Weekend Reading – Best Bond ETFs & 9 Biggest Mistakes Millennials Make

Weekend Reading is a collection of Investment Research and Lifestyle topics from all corners of the Web.We source the highest quality insights from Wall Street and Main Street that you may apply to your investment process. Unlike the rest of Bankeronwheels.com, this series is provided without additional guidance. As usual, everything is to be used at your own risk. Below is the type of content we shortlist.

Invest Wisely section is dedicated to research on how to invest for the Long Run using Passive Investment Strategies. Read Topics related to (i) Portfolio Construction and Asset Allocation (ii) Acting wisely by avoiding behavioural traps and also (iii) publications that help understand how financial markets work.

Active Investing section relates to improving your knowledge about active investing. If you decide to sin, then sin only a little. Given ample evidence, combined active bets should be ideally a relatively small fraction of your portfolio. This section also includes Sustainable Investing. You can invest in a Socially Responsible way, but there are many ESG traps. Learn how to invest sustainably, and what it means for expected returns, with our definitive guide to sustainable investing.

Personal Finance section is dedicated to UK and European Products. It can also touch on other European jurisdictions outside the Euro-zone.

- Recommeded Reading

- Youtube (Required watch time)

- Podcast (Listening Time)

- Academic Research - May require intermediate/advanced knowledge

- Noteworthy Twitter Thread

If investing wasn't hard, everyone would be rich.

Charlie Munger

INVEST WISELY

CONSTRUCT YOUR PORTFOLIO

Bond Yields are at decade high, but Bonds are also a shield for your medium and long-term portfolios, including when deflation strikes. This makes them a mandatory component for any portfolio.

Explore how investment horizon, geographical diversification, risk & return tradeoff & the specific ETF characteristics are important pillars of selecting a long term Bond ETF for your portfolio.

We also have a list of Best ETFs.

- Why Aren’t Investors Selling Stocks to Buy Bonds? (A Wealth of Common Sense)

- Market Cap (Weighted) Hated Indexes (Italian Leather Sofa)

- One of the best ways to build and maintain an investment portfolio is by stress testing different scenarios (Morningstar)

- Evidence on the stock-bond correlation (Robeco Qauntitative Investing)

- Does Adding Dividend Stocks Improve Portfolio Performance? (Morningstar)

- Is Gold a Good Inflation Hedge? (Invested with you)

UNDERSTAND FINANCIAL MARKETS

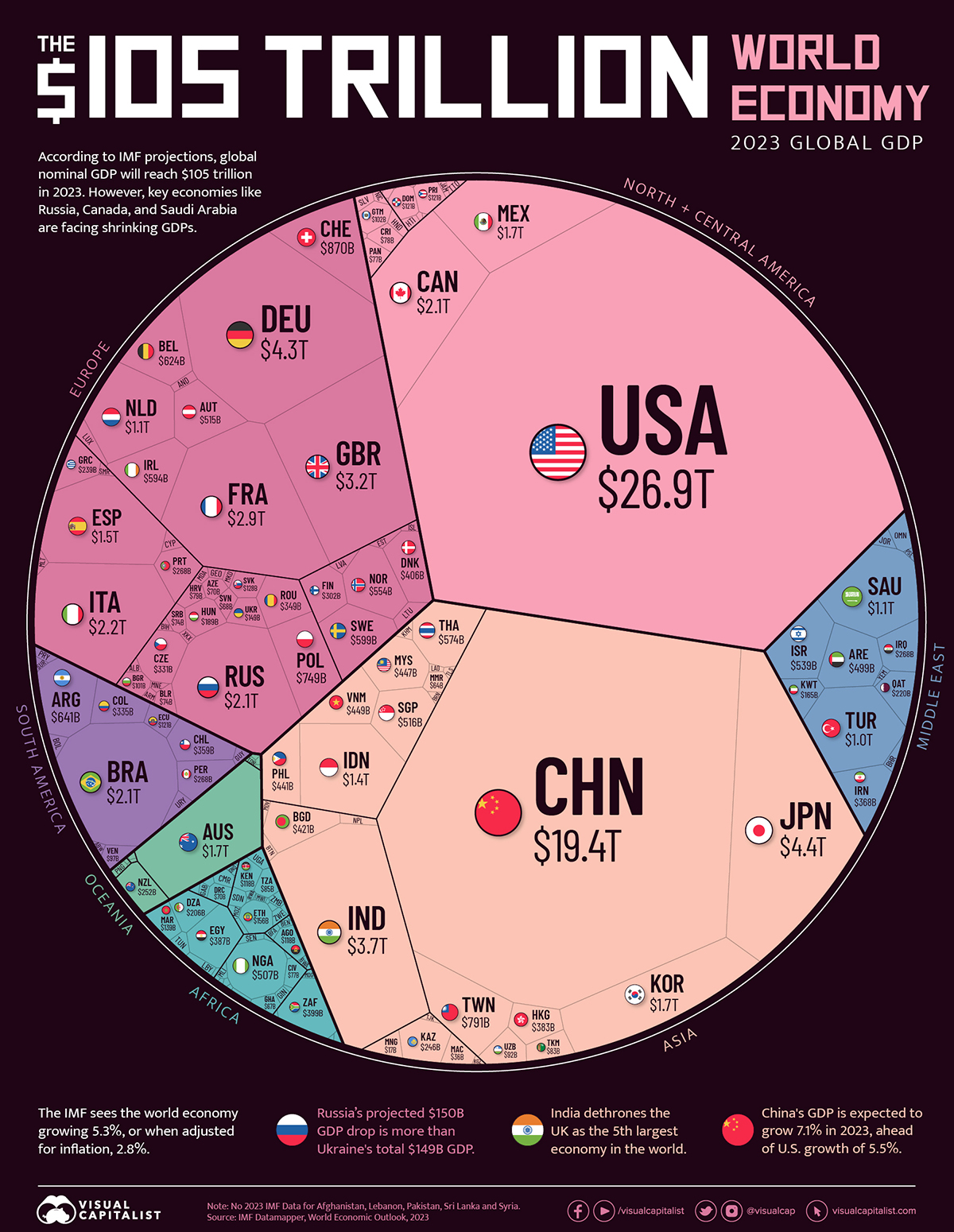

By the end of 2023, the world economy is expected to have a gross domestic product (GDP) of $105 trillion, or $5 trillion higher than the year before, according to the latest International Monetary Fund (IMF) projections from its 2023 World Economic Outlook report.

In nominal terms, that’s a 5.3% increase in global GDP. In inflation-adjusted terms, that would be a 2.8% increase.

The year started with turmoil for the global economy, with financial markets rocked by the collapse of several mid-sized U.S. banks alongside persistent inflation and tightening monetary conditions in most countries. Nevertheless, some economies have proven to be resilient, and are expected to register growth from 2022.

Read more on Visual Capitalist

- Is Britain really as poor as Mississippi? (FT.com - click on the first link)

- How economic complexity determines which countries become rich (Bloomberg - 51 min)

- The Fitch Downgrade: The Principal–Agent Problem in Modern Finance (CFA Institute)

- A Good Company and a Good Investment Aren't Always the Same (Morningstar)

HOW TO INVEST

Active Investing

FACTOR investing

discretionary investing

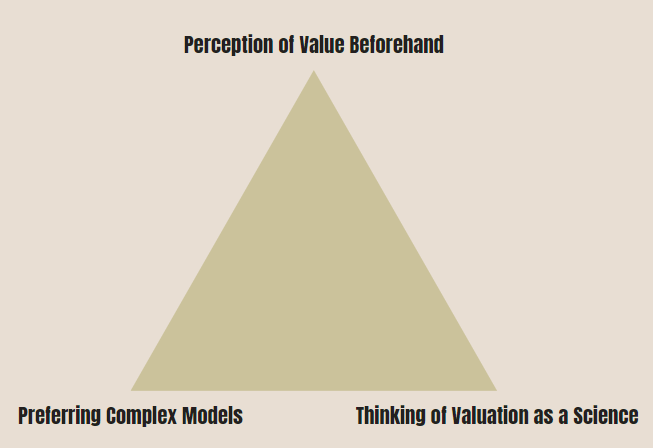

Aswath Damodaran is the ‘Dean of Valuation.’

For almost four decades, he has been teaching valuation at NYU. He also teaches millions of people online.

Here are 7 Key Valuation Lessons from him

Read more on Twitter

ALTERNATIVE ASSET CLASSES

WALL STREET

SUSTAINABLE investing

crypto

BAD BETS

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

PERSONAL FINANCE

Wealth Management

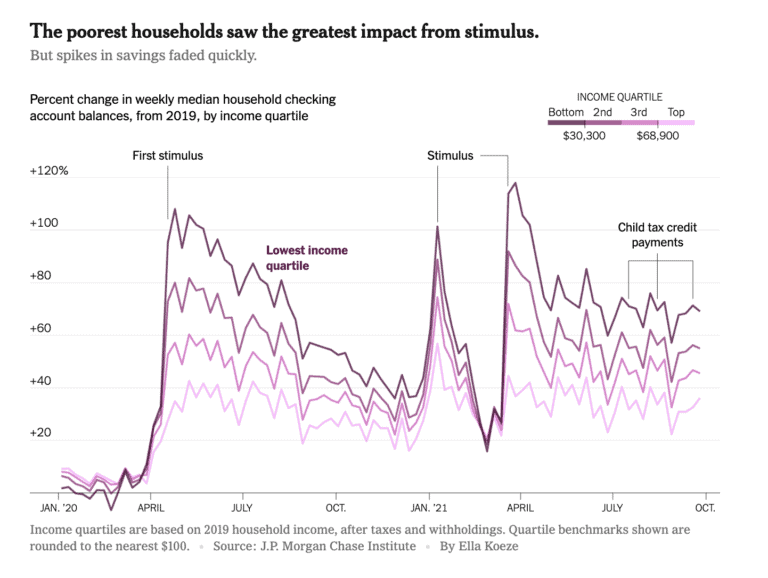

What’s the most important thing when it comes to building wealth? Is it what you invest in? Is it when you start? How about your mindset? The consensus is that the best predictor of whether someone is likely to build wealth is—their income. It’s not their asset allocation, their investment knowledge, or their financial goals that matter but What about someone’s spending? There are plenty of celebrities who had very high incomes but still went broke!

Read more on Of Dollars and Data

Early Retirement

FINANCIAL PRODUCTS

COST OF LIVING

OUR Community

Question of the week

Personal Development

Tim Ferriss Is Changing His Mind (Rich Roll - 2 hr 8 min)

While Tim is known and revered for his wisdom regarding optimization and productivity, it’s his arc as a human that is equally impressive. He’s been through a lot. He’s grown considerably. And he’s shared his personal and professional struggles with a laudable degree of courage and vulnerability. This exchange centers on Tim’s inward journey. How he grapples with anxiety and depression. The ways he learned to face difficult emotions. And the various modalities he has explored from silent meditation and psychotherapy to psychedelics.

- The secret to happiness - how to let go & stop worrying (The daily stoic - 13 min)

- In conversation with Dustin Moskovitz on coaching for endurance, no meeting Wednesdays, AI and more (The Tim Ferris Show - 1 hr 58 min)

- The Science of Joy: Why You Need It and How to Get It (Ten Percent Happier - 1 hr)

Health & Wellness

CAREERS

Travel

While you may be here to read about investing, there will be many of you who are curious about ways to travel the world on a bike while lowering the costs of travel, in general. Here are some key practical insights to get started, and an example of setup that can help you discover some of the most unique, and untapped places on our beautiful planet. From setting up, flights, accommodation, technology & leveraging local communities, this is an adventure worth taking second to none!

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

miscellaneous

Fool Me Once author Kelly Richmond Pope explains how fraud became a trillion-dollar industry and helps us avoid becoming its latest victims. Join in on a fascinating discussion on what types of people commit fraud, what is the fraud triangle, Why fraud seems more common and more severe, the multifarious faces of fraud & how businesses and individuals can avoid becoming the next victims

OUR Community

Last Week We asked you

How would you describe your current life situation?

SUGGEST AN ARTICLE

Thank you for reading.

Good Luck & keep’em* rolling!

(* Wheels & Dividends)

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – BlackRock Launches New iBonds, Truth About €1M Broker Insurance & BOW is 4 years old!

The Truth About €1 Million Broker Guarantees

4 Things I Learned In 4 Years Of Running A Finance Blog

Dodl By AJ Bell Review – AJ Bell’s Younger Brother

Vanguard LifeStrategy Review – A Retriever In A Babushka Doll

Why Do Portfolio Managers Care About Factors? It’s Not What You Think.

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.