Weekend Reading – Should Your Job Determine How You Invest?

Weekend Reading is a collection of Investment Research and Lifestyle topics from all corners of the Web. We source the highest quality insights from Wall Street and Main Street that you may apply to your investment process. Unlike the rest of Bankeronwheels.com, this series is provided without additional guidance. As usual, everything is to be used at your own risk. Below is the type of content we shortlist:

The art of investment is the discipline of inaction in the absence of a good opportunity, but aggressive action when one is identified.

Li Lu

Portfolio Construction

Asset Allocation

Interactive Brokers is a Top Tier platform: Passive Investors will appreciate very competitive fees, family subaccounts and the ability to put investing on autopilot using monthly standing orders. For investing geeks, it opens the door to running a family hedge fund by unlocking access to U.S. markets including Factor ETFs, advanced portfolio management techniques including synthetic leverage or margin loans.

Whether you are investing for the Short or Long Term, Bonds are a key component in a portfolio.

Today, we will spotlight the different bond categories. Which goals do you pursue? The category of bonds largely depends on the answer to this question. We will also go through bonds you may want to avoid, to accomplish your goals. Let’s dive in!

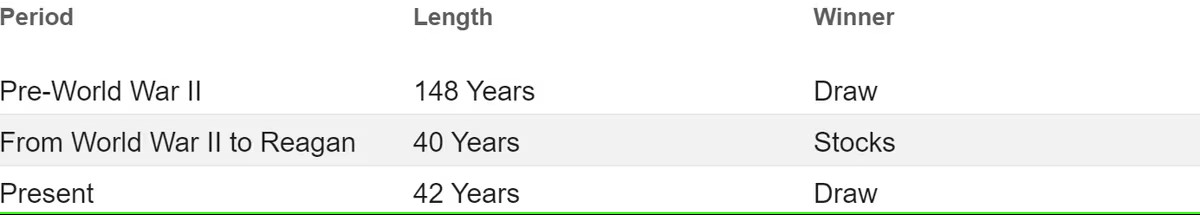

There is a raging debate about a couple recent academic papers we highlighted in prior weeks – one arguing that Bonds – in the long run – may be overrated, another that if we add more data prior to WW2, Stocks don’t look so good. What should you make of it?

Read more on Morningstar.

UNDERSTAND FINANCIAL MARKETS

- It’s Official: Passive Funds Overtake Active Funds (Morningstar)

- S&P 500 Very Expensive Relative to International Equities (Apollo)

- What Taiwan's election result means for Beijing relations (FT - 1 Min)

- Lessons From the Bear Market (The Irrelevant Investor)

- New All-Time Highs After a Bear Market (A Wealth of Common Sense)

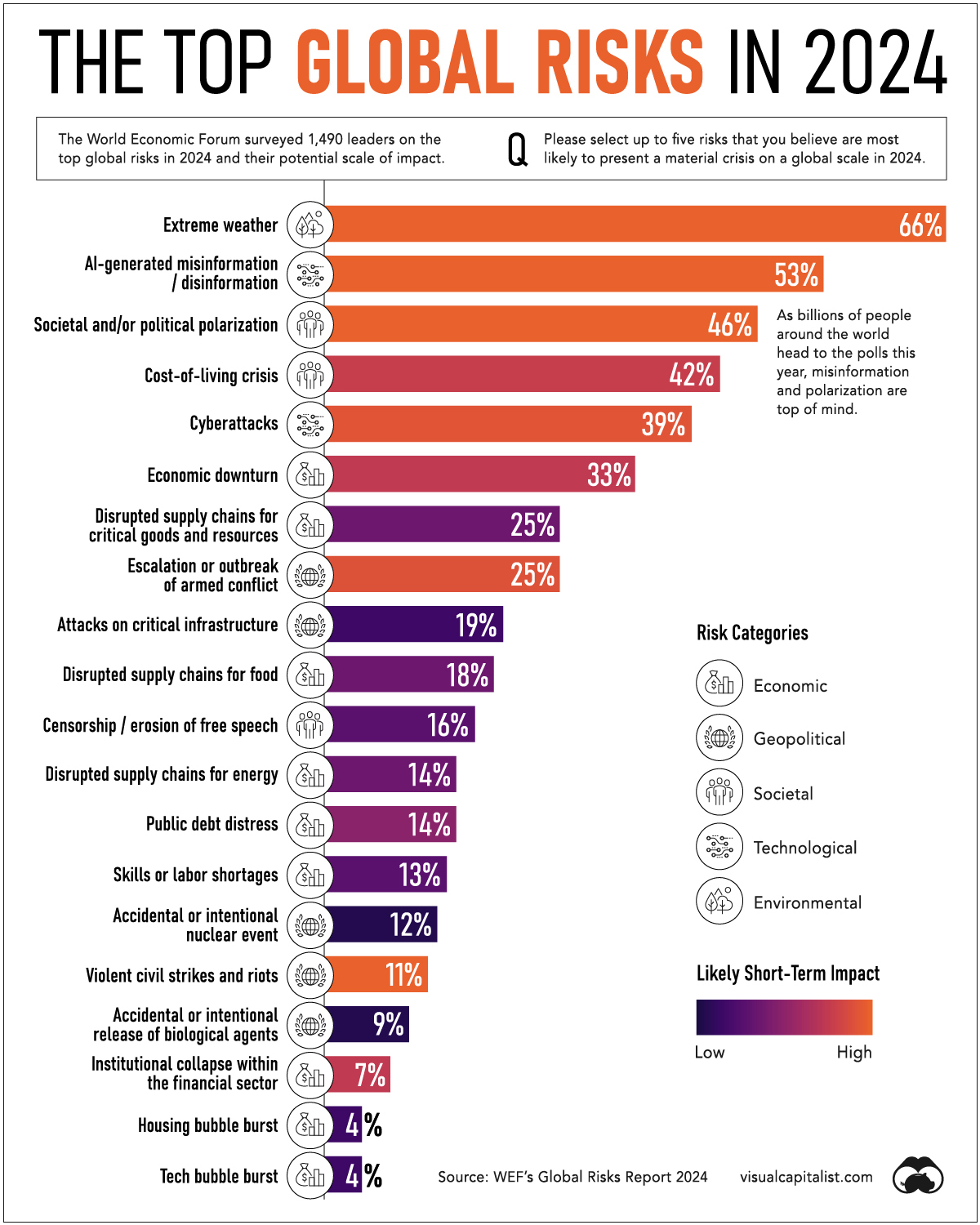

What is the global risk landscape in 2024?

Record global temperatures are leading to increasingly harmful impacts, a cost-of living crisis is making everyday life harder for people around the world, and escalating tensions in the Middle East have the potential to widen into a broader regional conflict.

Meanwhile, in 2024 it’s expected to be the world’s biggest election year ever with 4 billion people casting a vote across 60 countries. Will threats such as misinformation and polarization loom large as people head to the polls?

Read more on Visual Capitalist

HOW TO INVEST

Active Investing

FACTOR investing

Last summer, three researchers published an interesting paper that hammered home the importance of good data, and how subtle input changes (inadvertent or deliberate) can radically alter the conclusion.

The paper — “Noisy Factors”, by Pat Akey, Adriana Robertson and Mikhail Simutin — showed how the returns of several big theoretical drivers of investment returns could vary wildly depending just on what timeframe one measured.

Read more on FT (Click First Link)

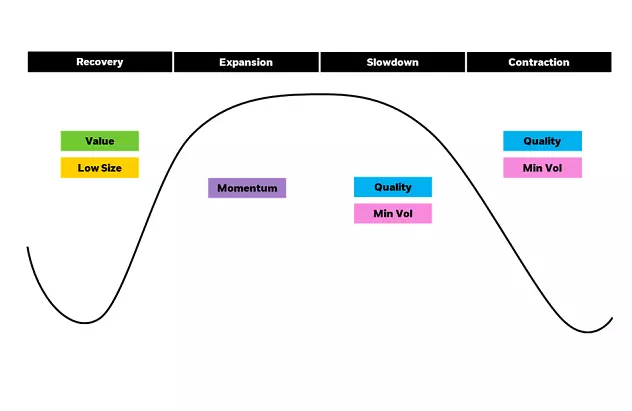

Factors are long run drivers of portfolio risk and returns. Having strategic allocations to factors may increase a portfolio’s expected return. As factor performance is cyclical, investors may be able to drive additional alpha in portfolios by tilting towards factors in a systematic way. Tilting decisions to any factor can be driven by the current economic regime or valuations.

discretionary investing

ALTERNATIVE ASSET CLASSES

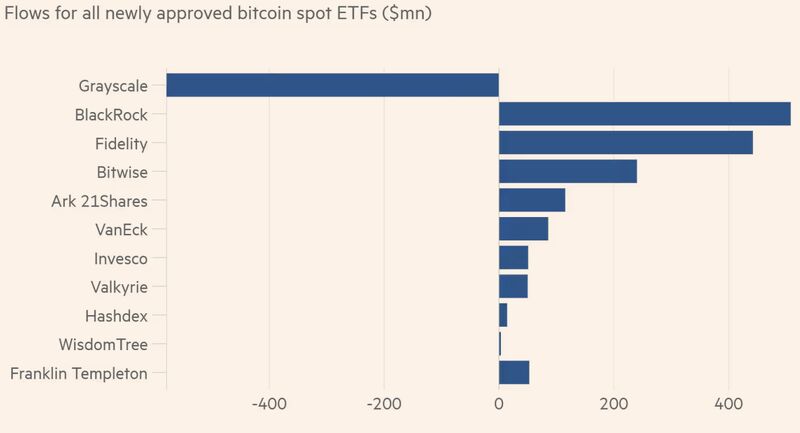

Has the Bitcoin ETF launch been an anti-climax? Most of the inflows come from Greyscale outflows. Also, 3 days in and Bitcoin ETFs have pulled in net new assets of just under $900mn.

That’s less than the $1bn that ProShares pulled in on its first two days after launching a bitcoin futures ETF back in October 2021.

Read more on FT (Click Second Link)

WALL STREET

This week, we speak with Matt Levine, Opinion columnist at Bloomberg. He is the author of Money Stuff, one of the most popular daily newsletters on Wall Street. Previously, he was an investment banker at Goldman Sachs and a mergers and acquisitions lawyer at Wachtell, Lipton.

SUSTAINABLE investing

BAD BETS

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

ETFs

UCITS ETFS

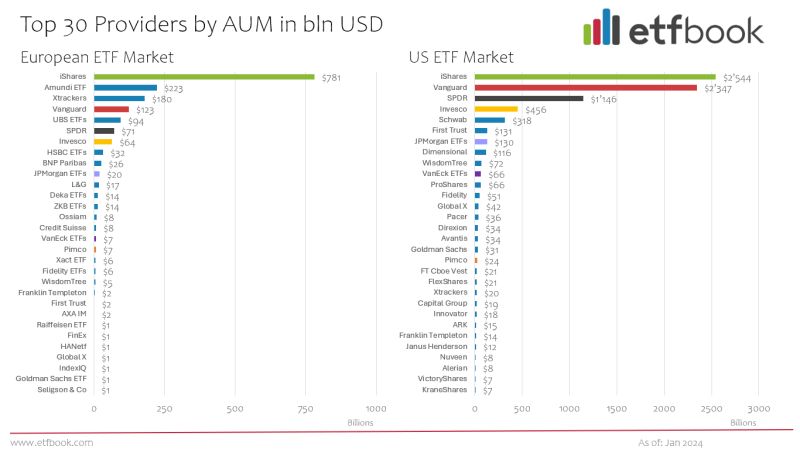

ETF Book Provided an updated overview of the US and European ETF markets by leading Issuers. US ETF market: AUM $7.96 trillion – European ETF market: AUM $1.81 trillion. iShares is leading in the US, but Vanguard is closing the gap. In Europe, iShares is much more dominant.

US ETFs

BlackRock is set to launch ten ETFs focused on Treasury inflation-protected securities (TIPS). Ranging in maturity from 2024 to 2033, these ETFs will seek to provide inflation protection to investors concerned with erosion of purchasing power. The new TIPS-defined maturity bond ETFs will carry an expense ratio of 0.1%. [ETF.com]

Personal Finance

Are You in the One Percent? (Patrick Boyle - 31 Min)

How much do you need to earn per year to be in the top 1%? The answer to this question varies depending on if you are asking about the 1% in a given country or globally?

In today’s video we discuss how much you have to earn and how wealthy you have to be to be considered in the top one percent. We discuss the careers and lifestyles of the one percent. We look at inequality research to try to understand if inequality is actually growing as much as researchers like Thomas Piketty say it is.

Scott has just penned a new book, Tightwads and Spendthrifts: Navigating the Money Minefield in Real Relationships, which serves as a guide for finding happiness while steering through money and love. We break down the psychology of tightwad and spendthrift behaviours, how these two personality types interact with one another in relationships & the myths of financial infidelity.

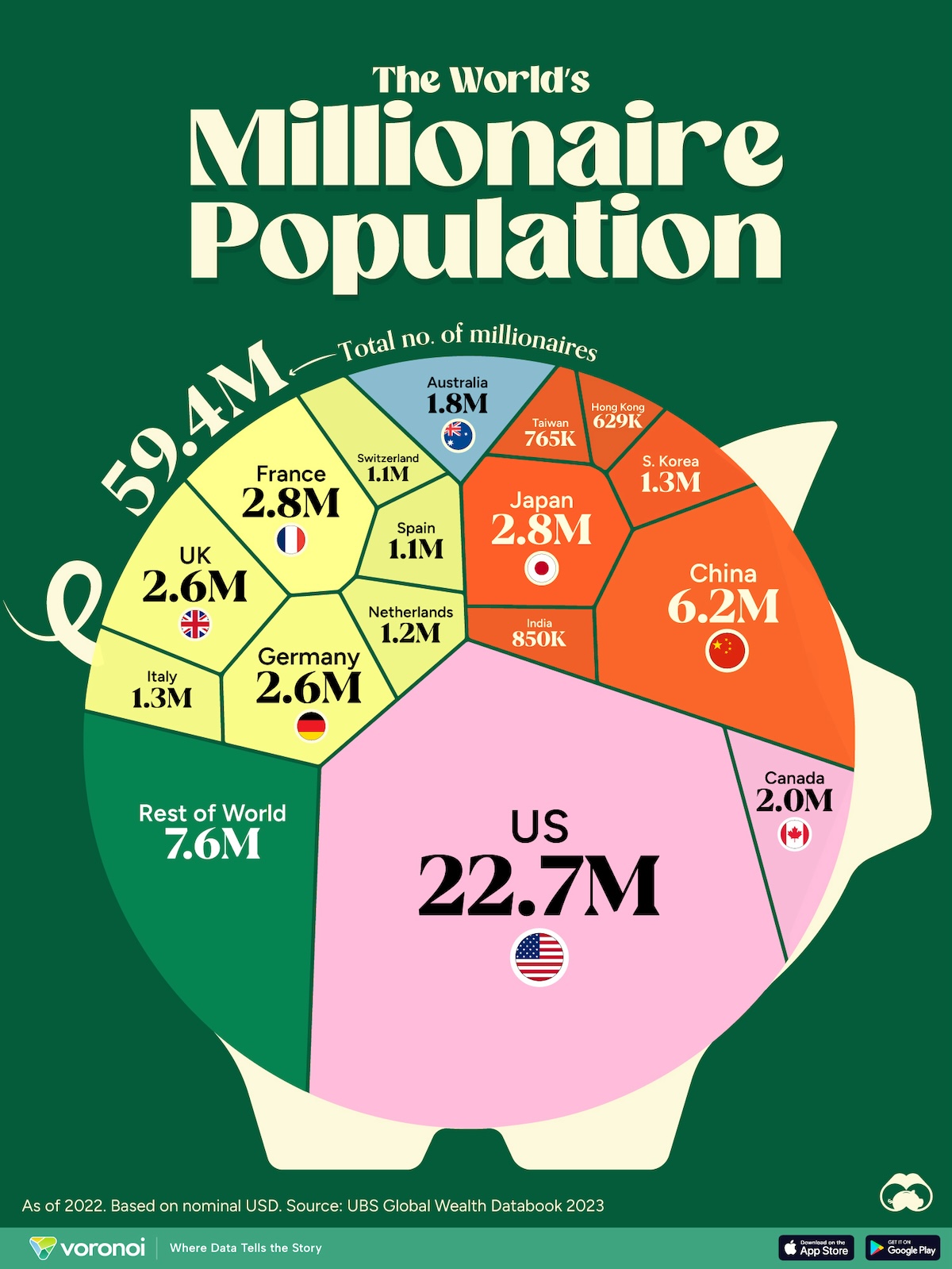

From UBS and Credit Suisse’s comprehensive Global Wealth Report 2023, we visualize the world’s millionaire population by country. Their databook details the sources they used, including household balance sheet data from the World Bank, the World Income Inequality Database, surveys, tax data, and Forbes’ findings.

UBS defines millionaires as individuals whose total wealth (including financial and non-financial assets, minus household debt) is at or above $1 million, using “smoothed exchange rates.” These are 2021 average currency exchange rates with the U.S. dollar, adjusted for inflation differences between the U.S. and concerned country, but not adjusted for U.S. inflation between 2021 and 2022.

Read more on Visual Capitalist

Early Retirement

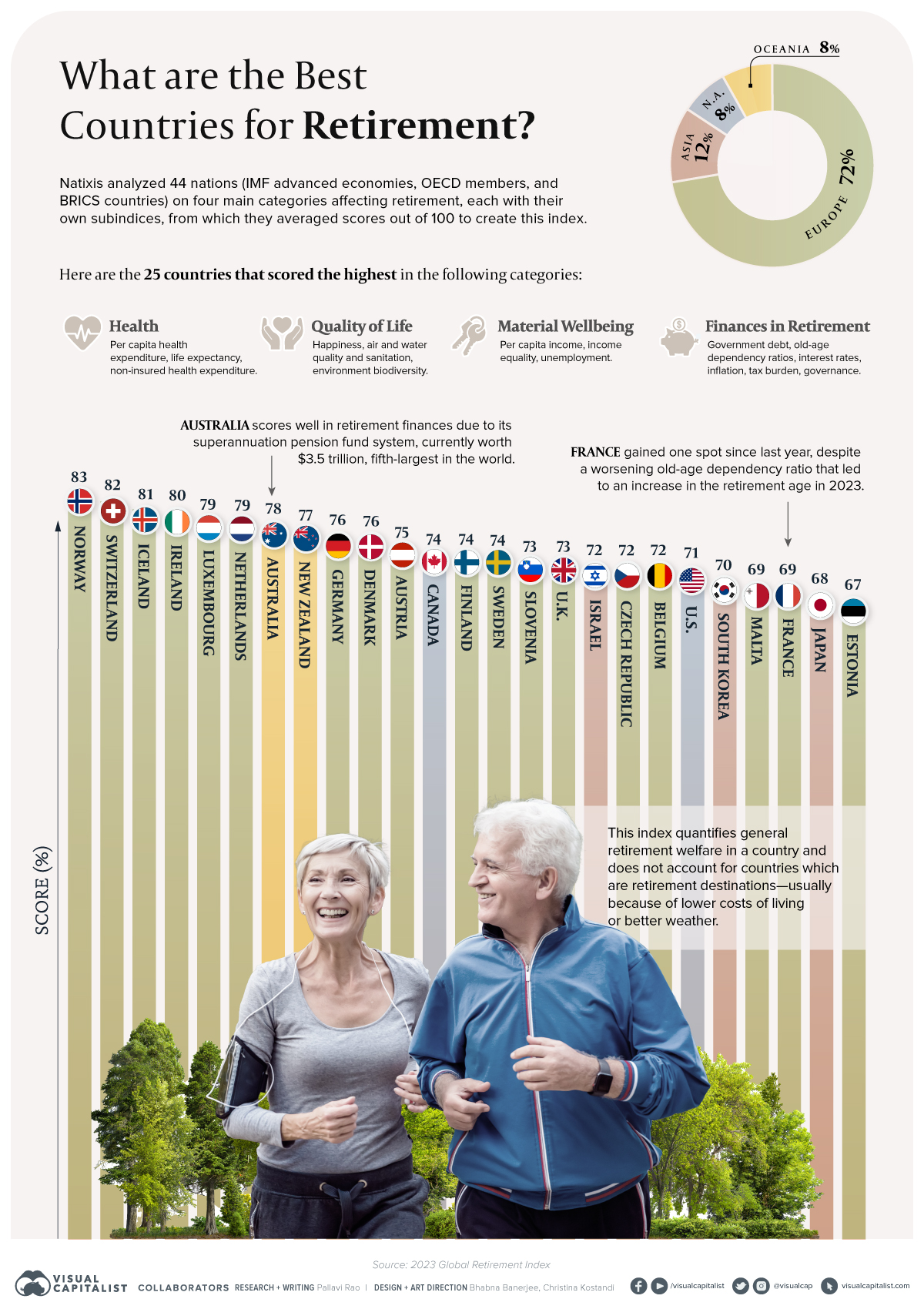

In 1881, Otto von Bismarck proposed a radical idea for retirement: people above the age of 70 would be given a state pension, encouraging them to stop working. This model has since been adopted en masse and most countries now have a retirement age, after which workers can claim benefits paid through years of their work. However, modern-day retirement is much more than just finances. Wealth management company Natixis analyzed 44 nations on four main categories affecting the ability for their residents to retire well in the 2023 Global Retirement Index. Each category has subindices, from which they averaged scores out of 100 to create this ranking.

Read more on Visual Capitalist

Personal Development

Health & Wellness

CAREERS & Entrepreneurship

Noah Kagan (@noahkagan) was #30 at Facebook, #4 at Mint, and has since created seven million-dollar businesses (Kickflip/Gambit, AppSumo, KingSumo, SendFox, Sumo, TidyCal, and Monthly1k).

He is the CEO of AppSumo.com, the #1 software-deals site for entrepreneurs, and has a popular YouTube channel, Noah Kagan.

The 4 things it takes to be an expert (Veritasium - 18 Min)

The four things are:

1. Valid environment

2. Many repetitions

3. Timely feedback

4. Deliberate practice

Travel

Curious pedals – cycling from finland to singapore (video) (Bikepacking.com - 1 Hr 11 Min)

In 2022, friends Alvari Poikola and Valtteri Heinilä pedaled 15,000 kilometers across more than 20 countries, departing from their home in Finland and completing their ride in Singapore. “Curious Pedals” is a feature-length documentary about their incredible eight-month journey across Europe and Asia.

Tech & Economy

economy

Why Greece Is Suddenly Doing Really Well (Economics Explained - 16 Min)

Greece became infamous for their economic stagnation following adoption of the Euro and subsequent over-spending and debt accumulation. But in recent years their economy has been improving and, while it isn’t out of the woods yet, there have definitely been big improvements that are worth celebrating. Are they still broke, or will Greece’s economy be an example to others how to recover from financial meltdown?

TECH AND SCIENCE

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

And finally

On Jan. 5, the plug door of an Alaska Airlines 737 Max 9 blew out mid-flight, forcing the plane into an emergency landings with a large hole in fuselage. Miraculously, nobody was hurt or killed, but it could have been a disaster. And it was the latest in the persistent string of mechanical and engineering setbacks that have plagued Boeing over the last six years. So what’s wrong with Boeing?

Bankeronwheels.com, born during the COVID pandemic, began as a personal blog blending cycling with investing insights.

By 2023, the blog had exceeded any growth expectations we had. Today, we want to make the blog the most impactful to our readers.

And there was no better than asking your opinion on how to bring it to the next level. Here are some takeaways from our last month’s survey.

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – BlackRock Launches New iBonds, Truth About €1M Broker Insurance & BOW is 4 years old!

The Truth About €1 Million Broker Guarantees

4 Things I Learned In 4 Years Of Running A Finance Blog

Dodl By AJ Bell Review – AJ Bell’s Younger Brother

Vanguard LifeStrategy Review – A Retriever In A Babushka Doll

Why Do Portfolio Managers Care About Factors? It’s Not What You Think.

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.