InvestEngine Review

Our take: InvestEngine offers competitive trading for ISA and General accounts, as well as a good range of ETFs. It caters well to buy-and-hold investors who want a simple portfolio. More advanced investors will quickly be very limited in their choices, as they can only trade LSE-listed ETFs.

Is it suitable for you?

- Passive Investors: will find ETFs they need to manage simple ETF portfolios at a very competitive price. The user interface and customer service are good, and the regular investing, set-and-forget order execution is great for a buy-and-hold strategy.

- Semi-Active Investors: will quickly find InvestEngine frustrating, given that the ETF offer is limited to only 600 LSE-listed ETFs.

- Advanced Investors: will not find any advanced tools and products typically found with Tier 1 brokers.

This article contains affiliate links. We provide full transparency on how it works.

Pros & Cons and suitability

Pros & Cons

- Cheap for General Accounts & ISAs

- Selection of Popular ETFs

- User Friendly Web And Mobile Apps

- Straightforward Business Model

- Very Limited Execution Flexibility

- Limited Tax wrappers

- Short track-record, not profitable

- Only LSE-listed ETFs available

- No Cash Interest

Suitability

Suitable

ETF-only offer. low fee, but low execution flexibility.

SOMEWHAT Suitable

no advanced features, NO ACCESS TO foreign exchanges. ONLY LSE ETFs.

UNSuitable

limited offering, SINGLE EXECUTION COUNTERPARTY, SINGLE EXCHANGE

Availability

InvestEngine is only Available in the UK

Broker Snapshot

Why Is InvestEngine A Tier 2 Broker?

InvestEngine, a newcomer on the UK brokerage scene, began its operations in 2019, founded by Ramsey Crookall, an independent wealth management firm, along with the founders of Gumtree. Unlike traditional brokerages, it is neither listed nor affiliated with any bank, carving out a niche with its focus on ETF products and low fees. The company’s heavy reliance on automation and a modern investing interface and platform allows it to operate with fewer employees. Today, it manages around £390m. These characteristics position InvestEngine as a Tier 2 broker. Its primary competitors are other Tier 2 UK brokers aimed at investors seeking low-cost providers, such as Freetrade or iWeb.

New, but Relatively straightforward business model & FCA Regulated

InvestEngine is a relatively new entrant in the UK brokerage scene, and as such, its size is still relatively small, although it has grown quite rapidly, reaching 38K customers in 2024. It was founded by the stockbroker firm Ramsey Crookall and the founder & CEO of Gumtree. InvestEngine is authorised and regulated by the FCA. Money and assets are protected by the FSCS up to £85,000 per person.

Company Info

| Characteristic | InvestEngine |

|---|---|

| Inception Date | 🛈 2019 |

| Headquarters | 🛈 London |

| Key Owner | 🛈 Ramsey Crookall (Stockbrokers firm) and Simon Crookall |

| Bank Affiliated | ❌ No |

| Listed on Stock Exchange | ❌ No |

| Parent Rating | ❌ No |

| Net Income | ⚠️ -£ 3 mn (2022) |

Regulation

| Feature | InvestEngine |

|---|---|

| EU Entity | 🛈 None |

| UK Entity | 🛈 InvestEngine Ltd |

| Key Regulators | ✅ FCA, UK |

| EU Regulator | N/A |

| UK Regulator | ✅ FCA, UK |

| EU Guarantee | N/A |

| UK Guarantee | 🛈 Max. £85k |

Very Competitive Fees but only UK ETFs

InvestEngine provides access to the London Stock Exchange (LSE) and UK ETFs. It does not charge any dealing fees, and accounts are free, with the exception of the SIPP, which is capped at £200 per year, and of the Managed Portfolio service which has a annual fee of 0.25%. However, multi-currency accounts and margin loans are not available, and cash interest is not paid.

Features

| Feature | InvestEngine |

|---|---|

| Key Base Currencies | 🛈 GBP |

| ETF Availability | ✅ Good (600) |

| Multicurrency | ❌ Not Available |

| Cash Interest | ❌ No |

| Margin Loans | ❌ No |

| Exchanges | ⚠️ LSE |

| External PFOF Reliance | ✅ None |

Fee Structure

| Feature | InvestEngine |

|---|---|

| Custody Fees | ✅ Very Competitive |

| Inactivity Fees | ✅ None |

| ETFs Dealing Fees | ✅ None |

| FX Fees | 🛈 N/A |

| Deposit Fees | ✅ None |

| Withdrawal Fees | ✅ None |

| Security Lending | ✅ No |

I. Company

InvestEngine, is a relatively new, unprofitable broker. The mitigating factor is that its business model is simple and transparent, offering good value to investors. Additionally, it has no known regulatory or compliance issues. As with all small Tier 2 players, Investors should strongly consider regulatory protections and investment compensation schemes.

Business Profile

InvestEngine was designed to simplify investing and make it accessible to everyone through technology, positioning itself between a traditional DIY broker and a robo-advisor (single execution counterparty, once a day trading). They specialise in ETFs, including bonds, or commodity ETFs. Currently, they operate exclusively in the UK and have begun to introduce tax-efficient accounts like ISAs and SIPPs. They also provide a managed portfolio service, which is relatively inexpensive compared to Tier 1 brokers’ offers.

The company is relatively transparent about its revenue sources, primarily earning through cash interest (not shared with investors) and fees charged for the SIPP account. Additionally, they generate returns from managed accounts. InvestEngine has automated a major portion of its operations and aims to maintain a reduced number of employees to lower expenses.

As of March 2024, InvestEngine has approximately 38K customers and manages £390 million in client funds, with about 35% being managed accounts. This marks significant growth from June 2022, when they reported 10k customers and over £70 million in assets under management.

Ownership and Transparency

The company was founded in 2016 by Ramsey Crookall, an independent wealth management firm, and Simon Crookall, the founder and former CEO of Gumtree, with business operations launching in 2019. Ramsey Crookall, established in 1946, is the Isle of Man’s oldest independent investment management and stockbroking firm, offering a broad spectrum of financial services such as portfolio management, stockbroking, and investment advice for both individual and institutional clients. Simon Crookall co-founded Gumtree with Michael Pennington in March 2000 aimed at individuals moving to London, especially from Australia, New Zealand, and South Africa.

As of the latest update, InvestEngine has undergone two rounds of funding. The company is not listed or rated, making information on ownership shares and profitability less accessible. The most recent report filed with UK Companies House for the fiscal year 2021-22 indicated a loss of under £3 million (nearly £1 million more than the previous year) and shareholder funds of £2 million (a decrease from £2.7 million the previous year). The company conducted a new fundraising round in 2022. Based on the crowdfunding estimations, it was worth around £15m in 2023.

Safety Considerations

Given that InvestEngine is a small, unprofitable Tier 2 player, the Financial Services Compensation Scheme (FSCS) protection of £85k is an extremely important consideration for investors.

Regulation & Investor Compensation Schemes

The Financial Services Compensation Scheme protects up to £85,000 per institution in event of firm failure. Importantly this is per customer per institution. A customer with £85,000 in an ISA and £85,000 in a SIPP would only be able to seek up to £85,000 total compensation in case of firm failure.

Share & Cash Custodians

Customer cash is held in ‘major banks’, although InvestEngine does not disclose their names. Customer stocks are pooled with CREST.

Reputation

As March 2024, InvestEngine has no known reputational and compliance issue.

II. Fee structure

InvestEngine offers very competitive fees for General and ISA accounts, where there is no custody charge, but the fees for SIPPs are less competitive. They also do not charge any transaction fees, enhancing their competitiveness for investors who trade more frequently. While direct fees are very competitive, indirect costs like spread can’t be controlled, as trades are processed only once a day at 6pm, reducing execution flexibility and visibility into these indirect costs. The mitigating factor is that there are only 600 ETFs as part of InvestEngine offer, most of which are assumed to be fairly liquid.

Platform fees

InvestEngine accounts are mostly free, with the exception of SIPP:

- DIY General Account – No Charge

- ISAs – No Charge

- SIPPs – 0.15% up to a maximum of £200 per year

- Business Account – No charge

- Managed Account – 0.25% per annum

Trading Commisions

Overall Fee Simulation vs Competitors

Most of our readers have simple Index portfolios. Using our Broker Total cost calculator, you can estimate the total cost of holding ETFs throughout the investment period. For our simulated scenarios:

- General Accounts – InvestEngine is very competitive

- ISAs – InvestEngine comes out the cheapest

- SIPPs – InvestEngine is average

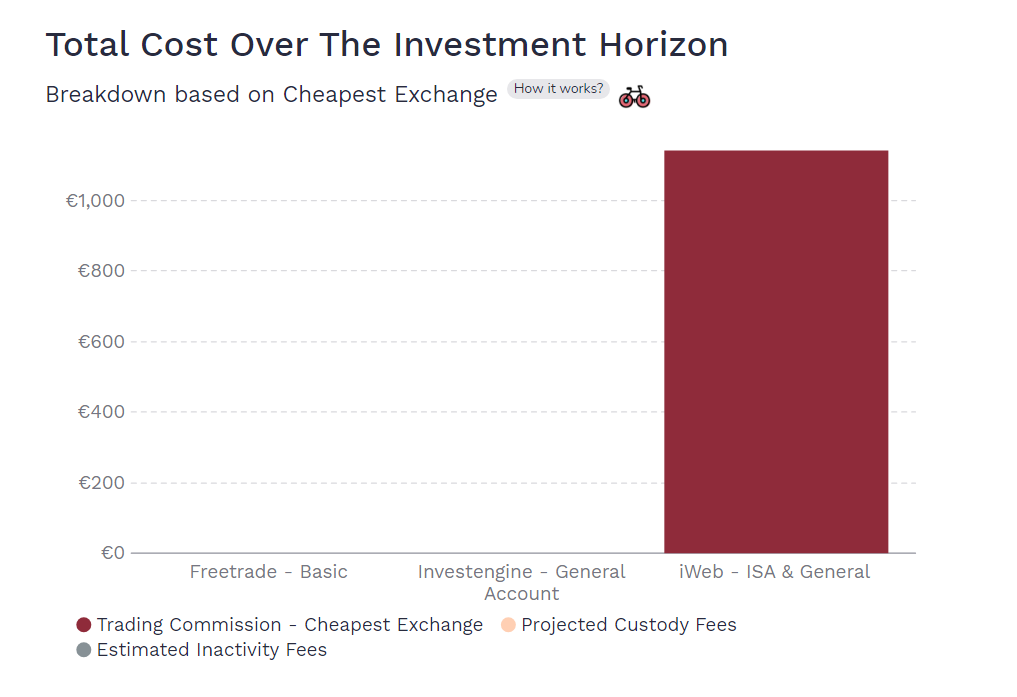

Fee Simulation For General Accounts

In the simulation below, for a 20-year accumulation period, the broker bill for a DIY General Investing account amounts to £0 for InvestEngine, matching the cost of one of its direct competitors, Freetrade. Conversely, iWeb is a significantly more expensive option, with a total bill of £1,140. It’s important to note that for iWeb, the costs are entirely accrued from dealing fees, as there are no custody fees.

Investor assumptions

| Model Feature | Assumption |

|---|---|

| Investor | UK |

| Instrument | UCITS ETF |

| Account | General |

| Initial Investment | £ 100,000 |

| Monthly | £ 1,000 |

| Time Horizon | 20 years |

| Gross Return | 8% |

Total Fees

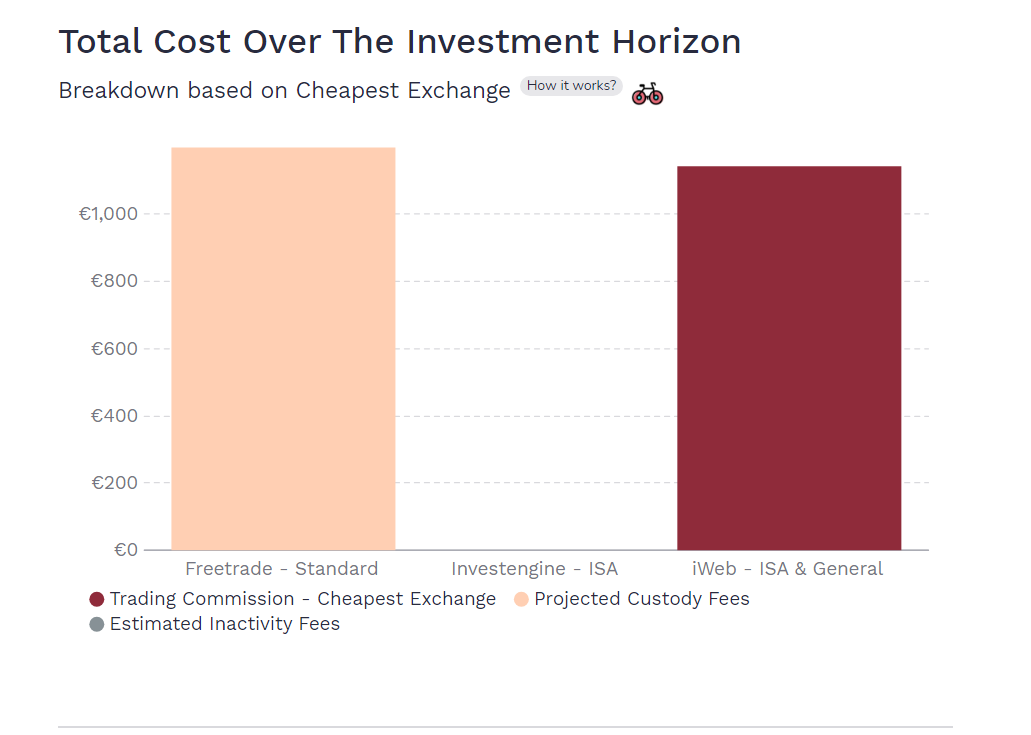

Fee Simulation For ISAs

In the simulation for a 20-year accumulation period, the broker bill for an ISA account is the cheapest with InvestEngine at £0. This contrasts with two of its competitors: Freetrade, which charges £1,198, assuming the investor opts for the annual charge, and iWeb, which totals £1,140. It’s important to note that iWeb’s costs stem entirely from dealing fees, as there are no custody fees.

Investor assumptions

| Model Feature | Assumption |

|---|---|

| Investor | UK |

| Instrument | UCITS ETF |

| Account | ISA |

| Initial Investment | £ 100,000 |

| Monthly | £ 1,000 |

| Time Horizon | 20 years |

| Gross Return | 8% |

Total Fees

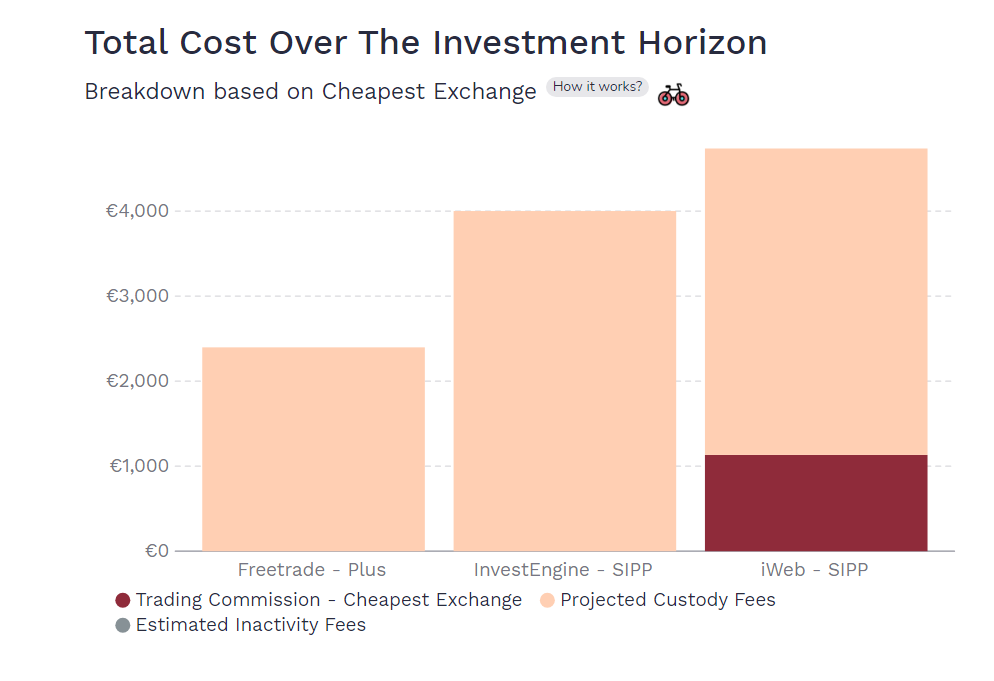

Fee Simulation For SIPPs

In the below simulation, for a 20-year accumulation period, the broker bill for a SIPP account is considered a mid-range option at £4,000. Freetrade emerges as a more affordable choice at £2,398, while iWeb is more expensive, totaling £4,740.

Investor assumptions

| Model Feature | Assumption |

|---|---|

| Investor | UK |

| Instrument | UCITS ETF |

| Account | SIPP |

| Initial Investment | £ 100,000 |

| Monthly | £ 1,000 |

| Time Horizon | 20 years |

| Gross Return | 8% |

Total Fees

Currency Exchange fees

InvestEngine offers products only in GBP and trades solely on the LSE stock exchanges, hence they do not charge any currency fees.

Other fees

Deposits and withdrawal are free of charge.

III. Platform & Features

InvestEngine’s platform boasts an intuitive and user-friendly interface, providing access to 600 ETFs on the LSE exchange. Execution is done only through one counterparty. It allows the opening of accounts for businesses. In case you want to transfer your shares to another provider, it is possible for most accounts except the managed service. Interest is not paid on the cash held in your account. The platform does not offer advanced trading instruments or products other than ETFs listed on LSE.

Account Opening Process

The sign-up process on InvestEngine is streamlined and entirely online, requiring personal and financial details and includes the step of selecting an account type, such as an ISA, personal, or business account. The minimum investment amount is £100, which can be lower if you opt for regular investments. Customer reviews frequently highlight the platform’s simplicity and cost-effectiveness, making it well-suited for entry-level investors. Additionally, InvestEngine’s customer support is often commended for its accessibility and helpfulness, with many customers praising the responsiveness and quality of the support they received.

account Features

- The InvestEngine website and app provide all the essential tools needed to find and execute ETF investments.

- InvestEngine offers a regular investment service and the option to buy fractional shares of ETFs.

- For those with DIY accounts, it’s possible to transfer your shares if you decide to close your account. Importantly, this feature is not available for managed accounts or fractional shares.

Internalisation and PFOF

There is no reliance on PFOF since it is not legally allowed in the UK.

Cash Interest

InvestEngine does not pay any interest on cash held in your accounts.

Advanced Features

InvestEngine offers ETFs only, Therefore you won’t find shares, bonds, funds, margin loan, derivatives, futures and options, CFDs. Below is a summary of the available investment types:

Features

| Investment Type | Availability |

|---|---|

| ETFs | ✅ |

| Stocks | ❌ |

| Bonds | ❌ |

| Funds | ❌ |

| Options | ❌ |

| Derivative | ❌ |

| Futures | ❌ |

| CFDs | ❌ |

| Forex | ❌ |

| Crypto | ❌ |

| Commodities | ❌ |

IV. Taxes

Tax Wrappers

InvestEngine offers the basic UK tax efficient accounts for those aiming for tax relief (SIPP) or capital gains and income tax shielding (ISA).

- ISA

- SIPP

Tax Reporting

For those clients who invest outside tax wrapper accounts, InvestEngine will provide consolidated tax certificates to help with filing tax reports annually