Weekend Reading – Are Short-Term Bonds a No-Brainer Right Now?

- Recommeded Reading

- Youtube (Required watch time)

- Podcast (Listening Time)

- Academic Research - May require intermediate/advanced knowledge

- Noteworthy Twitter Thread

A busy mind accelerates the perceived passage of time. Buy more time by cultivating peace of mind.

Naval Ravikant

INVEST WISELY

This section is dedicated to research on how to invest for the Long Run using Passive Investment Strategies. Read Topics related to (i) Portfolio Construction and Asset Allocation (ii) Acting wisely by avoiding behavioural traps and also (iii) publications that help understand how financial markets work.

CONSTRUCT YOUR PORTFOLIO

One of the advantages of DIY Investing is that you can optimise for your personal circumstances, including reducing your tax bill. ETFs are simple, transparent and efficient. But the devil is in the details. There are two ways to reduce Withholding Taxes. First, Synthetic ETFs. Second, U.S. ETFs can reduce the overall tax bill to both the U.S. and your Government due to tax offsets. But before investing is U.S. ETFs be sure that your country, like the UK or Switzerland, has a good Estate Tax Treaty with the U.S.

- The Biggest No-Brainer Investment Right Now? (A Wealth of Common Sense)

- The Biggest No-Brainer Investment Right Now? Actually, maybe not. (Italian Leather Sofa)

- Which asset allocation works best? A rear-view mirror back to 1926 (Joachim Klement)

- About Gold and Tradeoffs (Savant Wealth)

- Thoughts on BlackRock's decision to ditch the traditional 60/40 portfolio (CNBC -6 min)

- More Lessons From the Do Nothing Portfolio (Morningstar)

HOW TO INVEST

- 6 Tips To Boost Your Investing confidence (Best Interest)

- What Beat the S&P 500 Over the Past Three Decades? Doing Nothing (Morningstar)

- When investing is boring, the biggest risk is it can all seem rather pointless. (Monevator)

- A Case Study of How Recency Bias Destroyed Investor Wealth (Advisor Perspectives)

- Financial wellness and planning: Human investors make human decisions (Vanguard - 20 min)

UNDERSTAND FINANCIAL MARKETS

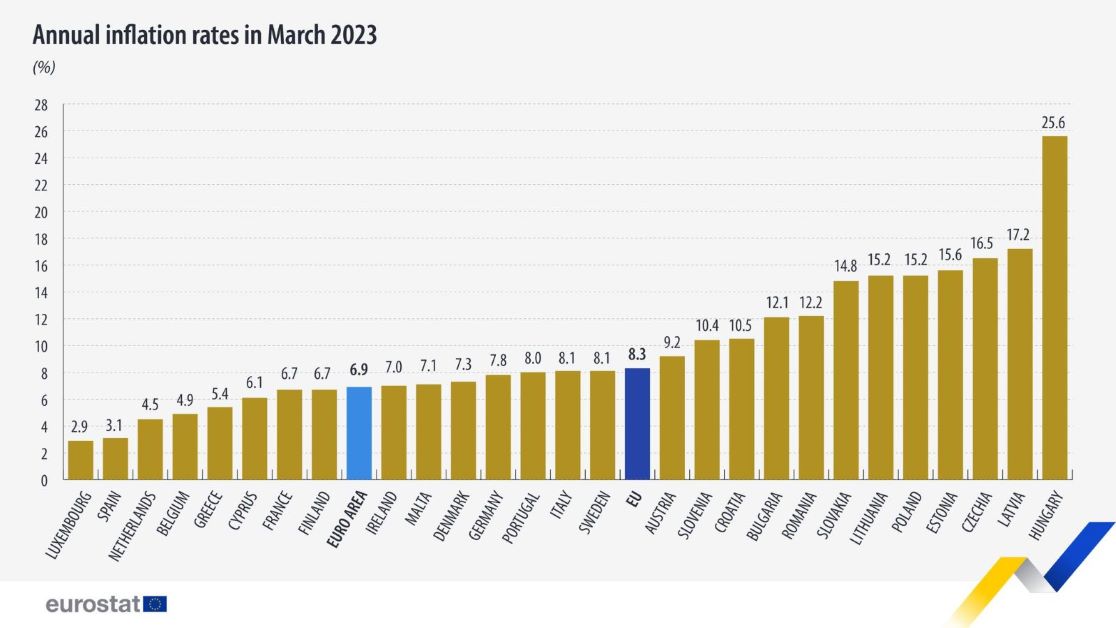

The euro area annual inflation rate was 6.9% in March 2023, down from 8.5% in February. The lowest annual rates were registered in Luxembourg (2.9%), Spain (3.1%) and the Netherlands (4.5%). The

highest annual rates were recorded in Hungary (25.6%), Latvia (17.2%) and Czechia (16.5%). Compared with

February, annual inflation fell in twenty-five Member States and rose in two.

Read more on Euro Stat

- Did Declining Rates Actually Matter? (Flirting With Models)

- What Happens After a Bad Year in the Stock Market? (A Wealth of Common Sense)

- Understanding the Basics of Stock Market Cycles (Darius Foroux)

- Howard Marks: The significance of the Silicon Valley Bank Collapse (Oaktree Capital)

- What I learnt from three banking crises (FT.com- click on the first link)

- The Tightening Cycle Is Beginning to Bite (Bridgewater Associates)

- The Great Comfort of Longevity in the Stock Market (Clipping Chains)

ACTIVE INVESTING

This section relates to improving your knowledge about active investing. If you decide to sin, then sin only a little. Given ample evidence, combined active bets should be ideally a relatively small fraction of your portfolio. This section also includes Sustainable Investing. You can invest in a Socially Responsible way, but there are many ESG traps. Learn how to invest sustainably, and what it means for expected returns, with our definitive guide to sustainable investing.

FACTOR & Thematic investing

- Swedish Fish: Are cheap Scandinavian valuations a sweet red herring? (Verdad)

- Fidelity's Winton: I'm not surprised small caps have done so badly (Trust Net)

- Improving the Quality Factor by Incorporating Intangible Intensity (Alpha Architect)

- We Have Expected Goals, What About Expected Alpha? (Behavioural Investment)

STOCKS

SUSTAINABLE investing

ALTERNATIVE ASSET CLASSES

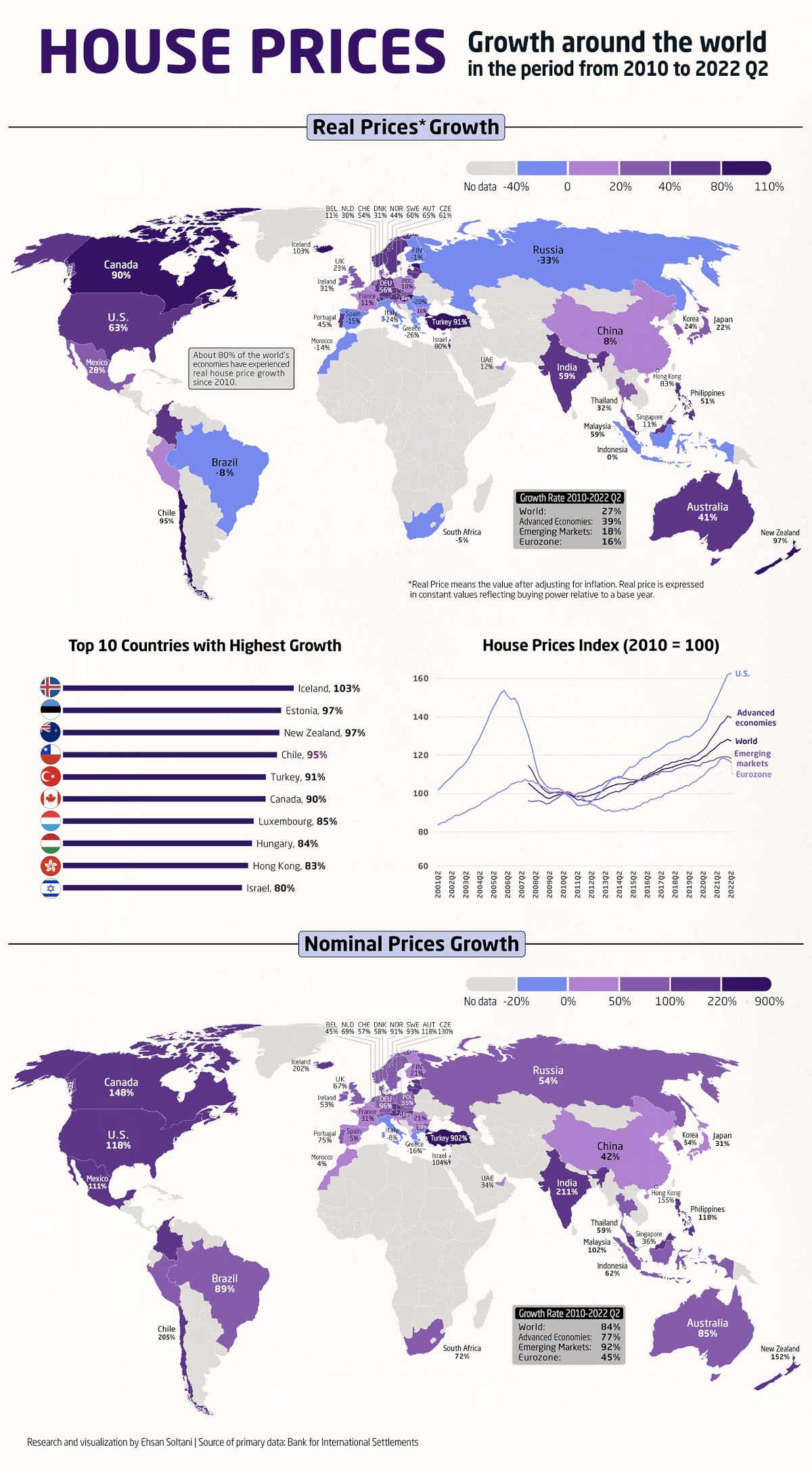

Mapped: House price growth around the world

In many countries around the world, it seems like house prices have been constantly climbing.

Houses fulfill a rare mix of necessity, utility, sentimentality, and for many, also act as a primary investment to build wealth. And it’s that last angle, combined with increasing demand in many countries, that is driving housing prices skyward.

Using data from the Bank of International Settlements, Ehsan Soltani has ranked the change in real residential property prices for 57 countries from 2010 to 2022.

Read more on VisualCapitalist.com

WALL STREET

crypto

BAD BETS

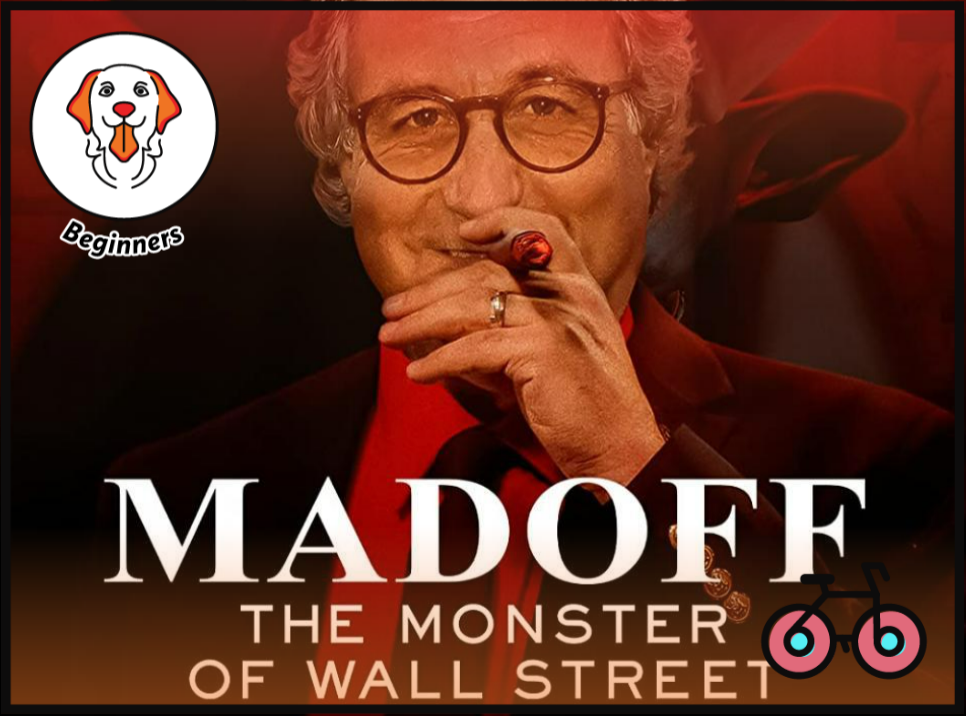

The 2023 Netflix docuseries Madoff: The Monster of Wall Street dives into the largest Ponzi scheme in history, worth $64.8 billion.

Although the Madoff madness stopped in late 2008, today’s investors still fall for the very same tricks.

What exactly can we learn from this series?

Let’s have a closer look.

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

PERSONAL FINANCE

This section is dedicated to UK and European Products. It can also touch on other European jurisdictions outside the Euro-zone.

Wealth Management

What is the real utility of financial advisors and what does research and findings about the supposed and actual value that advisors can offer investors say? There are a lot of positives investors can accrue from dealing with a trustworthy advisor and the conditions necessary for this.

- What to Do If You’re Not on the Same Financial Page as Your Spouse (Whitecoat Investor)

- Nobody wants to spend time planning for when they’re gone. But what happens if you don't? (Vanguard)

- How To Make Saving Money Fun And Exciting (Radical Fire)

- Rich vs Wealthy: A Comprehensive Guide to Different Financial Lifestyles (Of Dollars and Data)

FINANCIAL PRODUCTS

- Vanguard UK retail platform hits 500,000 users amid low-cost passive boom (ETF Stream)

- UK: Investors swell money market funds (FT.com - click on the first link)

- UK: Thinking of switching bank account? HSBC brings back £200 cash offer for new joiners as it looks to entice more customers (This is money)

COST OF LIVING

OUR Community

Question of the week

Personal Development

- The Microstress Effect: How Little Things Pile Up and Create Big Problems, and What to Do About It (Next Big Idea)

- One Big Web: A Few Ways the World Works (Collab Fund)

- In conversation with an ex rocket scientist on how to Awaken Your Genius (Jordan Harbinger - 1 hr 42 min)

- Ravi Gupta (Sequoia): The Realities of Success (The Knowledge Project - 1 hr 43 min)

- Life In 5 Senses (Scott Barry Kaufman - 1 hr)

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

Health & Wellness

CAREERS & REMOTE WORK

Should You Quit Your Job? (The Outcome - 12 Min )

Over the past year, Raph and I worked remotely from Digital Nomad places in Asia and Europe. Sometimes illusionary in a corporate environment, work-life balance can also be tricky on the move. We tested different coworking spaces, but sometimes adapted a work-from-home style when options were limited. Time off while travelling can be incredibly rewarding. We wanted to bring out unique activities each place offers to make your choice easier.

EARLY RETIREMENT

Travel

TECH

The Inside Story of ChatGPT’s Astonishing Potential (Greg Brockman - 30 Min )

miscellaneous

OUR Community

Last Week We asked you

How would you describe your current life situation?

SUGGEST AN ARTICLE

Thank you for reading.

Good Luck & keep’em* rolling!

(* Wheels & Dividends)

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Cash Is Not Enough: Why Hold Bond ETFs Despite Price Rollercoasters.

The Truth About €1 Million Broker Guarantees (Updated With Trading 212 Cap)

Halifax Share Dealing Review – Similar To Lloyds With SIPP On Top

Lloyds Share Dealing Review – Old School But Ticks The Boxes For Golden Retrievers

DEGIRO Review: A Transparent Leader In Low-Cost Investing

Weekend Reading – BlackRock Launches New iBonds, Truth About €1M Broker Insurance & BOW is 4 years old!

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.