Weekend Reading – Is the Fed done raising rates?

Weekend Reading is a collection of Investment Research and Lifestyle topics from all corners of the Web. We source the highest quality insights from Wall Street and Main Street that you may apply to your investment process. Unlike the rest of Bankeronwheels.com, this series is provided without additional guidance. As usual, everything is to be used at your own risk. Below is the type of content we shortlist:

Your personal experiences with money make up maybe 0.00000001% of what’s happened in the world, but maybe 80% of how you think the world works.

Morgan Housel

INVEST WISELY

CONSTRUCT YOUR PORTFOLIO

Most Equity ETFs track either an MSCI or FTSE Benchmark. Some ETFs may track a niche provider – Solactive. Exposure to 10%-15% of Small Caps is typically not captured. But some Small Cap Stocks are the black hole of investing, and not having exposure to them has historically been beneficial. Since we first ran this analysis in Q1’20, the U.S. Market’s relative share increased, at the expense of Japan, to represent 60% of Global Indices. India’s size in EM Indices has increased from 8% to 13%, while China lost 6%.

UNDERSTAND FINANCIAL MARKETS

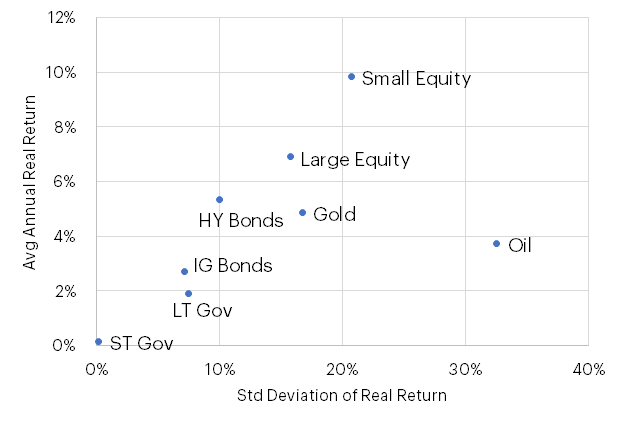

This post shows where various asset classes lie on the risk-return spectrum with a focus on the US market alone as an illustrative example for simplicity. The core insights of the CAPM hold across asset classes whereby more volatile asset classes do generally have higher returns, while less volatile asset classes have lower returns.

Read more on Verdad

HOW TO INVEST

Active Investing

FACTOR investing

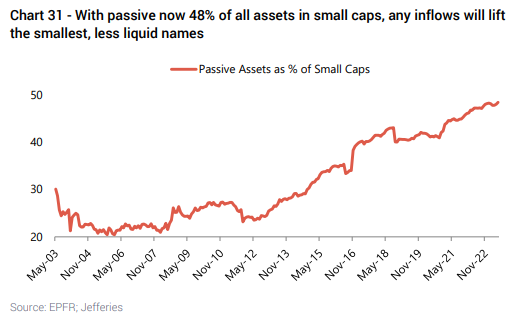

Dollar cost averaging into an index of small caps that does no due dilligence into its constituents may be a recipie for disaster. Why? With 48% of all investment in small caps classified as passive, any inflow will lift the smallest and less liquid names giving rise to the fallacy that investors rate the growth prospects highly whereas this is may just be a mirage.

Read more on 1 Main Capital

discretionary investing

Apple takes the top spot, having created nearly 5% of all shareholder wealth. From the iPod to the iPhone, Apple’s ability to keep innovating has helped it gain a loyal fan base and given the company pricing power. Notably, Apple is America’s most profitable company.

ExxonMobil is the only non-technology company among the five best stocks. When Exxon and Mobil merged in 1999, it was the biggest merger in history and ExxonMobil temporarily became the world’s largest public company by market capitalization. More recently, the company experienced record profits in 2022 due to high oil prices.

Read more on Visual Capitalist

ALTERNATIVE ASSET CLASSES

WALL STREET

SUSTAINABLE investing

crypto

BAD BETS

The fake genius: a $30b fraud (James Jani - 1 hr 5 min)

Sam Bankman-Fried was supposed to be a billionaire genius running the world’s largest Crypto exchange: FTX. In only a few weeks, his $32B empire crumbled, leading to his arrest. In this video, we unravel one of the decade’s most significant cases of financial fraud.

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

ETFs

UCITS ETFs

Robeco is stepping into the European ETF market with a focus on active funds. The Dutch asset manager, which has €181bn assets under management, is planning to launch its first UCITS ETFs in Q2 2024. [FT.com]

Xetra has seen the launch of 3 new fixed income ETFs by the German asset management group DWS. The ETFs provide ultra-short-duration exposure to bonds from issuers of Eurozone sovereigns. All the ETFs have a 0.07% fee. [ETFStrategy.com]

US ETFs

BlackRock is set to launch ten ETFs focused on Treasury inflation-protected securities (TIPS). Ranging in maturity from 2024 to 2033, these ETFs will seek to provide inflation protection to investors concerned with erosion of purchasing power. The new TIPS-defined maturity bond ETFs will carry an expense ratio of 0.1%. [ETF.com]

Personal Finance

Steven Chen is the founder of NewRetirement, a do-it-yourself tool for retirement planning. Prior to founding NewRetirement, Stephen founded venture-backed companies in education and financial services, and worked with organizations including Charles Schwab, Dimensional Fund Advisors, and Fidelity.

Early Retirement

If the wealthiest families of the past century spent a reasonable amount of their wealth, invested in the stock market, and paid taxes, there would be thousands of billionaires today. But there aren’t. So, what happened? To answer this question, authors and finance professionals, Victor Haghani and James White join the discussion on this episode of the Rational Reminder podcast.

FINANCIAL PRODUCTS

COST OF LIVING

OUR Community

Question of the week

DESIGN YOUR LIFESTYLE

Personal Development

4 Rules To Become Antifragile (For A Better Life) (Picking Nuggets - 15 min)

Traditional thinking would suggest that there is nothing to gain from chaos. Nassim Nicholas Taleb, however, disagrees and see’s chaos to not only be gainful but essential to survive and flourish. Here are his four rules to living an anti fragile life.

CAREERS

TECH AND SCIENCE

Travel

Raph has travelled the world with his bike in tow & it is nstural for him to be asked numerous questions related to his adventures. “What did you think of China?” is one of these questions. The answers are complex but a day from his life on the bike can give you some flavour. The highlight of this trip to China is without any doubt the Qinghai Province. Logistically, China was also the most challenging country on a bike. Here is why.

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

miscellaneous

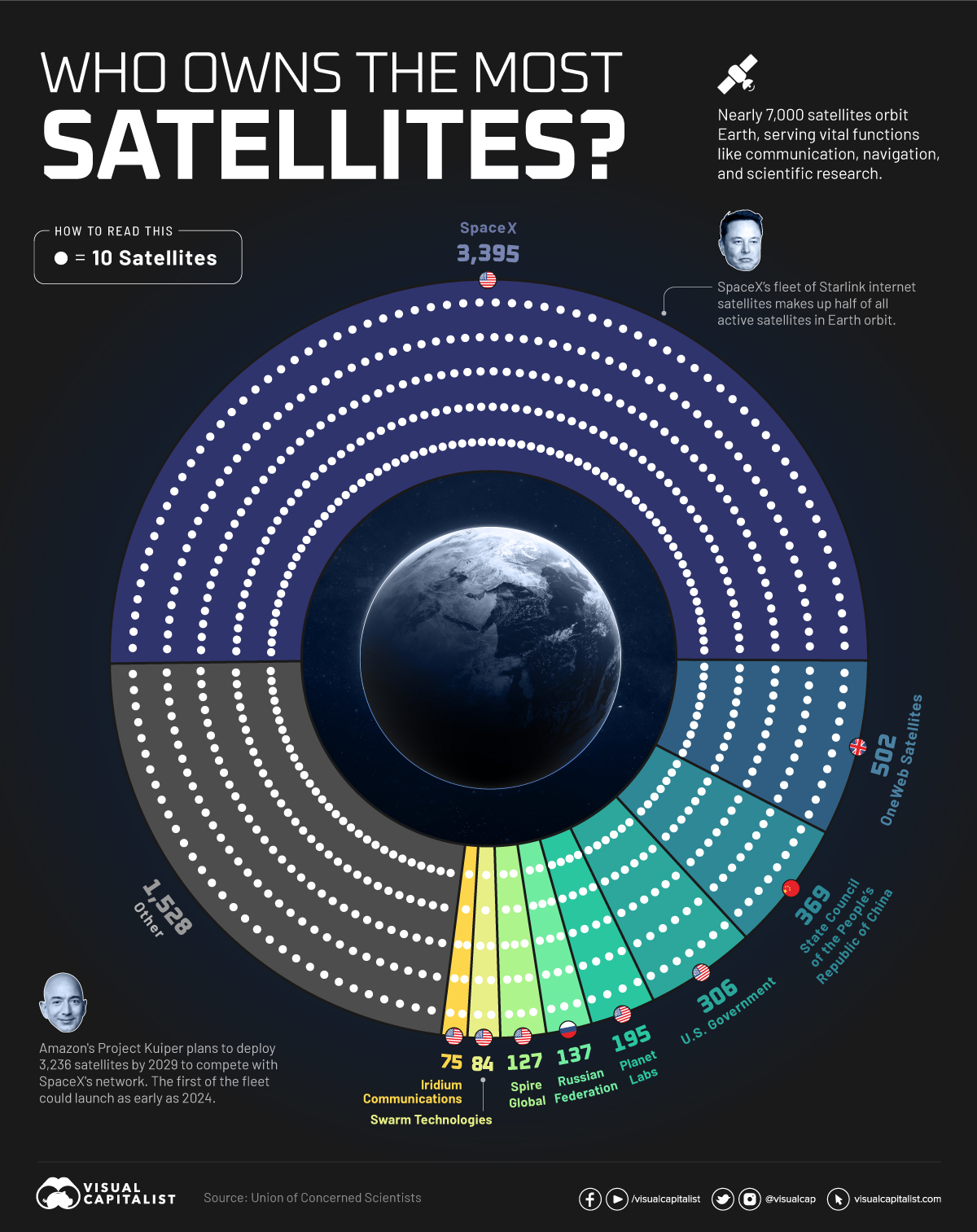

Nearly 7,000 satellites orbit the Earth, serving vital functions such as communication, navigation, and scientific research. In 2022 alone, more than 150 launches took place, sending new instruments into space, with many more expected over the next decade.

But who owns these objects? This graphic seeks to answer that question utilizing data from the Union of Concerned Scientists to highlight the leaders in satellite technology.

Read more on Visual Capitalist

OUR Community

Last Week We asked you

How would you describe your current life situation?

SUGGEST AN ARTICLE

Thank you for reading.

Good Luck & keep’em* rolling!

(* Wheels & Dividends)

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – BlackRock Launches New iBonds, Truth About €1M Broker Insurance & BOW is 4 years old!

The Truth About €1 Million Broker Guarantees

4 Things I Learned In 4 Years Of Running A Finance Blog

Dodl By AJ Bell Review – AJ Bell’s Younger Brother

Vanguard LifeStrategy Review – A Retriever In A Babushka Doll

Why Do Portfolio Managers Care About Factors? It’s Not What You Think.

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.