Weekend Reading – Interactive Brokers Fees: Are You Overpaying?

Weekend Reading is a collection of Investment Research and Lifestyle topics from all corners of the Web. We source the highest quality insights from Wall Street and Main Street that you may apply to your investment process. Unlike the rest of Bankeronwheels.com, this series is provided without additional guidance. As usual, everything is to be used at your own risk. Below is the type of content we shortlist:

“My partner Charlie says there is only three ways a smart person can go broke: liquor, ladies and leverage,”“Now the truth is — the first two he just added because they started with L — it’s leverage.”

Warren Buffett

Featured

Interactive Brokers offers two pricing models: Fixed and Tiered. Fixed pricing is easier to understand. Tiered pricing formula is more complex and exchange-dependent.

Can You Change The Pricing Plan?

Yes, you can change it at any time, but pricing model changes take one day to apply. Alternatively, you may also create an additional linked account with the desired pricing model. This selection is instant.

Portfolio Construction

Asset Allocation

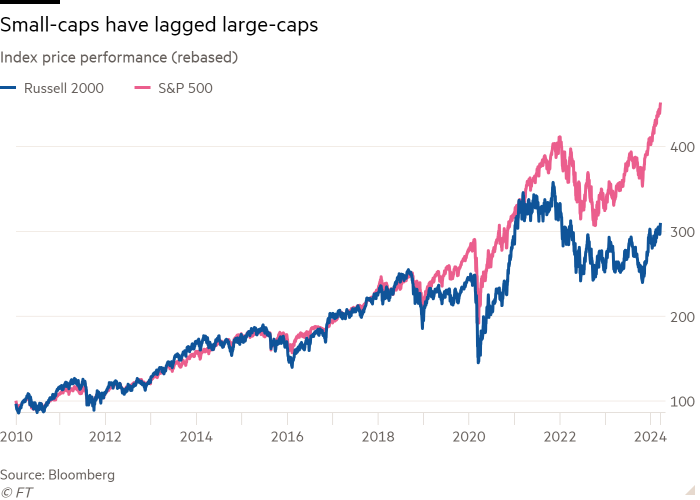

US small-cap stocks are suffering their worst run of performance relative to large companies in more than 20 years, highlighting the extent to which investors have chased megacap technology stocks while smaller groups are weighed down by high interest rates.The Russell 2000 index has risen 24 per cent since the beginning of 2020, lagging behind the S&P 500’s more than 60 per cent gain over the same period. What would it take for them to perform?

Read more on FT.Com, Click On First link

UNDERSTAND FINANCIAL MARKETS

- International diversification is no panacea, but what's the alternative? (Morningstar)

- If passive investing is bad for market efficiency, why aren't active managers cleaning up? (Acadian)

- Michael Green: Broken Markets (PhilBak Podcast - 46 Min)

- There is no guarantee of an equity risk premium over reasonable time horizons. (CFA Institute)

- The roots of deglobalisation (Joachim Klement)

- What the End of Japan’s Negative Interest Rates Means (Patrick Boyle - 15 Min)

HOW TO INVEST

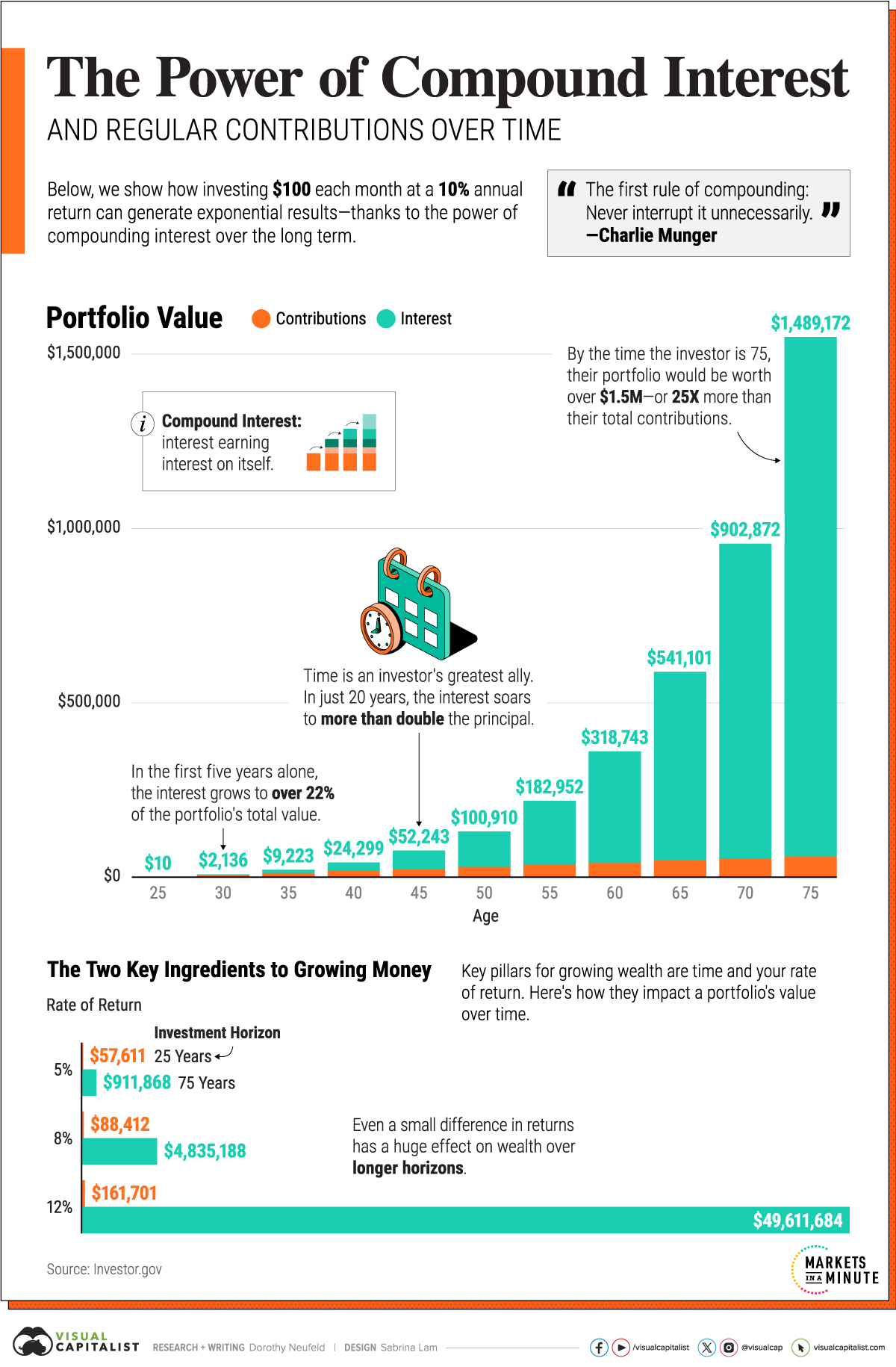

Time is an investor’s biggest ally, even if they start with just a modest portfolio.

The reason behind this is compounding interest, of course, thanks to its ability to magnify returns as interest earns interest on itself. With a fortune of $159 billion, Warren Buffett largely credits compound interest as a vital ingredient to his success—describing it like a snowball collecting snow as it rolls down a very long hill.

This bar chart shows the power of compound interest and regular contributions over time.

Generally speaking, building wealth involves two key pillars: time and rate of return. With this in mind, it’s important to take into account investment fees which can erode the value of your investments.

Read more on Visual Capitalist

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

Active Investing

FACTOR investing

- Corey Hoffstein talks with Otto van Hemert, Director of Core Strategies at Man AHL, about combining trend and seasonality in a single portfolio. (Flirting With Models)

- Value Investing, Inflation and Expected Returns with Rob Arnott (Excess Returns - 59 Min)

- How economic trend can complement price trend in momentum models. (Alpha Architect)

discretionary investing

ALTERNATIVE ASSET CLASSES

WALL STREET

SUSTAINABLE investing

BAD BETS

UCITS ETFS

Invesco has slashed the fees of four equity and bond ETFs including its $65m Russell 2000 ETF as it looks to boost demand. The US giant reduced the fees on the Invesco Russell 2000 UCITS ETF (RTYS) from 0.45% to 0.25%, making it Europe’s lowest cost ETF to track the US small-cap index, undercutting rivals State Street Global Advisors (SSGA), DWS and Amundi.

Read more on ETF Stream

New UCITS ETF launches

| # | ETF | TER | ISIN |

|---|---|---|---|

| 1 | Amundi Prime All Country World UCITS ETF | 0.07% | IE0009HF1MK9 |

| 2 | Xtrackers MSCI World ex USA UCITS ETF 1C | 0,16% | IE0006WW1TQ4 |

| 3 | AMUNDI PRIME USA UCITS ETF Acc | 0,05% | IE000FSN19U2 |

| 4 | AMUNDI PRIME USA UCITS ETF Dist | TBC | IE000IEGVMH6 |

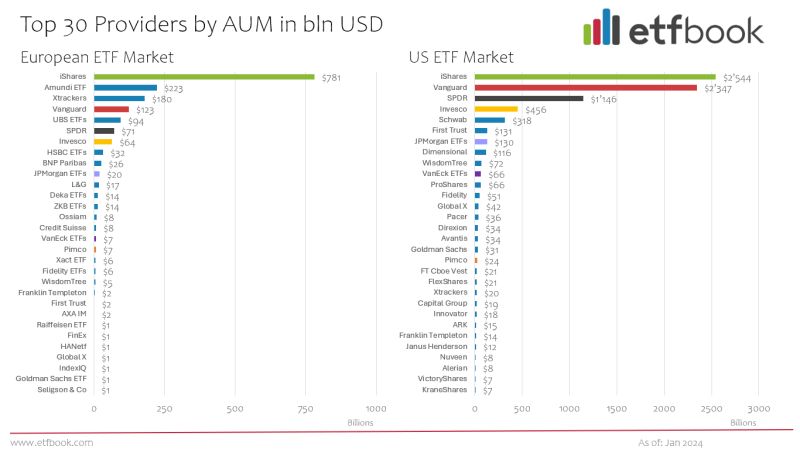

ETF Book Provided an updated overview of the US and European ETF markets by leading Issuers. US ETF market: AUM $7.96 trillion – European ETF market: AUM $1.81 trillion. iShares is leading in the US, but Vanguard is closing the gap. In Europe, iShares is much more dominant.

US ETFs

BlackRock is set to launch ten ETFs focused on Treasury inflation-protected securities (TIPS). Ranging in maturity from 2024 to 2033, these ETFs will seek to provide inflation protection to investors concerned with erosion of purchasing power. The new TIPS-defined maturity bond ETFs will carry an expense ratio of 0.1%. [ETF.com]

Wealth Management

Personal Finance

Fidelity International stands out as a great choice for investors with families, and looking for a reputable and competitive choice. However, advanced investors may find limitations depending on their sophistication and needs.

In today’s episode, Tim updates us on everything going on with Next Gen Personal Finance. You all know I’m a huge proponent of teaching kids personal finance and Tim is as focused on this making this happen as much as anyone. He talks about “Mission 2030,” which is to guarantee every high school student in the US takes at least one semester-long personal finance course by 2030.

Interactive Investor stands out as a great choice for UK investors with families, and looking for multicurrency accounts to reduce FX-fee frictions. However, advanced investors may find limitations depending on their sophistication and needs.

Is it suitable for you?

Early Retirement

- Spending guardrails are important in retirement, but the details matter. (Kitces)

- Tim Ranzetta talks with JL Collins author of "Pathfinders: Extraordinary Stories of People Like You on the Quest for Financial Independence―And How to Join Them." (NGPF - 45 Min)

- 13 Barista FIRE Jobs: The Best Places to Work During Barista FIRE (BravelyGo)

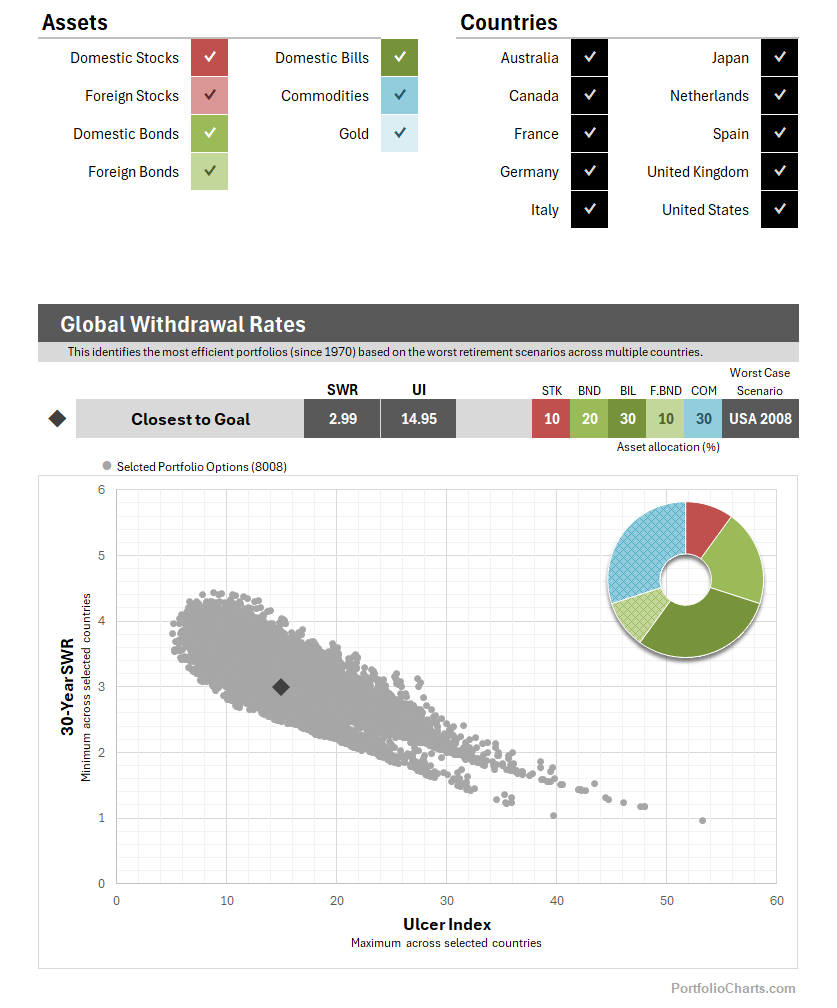

Between my own independent research and the discussions of other investors I enjoy reading, it seems the topic of safe withdrawal rates has been bubbling to the top lately. One particular question recently captured my attention. What portfolio has the best safe withdrawal rate in the worst case scenario around the world?

You see, the vast majority of withdrawal rate research focuses on the United States. However, most people consider the US to be an extremely positive outlier, which raises legitimate questions about the appropriateness of determining one’s retirement plan by myopically focusing on only the best case country.

Read more on Portfolio Charts

Personal Development

Scott Glenn’s acting career spans nearly 60 years. His impressive film resume includes performances in Apocalypse Now, Urban Cowboy, The Right Stuff, Silverado, The Hunt for Red October, The Silence of the Lambs, Backdraft, The Virgin Suicides, and The Bourne Ultimatum.

CAREERS & Entrepreneurship

DESIGN YOUR LIFESTYLE

Travel

“Wheels to Waves” is a new feature-length video that follows a group of new and old friends on a 600-kilometer journey around Indonesia’s alluring Lombok Island, experiencing the picturesque island’s challenging terrain, stunning beaches, and unique culture. Watch the 40-minute video with an introduction from creator Haetam Attamimy here…

Read more on Bikepacking.com

Tech & Economy

economy

TECH AND SCIENCE

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

And finally

Why is this number everywhere? (Veritasium - 24 Min)

The number 37 is on your mind more than you think. The number 37 might seem random, but it often pops up in various contexts, from mathematics to pop culture. In math, it’s a prime number, adding a layer of uniqueness. It also appears in temperature conversions, as the human body’s normal temperature in Celsius. This frequency in appearance could be due to its mathematical properties or simply a coincidence that makes it stand out more once you start noticing it.

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Cash Is Not Enough: Why Hold Bond ETFs Despite Price Rollercoasters.

The Truth About €1 Million Broker Guarantees (Updated With Trading 212 Cap)

Halifax Share Dealing Review – Similar To Lloyds With SIPP On Top

Lloyds Share Dealing Review – Old School But Ticks The Boxes For Golden Retrievers

DEGIRO Review: A Transparent Leader In Low-Cost Investing

Weekend Reading – BlackRock Launches New iBonds, Truth About €1M Broker Insurance & BOW is 4 years old!

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.