Fidelity International Review

Overall Rating: Golden Retriever-Friendly Platform

4.1

/5

GOLDEN RETRIEVER-FRIENDLY PLATFORM

Our take: Fidelity International stands out as a great choice for investors with families, and looking for a reputable and competitive choice. However, advanced investors may find limitations depending on their sophistication and needs.

Is it suitable for you?

- Passive Investors: They’ll find the platform’s ETF trading commissions for regular investment competitive, particularly for General & SIPP Accounts. The company’s reputation and convenience of setting up automated investments through monthly standing orders makes it an attractive choice. The cash interest rate can also be attractive.

- Semi-Active Investors: While the good offer of Junior accounts and fees makes Fidelity International attractive, the lack of access to Stock Exchange outside LSE and the limited range of ETFs may represent a significant constraint for certain investors.

- Advanced Investors: Fidelity International falls short in providing leverage and other advanced features like access to US ETFs for those looking to push their investment strategies further.

This article contains affiliate links. We provide full transparency on how it works.

Fidelity is a Tier 1 Asset Management firm, managing $4.5 Trillion. It has a distinct non-US operation called Fidelity International, managing USD $776.2 billion across Europe or Asia. Fidelity International acts as an asset manager for all non-US funds, but also has brokerage operations in countries like the UK or Germany. This review is only focused on the UK brokerage business of Fidelity International, and for simplicity it will be referred to as Fidelity International in this review.

Pros & Cons and suitability

Pros & Cons

- User Friendly and Straightforward

- Strong Reputation and long track record

- Competitive Fees for SIPP, Junior ISA/SIPP and General Account

- good Cash Interest Rate

- Can be expensive Non-UK transactions

- Transactions Primarily on LSE

- Fairly Limited ETF Range

- Lacks advanced features

Suitability

VERY Suitable

SIMPLE, reputable, competitive for Junior and General accounts

Suitable

Family accounts, BUT LIMITED ETF RANGE

SOMEWHAT Suitable

Lack of Advanced Features

Availability

Fidelity International (UK) is only Available in the UK

Fidelity International (UK) offers a retail investing platform also in Germany, but there will be a separate Bankeronwheels.com review of this entity.

As of March 2024, Fidelity International (UK) is also servicing institutional clients as well as management accounts in France and Italy.

Broker Snapshot

Why Is Fidelity International A Tier 1 Broker?

While not part of a bank or listed, Fidelity International manages funds totalling USD $776 billion as of December 31, 2023, serving over 2.8 million clients across regions including Asia Pacific, Europe, the Middle East, South America, and Canada. In the UK, Fidelity International has roughly 1 million of customers that can be compared to Hargreaves Lansdown, which is noted for having the largest share of the UK consumer platform market with 1.7 million clients and around £120 billion in assets. It also boasts nearly five decades of industry presence. Its fee structure is comparatively transparent, positioning it alongside major UK-focused competitors like AJ Bell and Hargreaves Lansdown.

Long Standing Player with worldwide presence

Fidelity International is privately owned, and it is not affiliate of any banking institution. Launched in 1969 in Tokyo, it opened the office in London in 1973. Since then, the company expanded in several markets across different geography, however UK remains the leading market as well as the major research hub. The company benefits from a growing customer base each year as well as a long history in the market. Regulated by the FCA, its clients are protected by the £85k Financial Services Compensation Scheme.

Company Info

| Characteristic | Fidelity International UK |

|---|---|

| Inception Date | 🛈 1973 |

| Headquarters | 🛈 Pembroke, Bermuda |

| Key Owner | 🛈 Johnson family (39.89%) |

| Bank Affiliated | 🛈 No (But affiliated with Fidelity US) |

| Listed on Stock Exchange | ❌ No |

| Parent Rating | ❌ No |

| Net Profit (2022) | ⚠️ - £60 ml |

Regulation

| Feature | Fidelity International UK |

|---|---|

| EU Entity | 🛈 N/A |

| UK Entity | 🛈 FAL Limited |

| Key Regulators | ✅ UK |

| EU Regulator | 🛈 N/A |

| UK Regulator | ✅ UK (FCA) |

| EU Guarantee | 🛈 N/A |

| UK Guarantee | 🛈 Max. £85k |

competitive fees for SIPP, Junior and General Accounts, Joint and business account supported

The fee structure is competitive for SIPPs, Junior and General Accounts, but less so for ISAs accounts versus its Tier 1 competitors. The FX rates are average, but the cash interest is competitive. Fidelity International does not engage in Payment for Order Flow, a practice prohibited in the UK, and it abstains from internalisation, ensuring transparency in order execution.

Features

| Feature | Fidelity International UK |

|---|---|

| Key Base Currencies | 🛈 GBP |

| ETF Availability | ↔️ Average (about 420) |

| Multicurrency | ❌ Not Available |

| Cash Interest | ✅ Competitive |

| Margin Loans | ❌ Not Available |

| Exchanges | ⚠️ LSE Only |

| External PFOF Reliance | ✅ None |

Fee Structure

| Feature | Fidelity International UK |

|---|---|

| Custody Fees | ✅ Low |

| Inactivity Fees | ✅ None |

| ETFs Dealing Fees | ✅ Low |

| FX Fees | ↔️ Average |

| Deposit Fees | ✅ None |

| Withdrawal Fees | ✅ None |

| Security Lending | 🛈 Not Available |

I. Company

Fidelity International has multi-decade long worldwide market presence. In addition, there is no known history of regulatory and compliance fines.

Ownership and Transparency

Fidelity International was created in 1969 as a subsidiary of Fidelity Management and Research, a US company, and became fully independent in 1980. Fidelity International is privately owned, with the majority of the company owned by its employees. However, the Johnson family, known for their association with Fidelity Investments in the United States, still owns a substantial share of 39.89%. Edward C. Johnson II founded Management and Research in 1946. The company has been led by multiple generations, including his son, Edward C. (Ned) Johnson III, and granddaughter, Abigail Johnson, who currently serves as CEO. The family’s involvement in Fidelity has significantly shaped the landscape of investment management and mutual funds over the decades.

The company is not listed, however provides regular annual and financial statements, making it a relatively transparent player. Like Vanguard, Fidelity also manages its own funds and ETFs in addition to the ones offered from the other asset management companies.

Fidelity International acquired Legal and General Investment Management’s direct-to-consumer investing arm for £5.8 billion in 2021, significantly expanding its customer base and assets under management. At that time, this M&A move increased Fidelity’s personal investing arm to 580,000 customers and £26 billion in assets.

Safety Considerations

The company is not rated. While not formally listed as a systemically important entity, Fidelity International has a large customer base, with over 500k customers in the UK and £26bn of assets. It is also affiliated with Fidelity’s US operations, making an intervention – including through possible M&A more likely – in case of difficulties. However, this is not a guarantee.

Regulation & Investor Compensation Schemes

Fidelity International (Financial Administration Services Limited) is regulated by the FCA – clients are protected up to £85,000.

Share & Cash Custodians

Your shares are held in a nominee account structure held by Fidelity directly. Your cash is deposited across multiple banks, including Barclays, HSBC, Royal Bank of Scotlands, LLoyd Bank, bank of America. Personal CREST accounts are not supported.

Reputation

Fidelity International holds a solid reputation, with no significant compliance fines or legal problems. It is recognized for a stable and reliable presence in the investment community as well as to support initiatives reflecting responsible investment practices, such as the UK government plan for shareholder influence over boardroom bonuses and expressing concerns over long-term incentive plans. However, it has also faced scrutiny for investments in companies like Hikvision and SenseTime, which have been implicated in human rights issues.

II. Fee structure

Fidelity International UK has a very simple fee structure that is even more convenient for higher asset accounts, because of the £90 yearly cap. It competes well against direct competitors for General, Junior and SIPP accounts, but is more expensive for ISAs. On the other side, FX rates and transaction on fees are average.

Platform fees

Fidelity International UK fee structure is designed as follows. For all accounts, ETFs and Mutual Funds benefit from a £90 annual cap:

- General Account and Junior ISA and SIPPs: No charge. However, when a child turns 18, Junior ISA and SIPP will be charged as adult ones.

- Regular ISA and SIPP accounts below £25k: If you inject regularly, you will charged 0.35% annually. If you don’t invest regularly, you will be charged £7.50 a month.

- Regular ISA and SIPP accounts between £25k & £250K: 0.35% annually.

- Regular ISA and SIPP accounts above £250K: 0.20% annually.

ETF and MUTUAL FUND Plans

| Account Type | Below 25K | £25K – £250K | £250K – £1ml | Above £1ml | Yearly Cap |

|---|---|---|---|---|---|

| General | £0 | £0 | £0 | £0 | N/A |

| SIPP & ISA | £7.5 or 0.35% | 0.35% | 0.20% | No Additional Charge | £90 |

| Junior SIPP & ISA | £0 | £0 | £0 | £0 | £0 |

Trading Commisions

Fidelity International trading fees are as following:

- Trading Fees: £7.5

- Regular Investing: £1.5 on the automated investing

- SICAV Mutual Funds: There is a charge when buying and selling Fidelity SICAV funds on top of FX: Up to $25,000 1.0%, $25,001 to $150,000 0.5%, Over $150,000 0.2%.

Overall Fee Simulation vs UK Tier 1 Competitors

Most of our readers have simple Index portfolios. Using our Broker Total cost calculator, you can estimate the total cost of holding ETFs throughout the investment period. For our simulated scenarios:

- General Accounts – Fidelity International is competitive

- ISAs – Fidelity International comes out as relatively expensive

- SIPPs – Fidelity International is very competitive

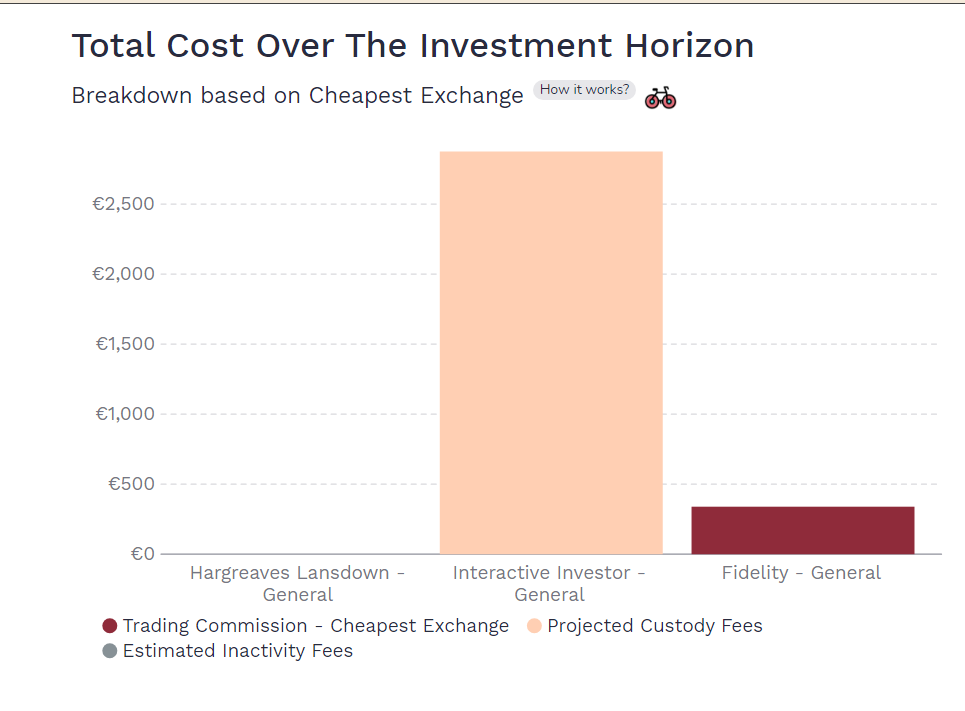

Fee Simulation For General Accounts

In the below simulation, a 20-year accumulation period broker bill for a General Trading account comes out at £342 for Fidelity International (assuming the use of regular investment plan transaction that are prices at £1.50 and the purchase of ETFs shares for which Fidelity International does not charge account fees). In this context, Fidelity International is significantly cheaper than Interactive Investor that has a total cost of £2,878 and AJ Bell (£1,182) but slightly more expensive than the £0 cost for Hargreaves Lansdown (the calculator assumes the use of its free regular investing service). Please note that the below simulation does not show AJ Bell fees.

Investor assumptions

| Model Feature | Assumption |

|---|---|

| Investor | UK |

| Instrument | UCITS ETF |

| Account | General |

| Initial Investment | £ 100,000 |

| Monthly | £ 1,000 |

| Time Horizon | 20 years |

| Gross Return | 8% |

Total Fees

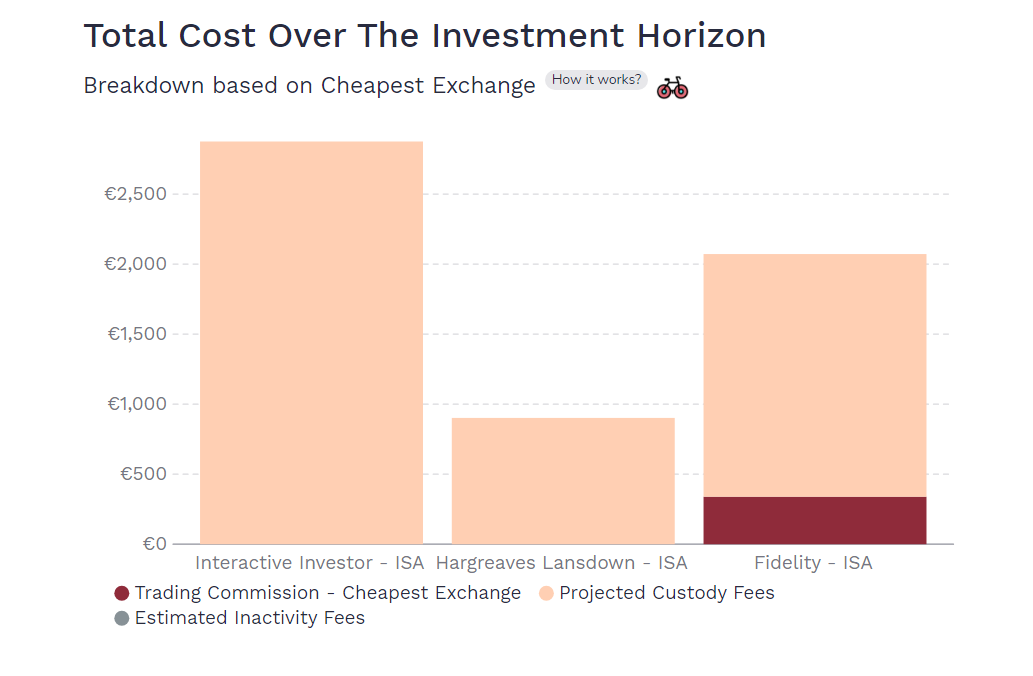

Fee Simulation For ISAs

In the below simulation, a 20-year accumulation period broker bill for an ISA account comes out at £2,075 for Fidelity International (assuming the use of regular investment plan transaction that are prices at £1.50 and the purchase of ETFs shares for which Fidelity International caps the yearly account fees at £90). Fidelity International is also in this case cheaper than the £2,878 charged by Interactive Investor, but still more expensive in comparison of Hargreaves Lansdown for which the total cost is £900 and £1,182 for AJ Bell. Please note that the below simulation does not show AJ Bell fees.

Investor assumptions

| Model Feature | Assumption |

|---|---|

| Investor | UK |

| Instrument | UCITS ETF |

| Account | ISA |

| Initial Investment | £ 100,000 |

| Monthly | £ 1,000 |

| Time Horizon | 20 years |

| Gross Return | 8% |

Total Fees

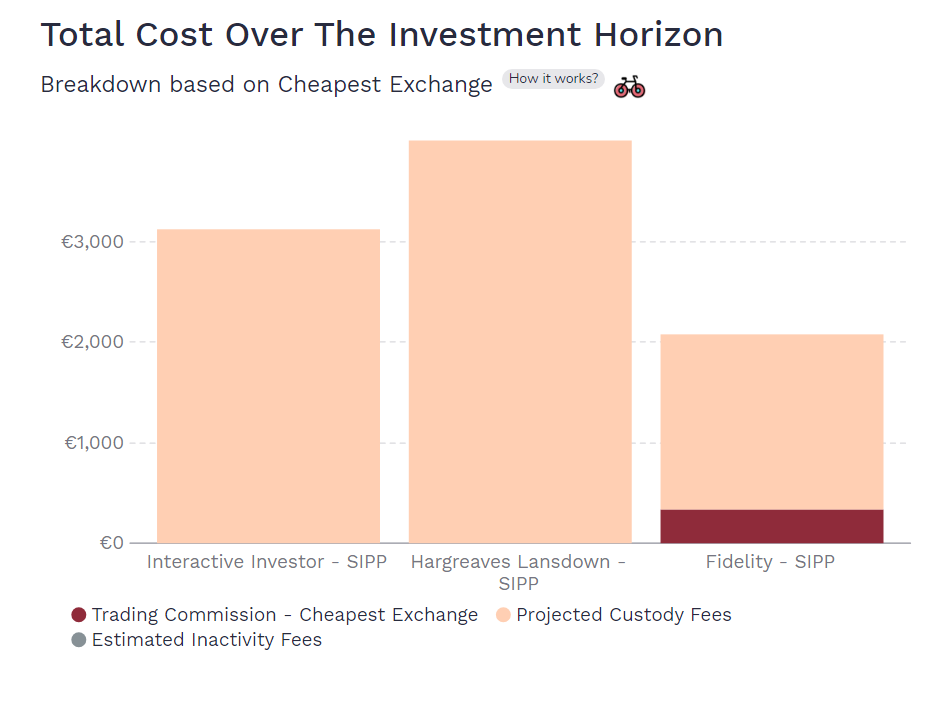

Fee Simulation For SIPPs

In the below simulation, a 20-year accumulation period broker bill for a SIPP account comes out at £2,075 for Fidelity International. Three of its direct competitors are more expensive: the charges are £3,118 for Interactive Investor, £4,000 for Hargreaves Lansdown and £2,742 for AJ Bell. Please note that the below simulation does not show AJ Bell fees.

Investor assumptions

| Model Feature | Assumption |

|---|---|

| Investor | UK |

| Instrument | UCITS ETF |

| Account | SIPP |

| Initial Investment | £ 100,000 |

| Monthly | £ 1,000 |

| Time Horizon | 20 years |

| Gross Return | 8% |

Total Fees

Currency Exchange fees

Fidelity International UK’s currency exchange fees are industry-average. They are structured with rates that decrease as the transaction amounts increase:

- Commissions: Begin at 0.75% up to £10,000, reducing to 0.50% for up to £20,000. Above £20k, the rate is the lowest at 0.25%.

- Spread: There is no information about the average spreads applied.

FX Fees

| Transaction Value | FX Fees |

|---|---|

| £0 – £10,000 | 0.75% |

| £10,000 – £20,000 | 0.50% |

| Above £20K | 0.25% |

Other fees

Deposits and withdrawal are free of charge. Fidelity International may also cover your exit fees up to £500 to transfer the shares from your current provider to them.

III. Platform & Features

Fidelity International UK stands out for its user-friendly interface, making it an ideal choice for beginners. It has several great features for long-term investors, including family accounts and good cash interest rate in comparison to other Tier 1 players. However, the platform may be limiting for advanced investors that are looking for more advanced options, including a more extensive offer of ETFs and Mutual Funds.

Account Opening Process

Opening an account with Fidelity International UK is a simple and intuitive process. Once electronic verification is successful, the account opening can be achieved rapidly, often within the same day. However, if Fidelity is unable to verify your identity electronically, they’ll ask you to upload documents online for manual verification, which could extend the process. Their customer service support is highly rated, mostly when you choose the phone option. There is a minimum amount of £1,000 to begin, however if you choose the regular investment option, you can start with only £25 a month.

account Features

Fidelity’s platform has received recognition for its quality. The Phone App is also well-designed and easy to use. Fidelity International UK offers several great features for Long-Term Investors:

- Joint & Company Accounts: Capability to create joint & business accounts as well as trusts.

- Junior Accounts (ISAs & SIPP) – Possibility to open account for your children. The option is particularly attractive because these accounts do not have service fees.

- Standing Orders – This feature is particularly attractive since the regular investment transactions are much cheaper than standard ones, and for smaller accounts they will entitle to a service fee discount.

- ETFs Selection – The platform has a good choice of Vanguard and iShares funds, but less so if you want to invest via other asset managers (such as Amundi or Xtrackers).

Internalisation and PFOF

PFOF is not allowed in the UK therefore Fidelity International UK does not engage in this practice. Fidelity has also specified that they do not engage in this practice worldwide.

Cash Interest

Fidelity International offers interest rates on cash balances that are above its direct competitors, although they may not compete with the more attractive rates offered Tier 2 brokers. The interest rate is 3.5% gross and 3.5% AER (although for SIPP is at 3.7%). The rate is below the SONIA rate (5.2%) as of 20th March 2024.

Advanced Features

Fidelity International UK prioritises simplicity and a focus on traditional investment products. As such, it does not offer advanced trading features like Futures, Options, Derivatives, and Margin Loans, catering more to investors looking for straightforward investment options. In addition, it offers mostly transaction on LSE exchange. Below a summary of the available investment types:

Features

| Investment Type | Availability |

|---|---|

| ETFs | ✅ |

| Stocks | ✅ |

| Bonds | ❌ |

| Funds | ✅ |

| Options | ❌ |

| Derivative | ❌ |

| Futures | ❌ |

| CFDs | ❌ |

| Forex | ❌ |

| Crypto | ❌ |

| Commodities | ❌ |

IV. Taxes

Tax Wrappers

Fidelity International UK offers the most common tax-advantaged accounts available in the UK. This includes:

- ISA

- Junior ISA

- Junior SIPP

- SIPP

Tax Reporting

Fidelity international UK provides detailed tax and consolidate reports, however the reporting functionality to the tax authority is not automated and is responsibility of the individual investor.

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – BlackRock Launches New iBonds, Truth About €1M Broker Insurance & BOW is 4 years old!

The Truth About €1 Million Broker Guarantees

4 Things I Learned In 4 Years Of Running A Finance Blog

Dodl By AJ Bell Review – AJ Bell’s Younger Brother

Vanguard LifeStrategy Review – A Retriever In A Babushka Doll

Why Do Portfolio Managers Care About Factors? It’s Not What You Think.

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.