Weekend Reading – 100% Equities For Non-US Investors? Pay Attention To Details.

Weekend Reading is a collection of Investment Research and Lifestyle topics from all corners of the Web. We source the highest quality insights from Wall Street and Main Street that you may apply to your investment process. Unlike the rest of Bankeronwheels.com, this series is provided without additional guidance. As usual, everything is to be used at your own risk. Below is the type of content we shortlist:

Bonds can beat stocks over short stretches; Bonds provide protection during market drops; Bond yields are still greater than current dividend yields.

Jack Bogle's three reasons to own bonds

Featured

These days, academic insights like the recent paper ‘Beyond the Status Quo: A Critical Assessment of Lifecycle Investment Advice’ by Scott Cederburg et al., which challenges traditional asset allocation are not just noted – they’re often implemented by individual investors. Today, let’s have a look why this paper’s recommendation can significantly reduce diversification for European investors, and why the way the study is designed should raise major concerns.

Portfolio Construction

Asset Allocation

UNDERSTAND FINANCIAL MARKETS

The Trillion Dollar Equation (Veritasium)

The most famous equation in finance, the Black-Scholes/Merton equation, came from physics. It launched an industry worth trillions of dollars and led to the world’s best investments. Featured in this video – The Man Who Solved the Market: How Jim Simons launched the quant revolution by Gregory Zuckerman.

- Barry Ritholtz talks with Jeffrey Hirsch about how the stock market performs during war. (Ritholtz - 15 Min)

- The list of Europe's biggest stocks is filled with pharma companies. (Euro News)

- Europe is underpriced (Verdad)

- Mike Green about how the growth in passive has changed markets (Excess Returns - 1 Hr)

HOW TO INVEST

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

Active Investing

FACTOR investing

People often ask us at DBi how it’s possible to emulate the managed futures space with a limited set of instruments, given that a typical managed futures fund invests in 100+ positions. The answer lies in the power of simplification through strategic factor selection.

Read more on DBI

discretionary investing

ALTERNATIVE ASSET CLASSES

In today’s episode, we dive into Tina’s teams’ recent piece about what they call a possible “once-in-a-generation opportunity” in emerging market local currency debt. Tina gives a great overview of the emerging market debt asset class, and then we dive into the reasons behind her team’s call. She shares why today is reminiscent of 2004 and how she thinks about things like liquidity panics and sanctions risk.

WALL STREET

- Barry Ritholtz talks with Bill Dudley, former president and CEO of the Federal Reserve Bank of New York. (Ritholtz - 1 Hr 25 Min)

- What stocks Buffett is unwilling to sell. (Morningstar)

- Warren Buffett could have continued running investment partnerships with high fees, but he didn't. (Roger Lowenstien)

SUSTAINABLE investing

BAD BETS

UCITS ETFS

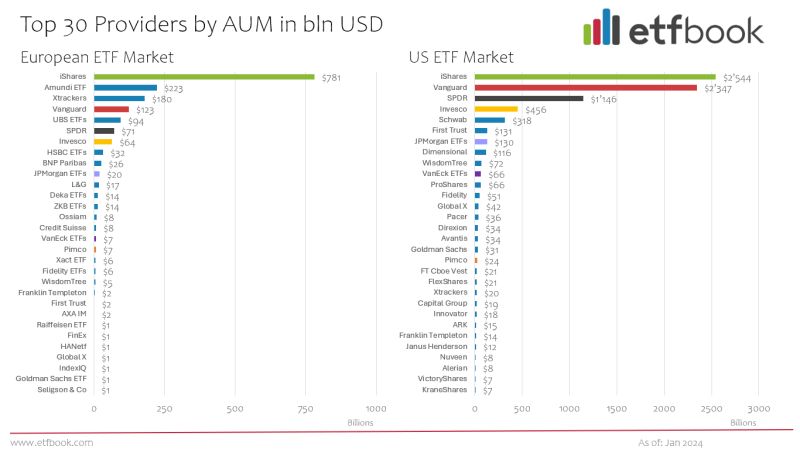

ETF Book Provided an updated overview of the US and European ETF markets by leading Issuers. US ETF market: AUM $7.96 trillion – European ETF market: AUM $1.81 trillion. iShares is leading in the US, but Vanguard is closing the gap. In Europe, iShares is much more dominant.

US ETFs

BlackRock is set to launch ten ETFs focused on Treasury inflation-protected securities (TIPS). Ranging in maturity from 2024 to 2033, these ETFs will seek to provide inflation protection to investors concerned with erosion of purchasing power. The new TIPS-defined maturity bond ETFs will carry an expense ratio of 0.1%. [ETF.com]

Wealth Management

Personal Finance

Interactive Investor stands out as a great choice for UK investors with families, and looking for multicurrency accounts to reduce FX-fee frictions. However, advanced investors may find limitations depending on their sophistication and needs.

Is it suitable for you?

Early Retirement

In this episode, we’re joined by Christine Benz, Director of Personal Finance at Morningstar, who shares fascinating insights from her latest co-authored paper: The State of Retirement Income 2023. Listen now and learn: Motivations for safe withdrawal rate research, Nuances of the 4% withdrawal rule.

Personal Development

Health & Wellness

CAREERS & Entrepreneurship

Travel

Crossing Tusheti – A Bikepacking Adventure in Northern Georgia (Film) (Bikepacking.com - 28 Min)

Tusheti National Park in northern Georgia and its trails are better known among hikers, but Sabine Schipflinger and Henna Palosaari decided to try bike packing through it with full-suspension mountain bikes. “Crossing Tusheti” documents their 180km journey over the 3,000m high mountain passes, lush green meadows, pristine beauty, remote mountain villages and countless switchbacks.

Oliver traveled from Scotland to Alaska to ride the 1,000-mile Iditarod Trail last year, and he put together this reflection that links a series of memories from several weeks out on the ephemeral trail across the rugged Alaskan backcountry. Read his story of braving the elements and making unexpected connections here.

Read more on Bikepacking.com

Tech & Economy

economy

TECH AND SCIENCE

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

And finally

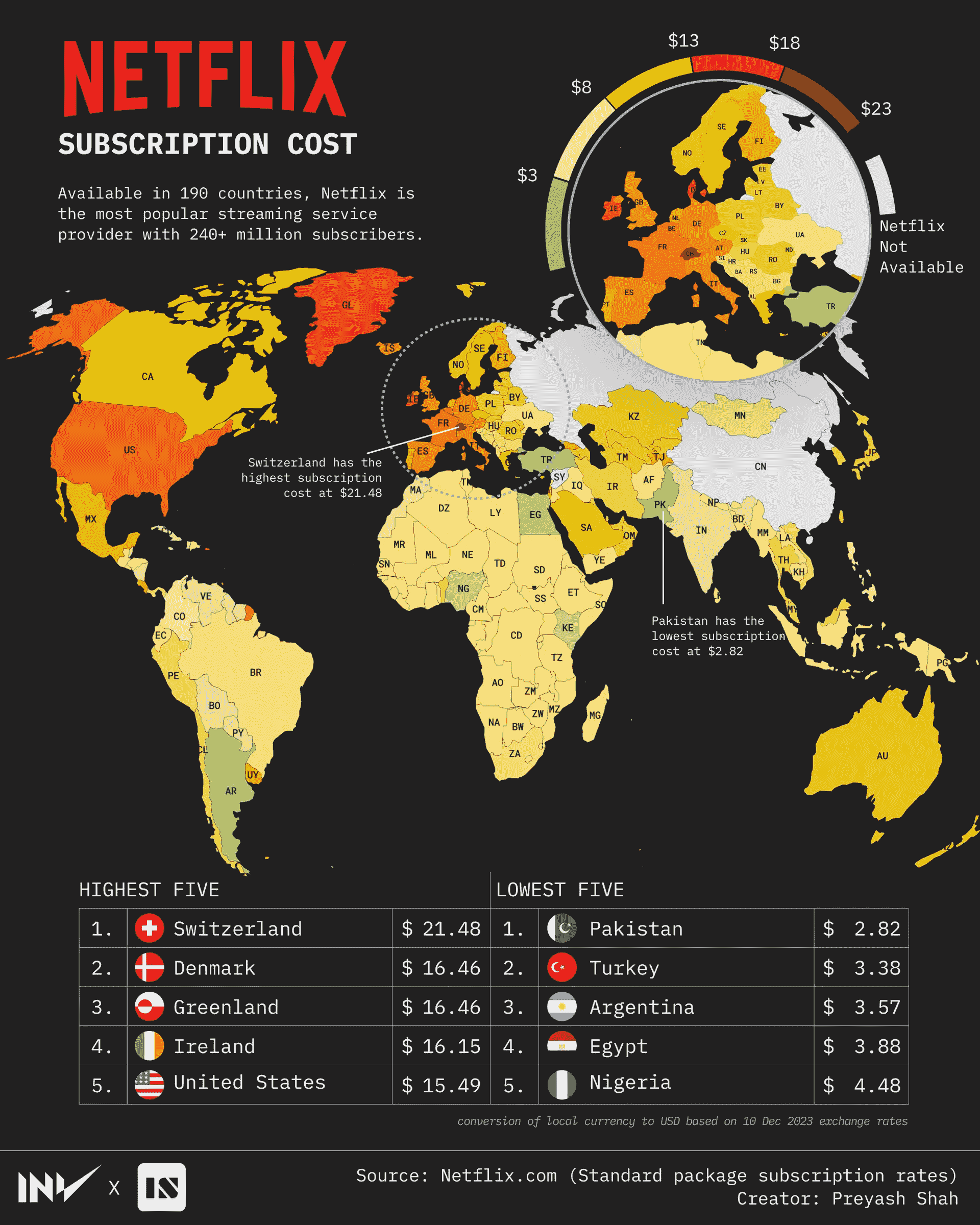

Netflix, the renowned streaming giant, has transformed the way we consume entertainment, providing a vast library of movies, TV shows, and documentaries at the touch of a button.

However, the cost of accessing this digital haven varies significantly from country to country, reflecting economic disparities and market dynamics.

This graphic from Preyash Shah maps Netflix price by country, using standard (basic) package subscription monthly rates from Netflix.com and converting to USD as of December 10, 2023.

Read more on Visual Capitalist

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – BlackRock Launches New iBonds, Truth About €1M Broker Insurance & BOW is 4 years old!

The Truth About €1 Million Broker Guarantees

4 Things I Learned In 4 Years Of Running A Finance Blog

Dodl By AJ Bell Review – AJ Bell’s Younger Brother

Vanguard LifeStrategy Review – A Retriever In A Babushka Doll

Why Do Portfolio Managers Care About Factors? It’s Not What You Think.

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.