Iweb Share Dealing Review

Our take: iWeb Share Dealing is the typical boring, but cost-efficient platform with good ETF availability. But make no mistake, it is an excellent option for investors seeking a reputable platform who don’t invest frequently, as there are no custody charges. However, advanced investors might encounter limitations based on their sophistication and needs.

Is it suitable for you?

- Passive Investors: The reputation of the parent company, along with the ease of establishing automated investments via monthly standing orders, enhances its appeal, particularly for investors who trade less frequently, the platform becomes more favorable since the only fees for ISA and General accounts are for transactions.

- Semi-Active Investors: The selection of stock exchanges and foreign products is satisfactory, but the fees for investing in international stock exchanges and currencies may seem high.

- Advanced Investors: iWeb Share Dealing lacks in offering leverage and features like access to US ETFs, which could limit those looking to expand their investment strategies. Additionally, active investors may find the trading costs dissatisfying.

This article contains affiliate links. We provide full transparency on how it works.

Pros & Cons and suitability

Pros & Cons

- Long standing, listed with rated parent

- Good ETFs and Stock Exchange availability

- Competitive fees

- Good Cash Interest for SIPPs

- Entry and drawdown fees for SIPPs

- Interface can be basic, no mobile app

- High FX Fees

- Lacks advanced features

Suitability

VERY Suitable

SIMPLE, reputable, competitive

Suitable

Good Product offer but high FX fees

SOMEWHAT Suitable

Lack of Advanced Features

Availability

iWeb Share Dealing is only Available in the UK

Broker Snapshot

Why Is iWeb Share Dealing A Direct Broker?

iWeb Share Dealing is a niche broker in the UK with assets under administration of £5.17 bn. Its parent company, Halifax, is part of Lloyds Banking Group, a major and historical financial institution in the UK, listed on two stock exchanges and rated by three rating agencies. In 2023, Lloyds Group was valued at £47 bn. iWeb has two decades of track record in the industry and is known for its transparent fee structure, making it competitive with both Tier 1 brokers like Hargreaves Lansdown and more affordable than brokerage services of traditional financial institutions like Lloyds Share Dealing.

Banking Affiliate, with Listed and Externally Rated Long Standing Parent

Company Info

| Characteristic | iWeb Share Dealing |

|---|---|

| Inception Date | 🛈 2003 |

| Headquarters | 🛈 Halifax, UK |

| Key Owner | 🛈 Lloyds Group (100%) |

| Bank Affiliated | ✅ Yes |

| Listed on Stock Exchange | ✅ LSE / Nasdaq: £$40.91bn (Lloyds G) |

| Parent Rating | ✅ S&P: BBB+ Moody A3 + Fitch A |

| Operating Profit | ✅ £$40.91 bn |

Regulation

| Feature | iWeb Share Dealing |

|---|---|

| EU Entity | 🛈 None |

| UK Entity | 🛈 iWeb Share Dealing |

| Key Regulators | ✅ UK |

| EU Regulator | N/A |

| UK Regulator | ✅ UK (FCA) |

| EU Guarantee | N/A |

| UK Guarantee | 🛈 Max. £85k |

competitive fees, high eTF availability

Features

| Feature | iWeb Share Dealing |

|---|---|

| Key Base Currencies | 🛈 GBP |

| ETF Availability | ✅ Very high |

| Multicurrency | ❌ Not Available |

| Cash Interest | ✅ SIPP Only |

| Margin Loans | ❌ Not Available |

| Exchanges | ✅ LSE, Nasdaq, Major European |

| External PFOF Reliance | ✅ None |

Fee Structure

| Feature | iWeb Share Dealing |

|---|---|

| Custody Fees | ✅ Low |

| Inactivity Fees | ✅ None |

| ETFs Dealing Fees | ✅ Low |

| FX Fees | ⚠️ Very High |

| Deposit Fees | ✅ None (exclude SIPP) |

| Withdrawal Fees | ✅ None |

| Security Lending | 🛈 Not Available |

I. Company

iWeb Share Dealing is part of a well-established, listed, and rated parent company. Furthermore, it has a clean record with no history of regulatory or compliance fines.

Business Profile

iWeb share Dealing was designed to offer a cheaper investing option compared to Lloyds group’s trading platforms, such us Halifax and Lloyds Share Dealing. They operate exclusively in the UK and the basic tax-efficient accounts like ISAs and SIPPs. The company is relatively transparent about its revenue sources, primarily earning through cash interest (not shared with investors with the exception of SIPP accounts), transaction fees and fees charged for the SIPP account. FX fees are also high making it another form of income for the company. As of March 2024, iWeb Share Dealing had £5.17 billion of assets under administration. The number of customers is not disclosed.

Ownership and Transparency

iWeb Share Dealing, initially part of Italy’s Sanpaolo IMI group as IMIWeb UK Limited, was acquired by HBOS plc in 2003. Following the 2009 merger of Lloyds TSB and HBOS, it became part of the Lloyds Banking Group. Subsequently, iWeb was positioned under the Halifax Share Dealing Limited umbrella, as an online share dealing platform within Lloyds Banking Group, aimed at providing accessible investment services in shares, funds, and securities to its clientele.

Lloyds Banking Group PLC, listed on the London Stock Exchange under the ticker LLOY, and on the NASDAQ under the ticker LYG holds a significant presence in the financial sector with an IG rating from all three rating agencies. As of April 2024, Lloyds Banking Group has a market capitalisation of $40.91 billion. It is also part of FTSE 100. in 2023, the company reported a profit after tax of £5.5 billion, a increase of £1.5 billion compared to 2022.

Safety Considerations

At a parent level, the credit rating is in the BBB or A category, which implies a very low estimated probability of default at parent level, as measured by historical 10-year peer cohort probability of default. Based on historical data, a couple of 100 similarly rated financial companies went out of business over a 10-year period. This rating applies at parent level and assumes financial support from Lloyds.

Regulation & Investor Compensation Schemes

Share & Cash Custodians

Halifax Share Dealing Limited is both the cash and share custodian. Personal CREST accounts are not supported.

Reputation

iWeb and Lloyds group have a solid reputation, with no significant compliance fines or legal problems. Both entities are recognized for their stable and reliable presence in the investment community.

II. Fee structure

iWeb Share Dealing offers a straightforward fee structure favorable for investors who trade infrequently, featuring no custody fees for ISA and General accounts. It is competitive across all account types, though it imposes entry fees and drawdown charges for SIPP, without exit fees. Its FX rates are notably high compared to the market.

Platform fees

iWebb Share Dealing’s fee structure is designed as follows:

- For ISAs and Trading accounts: No fee.

- For SIPP accounts below £50k: £22.5/quarter.

- For SIPP accounts above £50k: £45/quarter.

- Opening Accounts Fees: £100. However these fees are waived until June 2024 (originally waived till March 2024). This seems to be a pattern, and these promotions are frequent.

Trading Commisions

iWeb Share Dealing trading fees are as following:

- Trading Fees: UK ETFs and shares have a flat rate of £5 per transaction. For other markets, the charge is £0 but with 1.5% of FX fees.

- Dividend Reinvestment: Dividend reinvestment purchases are charged at 2% of the dividend value, and capped at a maximum of £5 per stock.

- SIPP Drawdown Charges:

- Flexi-access drawdown: £180 per annum.

- Capped drawdown:

- Before age 75 – £180 per annum.

- Age 75 onwards – £300 per annum.

- An additional £90 fee will be charged to move from a capped to a flexi drawdown.

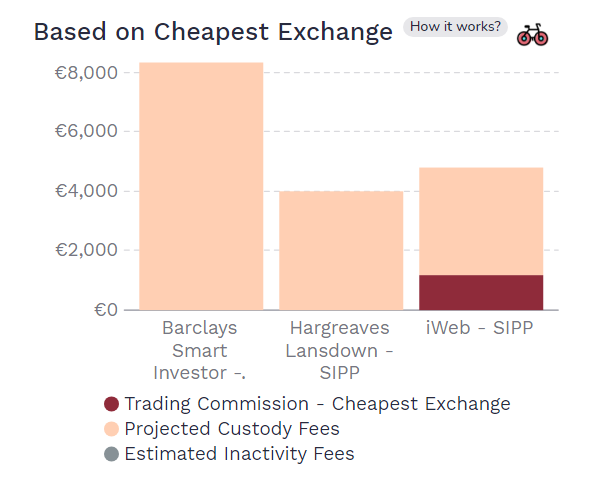

Overall Fee Simulation vs Competitors

Most of our readers have simple Index portfolios. Using our Broker Total cost calculator, you can estimate the total cost of holding ETFs throughout the investment period. For our similuated scenarios:

- General Accounts – iWeb Share Dealing comes out competitive

- ISAs – iWeb Share Dealing comes out competitive

- SIPPs – iWeb Share Dealing comes out competitive

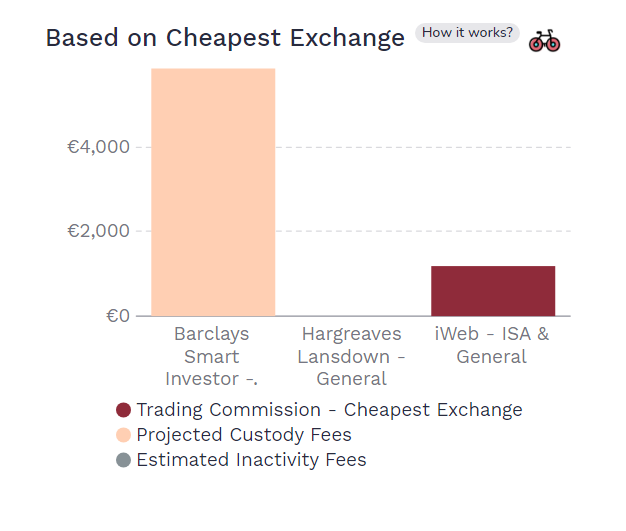

Fee Simulation For General Accounts

In the below simulation, a 20-year accumulation period broker bill for a General Trading account comes out at £1,195 for iWeb Share dealing. The cost is £0 for Hargreaves Lansdown (the calculator assumes the use of its free regular investing service) as the broker does not charge any custody fees for ETFs and £5,860 for Barclays Smart Investor. Please note that ISAs and General accounts have the same cost for both iWeb Share Dealing and Barclays Smart Investor.

Investor assumptions

| Model Feature | Assumption |

|---|---|

| Investor | UK |

| Instrument | UCITS ETF |

| Account | General |

| Initial Investment | £ 100,000 |

| Monthly | £ 1,000 |

| Time Horizon | 20 years |

| Gross Return | 8% |

Total Fees

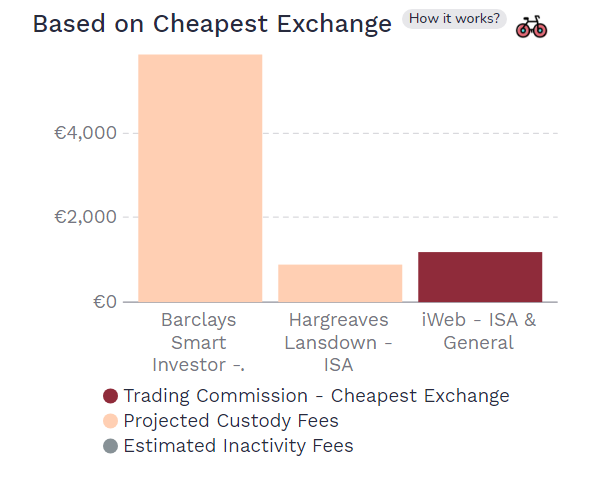

Fee Simulation For ISAs

In the below simulation, a 20-year accumulation period broker bill for an ISA account comes out at £1,195 for iWeb Share Dealing. The cost is £900 for Hargreaves Lansdown (the calculator assumes the use of free regular investing service), due to yearly custody fees capped at £45 and £5,860 for Barclays Smart Investor.

Investor assumptions

| Model Feature | Assumption |

|---|---|

| Investor | UK |

| Instrument | UCITS ETF |

| Account | ISA |

| Initial Investment | £ 100,000 |

| Monthly | £ 1,000 |

| Time Horizon | 20 years |

| Gross Return | 8% |

Total Fees

Fee Simulation For SIPPs

Investor assumptions

| Model Feature | Assumption |

|---|---|

| Investor | UK |

| Instrument | UCITS ETF |

| Account | SIPP |

| Initial Investment | £ 100,000 |

| Monthly | £ 1,000 |

| Time Horizon | 20 years |

| Gross Return | 8% |

Total Fees

Currency Exchange fees

iWeb Share Dealing’s currency exchange fees are very high at 1.5%. They provide an exchange rate from Digital Look, giving an indicative rate before placing an order. The exact rate for each trade is confirmed on the contract note after the trade completes.

Other fees

Deposits and withdrawal are free of charge for ISA and Share Dealing Accounts.

For SIPP, there are £60 transfer in per plan capped at £300. No exit fees.

III. Platform & Features

iWeb Share Dealing is appreciated for its straightforward – but old school – interface, ideal for beginners. It offers access to various international stock exchanges and a diverse range of products. However, the platform may feel outdated and could be restrictive for advanced investors. They also don’t have a mobile app. SIPP accounts benefit from favorable cash interest, but ISA and Share Dealing accounts do not earn interest.

Account Opening Process

Opening an account with iWeb Share Dealing is typically a quick, 10-minute online process. However, there are instances where electronic completion isn’t possible, significantly extending the time required. Customer feedback on iWeb varies; some users commend the platform’s simplicity and affordability, while others criticize the duration of transfers and the level of customer support.

account Features

iWeb Share Dealing offers several great features for Long-Term Investors:

- Foreign Stock Exchange: NYSE, NASDAQ, AMEX, Xetra and Euronext (Milan, Amsterdam, Paris, Brussels).

- Standing Orders

- Share Transfer

Internalisation and PFOF

PFOF is not allowed in the UK therefore iWeb Share Dealing does not engage in this practice.

Cash Interest

iWeb Share Dealing pays cash interest only for SIPP accounts. The interest is accrued daily and paid gross annually in March. The variable interest rate offered is 3.55% (Gross/AER), which is roughly 1.5% lower than short term banking rates at the time of writing.

Advanced Features

iWeb Share dealing prioritizes simplicity and user-friendliness, with a focus on traditional investment products. As such, it does not offer advanced trading features like Futures, Options, Derivatives, and Margin Loans, catering more to investors looking for straightforward investment options. Below a summary of the available investment types:

Features

| Investment Type | Availability |

|---|---|

| ETFs | ✅ |

| Stocks | ✅ |

| Bonds | ✅ |

| Funds | ✅ |

| Options | ❌ |

| Derivative | ❌ |

| Futures | ❌ |

| CFDs | ❌ |

| Forex | ❌ |

| Crypto | ❌ |

| Commodities | ❌ |

IV. Taxes

Tax Wrappers

iWeb Share Dealing offers the most common tax-advantaged accounts available in the UK. This includes:

- ISA

- SIPP

Tax Reporting

iWeb Share Dealing provides tax reports, however the reporting functionality to the tax authority is not automated and is responsibility of the individual investor.

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – BlackRock Launches New iBonds, Truth About €1M Broker Insurance & BOW is 4 years old!

The Truth About €1 Million Broker Guarantees

Three Sustainable Investing Strategies That Actually Work

ETF Fees – How They Work & How to Minimise Them!

How Much Should You Pay For An ETF?

4 Things I Learned In 4 Years Of Running A Finance Blog

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.