Weekend Reading – Do you need real estate in your portfolio?

Weekend Reading is a collection of Investment Research and Lifestyle topics from all corners of the Web. We source the highest quality insights from Wall Street and Main Street that you may apply to your investment process. Unlike the rest of Bankeronwheels.com, this series is provided without additional guidance. As usual, everything is to be used at your own risk. Below is the type of content we shortlist:

I only start counting [sit ups] when it starts hurting because they're the only ones that count. That's what makes you a champion.

Muhammad Ali

Featured

Trying to beat the market is an entertaining activity. It may look easy. But, what if you’re getting yourself into an investing minefield? What’s the potential damage if you pick a loser? Especially if you do it in an overheated market? Sure, your stock-picking cousin may get lucky in the short term. But, here are nine charts showing why – in the long run – he will underperform.

Portfolio Construction

Asset Allocation

- Bond Ladders Gain Traction in Direct Indexing (Think Advisor)

- Lifetime Financial Advice: A Personalized Optimal Multilevel Approach (CFA Institute)

- Self-Declared Benchmarks and Fund Manager Intent: “Cheating” or Competing? (Alpha Architect)

- Don't let any single asset distract you from your overall portfolio.(Mutiny Funds)

- Inflation-protected bonds are seeing a backlash. (The Economist - Paywall)

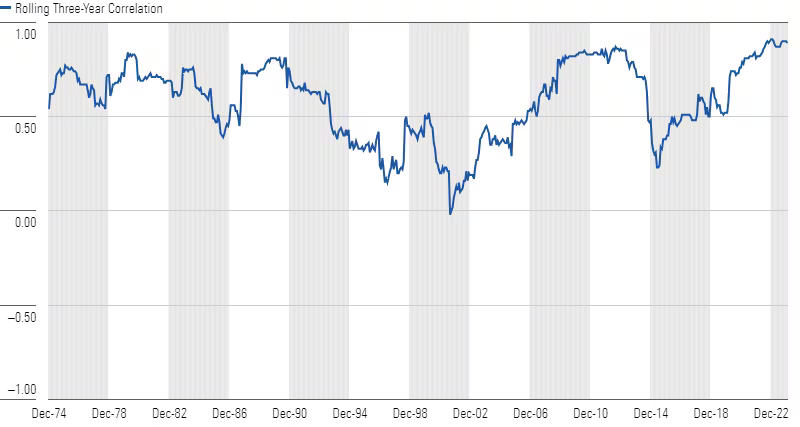

Real estate as an investment asset can take many different forms. In this article, I’ll focus mainly on real estate investment trusts and REIT funds, which are the most liquid type of real estate available to the average investor. In contrast to buying real estate directly, REITs don’t involve an extra operational burden of maintaining the property over time. But, there are issues with it as well.

Read more Morningstar

UNDERSTAND FINANCIAL MARKETS

- How Often Do Bear Markets Occur? (A Wealth of Common Sense)

- How indexing has made for a better financial advice industry. (Morningstar)

- Joe Weisenthal and Tracy Alloway talk with Steven Kelly about how bank bailouts now work. (Oddlots - 43 Min)

- Good luck modeling the 10-year Treasury yield. (The Spectator)

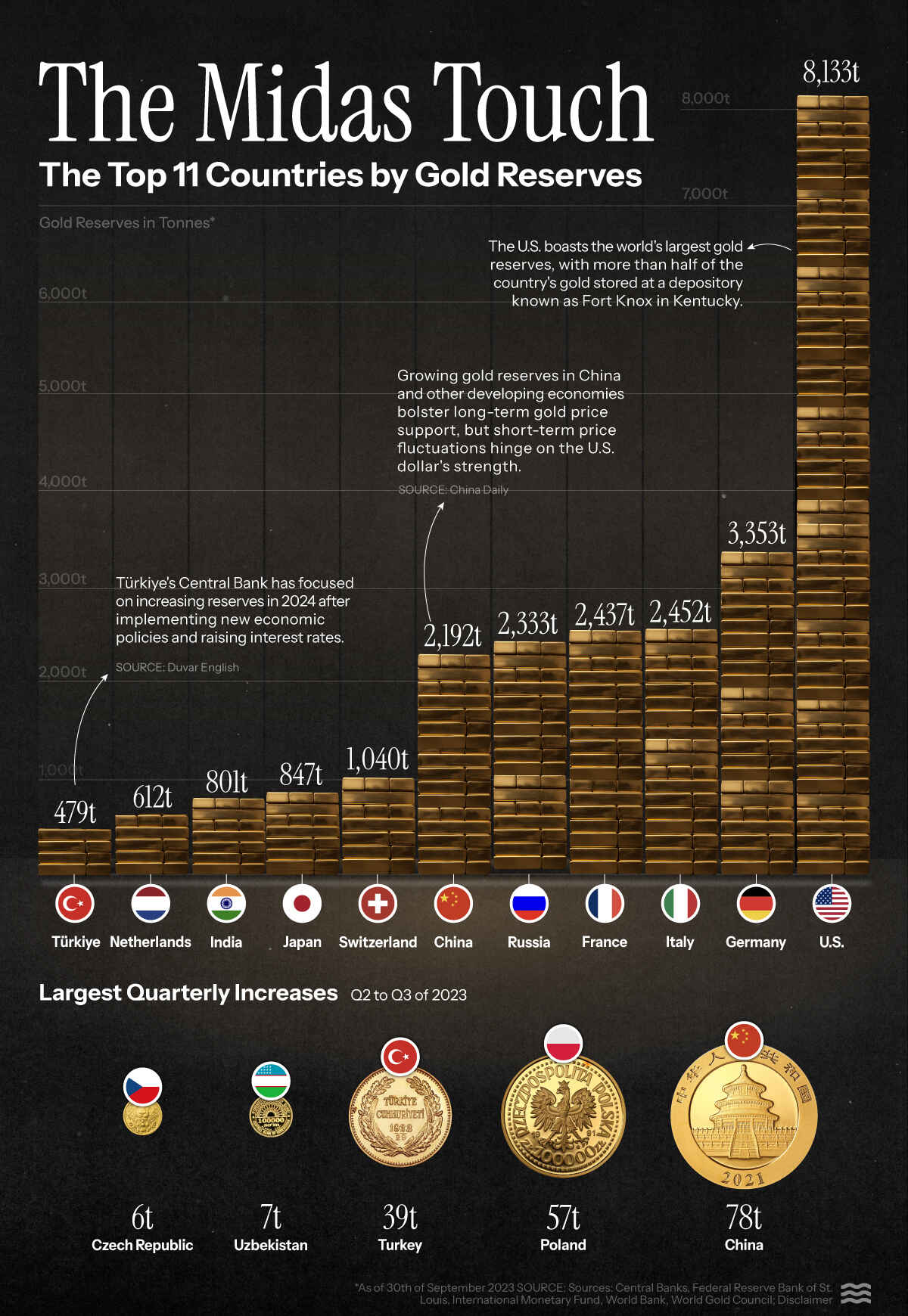

Gold remains an important store of value, serving as a hedge and retaining value during economic crises. In 2023, amid uncertainty about US interest rates and continued geopolitical risks, the metal once again demonstrated its importance by hitting a new record in December.

This graphic, by Sam Parker, displays the top 11 countries by gold reserves as of September 2023, based on data from Central Banks, the Federal Reserve Bank of St. Louis, the International Monetary Fund, the World Bank, and the World Gold Council.

Read more Visual Capitalist

HOW TO INVEST

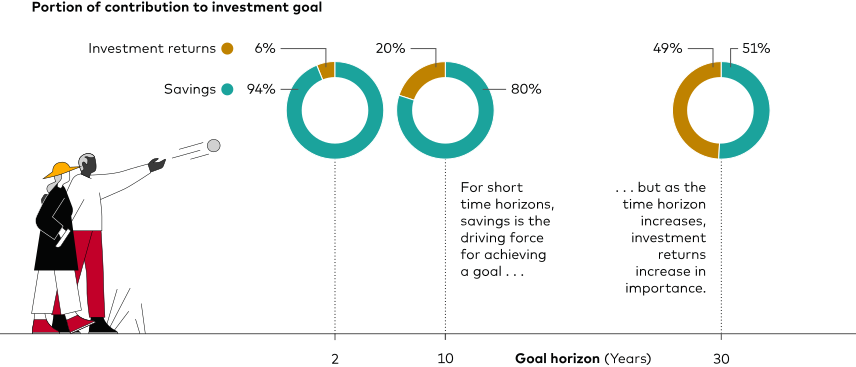

The start of the year is a great time to get aware of and aligned with the four Vanguard-recommended principles for investment success. Our principles focus on the things within your control, so you can create an actionable plan that takes you closer to your goals, one step at a time.

Read more Vanguard

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

Active Investing

FACTOR investing

- A Better Approach to Dividend Investing (Meb Faber - 8 Min)

- Barry Ritholtz talks value investing with Jeremy Schwartz of WisdomTree Investments (Ritholtz - 15 Min)

- On the Persistence of Growth and Value Stocks (Alpha Architect)

- Does cross-asset momentum work? (Finominal, Paywall)

- The straightforward case for the low volatility effect. (Enterprising Investor, Paywall)

This one is jam-packed with a variety of topics which range from structural differences in growth between Europe and the U.S to Joachim’s fascinating concept of industry “Cassandras”. Plus, we have the usual beloved banter, industry updates, and burning questions from listeners just like you. Tune in to cash out!

discretionary investing

ALTERNATIVE ASSET CLASSES

In today’s episode, we dive into Tina’s teams’ recent piece about what they call a possible “once-in-a-generation opportunity” in emerging market local currency debt. Tina gives a great overview of the emerging market debt asset class, and then we dive into the reasons behind her team’s call. She shares why today is reminiscent of 2004 and how she thinks about things like liquidity panics and sanctions risk.

WALL STREET

SUSTAINABLE investing

BAD BETS

UCITS ETFS

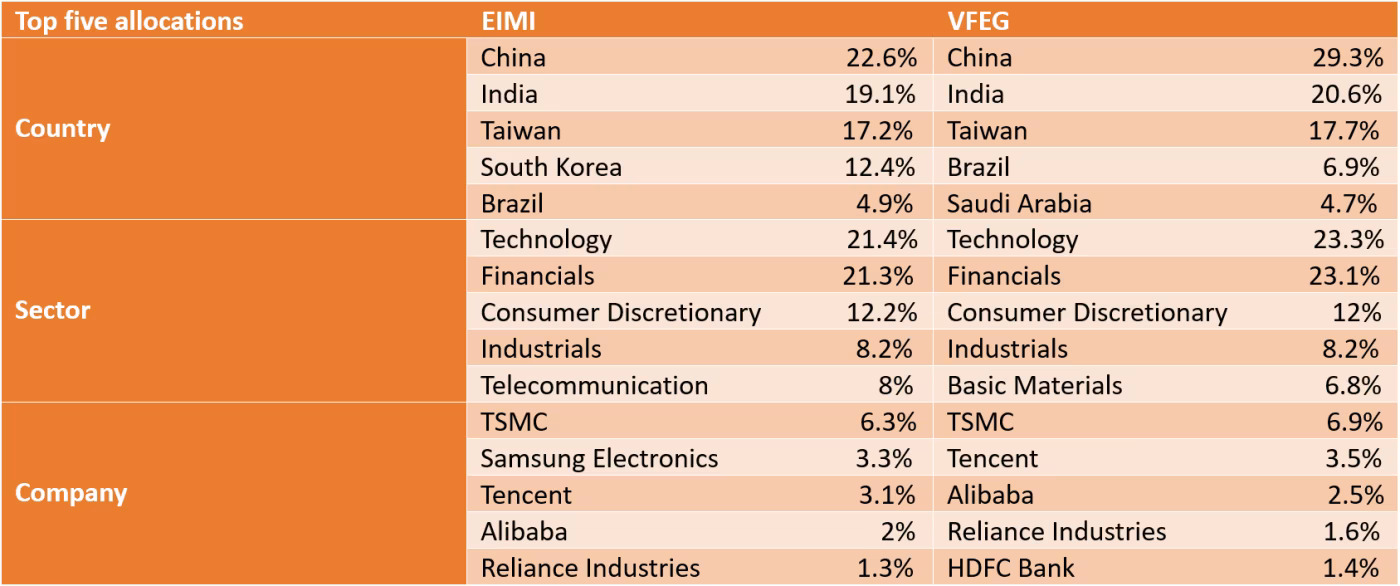

After a ‘lost decade’ spelled triple-digit underperformance for emerging markets, investors hunting for diversification and a comeback in developing economies may seek out ETFs such as those offered by BlackRock and Vanguard.

Read more on ETF Stream

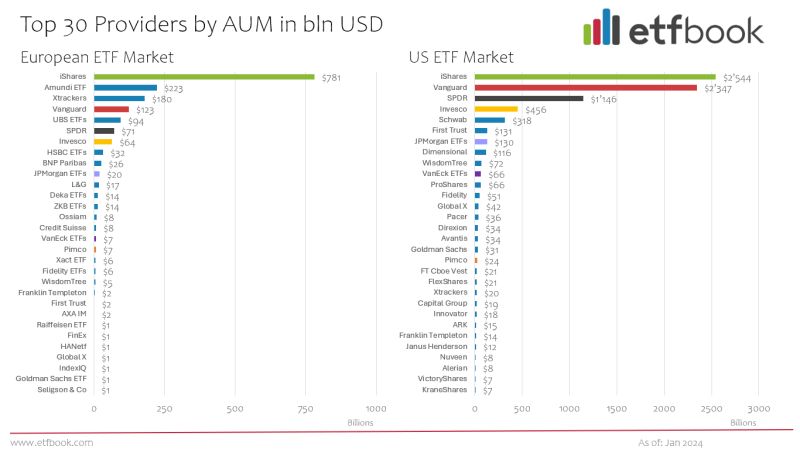

ETF Book Provided an updated overview of the US and European ETF markets by leading Issuers. US ETF market: AUM $7.96 trillion – European ETF market: AUM $1.81 trillion. iShares is leading in the US, but Vanguard is closing the gap. In Europe, iShares is much more dominant.

US ETFs

BlackRock is set to launch ten ETFs focused on Treasury inflation-protected securities (TIPS). Ranging in maturity from 2024 to 2033, these ETFs will seek to provide inflation protection to investors concerned with erosion of purchasing power. The new TIPS-defined maturity bond ETFs will carry an expense ratio of 0.1%. [ETF.com]

Wealth Management

Personal Finance

When choosing a broker, investors face a myriad of considerations, from safety measures to fee structures and beyond. Bankeronwheels.com takes a unique approach to broker comparison, designed with the discerning investor in mind. Here’s how we guide you through making an informed decision.

10 Questions to Ask a Financial Advisor (Pension Craft - 17 Min)

When it comes to investing many people prefer to do it for themselves but there are times when you might want to get advice from a professional. So if you are going to use a financial adviser, in this video I cover 10 questions that you should ask them to make sure that are a good fit for you and that you are going to be happy with the service they provide as they can often be expensive so you don’t want to make a mistake!

Early Retirement

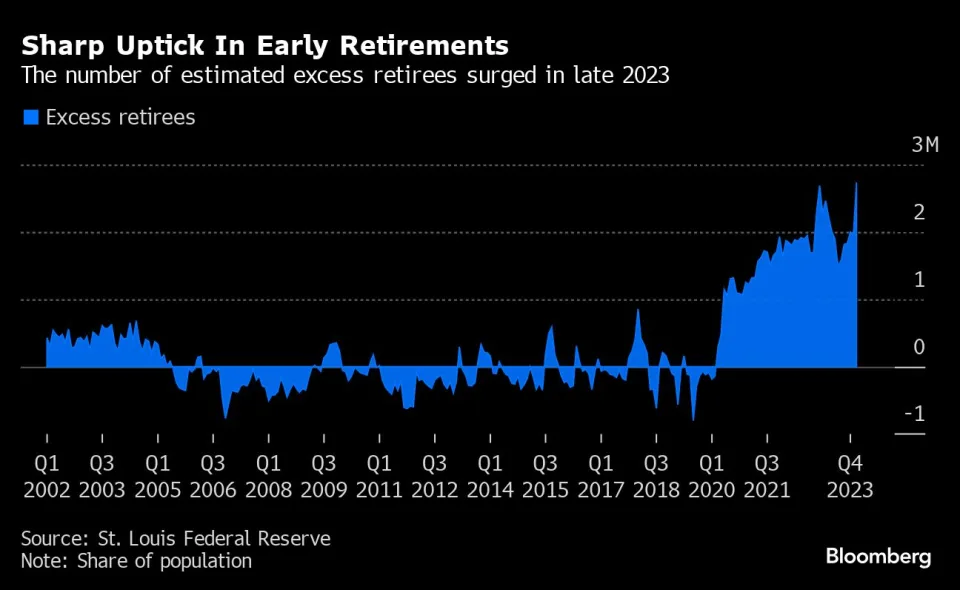

Economists long expected the share of retirees in the population to soar as baby boomers aged. Covid-19 then caused the number to spike well beyond expectations, a surge dubbed the “Great Retirement Boom.” But just as they seemed to be coming back down, the numbers surged again in recent months, reaching a post-pandemic record in December.

Read more Yahoo Finance

Personal Development

Cal Newport is a professor of computer science at Georgetown University, where he is also a founding member of the Center for Digital Ethics. His books have sold millions of copies and been translated into over forty languages. He is also a contributor to The New Yorker and hosts the popular Deep Questions podcast. His new book is Slow Productivity: The Lost Art of Accomplishment Without Burnout.

Health & Wellness

CAREERS & Entrepreneurship

Magnus Grimeland is the CEO and founder of Antler, one of the world’s largest day zero investors. Magnus founded Antler in 2017 after serving as the co-founder of Zalora, a tech-enable fashion brand in Asia. Our conversation covers characteristics of successful entrepreneurs, and the process for building the infrastructure for founders to solve important problems in the world.

Travel

Crossing Tusheti – A Bikepacking Adventure in Northern Georgia (Film) (Bikepacking.com - 28 Min)

Tusheti National Park in northern Georgia and its trails are better known among hikers, but Sabine Schipflinger and Henna Palosaari decided to try bike packing through it with full-suspension mountain bikes. “Crossing Tusheti” documents their 180km journey over the 3,000m high mountain passes, lush green meadows, pristine beauty, remote mountain villages and countless switchbacks.

Tech & Economy

economy

TECH AND SCIENCE

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

And finally

Bankeronwheels.com, born during the COVID pandemic, began as a personal blog blending cycling with investing insights.

By 2023, the blog had exceeded any growth expectations we had. Today, we want to make the blog the most impactful to our readers.

And there was no better than asking your opinion on how to bring it to the next level. Here are some takeaways from our last month’s survey.

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – BlackRock Launches New iBonds, Truth About €1M Broker Insurance & BOW is 4 years old!

The Truth About €1 Million Broker Guarantees

4 Things I Learned In 4 Years Of Running A Finance Blog

Dodl By AJ Bell Review – AJ Bell’s Younger Brother

Vanguard LifeStrategy Review – A Retriever In A Babushka Doll

Why Do Portfolio Managers Care About Factors? It’s Not What You Think.

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.