Weekend Reading – How To Invest Like The 1%

Weekend Reading is a collection of Investment Research and Lifestyle topics from all corners of the Web.We source the highest quality insights from Wall Street and Main Street that you may apply to your investment process. Unlike the rest of Bankeronwheels.com, this series is provided without additional guidance. As usual, everything is to be used at your own risk. Below is the type of content we shortlist.

Invest Wisely section is dedicated to research on how to invest for the Long Run using Passive Investment Strategies. Read Topics related to (i) Portfolio Construction and Asset Allocation (ii) Acting wisely by avoiding behavioural traps and also (iii) publications that help understand how financial markets work.

Active Investing section relates to improving your knowledge about active investing. If you decide to sin, then sin only a little. Given ample evidence, combined active bets should be ideally a relatively small fraction of your portfolio. This section also includes Sustainable Investing. You can invest in a Socially Responsible way, but there are many ESG traps. Learn how to invest sustainably, and what it means for expected returns, with our definitive guide to sustainable investing.

Personal Finance section is dedicated to UK and European Products. It can also touch on other European jurisdictions outside the Euro-zone.

- Recommeded Reading

- Youtube (Required watch time)

- Podcast (Listening Time)

- Academic Research - May require intermediate/advanced knowledge

- Noteworthy Twitter Thread

It is better to be roughly right than precisely wrong

John Maynard Keynes, father of modern macroeconomics

INVEST WISELY

CONSTRUCT YOUR PORTFOLIO

Over the past 50 years, the US Market outperformed the Rest of the World by 1% annually. But all of it came in the last 8 years.

Compared to the S&P 500, a Global Portfolio has lower volatility and increases the likelihood of financing your projects, especially in the medium-term.

Global Markets’ high correlations don’t justify relying only on the US, because correlations don’t capture magnitude of returns.

The primary purpose of bonds is to reduce the overall volatility of the portfolio, but as we saw in 2022, that doesn’t mean they can’t lose money. In fact, 2022 was the worst year for bonds in US history. And now that we’re in a new period of higher interest rates on money market funds, CDs, and short-term Treasury bills, its quite noticable that an increasing number of people are wondering whether they should hold cash instead of bonds.

UNDERSTAND FINANCIAL MARKETS

- End of an era? Here is why a slowdown in profits is on the cards (Verdad)

- Nasdaq Changes: Tech's Magnificent Seven Force Rebalance (Morningstar)

- Who Should Worry About AI More? Active Managers or Advisers? (Morningstar)

- The Problem with Valuation (Of Dollars and Data)

- Should you be worried about a run on your bank? (Pension Craft - 21 min)

- Ukraine bond rally has legs as GDP improves says BofA (Bloomberg)

“I am not a market prognosticator for a simple reason. I am just not good at it, and the first six months of 2023 illustrate why market timing is often the impossible dream, something that every investor aspires to be successful at, but very few succeed on a consistent basis. At the start of the year, the consensus of market experts was that this would be a difficult year for markets, given the macro worries about inflation and an impending recession, and adding in the fear of the Fed raising rates to this mix made bullishness a rare commodity on Wall Street.”

Read more on Aswath Damodaran

HOW TO INVEST

You may not know, but Harry Markowitz, a Nobel Prize-winning economist, helped shape Index Investing as you know it by showing that diversification could reduce investment risk while maximizing returns. He recently passed away, aged 95. Robin Wigglesworth has written an excellent book about the Indexing Revolution, including how Markowitz contributed to it. We highly recommend it if you haven’t read it already.

Active Investing

FACTOR investing

Sector classifications are useful for viewing companies in similar lines of business, but companies often have business lines that span multiple industries or sectors. This us a huge question market on the effectiveness of sectoral analysis. Fortunately, factor investing drills through broad labels to highlight what investors may care about and to help understand past performance and expected returns.

Read more on Blackrock

Craving an edge with more diversification and potential for higher-than-average returns?Berkin and Swedroe’s “Your Complete Guide to Factor-Based Investing” is a great place to start. This book navigates you through the ‘zoo’ of factors, retaining only the most pertinent and investable factors influencing returns, including the ones that accounted for most of Warren Buffett’s outperformance. But beware, it’s not all smooth sailing. Risks and costs lurk around the corner, demanding knowledge and patience.

Factor Outperformance vs.Tracking Error (Robeco)

Great animated chart with Factor Outperformance vs. Tracking Error since the 1960s for the different factors.

discretionary investing

We’re in the midst of an AI mania of sorts. In public markets, investors are placing bets on the companies perceived as being the winners of this new wave of computing. Companies that aren’t even in “tech” are touting their AI bonafides. And of course, in private markets, every venture capitalist suddenly seems to be pivoting to AI in some way or another. But who will actually win?

ALTERNATIVE ASSET CLASSES

WALL STREET

SUSTAINABLE investing

crypto

BAD BETS

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

PERSONAL FINANCE

Wealth Management

- How to Invest Like the 1% (A Wealth of Common Sense)

- 4 important ways financial advice can make a difference (Vanguard - 3 min)

- Breakups are hard, but breaking up with financial advisor can be harder (ChooseFi - 58 min)

- Consumption and Portfolio Choice over the lifecycle (Rational Reminder - 58 min)

An avid cyclist, Jonathan was born in London, England, and graduated from Cambridge University. Jonathan spent almost 20 years at The Wall Street Journal, where he was the newspaper’s personal finance columnist. He then worked for six years at Citigroup, where he was Director of Financial Education for Citi Personal Wealth Management, before returning to the Journal for an additional 15-month stint as a columnist.

Early Retirement

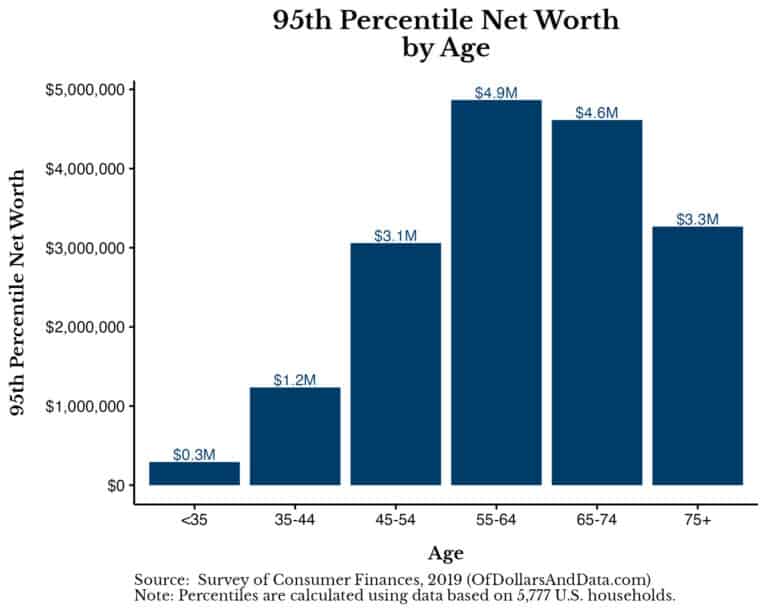

Over the past few years, more and more people are looking to achieve financial independence and retire early. Among the many different ways to achieve FIRE, one stands above the rest—Fat FIRE. Fat FIRE is an early retirement strategy that allows you to live life on your own terms. It’s much more than just escaping the rat race and leaving the corporate world behind—it’s about achieving a level of financial independence that gives you the retirement you’ve always dreamed of. But what exactly does Fat FIRE entail? What are its advantages and disadvantages? And what does it take to achieve?

Read more on Of Dollars and Data

FINANCIAL PRODUCTS

COST OF LIVING

OUR Community

Question of the week

Personal Development

This is a special episode and a turning of the tables. This time, legendary investor Bill Gurley interviews Tim. The conversation explores some of his lessons learned and favorite findings over the last two decades in areas like entrepreneurship, tech, and podcasting. He also throws in some of his favorite books and other spice to keep things interesting.

Health & Wellness

CAREERS

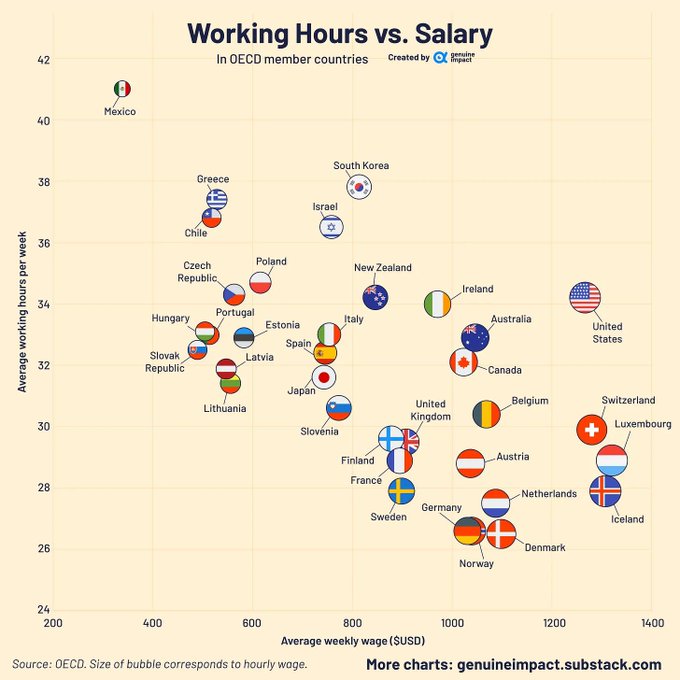

At the top is Mexico, where the average worker clocks over 2,000 hours per year. This reflects the country’s labor dynamics, which typically involves a six-day workweek. For context, 2,128 hours is equal to 266 eight-hour workdays. The only other country to surpass 2,000 annual hours worked per worker is Costa Rica, which frequently tops the World Economic Forum’s Happy Planet Index (HPI). The HPI is a measure of wellbeing, life expectancy, and ecological footprint. Looking at the other end of the list, the two countries that work the fewest hours are Germany and Denmark. This is reflective of the strong labor laws in these countries as well as their emphasis on work-life balance.

More on PBS

Travel

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

miscellaneous

OUR Community

Last Week We asked you

How would you describe your current life situation?

SUGGEST AN ARTICLE

Thank you for reading.

Good Luck & keep’em* rolling!

(* Wheels & Dividends)

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Banker’s Paradise: Two Easy Ways To Fool Investors

Slashing FX costs! In which currency should I buy ETFs?

Cash Is Not Enough: Why Hold Bond ETFs Despite Price Rollercoasters.

Weekend Reading – Global Shocks: How Do Stocks Perform?

Trading 212 Review: Pros & Cons

The Reason Why Sustainable Investing Will Underperform

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.