Ranking Of Largest Brokerage Firms by Assets in 2024

Brokers can have a staggering range of Assets Under Administration and sometimes – mammoth scales.

But pay attention to the nuances. A lot of websites compare brokers using the AUM metric, which is misleading. Some brokers are also asset managers, and play different roles.

KEY TAKEAWAYS

- AUA vs. AUM: Assets Under Administration (AUA) is a key metric for brokers, focusing on the total value of assets they administrate without investment decision powers, unlike Assets Under Management (AUM) where fund management and fiduciary responsibilities come into play.

- Administrative Expertise: AUA emphasises a broker’s capacity in administrative roles, including accounting, tax compliance, and custodial services.

- Ranking Criteria: Our Table only includes (i) Brokers that are not affiliated with large Banking Groups, since they have different reporting and aggregation standards (ii) Brokers that are relevant to long-term investors (not speculative platforms) (iii) Brokers that can be used by European or UK Investors.

- Diverse Scale: The scope of assets under administration spans a broad spectrum across these brokers, ranging from a towering 430 billion USD to a modest 150 million GBP, mirroring the varied dimensions of brokerage firms and their clients. Average broker account sizes can range from a few hundreds Euros for the smallest Tier 2 Brokers to €100-150k, for Tier 1 Brokers.

Here is the full analysis

How to measure brokers's assets

Understanding Assets Under Administration (AUA)

Why its different from Assets Under Management (AUM)

For Brokers, we talk about Assets Under Administration (AUA), which refers to the aggregate value of assets over which a financial institution exercises administrative oversight, providing specialized services for a fee. These assets remain under the direct ownership and strategic management of the clients.

Unlike Assets Under Management (AUM), AUA involves a non-discretionary role focused on administrative functions. These functions encompass a wide array of services, including fund accounting, tax compliance, trade processing, and custodial duties, executed by leading global banks and financial institutions. AUM pertains to assets that are actively managed by investment professionals who bear fiduciary responsibilities, enabling them to execute investment decisions on behalf of their clients. In contrast, AUA focuses on the administrative stewardship of assets.

That’s why it’s more relevant to talk about AUA, Client Assets, Assets under custody, Customer Equity rather than Assets Under Management.

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

What are the big brokers in europe & the UK?

Non-Banking Brokers

Scope of this comparison

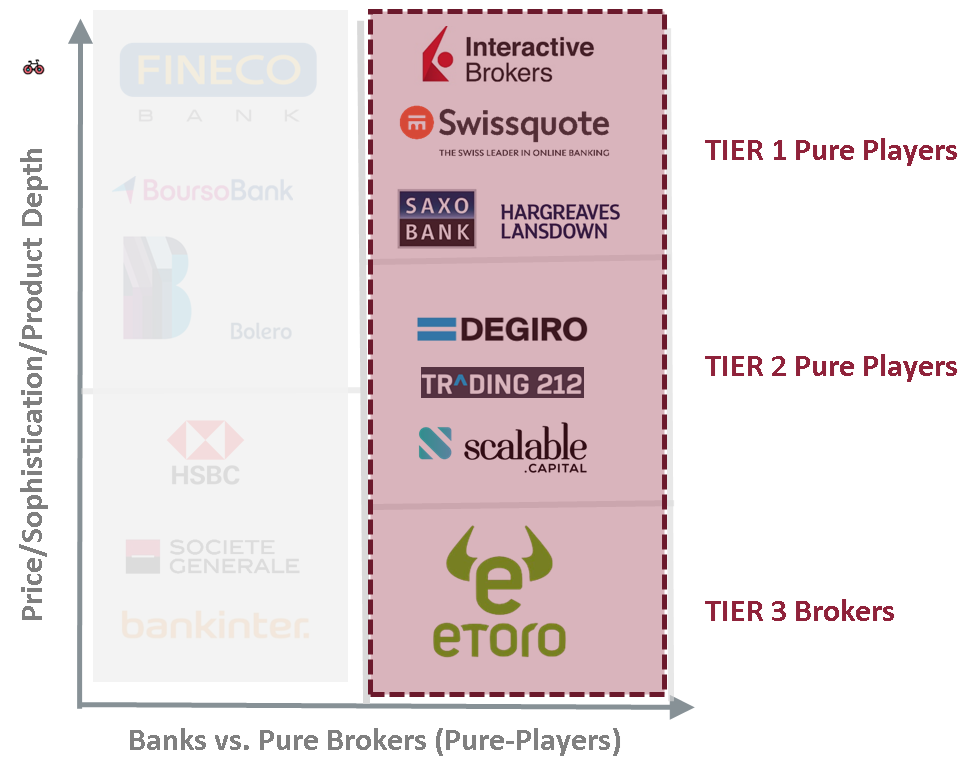

We rank brokers that are used by European and UK Investors, but are not affiliated with a Large Banking Group, as represented on the below graph (Tier 1 & Tier 2 Brokers). We also excluded Tier 3 brokers that are irrelevant, since they are speculative platforms with low sticky Assets.

Tier 1 and Tier 2 Brokers

International & UK-based brokers are the leaders

Ranking of Pure-player Brokers

Key highlights:

- The majority of assets – are managed by a few big brokers listed are Tier 1 institutions, indicating a strong presence of top-tier brokers in the market, particularly in the UK

- Average account size – Average account sizes vary from £/€100-150k for the largest Tier 1 Brokers (AJ Bell or Interactive Investor) to €20k (DEGIRO) or below for Tier 2 brokers.

- Variety in AUA: Assets under administration vary widely among these brokers, from as high as 430 billion USD to as low as 0.15 billion GBP, reflecting a broad range of broker sizes and client bases.

Brokers Used by European and UK Investors by Assets

| Broker | TIER | Main Area | AUA (in bn) | Currency | As Of |

|---|---|---|---|---|---|

| Interactive Brokers | Tier 1 | Pan-European | 430 | USD | 2023 |

| Hargreaves Lansdown | Tier 1 | UK | 141 | GBP | 2023 |

| SAXO | Tier 1 | Pan-European | 100 | EUR | 2023 |

| AJ Bell | Tier 1 | UK | 74 | GBP | 2023 |

| Firstrade | Tier 1 | US-based | 70 | USD | 2023 |

| Swissquote | Tier 1 | Pan-European | 56 | CHF | 2023 |

| Interactive Investor | Tier 1 | UK | 55 | GBP | 2022 |

| DEGIRO | Tier 2 | Pan-European | 48 | EUR | 2023 |

| Trade Republic | Tier 2 | Pan-European | 35 | EUR | 2023 |

| Vanguard Investor UK* | Tier 1 | UK | 15 | GBP | 2023 |

| Scalable Capital | Tier 2 | Pan-European | 10 | EUR | 2022 |

| IG / Tastytrade | Tier 1 | Pan-European | 4 | GBP | 2023 |

| Trading 212 | Tier 2 | Pan-European | 4 | EUR | 2023 |

| FreeTrade | Tier 2 | UK | 1.5 | GBP | 2023 |

| InvestEngine | Tier 2 | UK | 0.15 | GBP | 2022 |

| Lightyear | Tier 2 | Pan-European | Undisclosed | EUR | 2023 |

Data collected as of February 2024, Sources: Broker Websites, Bankeronwheels.com.

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

Why AUM is misleading?

Vanguard or Fidelity are the largest asset management firms

But they also act as brokers

Comparing asset managers to brokers by using Assets Under Management (AUM) as a common metric is like comparing apples to oranges, due to the fundamental differences between AUM and Assets Under Administration (AUA). Here’s why most websites use a misleading metric:

- Different Roles and Functions: Asset managers, such as Vanguard or Fidelity, actively manage their clients’ investments, making strategic decisions to achieve growth or income. Brokers – like Interactive Brokers or SAXO Bank – primarily provide a platform for buying and selling securities, along with other related services, without making discretionary investment decisions.

- AUM vs. AUA: AUM refers to the total market value of the assets that an asset manager has the discretion to invest on behalf of their clients. It reflects the manager’s direct control and responsibility over the assets. AUA, commonly associated with brokers, encompasses assets that are under the broker’s administrative care but not directly managed or controlled in terms of investment decisions. This can include custodial services, record-keeping, and execution of trades as instructed by the client or their asset manager.

Thus, while Vanguard and Fidelity are indeed leading asset managers with significant AUM, using AUM to rank them alongside brokers can overlook the distinct nature of services each provides and the different value they bring to their clients.

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Cash Is Not Enough: Why Hold Bond ETFs Despite Price Rollercoasters.

The Truth About €1 Million Broker Guarantees (Updated With Trading 212 Cap)

Halifax Share Dealing Review – Similar To Lloyds With SIPP On Top

Lloyds Share Dealing Review – Old School But Ticks The Boxes For Golden Retrievers

DEGIRO Review: A Transparent Leader In Low-Cost Investing

Weekend Reading – BlackRock Launches New iBonds, Truth About €1M Broker Insurance & BOW is 4 years old!

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.