Weekend Reading – Millionaire Expat: How To Build Wealth Overseas

Weekend Reading is a collection of Investment Research and Lifestyle topics from all corners of the Web.We source the highest quality insights from Wall Street and Main Street that you may apply to your investment process. Unlike the rest of Bankeronwheels.com, this series is provided without additional guidance. As usual, everything is to be used at your own risk. Below is the type of content we shortlist.

Invest Wisely section is dedicated to research on how to invest for the Long Run using Passive Investment Strategies. Read Topics related to (i) Portfolio Construction and Asset Allocation (ii) Acting wisely by avoiding behavioural traps and also (iii) publications that help understand how financial markets work.

Active Investing section relates to improving your knowledge about active investing. If you decide to sin, then sin only a little. Given ample evidence, combined active bets should be ideally a relatively small fraction of your portfolio. This section also includes Sustainable Investing. You can invest in a Socially Responsible way, but there are many ESG traps. Learn how to invest sustainably, and what it means for expected returns, with our definitive guide to sustainable investing.

Personal Finance section is dedicated to UK and European Products. It can also touch on other European jurisdictions outside the Euro-zone.

- Recommeded Reading

- Youtube (Required watch time)

- Podcast (Listening Time)

- Academic Research - May require intermediate/advanced knowledge

- Noteworthy Twitter Thread

Inflation is when you pay fifteen dollars for the ten-dollar haircut you used to get for five dollars when you had hair.

Sam Ewing

INVEST WISELY

CONSTRUCT YOUR PORTFOLIO

Some of our readers moved to cheaper countries, including in Europe, South East Asia or Latin America.

But what are the implications from an investing standpoint?

If you thought that regular investors get a bad deal with their pension providers, read who’s at the top of the predatory food chain – the snakes in suits selling offshore pensions.

- BlackRock launches Fixed Maturity Bond ETFs in Europe (FT)

- ETF premiums and discounts, explained (Vanguard)

- 7 Things I Don’t Own in My Portfolio (Morningstar)

- What you need to know about Gold (Bloomberg - 45 min)

- What higher rates for longer could mean for bondholders (Vanguard)

- What's your favourite diversifier? (Meb Faber - 49 min)

- Cash Is No Longer Trash, but the Opportunity Cost Might Be Greater Than You Think (Morningstar)

Building the perfect portfolio doesn’t matter one bit if it doesn’t align with your willingness and ability to take risk. Evaluating your own risk tolerance is difficult. Listen in to a fascinating conversation on the difference between ability and willingness to take risk, Factors that drive an investor’s risk tolerance & How to choose the right asset allocation based on your risk tolerance

UNDERSTAND FINANCIAL MARKETS

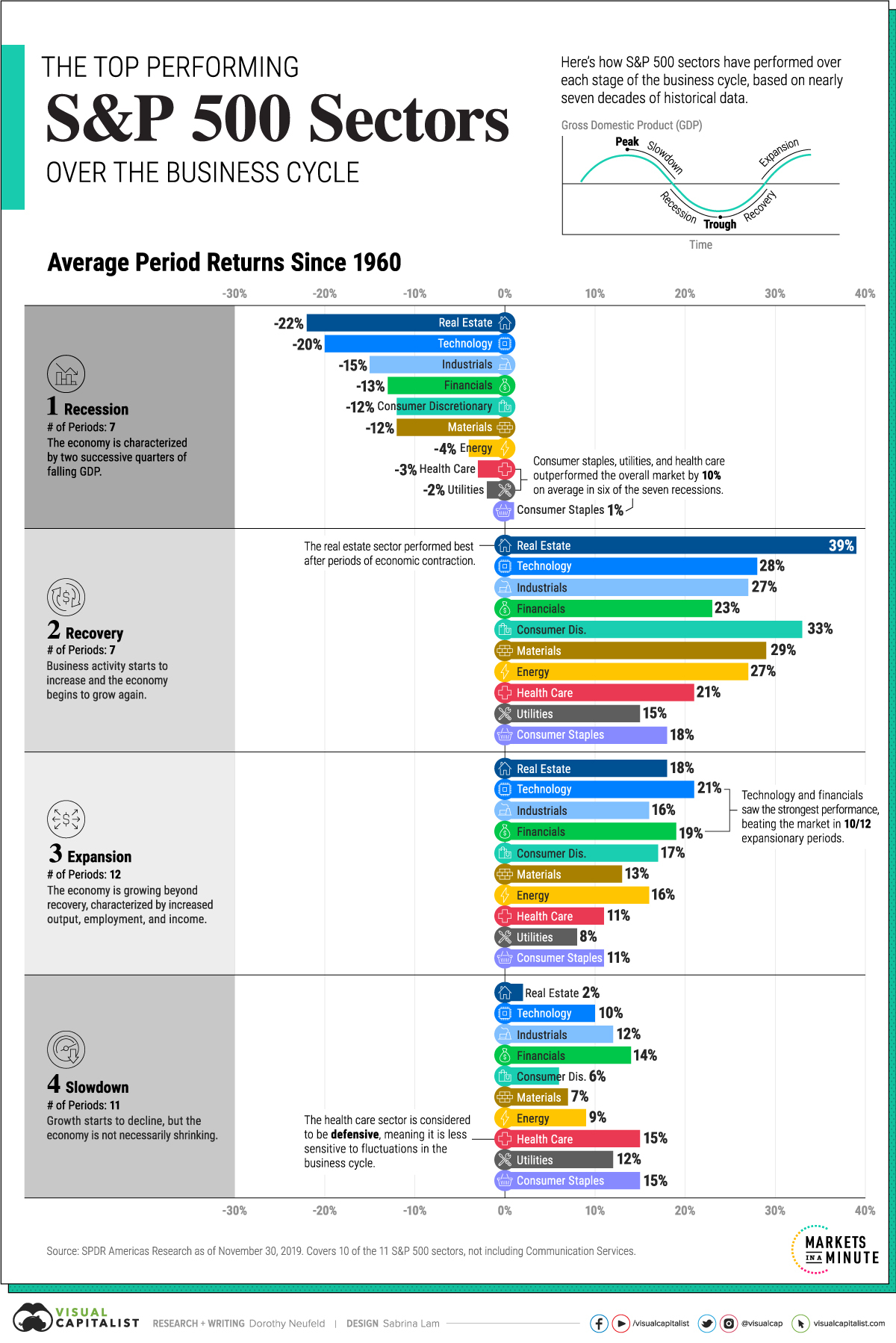

The Top Performing S&P 500 Sectors Over the Business Cycle (Visual Capitalist)

The business cycle fluctuates over time, from the highs of an expansion to the lows of a recession, and each phase impacts the performance of S&P 500 sectors differently. And though affected sectors have different levels of average performance, any given period may see the outperformance of certain sectors due to external factors, such as technological advancements or high-impact global events (i.e. global pandemics, international conflicts, etc.)This graphic uses data from SPDR Americas Research to show the top performing sectors through the business cycle over almost 70 years. Overall from December 1, 1960 to November 30, 2019, the dataset covers: 7 recessions, 7 recoveries, 12 expansions and 11 slowdowns.

Read more on Visual Capitalist

- The Price of Risk (Aswath Damodaran)

- Vanguard’s perspective on the U.S. credit downgrade (Vanguard)

- Germany: A country at the crossroads (Goldman Sachs - 24 min)

- World’s Shrinking AAA Debt Options Include Singapore, Norway (Bloomberg)

- A Generational Change - The FED it seems is no longer punishing savers (Irrelevant Investor)

HOW TO INVEST

Wall Street calls itself ‘Smart Money’, casting Individual Investors as ‘Dumb Money’.

Even on Wall Street, it’s not binary. There is ‘Real Money’ or ‘Fast Money’. Some on Wall Street may not even be smart.

Bankeronwheels.com was born out the discovery of Wise Investing. To make them distinct from the investor crowd, I coined the term ‘Wise Money’. But today, for every Wise Investor, there are around 50 investors chasing Fast Money. Our mission? Read more below.

Active Investing

FACTOR investing

Pim van Vliet, joins the conversation with insights on volatility, the changing market, and combining low-risk with other traditional factors. He equips listeners with key considerations for evaluating strategies or products when allocating low-risk and offers his perspective on out-of-sample-testing, distinguishing between global-factor and cross-sectional premiums, and more.

- The evolution of value investing (We Study Billionaires - 51 min)

- Will Today’s Behemoths Rule Tomorrow? (Verdad)

- Narrative as an investing factor (Excess Returns - 1 hr 3 min)

- The Quality Factor and the Low-Beta Anomaly (Alpha Architect)

- Investor demand, rating reform and equity returns (Alpha Architect)

In a very simplistic way, one can think of your portfolio, like a baseball team:

Stocks would be your home run hitter who strikes out a lot and play first base — they can produce some great offense, but not much with respect to defense.

Bonds are like a great defensive shortstop: mediocre at hitting, but they are on your team to play defense.

Read more on Alpha Architect

discretionary investing

ALTERNATIVE ASSET CLASSES

WALL STREET

SUSTAINABLE investing

crypto

BAD BETS

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

PERSONAL FINANCE

Wealth Management

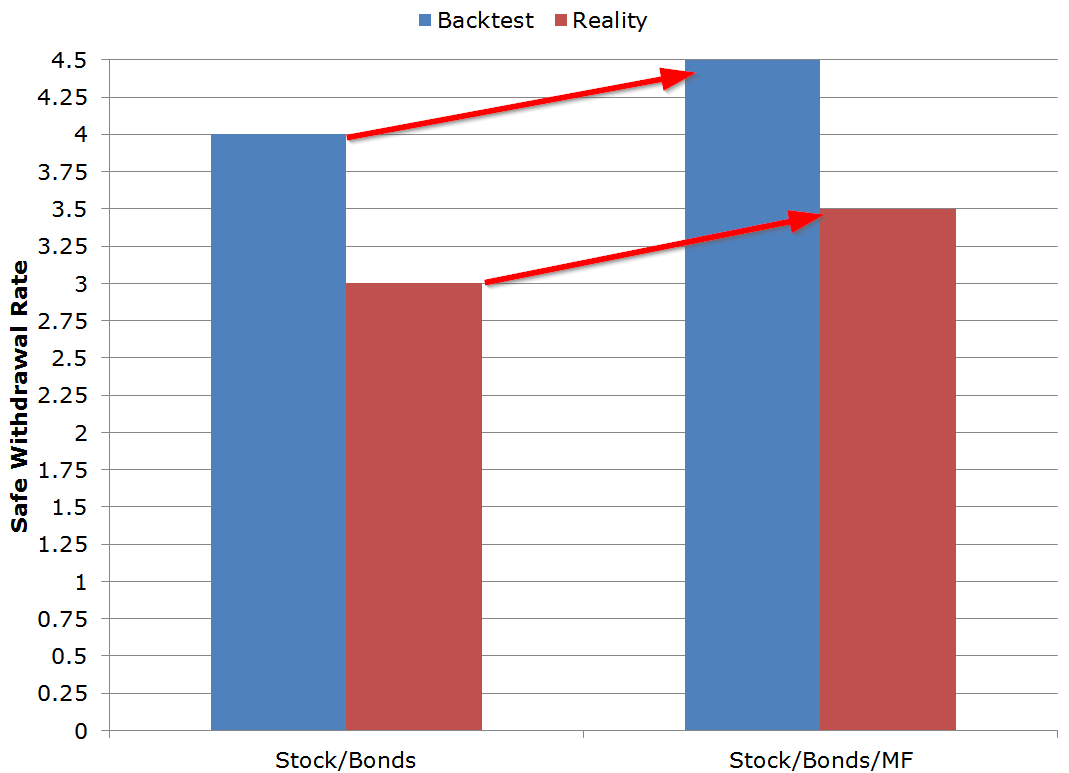

Early Retirement

FINANCIAL PRODUCTS

COST OF LIVING

OUR Community

Question of the week

Personal Development

Naval Ravikant - The 6 BIGGEST Middle Class Habits Keeping You in the Rat Race (Naval Ravikant)

Naval digs deep into psychology of status, materialism, beliefs and much more that is keeping you down.

Health & Wellness

Shirley A. Sahrmann, PT, PhD, is Professor Emerita of Physical Therapy at Washington University School of Medicine in St. Louis, Missouri.

Join the conversation here as she deep dives into Tim’s lower back issues, teaches how to unlearn painful patterns, talks about movement as medicine (or poison) and much more!

CAREERS

Travel

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

miscellaneous

Today, Asia’s 15 richest families control over $400 billion in wealth.

Many family dynasties have shaped Asia’s economy—from energy conglomerates to banking empires. In many ways, this was supported by social capital and long-term planning often built into family business structures.

The above graphic uses data from Bloomberg to show the wealthiest families in Asia from a multi-generational perspective. Data is based on combined family wealth and does not include first generation founders, or single family heirs.

Read more on Visual Capitalist

Why Oppenheimer deserves his own movie (Veritasium - 33 min)

“If you want to learn more about Oppeheimer, I strongly recommend the book “American Prometheus” By Kai Bird and Martin Sherwin. It is a remarkable book, very much deserving of the Pulitzer prize it received”

OUR Community

Last Week We asked you

How would you describe your current life situation?

SUGGEST AN ARTICLE

Thank you for reading.

Good Luck & keep’em* rolling!

(* Wheels & Dividends)

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – BlackRock Launches New iBonds, Truth About €1M Broker Insurance & BOW is 4 years old!

The Truth About €1 Million Broker Guarantees

4 Things I Learned In 4 Years Of Running A Finance Blog

Dodl By AJ Bell Review – AJ Bell’s Younger Brother

Vanguard LifeStrategy Review – A Retriever In A Babushka Doll

Why Do Portfolio Managers Care About Factors? It’s Not What You Think.

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.