Interactive INVESTOR Review

Overall Rating: A LEADING UK BROKER

4.3

/5

Overall Rating: A LEADING UK BROKER

Our take: Interactive Investor stands out as a great choice for investors with families, and looking for multicurrency accounts to reduce FX-fee frictions. However, advanced investors may find limitations depending on their sophistication and needs.

Is it suitable for you?

- Passive Investors: They’ll find the platform’s ETF trading commissions for regular investment competitive, particularly for SIPPs. The company’s reputation and convenience of setting up automated investments through monthly standing orders makes it an attractive choice. Given average customer balances around of £150k, it is a preferred choice for large accounts.

- Semi-Active Investors: While the costs associated with investing in foreign stock exchanges and currencies might feel steep, the multicurrency accounts may limit the cost-damage. The addition of family subaccounts makes the costs outside SIPPs competitive.

- Advanced Investors: Interactive Investor falls short in providing leverage and advanced features like access to US ETFs for those looking to push their investment strategies further.

This article contains affiliate links. We provide full transparency on how it works.

Pros & Cons and suitability

Pros & Cons

- User Friendly and Straightforward

- Parent Listed on LSE and Rated by S&P & Moody's

- Strong Reputation and long track record

- Competitive Fees for families. multicurrency.

- Can be expensive for smaller portfolios

- High Forex and non-UK transaction fees

- Lacks advanced features

Suitability

VERY Suitable

SIMPLE, reputable, competitive for SIPPs

Suitable

Family subaccounts, MultIcurrency support

SOMEWHAT Suitable

Lack of Advanced Features

Availability

Interactive Investor is only Available in the UK

We do understand that in some cases UK citizens that are not resident in the UK are allowed to open account. However, they cannot do this online but send the related documentation via post to Interactive Investor.

Broker Snapshot

Why Is Interactive Investor A Tier 1 Broker?

Interactive Investor stands as a leading brokerage in the UK, handling nearly a quarter of all UK transactions. While not part of a bank, its parent company is a well known asset management firm (Abrdn), listed on a Stock Exchange, with IG ratings from two rating agencies. Interactive Investor was worth £1.5 bn in 2022. With Assets Under Administration of £62bn across approximately 400K customers, the average balance is £152k – way above averages in the UK, and Europe. It also boasts nearly three decades of industry presence. Its fee structure is comparatively transparent, positioning it alongside major UK-focused competitors like AJ Bell and Hargreaves Lansdown.

Profitable with Listed and Externally Rated Parent

Interactive Investor, listed on the London Stock Exchange (LSE), is wholly owned by Abrdn, an insurance group with an Investment Grade Rating from S&P and Moody’s. Distinctly separate from any banking institution, the company benefits from significant profitability and a growing customer base each year. Regulated by the FCA, its clients are protected by the £85k Financial Services Compensation Scheme.

Company Info

| Characteristic | Interactive Investor |

|---|---|

| Inception Date | 🛈 1995 |

| Headquarters | 🛈 Manchester, UK |

| Key Owner | 🛈 Abrdn (100%) |

| Bank Affiliated | 🛈 No |

| Listed on Stock Exchange | ✅ LSE: £2.97 bn (Abrdn) |

| Parent Rating | ✅ S&P: BBB+ Moody Baa1 |

| Operating Profit | ✅ £114 n |

Regulation

| Feature | Interactive Investor |

|---|---|

| EU Entity | 🛈 None |

| UK Entity | 🛈 Interactive Investor Limited |

| Key Regulators | ✅ UK |

| EU Regulator | N/A |

| UK Regulator | ✅ UK (FCA) |

| EU Guarantee | N/A |

| UK Guarantee | 🛈 Max. £85k |

competitive fees for family accounts, multicurrency support

The platform facilitates multicurrency accounts, particularly with SIPPs – which is rare in the UK. In ISAs multicurrency is not available across all UK Brokers. While Interactive Investor supports transactions in most major currencies and provides access to all significant global exchanges, transactions on the Swiss exchange are limited to phone-based operations. II does not engage in Payment for Order Flow, a practice prohibited in the UK, and it abstains from internalization, ensuring transparency in order execution. The fee structure is competitive for SIPPs, but less so for ISAs and General accounts versus its Tier 1 competitors, unless you opt for family accounts.

Features

| Feature | Interactive Investor |

|---|---|

| Key Base Currencies | 🛈 All Major Currencies |

| ETF Availability | ✅ Very high |

| Multicurrency | ✅ Available (a part ISA) |

| Cash Interest | ✅ Competitive |

| Margin Loans | ❌ Not Available |

| Exchanges | ✅ All Major |

| External PFOF Reliance | ✅ None |

Fee Structure

| Feature | Interactive Investor |

|---|---|

| Custody Fees | ✅ Low |

| Inactivity Fees | ✅ None |

| ETFs Dealing Fees | ✅ Low |

| FX Fees | ❌ High |

| Deposit Fees | ✅ None |

| Withdrawal Fees | ✅ None |

| Security Lending | 🛈 Not Available |

I. Company

Interactive Investor is a very transparent company owned by a long-standing and rated parent. In addition, there is no known history of regulatory and compliance fines.

Ownership and Transparency

Interactive Investor, established in 1995 in the UK, became a wholly-owned subsidiary of Abrdn in May 2022. Abrdn, a global investment firm formed by the merger of Standard Life and Aberdeen Asset Management, is listed on the London Stock Exchange and part of the FTSE 250 Index. With a market capitalization of £3bn as of January 2024, Abrdn is also rated BBB+ by S&P and Baa1 by Moody’s.

Safety Considerations

At a parent level, the credit rating is BBB+, which means that the estimated probability of default is of the parent company is very low, as measured by 10-year peer cohort probability of default. Based on historical data, a couple of 100 similarly rated financial companies went out of business over a 10-year period. However, this rating applies at parent level and assumes financial support from Abrdn. While not formally listed as a systemically important entity, Interactive Investor large customer base may increase chances of some form of state intervention in case of bankruptcy, but it is not a guarantee.

Regulation & Investor Compensation Schemes

Share & Cash Custodians

Interactive Investor serves as the direct custodian for your shares. Your cash is deposited across multiple banks, including an initial account setup with Barclays Bank UK PLC for your first deposit. Personal CREST accounts are not supported.

Reputation

Interactive Investor boasts a solid reputation, with no significant compliance fines or legal problems. This credibility extends to its parent company, Abrdn, despite facing some criticism regarding recent strategic decisions. Both entities are recognized for their stable and reliable presence in the investment community.

II. Fee structure

Interactive Investor has a simple fee structure that is convenient for higher asset accounts, because the monthly fixed costs don’t scale up after £50k of assets. It competes well against direct competitors for SIPP accounts, but is more expensive for General accounts and ISAs. FX rates and transaction on fees outside the London Stock Exchange are among the most expensive on the market.

Platform fees

Interactive Investor’s fee structure is designed as follows:

- Flat Fee Scheme: Charges are applied monthly and vary based on your assets.

- For ISAs and Trading accounts below £50k: Essential Investor Plan is £4.99/month.

- For ISAs and Trading accounts above £50k: Investor Plan or Super Investor Plan each priced at either £11.99 or £19.99/month. If you need more free trades or family accounts, the latter is more beneficial as it gives 5 family accounts for free. There are unlimited accounts per child under the Investor and Super Investor plans. Additional family accounts, up to 5, can be added for £5 each for the Investor plan.

- For SIPPs: Either Pension essential up to £50K at £5.99 a month or Pension Builder priced at £12.99/month for assets above.

- Combined SIPP and ISA Accounts: Under £75k: Essential Plan at £9.99/month. Over £75k: Investor Plan at £21.99/month and Super Investor Plan at £29.99/month.

Monthly fees & Subscription Plan Features

| Subscription Type | Account Type | Condition | Fee | Free Trades | Family Account | Junior Account |

|---|---|---|---|---|---|---|

| Essential Investor | Trading & ISAs | <£50k | £4.99 | 0 | 0 | ❌ |

| Investor | Trading & ISAs | None | £11.99 | 1 | 2 | ✅ |

| Super Investor | Trading & ISAs | None | £19.99 | 2 | 5 | ✅ |

| Pension Essential | SIPP | <£50k | £5.99 | None | 0 | ❌ |

| Pension Builder | SIPP | None | £12.99 | None | 0 | ❌ |

Trading Commisions

Interactive Investor trading fees are as following:

- Trading Fees: UK and US ETFs and shares are a flat rate of £3.99 per transaction. For other markets, the charge is £9.99, reduced to £5.99 for Super Investor Plan members.

- Free Transactions: The Investor Plan includes one free trade per month, while the Super Investor Plan doubles this benefit to two free trades monthly.

- Free Regular Investing: since 2020, Interactive Investor does not change any fee on regular investing trades (minimum trade is £25) for a large selection of ETFs, shares and funds. You can set up to 25 different regular transactions a month.

- Dividend Reinvestment: A nominal fee of £0.99 is applied to reinvest dividends.

- Other Trading Charges:

- For transactions over £100k in UK assets: £40 charge.

- For transactions over £100k in US assets: 0.04% of trade value.

- For transactions on other international markets: 0.1% charge on amounts above £25,000.

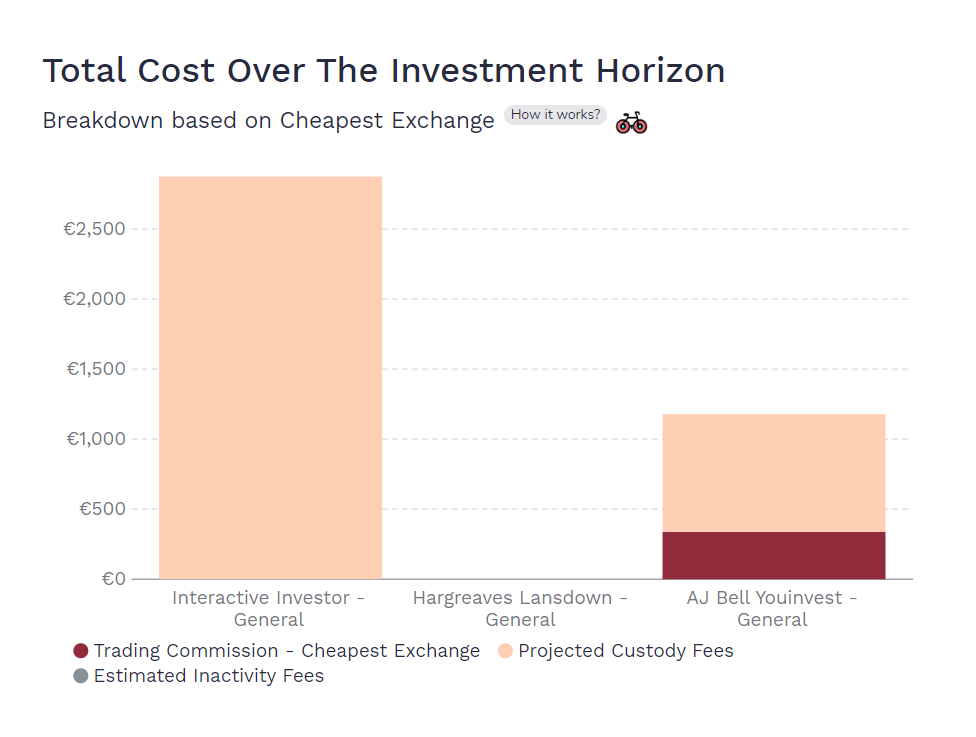

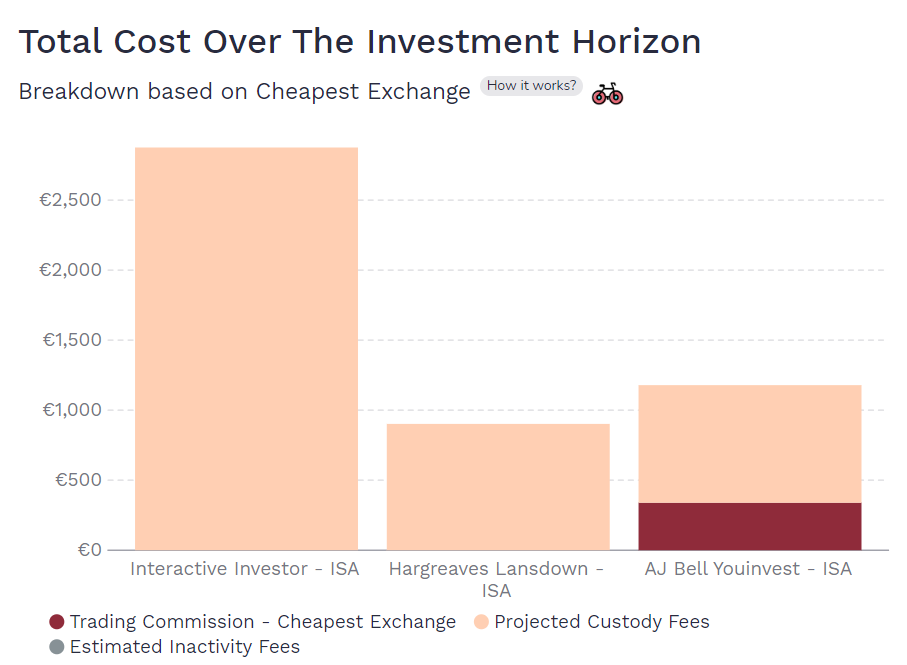

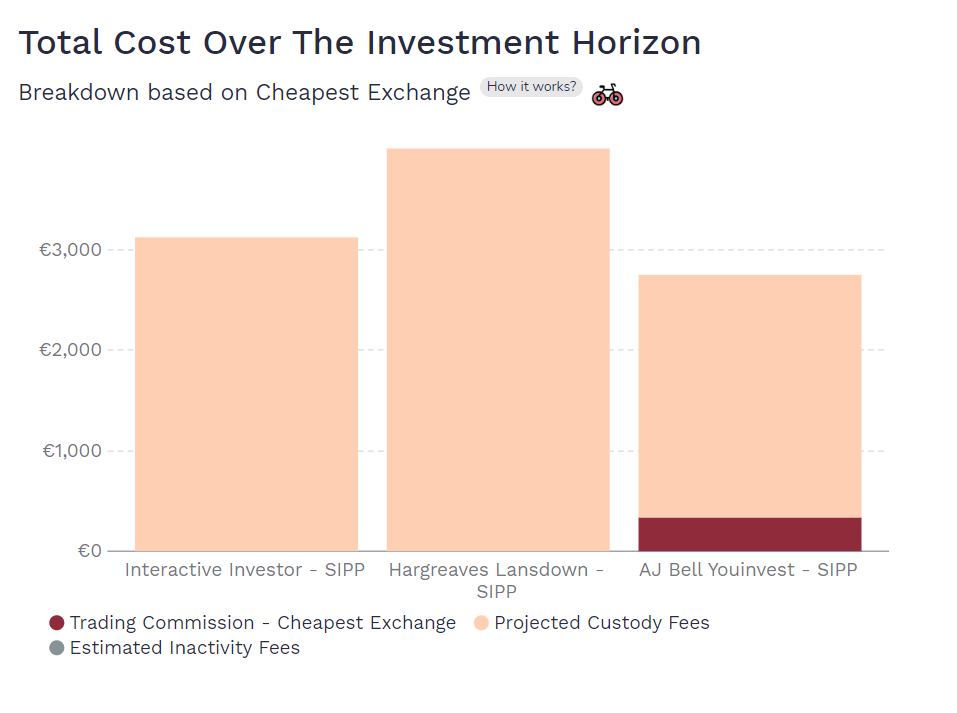

Overall Fee Simulation vs UK Tier 1 Competitors

Most of our readers have simple Index portfolios. Using our Broker Total cost calculator, you can estimate the total cost of holding ETFs throughout the investment period. For our similuated scenarios:

- General Accounts – Interactive Investor comes out more expensive

- ISAs – Interactive Investor comes out more expensive

- SIPPs – Interactive Investor is competitive

Fee Simulation For General Accounts

In the below simulation, a 20-year accumulation period broker bill for a General Trading account comes out at £2,878 for Interactive Investor (please note Investor Plan fees are used since the initial investment is above £50K). Two of its direct Tier 1 UK competitors are less expensive. The cost is £0 for Hargreaves Lansdown (the calculator assumes the use of its free regular investing service) as the broker does not charge any custody fees for ETFs and £1,182 for AJ Bell, that charges £1.50 for regular investing. Please note that ISAs and General accounts have the same cost for both Interactive Investor and AJ Bell Youinvest.

Investor assumptions

| Model Feature | Assumption |

|---|---|

| Investor | UK |

| Instrument | UCITS ETF |

| Account | General |

| Plan | Investor Plan |

| Initial Investment | € 100,000 |

| Monthly | € 1,000 |

| Time Horizon | 20 years |

| Gross Return | 8% |

Total Fees

Fee Simulation For ISAs

In the below simulation, a 20-year accumulation period broker bill for an ISA account comes out at £2,878 for Interactive Investor (please note Investor Plan fees are used since the initial investment is above £50K). Two of its competitors in the same category are less expensive. The cost is £900 for Hargreaves Lansdown (the calculator assumes the use of free regular investing service), due to yearly custody fees capped at £45 and £1,182 for AJ Bell, that charges £1.50 for regular investing transactions.

Investor assumptions

| Model Feature | Assumption |

|---|---|

| Investor | UK |

| Instrument | UCITS ETF |

| Account | ISA |

| Plan | Investor Plan |

| Initial Investment | € 100,000 |

| Monthly | € 1,000 |

| Time Horizon | 20 years |

| Gross Return | 8% |

Total Fees

Fee Simulation For SIPPs

In the below simulation, a 20-year accumulation period broker bill for a SIPP account comes out at £3,118 for Interactive Investor (Pension Builder fees are used since the initial investment is above £50K). One of its competitors in the same category is less expensive. AJ Bell charges £2,742 (using the regular investing transaction service that bills any transaction £1.50). Hargreaves Lansdown comes as the most expensive option, charging £4,000 (assuming the use of free regular investing service).

Investor assumptions

| Model Feature | Assumption |

|---|---|

| Investor | UK |

| Instrument | UCITS ETF |

| Account | SIPP |

| Plan | Pension Builder |

| Initial Investment | € 100,000 |

| Monthly | € 1,000 |

| Time Horizon | 20 years |

| Gross Return | 8% |

Total Fees

Currency Exchange fees

Interactive Investor’s currency exchange fees are prohibitively high. They are structured with rates that decrease as the transaction amounts increase:

- Rates: Begin at 1.5% for amounts up to £25,000, reducing to 1.25% for up to £50,000, 1% for up to £100,000, 0.5% for up to £600,000, and the lowest tier at 0.25% for amounts up to £1 million (online order maximum).

- Spread: The website indicates that the maximum applied spread can reach up to 1.5%.

FX Fees

| Transaction Value | Margin Rate |

|---|---|

| £0 – £24,999.99 | 1.50% |

| £25,000 – £49,999.99 | 1.25% |

| £50,000 – £99,999.99 | 1.00% |

| £100,000 – £599,999 | 0.50% |

| £600,000 – £999,999.99 | 0.25% |

Other fees

Deposits and withdrawal are free of charge.

III. Platform & Features

Interactive Investor stands out for its user-friendly interface, making it an ideal choice for beginners. It has several great features for long-term investors, including family or multicurrency accounts. However, the platform may be limiting for advanced investors.

Account Opening Process

Opening an account with Interactive Investor is a simple and intuitive process also to those with no prior experience. The entire signup process takes roughly 15 minutes, with account approval typically completed within a day. Applicants are required to submit proof of identity and residency, such as a passport or driver’s license, along with a bank statement or utility bill for address verification. Customer support at Interactive Investor is highly regarded, with users often praising the minimal wait times for phone support and the quick turnaround on email inquiries. While it primarily serves the UK market, Interactive Investor provide support in multiple languages, including English, German, Arabic, Polish, Chinese, Japanese, and Hungarian.

account Features

Interactive Investor offers several great features for Long-Term Investors:

- Multicurrency Accounts – with the exclusion of ISA accounts. SIPP multicurrency accounts are not common in the UK.

- Family Sub-accounts: Capability to create subaccounts including joint-accounts, Trust or even company accounts.

- Junior Accounts (ISAs only) – Possibility to open account for your children. The option is particularly attractive because these accounts are included in your subscription.

- Standing Orders – This feature is particularly attractive since the regular investment transactions are free of charge.

Internalisation and PFOF

PFOF is not allowed in the UK therefore Interactive Investor does not engage in this practice.

Cash Interest

Interactive Investor offers average interest rates on cash balances, which may not compete with the more attractive rates offered by competitors. The interest you earn can vary significantly based on the size of your balance and the type of account you hold, as well as the specific currency of your account. Interest is credited to your account on a monthly basis. For more details see Geeky Section below.

Illustrative Interest

Below are the illustrative interest rates as of February 2024. For comparison SONIA was 5.2% as of analysis date, so for a £10-100k ISA account gross interest is 2.75% which is 2.45% below SONIA (that’s the margin that Interactive Investor take). For € rate, the Trading Account Gross Interst is 2%, while €STR rate is 3.9% (Interactive Investor takes 1.9% margin).

Interest as of february 2024

| Account | Amount | Currency | Interest Gross % | AER % |

|---|---|---|---|---|

| ISA, Junior ISA & Trading Account | < £10K | £/$ | 2.00 | 2.02 |

| ISA, Junior ISA & Trading Account | £10K – £100K | £/$ | 2.75 | 2.78 |

| ISA, Junior ISA & Trading Account | £100K – £1 mln | £/$ | 3.75 | 3.82 |

| ISA, Junior ISA & Trading Account | > £1 mln | £ | 4.75 | 4.85 |

| Trading Account | > £1 mln | $ | 5.00 | 5.12 |

| SIPP | < £10K | £/$ | 3.00 | 3.04 |

| SIPP | £10K – £100K | £/$ | 3.75 | 3.82 |

| SIPP | £100K – £1 mln | £/$ | 4.00 | 4.07 |

| SIPP | > £1 mln | £ | 4.75 | 4.85 |

| SIPP & Trading Account | > £1 mln | $ | 5.00 | 5.12 |

| Trading Account | All | € | 2.00 | 2.02 |

| SIPP | All | € | 3.00 | 3.04 |

Advanced Features

Interactive Investor prioritizes simplicity and user-friendliness, with a focus on traditional investment products. As such, it does not offer advanced trading features like Futures, Options, Derivatives, and Margin Loans, catering more to investors looking for straightforward investment options. Below a summary of the available investment types:

Features

| Investment Type | Availability |

|---|---|

| ETFs | ✅ |

| Stocks | ✅ |

| Bonds | ✅ |

| Funds | ✅ |

| Options | ❌ |

| Derivative | ❌ |

| Futures | ❌ |

| CFDs | ❌ |

| Forex | ❌ |

| Crypto | ❌ |

| Commodities | ❌ |

IV. Taxes

Tax Wrappers

Interactive Investor offers the most common tax-advantaged accounts available in the UK. This includes:

- ISA

- Junior ISA

- SIPP

Tax Reporting

Interactive Investor provides tax reports, however the reporting functionality to the tax authority is not automated and is responsibility of the individual investor.

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – BlackRock Launches New iBonds, Truth About €1M Broker Insurance & BOW is 4 years old!

The Truth About €1 Million Broker Guarantees

4 Things I Learned In 4 Years Of Running A Finance Blog

Dodl By AJ Bell Review – AJ Bell’s Younger Brother

Vanguard LifeStrategy Review – A Retriever In A Babushka Doll

Why Do Portfolio Managers Care About Factors? It’s Not What You Think.

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.