Interactive Brokers

Pricing Plan Comparison

Determine The best plan for you With our new tool

What are the plans?

What is IBKR Fixed vs Tiered Pricing?

Interactive Brokers offers two pricing models: Fixed and Tiered. Fixed pricing is easier to understand. Tiered pricing formula is more complex and exchange-dependent:

- Fixed Pricing: Simple and straightforward. Involves a fixed charge. Similar to some pricing models across many brokers.

- Tiered Pricing: Comprises various sub-fees including regulatory, exchange, trading, and clearing fees. Fees vary, being per share (U.S. ETFs), or based on trade value (UCITS ETFs). Complexity and costs differ significantly across exchanges.

Can You Change The Pricing Plan?

Yes, you can change it at any time, but pricing model changes take one day to apply. Alternatively, you may also create an additional linked account with the desired pricing model. This selection is instant.

TRADING UCITS ETFs

How To Choose The Cheapest Plan For UCITS ETFs?

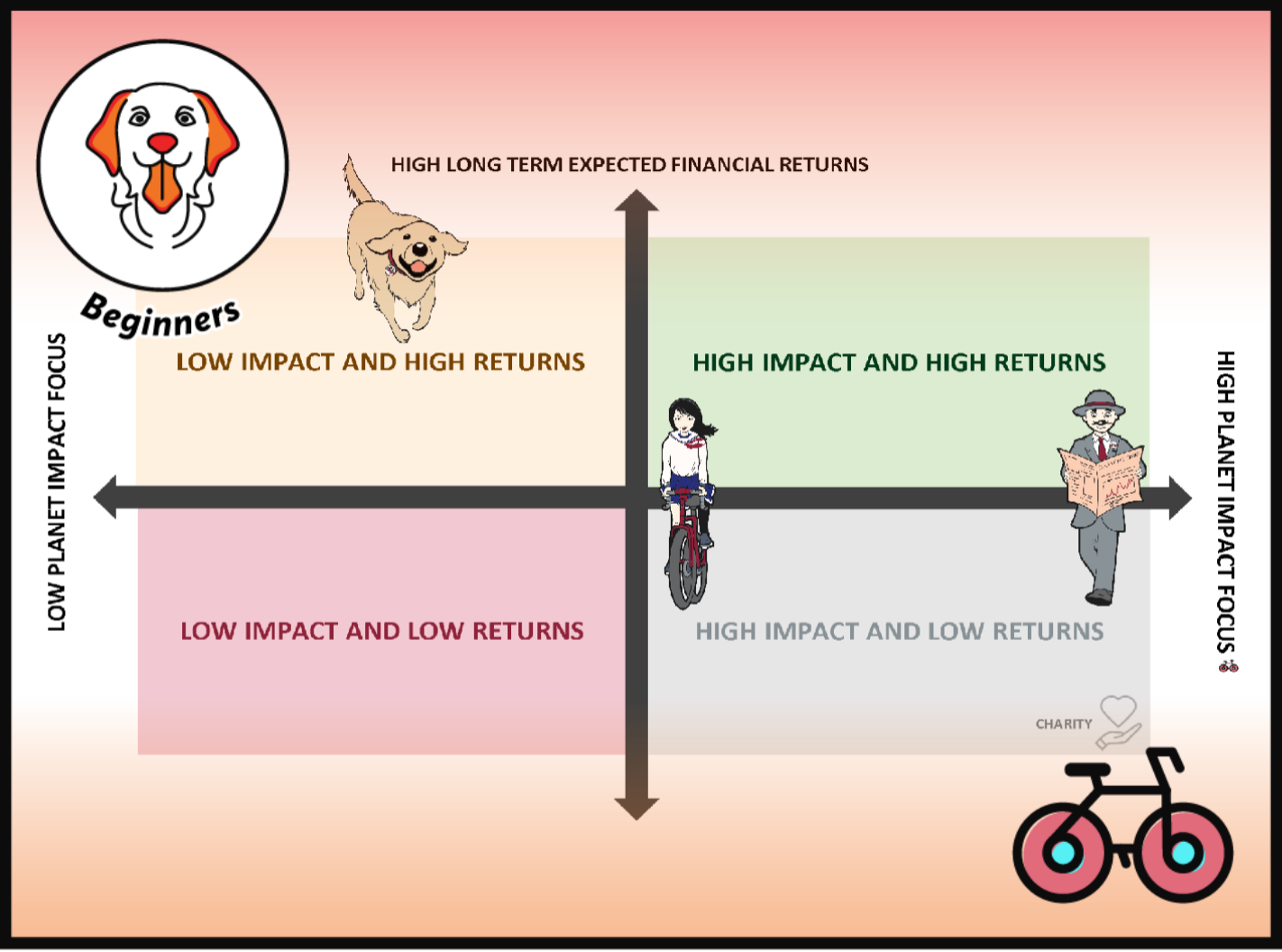

It Depends On The Exchange, And The Trade Value

The best plan depends on the Exchange you choose and the amount you trade.

The most liquid Exchanges for UCITS ETFs are typically:

- If You Trade in EUR: XETRA in Germany or Euronext (AEB/SBF/ENEXT.BE) in Amsterdam, Paris or Bruxelles.

- If You Trade in USD or GBP: LSE – the London Stock Exchange.

Trading ETFs on German Exchange (XETRA)

If you’re trading ETFs in EUR on the XETRA Market, the Maximum €29 fee through the Tiered Pricing makes this plan cheaper for small and very large transactions. Medium to large sized monthly trade volume (e.g. €10-20k can be a bit more expensive with Tiered Plan).

XETRA - FEE STRUCTURE (<50M)

| Fee Type | Tiered | Fixed |

|---|---|---|

| Commission | 0.05% | 0.05% |

| Minimum | €1.25 | €3 |

| Max | €29 | No |

| Exchange fee | Yes | No |

| Clearing Fee | Yes | No |

| Regulatory Fee | Yes | No |

XETRA FEES - Monthly TRADE VALUE

| Volume | Tiered | Fixed |

|---|---|---|

| €500 | €1.30 | €3 |

| €2,000 | €1.34 | €3 |

| €5,000 | €2.69 | €3 |

| €10,000 | €5.35 | €5 |

| €20,000 | €10.67 | €10 |

| €50,000 | €26.63 | €25 |

| €100,000 | €32.23 | €50 |

Trading ETFs on French, Dutch or Belgian Exchanges (EuroNext)

If you’re trading ETFs in EUR on EuroNext whether in Paris, Amsterdam or Brussels, the Maximum fee of €29 through the Tiered Pricing means that the plan is generally cheaper for very large transactions. Medium and large-sized monthly trade volume (e.g. €5-50k are cheaper with the Fixed Plan). For smaller transactions the difference is less significant than with Xetra as the Exchange fee is higher, while the Clearing fees are similar.

EURONEXT - FEE STRUCTURE (<50m)

| Fee Type | Tiered | Fixed |

|---|---|---|

| Commission | 0.05% | 0.05% |

| Minimum | €1.25 | €3 |

| Max | €29 | No |

| Exchange fee | Yes | No |

| Clearing Fee | Yes | No |

| Regulatory Fee | Yes | No |

EURONEXT FEES - TRADE VOLUME

| Volume | Tiered | Fixed |

|---|---|---|

| €500 | €2.55 | €3.00 |

| €2,000 | €2.55 | €3.00 |

| €5,000 | €3.80 | €3.00 |

| €10,000 | €6.30 | €5.00 |

| €20,000 | €11.30 | €10.00 |

| €50,000 | €28.10 | €25.00 |

| €100,000 | €35.10 | €50.00 |

Trading ETFs on the London Stock Exchange (LSE)

If you’re trading ETFs in GBP on the LSE, the Tiered Pricing comes out cheaper only for smaller transactions, given the lack of a cap on fees in Tiered plan. Medium and large monthly trade volumes come out cheaper with the Fixed Plan.

LSE - GBP FEE STRUCTURE (<40m)

| Fee Type | Tiered | Fixed |

|---|---|---|

| Commission | 0.05% | 0.05% |

| Minimum | £1 | £3 |

| Exchange fee | Yes | No |

| Clearing Fee | Yes | No |

| Regulatory Fee | Yes | No |

LSE FEES - BY TRADE VOLUME

| Fee Type | Tiered | Fixed |

|---|---|---|

| £500 | £1.16 | £3.00 |

| £2,000 | £1.16 | £3.00 |

| £5,000 | £2.79 | £3.00 |

| £10,000 | £5.51 | £5.00 |

| £20,000 | £10.96 | £10.00 |

| £50,000 | £27.31 | £25.00 |

| £100,000 | £54.56 | £50.00 |

Can I do a simulation tailored to my Trade value and preferences?

Yes, with the contribution from David de Marneffe of the Bogleheads UAE Chapter, we have created a tool so that you can make the best choice based on your circumstances:

- Trading Currency of the UCITS ETF – read here if you’re unsure what ETF currency means

- Exchange – read what IBKR Exchange Codes mean

- Estimated trade value – how much do you intent to trade

OUR PRICING COMPARISON TOOL

⚠️ Note: Avoid using fractional shares or automatic recurring investments with tiered pricing: a 1% commission is charged on fractional shares.

Tool Assumptions

The Fixed Plan in the tool uses IBKR Smart Routing (except for EUIBSI).

Here is what it means:

- If you use IBKR Smart Routing with default settings, your order will be routed for best execution. IBKR’s SmartRouting system continually scans competing market centers and automatically seeks to route orders to the best market, taking into account factors such as quote size, quote price, exchange or ATS transaction fees or rebates and the potential availability of price improvement.

- If you want your order executed on a particular exchange, you can use direct routing in IBKR’s TWS, however do not use fixed pricing combined with direct routing, as IBKR’s commission will be doubled. Another way if you want to exclude some exchanges is to switch off the corresponding countries in your trading permissions.

TRADING U.S. ETFs

How To Choose The Cheapest Plan For U.S. ETFs?

It Depends On The Number Of Shares You Trade

The best plan depends on the number of shares (not trade value, as for UCITS ETFs) that you trade per month.

On NYSE this comes out as follows:

- Fixed Plan: $0.005 per share, Minimum fee of $1, Maximum fee of 1% of the trade value.

- Tiered Plan: $0.0035 per share, Minimum fee of $0.35, Maximum fee of 1% of the trade value. Additional fees: Clearing fee of $0.0002 per share, NYSE exchange fee of $0.003 per share, Pass-through fees: 0.000175 times the total of the other fees.

The Tiered plan only comes out more beneficial for smaller trade volumes.

Tiered vs fixed Pricing on NYSE

| Value ($) | Shares (#) | Cheapest | Tiered ($) | Fixed ($) |

|---|---|---|---|---|

| $1,000 | 10 | Tiered | 0.35 | 1.00 |

| $10,000 | 100 | Tiered | 0.67 | 1.00 |

| $15,000 | 150 | Fixed | 1.01 | 1.00 |

| $25,000 | 250 | Fixed | 1.68 | 1.25 |

| $50,000 | 500 | Fixed | 3.35 | 2.50 |

| $100,000 | 1,000 | Fixed | 6.70 | 5.00 |

| $500,000 | 5,000 | Fixed | 33.50 | 25.00 |

| $1,000,000 | 10,000 | Fixed | 67.00 | 50.00 |

Our Assessment

Interactive Brokers

EXCELLENT

4.6

/5

Pros:

- One of the most sophisticated brokers

- Strong Reputation

- Very competitive fees

As of 29/03/2024, Interactive Brokers offers rates up to 4.738% (GBP), 3.445% (EUR) and 4.83% (USD) on cash.

Our Assessment

EXCELLENT

4.7

/5

Pros:

- One of the most sophisticated brokers

- Strong Reputation

- Very competitive fees

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – BlackRock Launches New iBonds, Truth About €1M Broker Insurance & BOW is 4 years old!

The Truth About €1 Million Broker Guarantees

Three Sustainable Investing Strategies That Actually Work

ETF Fees – How They Work & How to Minimise Them!

How Much Should You Pay For An ETF?

4 Things I Learned In 4 Years Of Running A Finance Blog

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.