Weekend Reading – More iBonds & Highest Security Lending Returns

Weekend Reading is a collection of Investment Research and Lifestyle topics from all corners of the Web. We source the highest quality insights from Wall Street and Main Street that you may apply to your investment process. Unlike the rest of Bankeronwheels.com, this series is provided without additional guidance. As usual, everything is to be used at your own risk. Below is the type of content we shortlist:

The Intelligent investor is a realist who sells to optimists and buys from pessimists.

Benjamin Graham

INVEST WISELY

CONSTRUCT YOUR PORTFOLIO

This analysis reflects four newly listed ETFs in Sept’23, and accumulating share classes for previously listed ETFs.

iBonds act like regular Bonds. The ETF will mature, and you will be repaid at a predetermined date. However, they offer several ETF advantages over regular bonds – they trade like stocks, are diversified, and don’t require high investment amounts to get started.

So, who should buy them, and how do they work?

- It’s Time to Consider TIPS (Morningstar)

- Securities Lending Provides Value. But Is It Enough To Make a Bad Fund Good? (Morningstar)

- Reports of 60:40's Death Have Been Greatly Exaggerated (Morningstar - 5 min)

- 4 ways to diversify concentrated stock positions (Peter Lazaroff - 15 min)

- The Yale Model in David Swensen’s Words (Capital Allocators - 16 min)

UNDERSTAND FINANCIAL MARKETS

The highlight of this Oddlots podcast with Bill Gross is not the ego question of the bond king. It’s quite pathetic.

I think it’s rather what makes a lot of folks miserable in finance looking for purpose and that’s when he says “at pimco our mantra was client comes first. That sounds like bullshit”. Indeed.

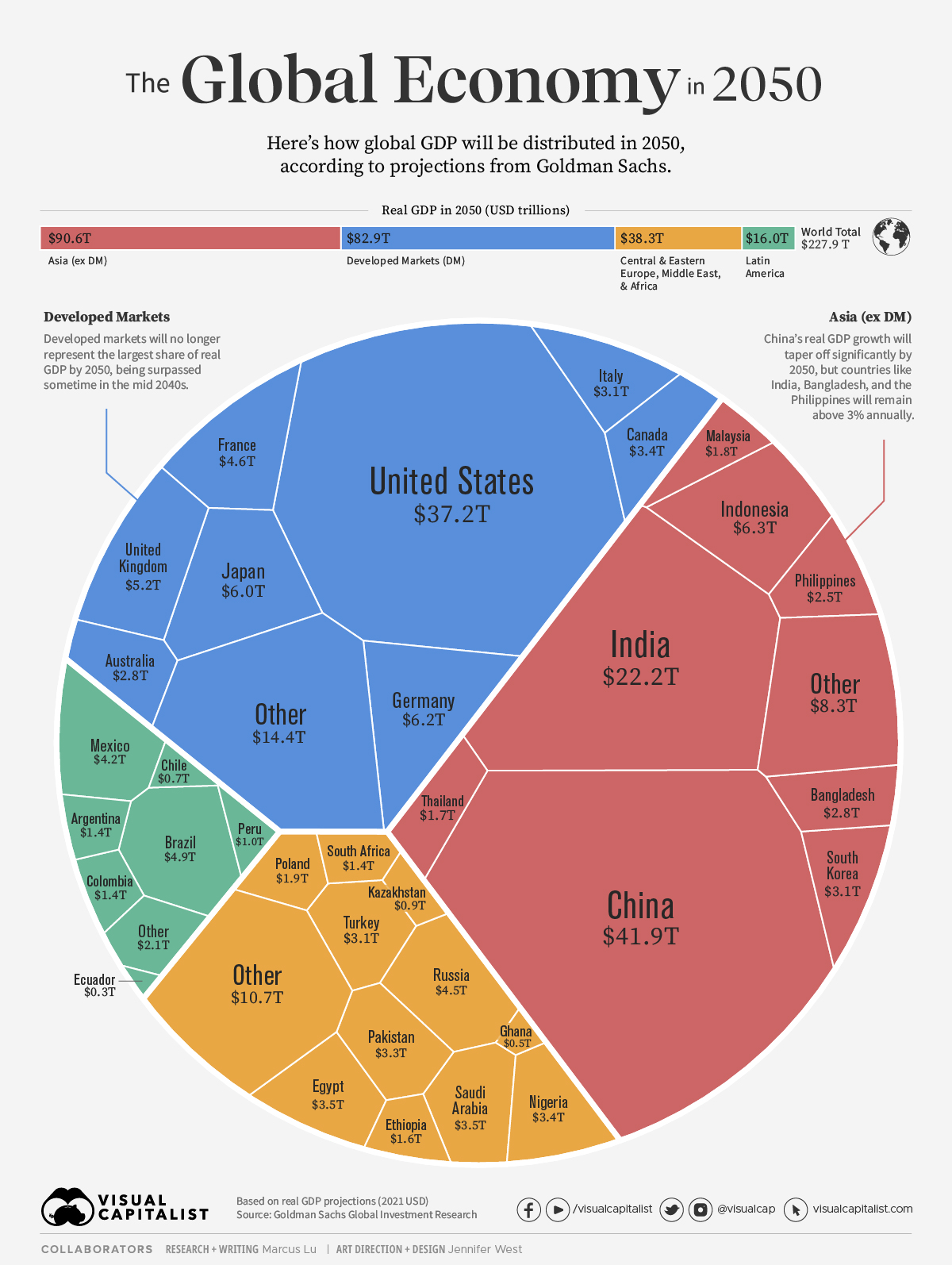

Based on these projections, Asia (ex DM) will represent 40% of global GDP, slightly ahead of Developed Markets’ expected share of 36%. This would mark a massive shift from 50 years ago (2000), when DMs represented over 77% of global GDP.

Focusing on Asia, China and India will account for the majority of the region’s expected GDP in 2050, though growth in China will have tapered off significantly. In fact, Goldman Sachs expects annual real GDP growth in the country to average 1.1% through the 2050s. This is surprisingly slower than America’s expected 1.4% annual growth during the same decade.

Read more on Visual Capitalist

HOW TO INVEST

Active Investing

FACTOR investing

The Magnificent Seven names have high exposure to large size and negative exposure to value. They are mixed on volatility. However, except for Amazon, they all score above average on profitability.

Read more on Blackrock

discretionary investing

Apple takes the top spot, having created nearly 5% of all shareholder wealth. From the iPod to the iPhone, Apple’s ability to keep innovating has helped it gain a loyal fan base and given the company pricing power. Notably, Apple is America’s most profitable company.

ExxonMobil is the only non-technology company among the five best stocks. When Exxon and Mobil merged in 1999, it was the biggest merger in history and ExxonMobil temporarily became the world’s largest public company by market capitalization. More recently, the company experienced record profits in 2022 due to high oil prices.

Read more on Visual Capitalist

ALTERNATIVE ASSET CLASSES

WALL STREET

JP Morgan - The Most Powerful Bank in America (FinAIus - 43 min)

Delve into the intricate web that’s made it the most powerful bank in America. Uncover a legacy of ambition, influence, and unparalleled financial prowess. Join us on this revealing journey.

SUSTAINABLE investing

crypto

BAD BETS

The fake genius: a $30b fraud (James Jani - 1 hr 5 min)

Sam Bankman-Fried was supposed to be a billionaire genius running the world’s largest Crypto exchange: FTX. In only a few weeks, his $32B empire crumbled, leading to his arrest. In this video, we unravel one of the decade’s most significant cases of financial fraud.

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

Wealth Management

New UCITS ETFs

1. BlackRock iBonds ETFs. BlackRock has introduced five more iBonds ETFs, expanding the total to nine with maturities between 2025 to 2028. These ETFs offer exposure to IG corporate bonds across different countries and sectors, as well as US treasuries. The range now covers maturities in December of 2025, 2026, 2027, and 2028.

2. VanEck US Fallen Angel High Yield Bond UCITS ETF – VanEck has listed this ETF on the London Stock Exchange and Deutsche Börse Xetra. The ETF targets US dollar-denominated high-yield bonds formerly rated as investment grade and rebalances monthly with a TER of 0.35%.

3. WisdomTree Physical Ethereum – WisdomTree has activated staking in its Ethereum ETF. The product is named WisdomTree Physical Ethereum.

Personal Finance

Listen in as Preet provides a comprehensive overview of the current state of financial planning and shares his most intriguing findings before unpacking the policy and regulatory recommendations that emerge from his research. His research interrogates the value of financial advice within households and explores the pressing question of whether it’s worth getting it.

Early Retirement

FINANCIAL PRODUCTS

COST OF LIVING

OUR Community

Question of the week

Personal Development

Health & Wellness

- How To Get The Best Sleep Of Your Life: Six Secrets From Research (Barking Up The Wrong Tree)

- Outlive – The Science & Art of Longevity (A Book Review) (The Retirement Manifesto)

- The Favorite Doctor of Bio-Hackers and the Longevity-Obsessed (Wall Street Journal, Paywall)

- For A Better Workout, Think Like A Kid (Art of Manliness - 50 min)

CAREERS

- Try Hard, but Not That Hard. 85% Is the Magic Number for Productivity (Wall Street Journal, Paywall)

- 90% of companies say they’ll return to the office by the end of 2024—but the 5-day commute is ‘dead,’ experts say (CNBC)

- Your pay is determined by the gender of your boss (Joachim Klement)

- Looking for a job abroad? Don’t move to Germany (Joachim Klement)

Travel

Raph has travelled the world with his bike in tow & it is nstural for him to be asked numerous questions related to his adventures. “What did you think of China?” is one of these questions. The answers are complex but a day from his life on the bike can give you some flavour. The highlight of this trip to China is without any doubt the Qinghai Province. Logistically, China was also the most challenging country on a bike. Here is why.

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

miscellaneous

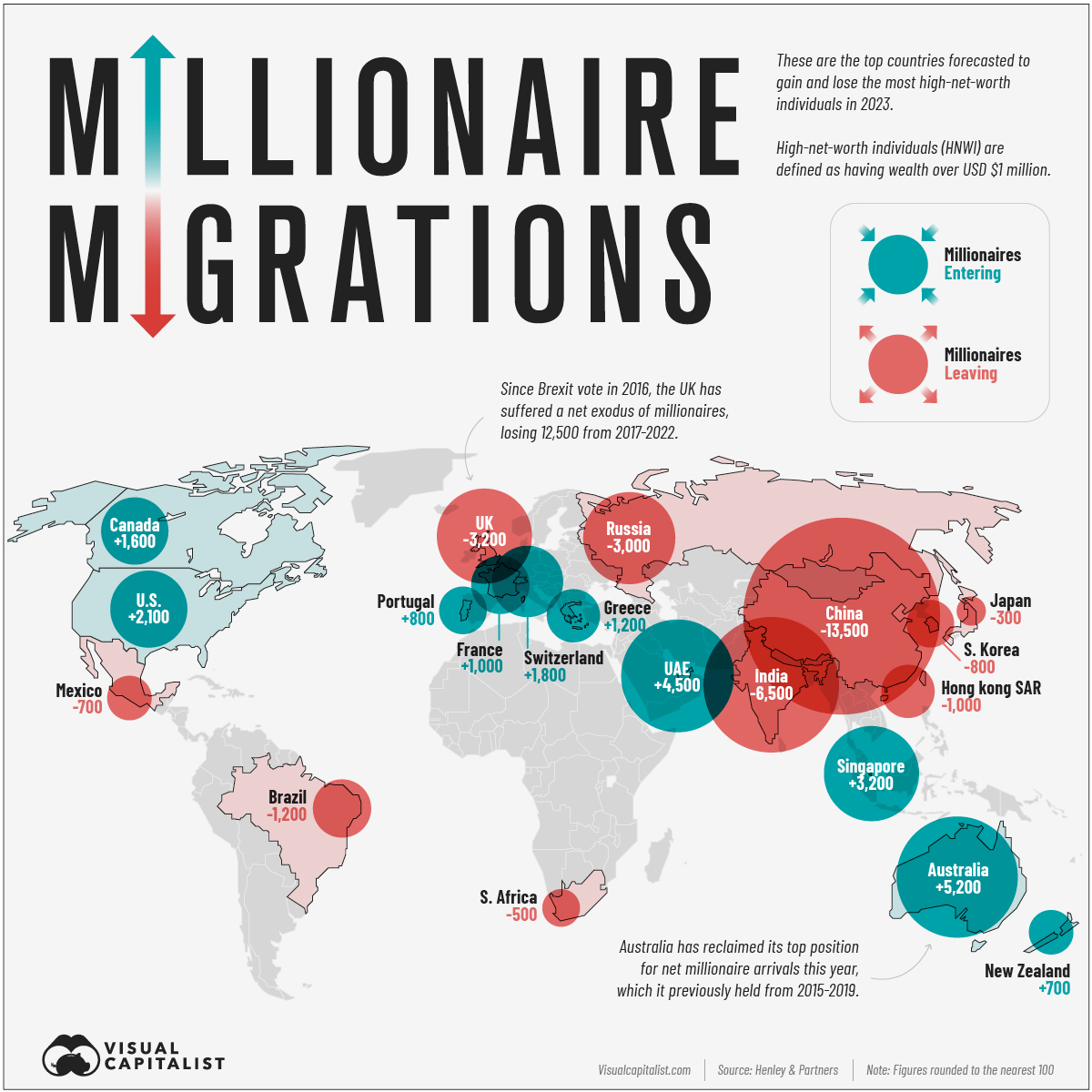

Only two Asian countries make the top 10, with the rest spread across Europe, North America, and Oceania.

Despite historic economic challenges, Greece is projected to gain 1,200 High Net Worth Individuals this year. One reason could be the country’s golden visa program, wherein wealthy individuals can easily obtain residence and eventually EU passports for the right price—currently a minimum real estate investment cost of 250,000 euros is all that’s required.

Read more on Visual Capitalist

OUR Community

Last Week We asked you

How would you describe your current life situation?

SUGGEST AN ARTICLE

Thank you for reading.

Good Luck & keep’em* rolling!

(* Wheels & Dividends)

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – BlackRock Launches New iBonds, Truth About €1M Broker Insurance & BOW is 4 years old!

The Truth About €1 Million Broker Guarantees

4 Things I Learned In 4 Years Of Running A Finance Blog

Dodl By AJ Bell Review – AJ Bell’s Younger Brother

Vanguard LifeStrategy Review – A Retriever In A Babushka Doll

Why Do Portfolio Managers Care About Factors? It’s Not What You Think.

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.