How To Construct a Bond Ladder with iBonds

Have you ever considered matching bond cash flows with a life event, such as buying a house or annual retirement expenses, using an ETF?

iBonds act like regular Bonds. The ETF will mature, and you will be repaid at a predetermined date. However, they offer several ETF advantages over regular bonds – they trade like stocks, are diversified, and don’t require high investment amounts to get started.

So, who should buy them, and how do they work?

KEY TAKEAWAYS

- For Short to Medium-Term Goals – iBonds have four maturities – from Dec 2025 to Dec 2028. It can fund your child’s 2027 tuition, or annual retirement expenses over four years.

- Available in EUR and USD – For each maturity, you can choose between exposure to Euro Corporate Bonds or US Corporate Bonds, in their respective currencies.

- High Yields – Most iBonds invest in Corporate Bonds, offering higher returns, except in their last year when you will be exposed to Government Bonds – French or German for EUR ETFs and US Treasuries for USD ETFs.

- Advantages vs Bonds – iBonds offer diversification, liquidity, and a lower investment threshold. All ETFs have accumulating share classes. ETFs with US Bonds can be used in UK’s ISAs and SIPPs.

- Low Commercial Risk – iBonds for professionals launched in Europe in 2015. Despite low demand, BlackRock allowed funds to mature as planned in 2018.

- We don’t like ESG and Security Lending – Yields may be marginally affected due to exclusions. A mitigating factor is the lack of reliance on flawed MSCI ESG Ratings. iBonds engage in security lending, which is mitigated by BlackRock’s borrower default indemnity.

Here is the full analysis

This analysis reflects four newly listed ETFs in Sept’23, and accumulating share classes for previously listed ETFs.

What etfs are available?

In Q3’23, BlackRock listed nine iBonds ETFs:

- Four Corporate Bond EUR ETFs with Maturities from Dec 2025 to Dec 2028

- Four Corporate Bond USD ETFs with Maturities from Dec 2025 to Dec 2028

- One US Treasury Bonds USD ETF maturing in Dec 2025 (excluded from the below review)

Available ETFs

| ETF | Currency | Bond Type |

|---|---|---|

| iShares iBonds Dec 2025 Term € Corp UCITS ETF | EUR | Corporates |

| iShares iBonds Dec 2026 Term € Corp UCITS ETF | EUR | Corporates |

| iShares iBonds Dec 2027 Term € Corp UCITS ETF | EUR | Corporates |

| iShares iBonds Dec 2028 Term € Corp UCITS ETF | EUR | Corporates |

| iShares iBonds Dec 2025 Term $ Corp UCITS ETF | USD | Corporates |

| iShares iBonds Dec 2026 Term $ Corp UCITS ETF | USD | Corporates |

| iShares iBonds Dec 2027 Term $ Corp UCITS ETF | USD | Corporates |

| iShares iBonds Dec 2028 Term $ Corp UCITS ETF | USD | Corporates |

| iShares iBonds Dec 2025 Term $ Treasury UCITS ETF | USD | Treasuries |

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

Should you consider theM?

Potentially suitable

potentially NOT Suitable

- You have a short to medium term goal

- You want a Fairly predictable return

- You want to match future expenses

- You want corporate bonds to increase yield

- You want bonds for the long run

- You save for expenses in unknown amounts and/or unknown time horizons e.g. retirement

- You need government bonds for portfolio rebalancing

Who Are iBonds Funds For?

- You have a short to medium term goal

- You want a Fairly predictable return

- You want to match future expenses

- You want corporate bonds to increase yield

When May iBonds NOT Be Suitable?

- You want bonds for the long run

- You save for expenses in unknown amounts and/or unknown time horizons e.g. retirement

- You need government bonds for portfolio rebalancing

Paying a Tuition fee

A one-off payment in 2026

Let’s say you want to fund your child’s tuition in two years from now. Here is how you can think about it:

- How Much You Need: Today’s invested amount plus the return from bonds will match the 2026 expense.

- Buy the ETF maturing before: Here, iBonds maturing in December 2025 would be the closest. Then, you can park the cash with a Bank for a couple of months.

- Reinvest the Interest: Distributing ETFs pay interest. Even though the coupon is much lower than the yield, consider reinvesting the interest payments.

funding Two Projects

Two payments in 2027 and 2029

But, you may also want to fund two goals – for example, an adventure in 2027 and helping your kid kickstart his business in 2029:

- Allocate : Determine exactly how much money you will need in 2027, and then in 2029.

- Select Your ETF: Choose the iBonds maturing before – here December 2026 and 2028.

- Reinvest the Interest: Again, consider reinvesting the interest payments.

Funding your retirement lifestyle

funding annual expenses

You probably see where I am going with this. If iBonds get more traction, and more maturities are available, you could fund your retirement lifestyle for years to come. Today, four maturities are already available – from 2025 to 2028.

How do they compare with Regular ETFs?

3 major differences with regular bond etfs

#1 The ETF will Mature

Unlike most Bond ETFs, iShares iBonds have a distinct maturity date. It’s in the name of the fund. Regular Bond ETFs roll Bonds to maintain roughly the same maturity profile and duration. iBonds collateral matures within 12 months of the ETF closure, when the principal is paid back to the investor. The Funds will be de-listed from the Stock Exchanges.

#2 The Collateral changes in the last year

But what happens to the collateral that matures 10 or 6 months before the Bond ETF Maturity? In the final year of an iBonds ETF, the Fund starts transitioning its holdings from corporate bonds to US Treasuries, for a USD fund and Bunds or French OATs for a EUR fund. It’s a carefully orchestrated manoeuvre designed to ensure the fund’s value remains steady as it approaches maturity.

#3 The ETF size doesn't matter (that much)

For traditional ETFs, size matters—a lot. It comes with commercial risk of closure. For iShares iBonds ETF, size isn’t as paramount. BlackRock is unlikely to close them, even with low demand. The star of the show is the maturity date, and everything else plays second fiddle.

Full Comparison

Regular Bond ETFs vs ibonds

| Criteria | Regular Bond ETF | iShares iBonds |

|---|---|---|

| Build Bond Ladders | No | Yes |

| Rolling Maturities | Yes | No |

| Decreasing Duration | No | Yes |

| Return of Principal | No | At Maturity |

| Different collateral in last year | No | Yes - Govies |

| Liquidity | Traded on Exchanges | Traded on Exchanges |

| Diversification | Very High | High |

| Minimum Investment | Low | Low |

| Value Fluctuation | Yes - Visible | Yes - Visible |

| Management fees | ETF TER | ETF TER |

| Security Lending | Depends | Yes |

3 major differences with regular bondS

#1 iBonds Are Liquid

iBonds are traded on an exchange, making them much more liquid than regular bonds. Investors can sell out of iBonds, should their plans change. Regular bonds may require finding a buyer in the over-the-counter market, which can sometimes be challenging and time-consuming.

#2 iBonds Are Diversified

iBonds provide exposure to a diversified basket of bonds, rather than a single bond issuer. Each ETF has between 230 and 330 individual Bonds.

#3 iBonds Are Easier To Access

Buying and selling iBonds is as easy as trading stocks. Regular bonds, may require a minimum investment amount that could be prohibitive for some investors.

Full Comparison

Regular Bond ETFs vs ibonds

| Criteria | Single Corporate Bond | iShares iBonds |

|---|---|---|

| Build Bond Ladders | Yes | Yes |

| Decreasing Duration | Yes | Yes |

| Return of Principal | At Maturity | At Maturity |

| Different collateral in last year | No | Yes - Govies |

| Liquidity | Traded OTC | Traded on Exchanges |

| Diversification | Single Issuer Risk | High Diversification |

| Minimum Investment | Usually High | Low |

| Value Fluctuation | Yes - but Invisible | Yes - Visible |

| Management fees | No | ETF TER |

| Security Lending | No | Yes |

What else is different?

While iBonds have clear advantages over regular Bonds, there are a few things to keep in mind:

- Management fees – although they are very low for iBonds (0.12%)

- Different collateral – as mentioned, during its last year you’re exposed to another, safer, asset class – Government Bonds.

- Securities Lending – more on that below.

Have ibonds ever been tested?

Do iBonds Have A Track Record?

What About Europe?

In 2015, iBonds were issued in UCITS format for the first time. But they were only targetted towards professional investors. Despite interest in iBonds having fizzled out after the launch of a US investment-grade credit fund in 2015, it reached its liquidation date in 2018.No new iBonds were launched for European investors until now. This suggests that even when faced with low demand, BlackRock has a history of allowing funds to mature as planned rather than closing them prematurely.

What Return Can you Expect?

Corporate iBonds Listed in Q3'23

Corporate Bond ibonds - Yields & Cost

| ETF | Currency | Maturity | Yield | TER | Duration | Coupon |

|---|---|---|---|---|---|---|

| Dec 2025 $ Corp | USD | 31/12/2025 | 5.80% | 0.12% | 1.6 | 4% |

| Dec 2026 $ Corp | USD | 31/12/2026 | 5.62% | 0.12% | 2.6 | 3.1% |

| Dec 2027 $ Corp | USD | 31/12/2027 | 5.50% | 0.12% | 3.4 | 3.6% |

| Dec 2028 $ Corp | USD | 31/12/2028 | 5.54% | 0.12% | 4.2 | 4.2% |

| Dec 2025 € Corp | EUR | 31/12/2025 | 4.17% | 0.12% | 1.7 | 1.5% |

| Dec 2026 € Corp | EUR | 31/12/2026 | 4.02% | 0.12% | 2.7 | 1.7% |

| Dec 2027 € Corp | EUR | 31/12/2027 | 4.05% | 0.12% | 3.6 | 1.7% |

| Dec 2028 € Corp | EUR | 31/12/2028 | 4.04% | 0.12% | 4.5 | 1.8% |

Few Quirks Of iBonds To Remember

- Yield-to-Maturity is a proxy – The above yields are a good indication of what you will earn. But, it’s not exactly Professional Liability Driven Investing (or LDI). Remember, in the last year, the Bonds will be gradually replaced with Government exposure, so yield in the final year will be determined by rates at that point in time. Duration is also calculated based on current portfolio composition.

- You will earn more than the coupons – The Yield-to-Maturity comprises coupons, paid quarterly, and appreciation of ETF price over time. Some of the underlying Bonds were issued a few years ago, in a much lower yield environment.

- Low coupons may be beneficial – A significant part of total return comes from price appreciation, reducing hassle of reinvesting and potential taxes/transaction fees. The difference between ETF Yield and Coupons from the Bonds is smaller for the USD Funds. Fortunately, for the USD funds, there are accumulating funds available.

- iBonds are unhedged – if you are a European or UK investor, you will be taking currency risk when e.g. investing through US Corporate iBonds. Learn more about FX risk.

What Credit Risks are you taking?

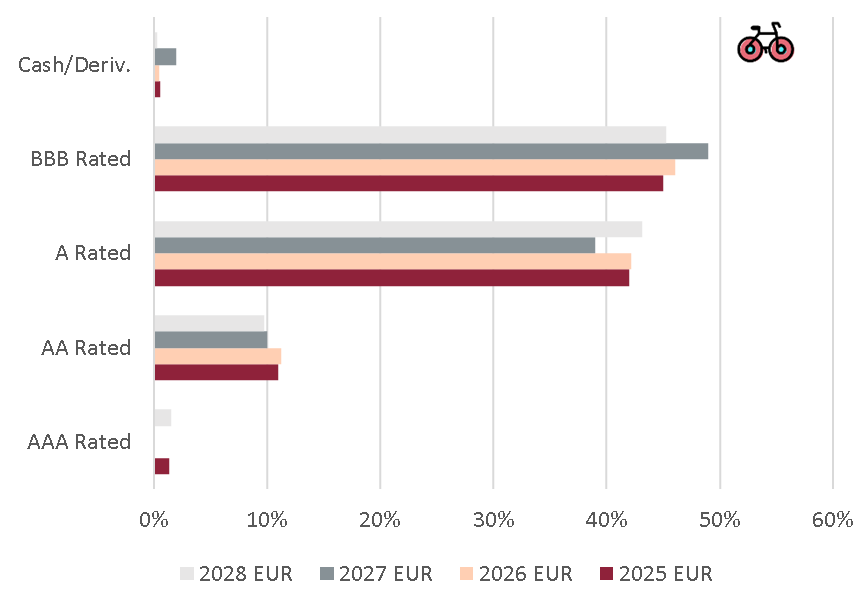

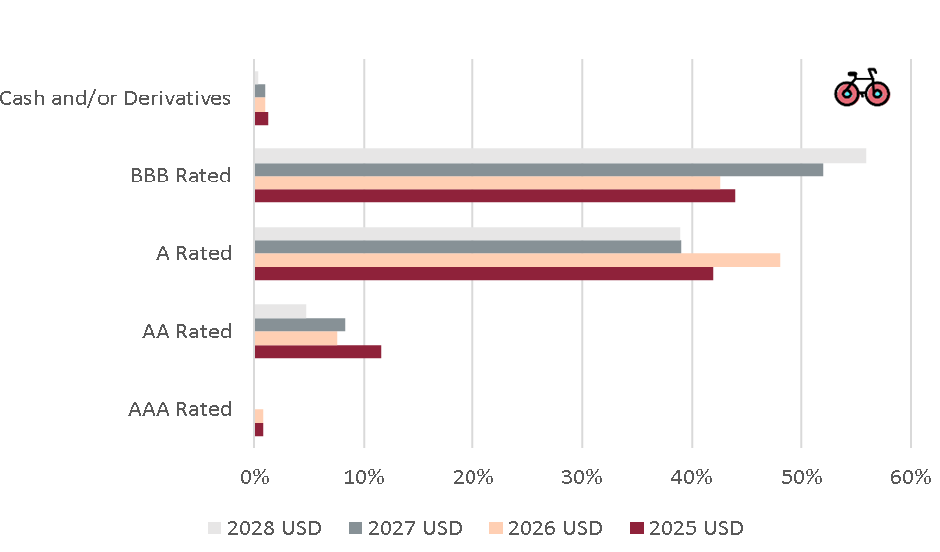

Overall Risk

- European Corporate iBonds are conservative – with generally below 45% in BBB Bonds, the lowest Investment Grade rating category.

- US Corporate iBonds are slightly riskier – especially the longer dated 2027 and 2028 Bonds with 53% and 56% in BBB category. The 2026 ETF is the safest overall, with only 42% BBB.

European Corporate iBonds - Ratings

US Corporate iBonds - Ratings

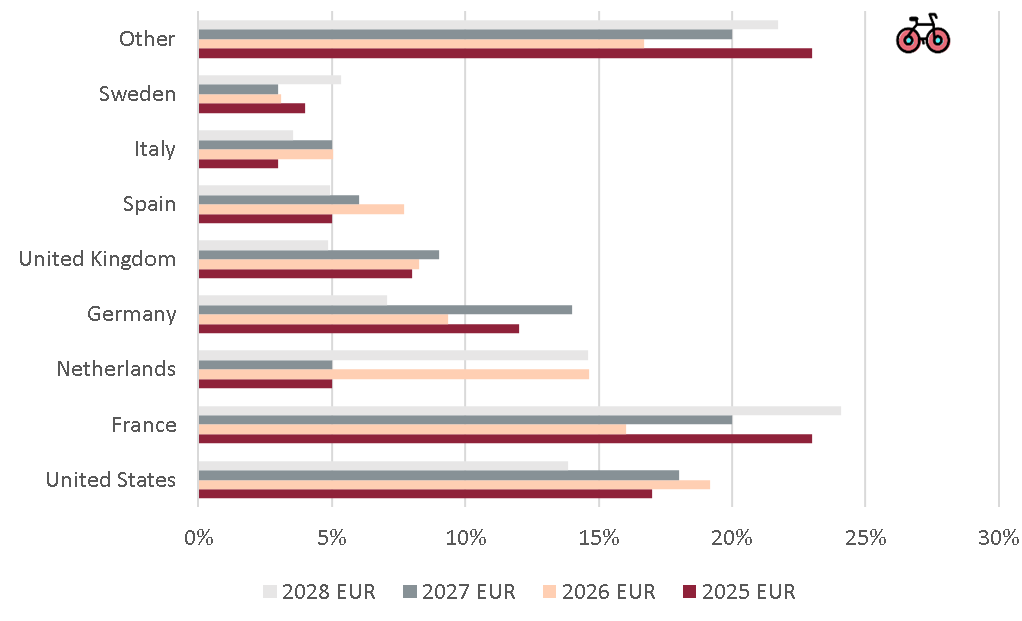

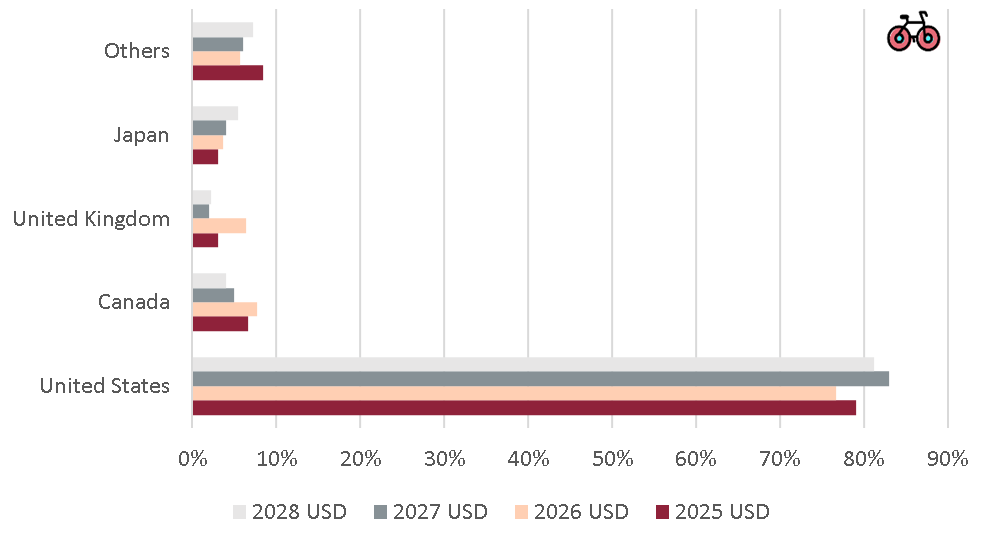

Country Exposure

- European Corporate iBonds are diversified – with more exposure to French issuers for 2025 and 2028 ETFs.

- US Corporate iBonds are exposed to the US – with marginal exposure to Japan, the UK and Canada.

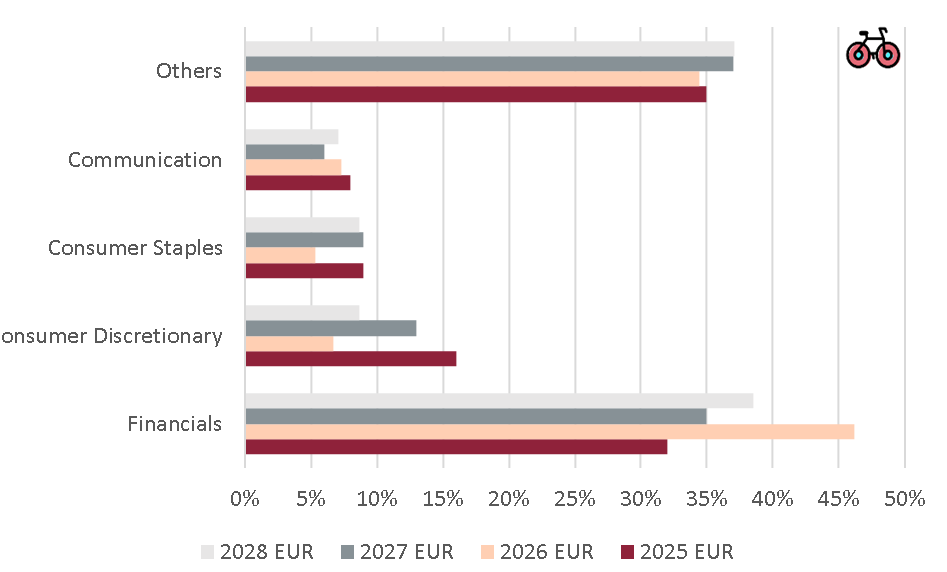

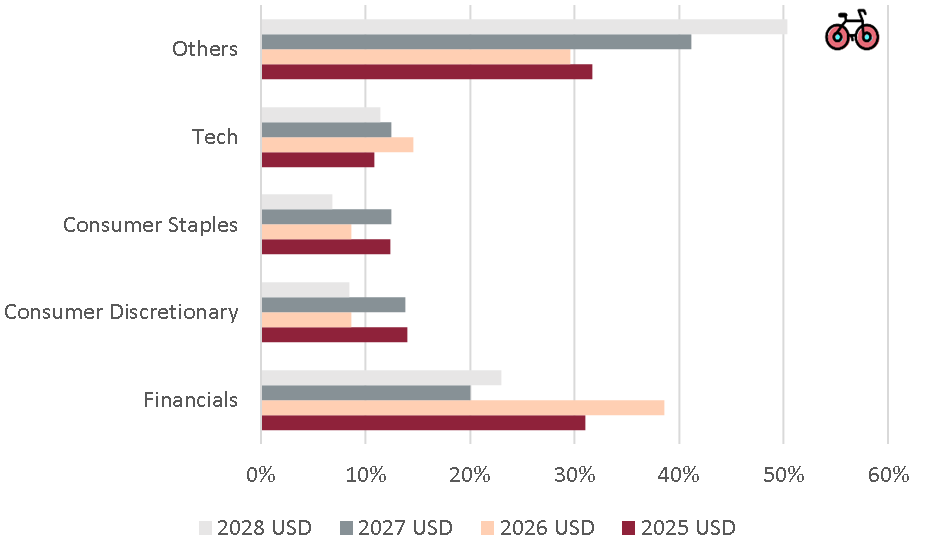

Industry Exposure

- European Corporate are exposed to European Banks – like Credit Agricole, Credit Mutuel, or Rabobank, especially the 2026 ETF (46%).

- US Corporate iBonds are exposed to US Banks – like Barclays, HSBC or Wells Fargo, particularly the 2026 ETF, and to Tech. 2028 ETF has significant exposure to healthcare.

European Corporate iBonds - Sectors

US Corporate iBonds - Sectors

What we don't like about ibonds

#1 ESG

All iBonds include Sustainability considerations. For example, the iShares iBonds Dec 2026 Term $ Corp UCITS ETF tracks the Bloomberg MSCI December 2026 Maturity USD Corporate ESG Screened Index. What does it mean? Bonds won’t finance issuers:

- From certain sectors – involved in tobacco, nuclear weapons, civilian firearms, thermal coal, oil sands, various weapons.

- Involved in controversies – with low score or not compliant with United Nations Compact Principles.

Why It may not be beneficial

We spent a few months creating an apolitical, evidence-based guide to sustainable investing. We concluded that:

- ESG Ratings are not designed to protect the planet, but corporate profits (read why)

- On a Risk-adjusted basis, ESG ETFs will, inevitably underperform (read why)

Mitigating Factor: BlackRock stayed away from MSCI ESG Ratings

A strong mitigant is the lack of MSCI ESG Ratings, that according to us harm Investors without necessarily helping the planet. Overall, the Sustainably aspect in iBonds is acceptable.

#2 SecuritY Lending

All ETFs engage in Securities Lending, which is not a feature that we like in simple products for individual investors. Most of the income will flow to the Investors – Income from securities lending is split between the Investors and the Asset Manager. Generally in the ETF Industry, income is split from 98% to Investors to 60/40 (Investors / Asset Manager). BlackRock is at the lower end of this scale, with 62.5% going to Investors and 37.5% retained by BlackRock.

Why It may not be beneficial

Counterparty risk can be problematic, if not adequately mitigated.

Mitigating Factor: BlackRock's Indemnity

BlackRock provides an indemnity for full replacement of the securities lent if the

collateral received does not cover the value of the securities loaned in the event of a borrower default.

Which Share Classes can I Choose From?

Stock Exchanges

All ETFs trade on Xetra. USD Funds also trade on LSE and Euronext, and EUR Funds – on Borsa Italiana.

Dividend Distribution

Accumulating vs Distributing Share Classes

| ETF | Currency | DIST. | ACC. |

|---|---|---|---|

| Dec 2025 $ Corp | USD | ✘ | ✓ |

| Dec 2026 $ Corp | USD | ✓ | ✓ |

| Dec 2027 $ Corp | USD | ✘ | ✓ |

| Dec 2028 $ Corp | USD | ✓ | ✓ |

| Dec 2025 € Corp | EUR | ✘ | ✓ |

| Dec 2026 € Corp | EUR | ✓ | ✓ |

| Dec 2027 € Corp | EUR | ✘ | ✓ |

| Dec 2028 € Corp | EUR | ✓ | ✓ |

Other information

| ETF | Distributing ISIN | Accumulating ISIN |

| iShares iBonds Dec 2025 Term $ Corp UCITS ETF | – | IE0000X2DXK3 |

| iShares iBonds Dec 2026 Term $ Corp UCITS ETF | IE0007UPSEA3 | IE000BWITBP9 |

| iShares iBonds Dec 2027 Term $ Corp UCITS ETF | – | IE000I1D7D10 |

| iShares iBonds Dec 2028 Term $ Corp UCITS ETF | IE0000VITHT2 | IE0000UJ3480 |

| iShares iBonds Dec 2025 Term € Corp UCITS ETF | – | IE000GUOATN7 |

| iShares iBonds Dec 2026 Term € Corp UCITS ETF | IE000SIZJ2B2 | IE000WA6L436 |

| iShares iBonds Dec 2027 Term € Corp UCITS ETF | – | IE000ZOI8OK5 |

| iShares iBonds Dec 2028 Term € Corp UCITS ETF | IE000264WWY0 | IE0008UEVOE0 |

Only iShares iBonds USD are available for the UK tax wrappers.

A Game-Changer, If rates stay high.

The arrival of iBonds to Europe is potentially a game-changer, should yields stay high. As their popularity soars, the emergence of new fixed- maturity Bond ETFs from BlackRock and other Asset Managers could provide investors with Bond ETF ladders as another great tool in their ETF toolbox.

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

Will you Invest?

What about you? Do you think this is a good way of investing cash? Will you buy iBonds, or do you have better alternatives?

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – BlackRock Launches New iBonds, Truth About €1M Broker Insurance & BOW is 4 years old!

The Truth About €1 Million Broker Guarantees

4 Things I Learned In 4 Years Of Running A Finance Blog

Dodl By AJ Bell Review – AJ Bell’s Younger Brother

Vanguard LifeStrategy Review – A Retriever In A Babushka Doll

Why Do Portfolio Managers Care About Factors? It’s Not What You Think.

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.