Weekend Reading – Second-biggest bank collapse in U.S. history

Weekend Reading is a collection of Investment Research and Lifestyle topics from all corners of the Web.

We source the highest quality insights from Wall Street and Main Street that you may apply to your investment process.

Unlike the rest of Bankeronwheels.com, this series is provided without additional guidance.

As usual, everything is to be used at your own risk.

TYPE OF CONTENT

- Youtube

- Reading

- Podcast

- Academic

- Twitter Thread

The big money is not in buying or selling, but in the waiting

Charlie Munger

INVEST WISELY

This section is dedicated to research on how to invest for the Long Run using Passive Investment Strategies. Read Topics related to (i) Portfolio Construction and Asset Allocation (ii) Acting wisely by avoiding behavioural traps and also (iii) publications that help understand how financial markets work.

CONSTRUCT YOUR PORTFOLIO

For each type of investment and geography, based on Academia and our Portfolio Management experience, we first designed a dedicated framework for ETF selection. Our guides are:

- Simple when possible

- Tailored to your needs

- Tax-Efficient with respect to dividends

- Sustainable when desired and intellectually honest

- How Long Does It Take For You To Double Your Wealth (Of Dollars and Data)

- Should Investors be wary of corporate bonds? (Morningstar)

- Asset Allocation In Times of Inflation (Infrmtn Overflow)

- The implications of the UK dividend tax on your portfolio (Monevator)

- Personalised Inflation Hedging (Italian Leather Sofa)

How to Review Your Portfolio Performance (Peter Lazaroff - 11 min)

Measuring the success of your portfolio is important for several reasons, but most people don’t know how to properly measure the success of their portfolios. What are the differences between Portfolio-Based Benchmarks and Goals-Based Benchmarks & meaningful questions to ask when evaluating performance.

HOW TO INVEST

- The True Advantage Of Index Funds (Morningstar)

- The "secret" to financial freedom? Persist when others quit. (Vanguard)

- Is it Easier for Investors to Forecast the Long-Term or Short-Term? (Behavioural Investment)

- How Do Great Investors Make Decisions? (The Tim Ferris Show - 2 hr 4 min)

- Want to Invest Successfully? Stop Trying to Make Sense of It (Morningstar)

- Why regret & good investing don't mix (Intrinsic Investing)

Why you should invest based on evidence alone (Peter Lazaroff - 38 min)

Robin Powell is an award-winning journalist and campaigner for positive change in global investing, advocating better investor education, and greater transparency. Robin explains what evidence-based investing is all about, the importance of developing a financial plan prior to choosing investments, the differences in the adoption of evidence-based investing outside the U.S.

UNDERSTAND FINANCIAL MARKETS

- The Meltdown in Bank Stocks explained (Shorter version - MacroAlf)

- Why was there a run on Silicon Valley Bank? (Longer Version - Noahpinion)

- Buy-backs are leaving stock markets smaller (FT.com - click on the first link)

- Business Bankruptcies break 7 year record (Euro Stat)

- Resilient economy to spur more Fed rate hikes (Vanguard)

- Its time for investors to reevaluate their China exposures (Investments & Wealth Institute)

- Why Rob Arnott prefers International stocks (Bloomberg - 1 min)

Economic history & today's financial markets (Bogleheads on Investing - 57 min)

Edward Chancellor is a financial historian, journalist, and investment strategist. Ed graduated with first-class honors from Trinity College, Cambridge, and later from Oxford University. He worked for the London merchant bank, Lazard Brothers, and was later an editor at the financial commentary site, Breakingviews of Reuters. Ed was also a senior member of the asset allocation team at GMO, the Boston-based investment firm.

ACTIVE INVESTING

This section relates to improving your knowledge about active investing. If you decide to sin, then sin only a little. Given ample evidence, combined active bets should be ideally a relatively small fraction of your portfolio.

FACTOR & Thematic investing

STOCKS

A data-driven approach to picking growth stocks and thematic baskets (Flirting With Models - 14 Min )

It’s no secret that high flying growth stocks were hammered in 2022, so here is a revisit of a conversation with Jason Thomson.

Jason is a portfolio manager at O’Neil Global Advisors, where he manages highly concentrated portfolios of growth stocks.

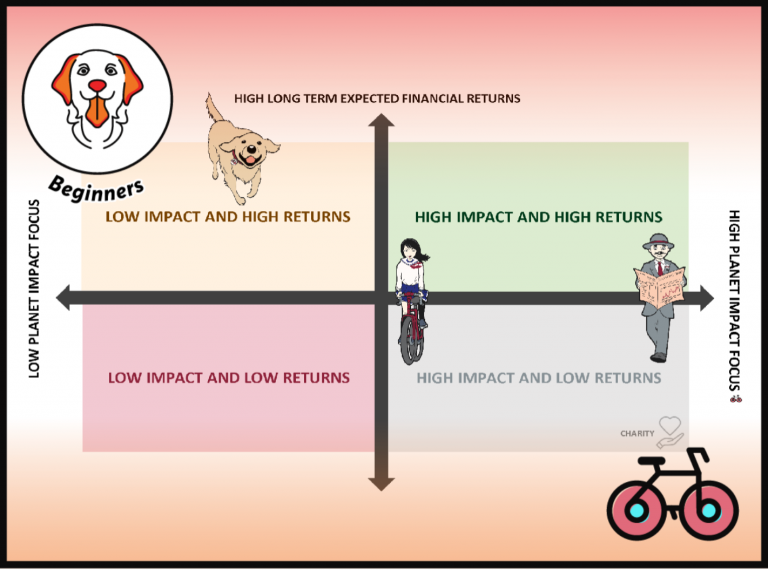

SUSTAINABLE investing

This section is about Sustainable Investing. You can invest in a Socially Responsible way but there are many ESG traps. Learn how to invest sustainably, and what it means for expected returns, with the our definitve guide to sustainable investing.

There are at least three proven sustainable investing strategies.

To keep it simple, you may hold a non-screened portfolio and, use the incremental profits for philanthropy.

If you want to avoid investing in certain types of industries, e.g. Tobacco companies, you may select cost-efficient and well-diversified SRI Funds. The most active sustainable strategy is Impact Investing.

ALTERNATIVE ASSET CLASSES

FROM WALL STREET

Asness on Bloomberg about a Historic 2022 for AQR Hedge Fund

Show Us Your Portfolio: Corey Hoffstein (Excess Returns - 59 min)

The podcast discusses how Corey constructs his personal portfolio and how he applies concepts like return stacking and capital efficiency in that process, but also including the importance of human capital, international diversification, the role of valuations in his investment process and a lot more.

crypto & blockchain

Coinbase CEO Brian Armstrong on the key challenges facing Crypto (Bloomberg - 44 min)

Crypto is facing two distinct, yet related problems. First, a bunch of people have lost money due to the decline in coin prices and the collapse of major firms, such as FTX. At the same time, regulatory scrutiny is also increasing. And of course, the reason that scrutiny is increasing is in part due all the lost money. So how is the industry dealing with all this? On this episode of the podcast, BBG speaks with Brian Armstrong, the co-founder and CEO of Coinbase, the biggest crypto exchange in the US. He talks about the trajectory of the industry, where he sees it going, the impediments it faces, and much more.

REMINDERS TO PUNT RESPONSIBLY

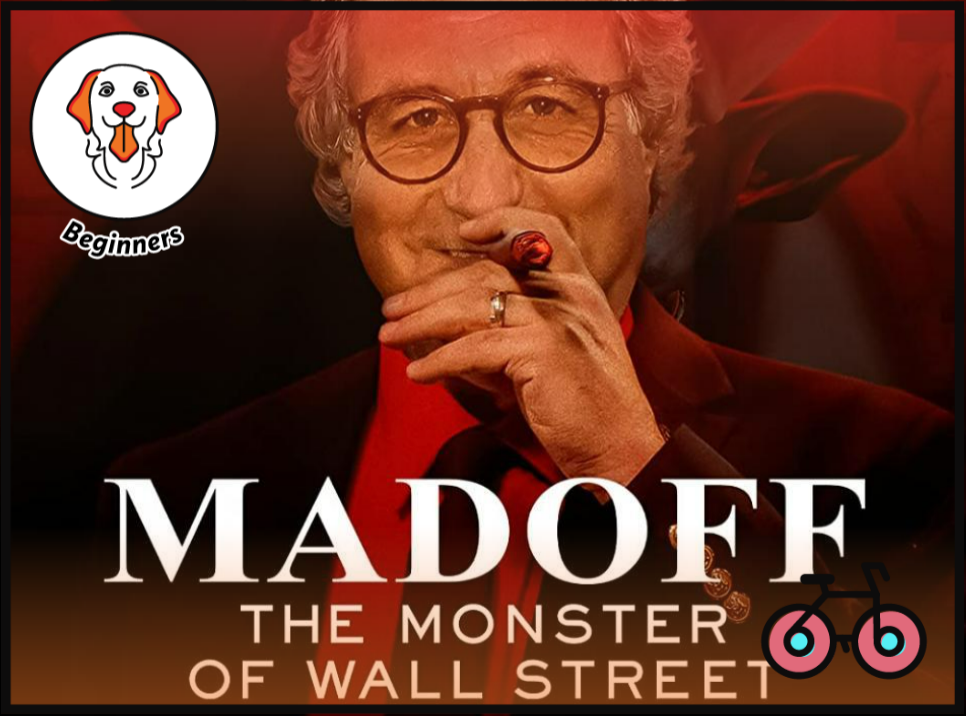

In conversation with Madoff Trader & Investor Andrew Cohen (Excess Returns - 51 min )

With the recent release of the Netflix documentary “Madoff: The Monster of Wall Street,” many of us have been learning more of the details behind the scandal. Andrew Cohen, participated in the documentary and was both a trader on the legitimate side of Madoff’s business and a victim of the Ponzi scheme. Andrew gives us an inside look at what it was like to work in the Madoff organization and takes us through the timeline of events from when he started there to when the Ponzi scheme was uncovered.

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

DIVE DEEPER - BOOKS & MOVIES

In the Book review section we rate some of the most relevant resources related to Financial Independence, Personal Finance and Investing. Browse All Book and Video Reviews.

The 2023 Netflix docuseries Madoff: The Monster of Wall Street dives into the largest Ponzi scheme in history, worth $64.8 billion.

Although the Madoff madness stopped in late 2008, today’s investors still fall for the very same tricks.

What exactly can we learn from this series?

Let’s have a closer look.

This section is dedicated to UK and European Products. It can also touch on other European jurisdictions outside the Euro-zone.

- The first ‘L’ is Living Life. How do you plan around life essentials while reducing unnecessary costs?

- The second ‘L’ is Loving Life. It’s usually the mismanaged L. It’s not only about the destination but also the journey and values that define you today.

- The third ‘L’ is Later Life. How to invest wisely for Early Retirement.

FINANCIAL PRODUCTS

- Understanding your credit card statement is of paramount importance (Which?)

- UK: As rates rise, you're better off shopping for a better savings rate instead of being loyal to your bank (Guardian)

- UK: Mortgage rate cut proves to be a flash in the pan (This is money)

- UK: 7 Ongoing Schemes To Help You Buy Your First House (Which?)

COST OF LIVING

OUR Community

Question of the week

This section is dedicated to the ‘Why’ of Investing, trends or career choices.

LIFESTYLE

Personal Finance Tactics For The Real World (Rational Reminder - 1 hr 2 min)

The intersection between economics and psychology makes the subject of personal finance complex. To help us elucidate this topic is personal finance writer and author, Erica Alini. Her journey into finance journalism began when she started working for the Wall Street Journal immediately after the financial crisis of 2007/08. Since then, Erica has become an accomplished writer and journalist, having worked for many respected organizations. She is also the author of a best-selling book, Money Like You Mean It.

EARLY RETIREMENT

CAREERS

TECH & ECONOMY

James Clear, Atomic Habits — Mastering Habits, Growing an Email List to 2M+ People (2hrs)

James Clear (@JamesClear) is a writer and speaker focused on habits and continuous improvement. He is the author of the #1 New York Times bestseller Atomic Habits, which covers easy and proven ways to build good habits and break bad ones.

Travel

miscellaneous

Revisiting Japan's Lost Decade (Konichi-Value - 29 min)

Japan was on its way to surpass the United States as the world’s largest economy, and the supply of infinite growth and prosperity seemed non-stop. Then, the party suddenly stopped.The video & podcast is a detailed depiction of Japan’s lost decade (1991-2001): The tragic tale of the world’s largest economic bubble burst and its consequences.

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

OUR Community

Last Week We asked you

How would you describe your current life situation?

SUGGEST AN ARTICLE

Thank you for reading.

Good Luck & keep’em* rolling!

(* Wheels & Dividends)

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – BlackRock Launches New iBonds, Truth About €1M Broker Insurance & BOW is 4 years old!

The Truth About €1 Million Broker Guarantees

Dodl By AJ Bell Review – AJ Bell’s Younger Brother

Vanguard LifeStrategy Review – A Retriever In A Babushka Doll

Why Do Portfolio Managers Care About Factors? It’s Not What You Think.

Money Market Funds: Are ETFs The Best Bang For Your Buck Or A Risky Ride?

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.