Interactive Brokers

Exchanges

HOW TO IDENTIFY STOCK EXCHANGES IN EUROPE?

KEY TAKEAWAYS

- Initiate Your Search: Begin by utilising the search functionality in Interactive Brokers. Input either the ETF’s specific ticker symbol or its International Securities Identification Number (ISIN) into the search box. This action will streamline your search and quickly direct you to the ETF you’re interested in.

- Identify The Stock Exchange: Europe boasts several prominent stock exchanges where ETFs are frequently traded. Key among these are XETRA (denoted as IBIS2), the London Stock Exchange for ETFs (marked as LSEETF), and the Euronext exchanges, which include both the Paris (SBF) and Amsterdam (AEB). Selecting the right exchange is important as it affects opening times and liquidity.

- Select the Settlement Currency: This step is particularly important if your search was conducted using the ISIN, as ETFs can be listed in multiple currencies. Ensure that the currency corresponds to the share class you intend to invest in. If you used the ticker symbol for your search, the platform typically defaults to the primary currency, simplifying this step.

- Use Our Reference Table: It matches the most utilised exchanges with their codes. This resource is designed to assist you in identifying the most suitable exchange for your ETF trades, taking into account factors like trading volume, currency, and geographical preferences.

Here is the full analysis

How To identify The Stock Exchange

USE IBKR Search box

Search by Ticker or ISIN

Once you type the ETF ticker using the search box, you will have the choice to pick a security from a specific Exchange. For example:

For IWDA you have the choice of AEB, LSEETF OR MEXI.

INteractive brokers - how to find an ETF

Popular exchanges on interactive brokers

What are the different categories of exchanges?

Lit, Quote-Driven and IBKR Routing & Internalizer

Below is a list of popular exchanges and shortcodes used by Interactive Brokers.

Remember, there are different Exchange cateogries:

- Lit Exchanges – most of the exchanges are traditional Lit Exchanges like AEB, IBIS, LSE or SBF. The most liquid ones for ETFs are typically Xetra, Euronext and LSE.

- Quote-Driven Markets – some of them – like Gettex or Tradegate – are de facto single-market maker Exchanges. These can be a problem in terms of best execution, especially for medium or large orders.

- EUIBISI (IBKR Specific) is the Systematic Internalizer of IBKR. This is not automatically available at IBKR and needs to enabled in user settings. “Internalization” is when a broker as the counter-party to a customer’s order. IBKR added this to improve execution quality (i.e., increase price improvement) and/or reduce customer execution costs without reducing execution quality. Read more on PFOF here.

- SMART (IBKR Specific, not listed below) – also known as IB SmartRouting, is Interactive Brokers’ proprietary order-routing algorithm. It is designed to support best execution by searching for the best available prices across traditional exchanges and dark pools.

Popular EUROEPAN Exchanges and IBKR codes

| IBKR CODE | Description | Also Known As | COUNTRY |

|---|---|---|---|

| AEB | Amsterdamse Effectenbeurs | Euronext Amsterdam | Netherlands |

| BM | Bolsa de Madrid | Madrid Stock Exchange | Spain |

| BUX | Budapest Stock Exchange | Budapest Stock Exchange | Hungary |

| BVL | Lisbon Stock Exchange | Euronext Lisbon | Portugal |

| BVME | Borsa Valori di Milano | Borsa Italiana | Italy |

| BVME.ETF | Borsa Italiana ETF | Borsa Italiana ETF | Italy |

| CPH | Copenhagen Stock Exchange | Nasdaq Copenhagen | Denmark |

| EBS | Elektronische Boerse Schweiz | SIX Swiss Exchange | Switzerland |

| ENEXT.BE | Brussels Stock Exchange | Euronext Belgium | Belgium |

| EUIBSI | EU IB Systematic Internaliser | IBKR Internalization | EU |

| FWB | Frankfurter Wertpapierboerse | Frankfurt Stock Exchange | Germany |

| GETTEX | Boerse Muenchen | Gettex | Germany |

| IBIS & IBIS2 | Integriertes Boersenhandels- und Informations-System | Deutsche Börse Xetra | Germany |

| LSE | London Stock Exchange | London Stock Exchange | United Kingdom |

| LSEETF | ETF segment on LSE | London Stock Exchange - ETF | United Kingdom |

| OMXNO | Norwegian shares on OMX | OMX | Sweden |

| OSE | Oslo Stock Exchange | Euronext Oslo | Norway |

| PRA | Prague Stock Exchange | Prague Stock Exchange | Czech Republic |

| SBF | Paris Stock Exchange | Euronext Paris | France |

| SWB | Stuttgart Wertpapierboerse | Börse Stuttgart | Germany |

| TASE | Tel Aviv Stock Exchange | TASE | Israel |

| TGATE | TradeGate | TradeGate Exchange | Germany |

Vanguard FTSE-All World example

Start by typing the ticker

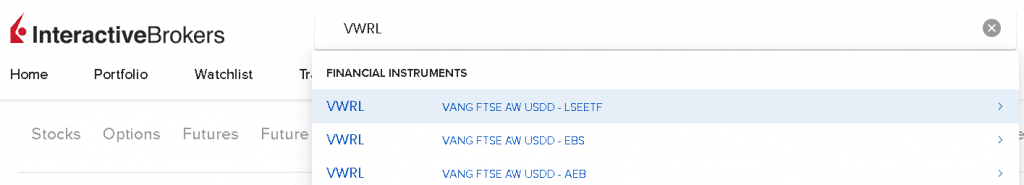

Example: VWRL

Interactive brokers search box

The problem in Europe is that the same ETF share class can trade on multiple stock exchanges. It will have the same ISIN but different tickers. That can get you confused about which exchange and currency to prioritise. Some may offer FX fee conversion savings.

Once you’ve decided, start typing the ticker (e.g. VWRL), and Interactive Brokers will show you on which exchange you can buy the ETF. Above, are three Stock Exchanges show up:

- LSE (London Stock Exchange)

- AEB (Euronext Amsterdam)

- EBS (SIX Swiss)

To find it on the most liquid EUR Exchange, XETRA you will need to type VGWL. Below are all the Exchanges and tickers for this share class.

If this is confusing, read our guide related to decoding ETF names.

Vanguard FTSE All-World (Distributing Share Class)

| Exchange | Currency | Ticker | IBKR Exchange Code |

|---|---|---|---|

| Euronext Paris | EUR | VWRL | SBF |

| Borsa Italiana | EUR | VWRL | BVME |

| Euronext Amsterdam | EUR | VWRL | AEB |

| London Stock Exchange | USD | VWRD | LSEETF |

| London Stock Exchange | GBP | VWRL | LSEETF |

| SIX Swiss Exchange | CHF | VWRL | EBS |

| XETRA | EUR | VGWL | IBIS2 |

The same applies to the Accumulating Share Class, which is only available on four Exchanges.

Vanguard FTSE All-World (Accumulating Share Class)

| Exchange | Currency | Ticker | IBKR Exchange Code |

|---|---|---|---|

| Borsa Italiana | EUR | VWCE | BVME.ETF |

| Euronext Amsterdam | EUR | VWCE | AEB |

| London Stock Exchange | USD | VWRA | LSEETF |

| London Stock Exchange | GBP | VWRP | LSEETF |

| XETRA | EUR | VWCE | IBIS2 |

Our Assessment

Interactive Brokers

EXCELLENT

4.6

/5

Pros:

- One of the most sophisticated brokers

- Strong Reputation

- Very competitive fees

As of 29/03/2024, Interactive Brokers offers rates up to 4.738% (GBP), 3.445% (EUR) and 4.83% (USD) on cash.

Our Assessment

EXCELLENT

4.7

/5

Pros:

- One of the most sophisticated brokers

- Strong Reputation

- Very competitive fees

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Cash Is Not Enough: Why Hold Bond ETFs Despite Price Rollercoasters.

The Truth About €1 Million Broker Guarantees (Updated With Trading 212 Cap)

Halifax Share Dealing Review – Similar To Lloyds With SIPP On Top

Lloyds Share Dealing Review – Old School But Ticks The Boxes For Golden Retrievers

DEGIRO Review: A Transparent Leader In Low-Cost Investing

Weekend Reading – BlackRock Launches New iBonds, Truth About €1M Broker Insurance & BOW is 4 years old!

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.