Weekend Reading – Invesco Lowers Small Cap ETF Fee To Become The Lowest In Europe

Weekend Reading is a collection of Investment Research and Lifestyle topics from all corners of the Web. We source the highest quality insights from Wall Street and Main Street that you may apply to your investment process. Unlike the rest of Bankeronwheels.com, this series is provided without additional guidance. As usual, everything is to be used at your own risk. Below is the type of content we shortlist:

Women fake orgasms and men fake finances.

Suze Orman

Featured

One of the biggest misconceptions and most frequent question that people ask adventure cyclists is whether they’re lonely. It couldn’t be further away from reality. Some cycling experiences changed me in various ways, including my way of looking at investing. You may think that spending 15 years on Wall Street would teach me more about successful investing than cycling. Technical knowledge – yes. The perspective? Not necessarily.

Portfolio Construction

Asset Allocation

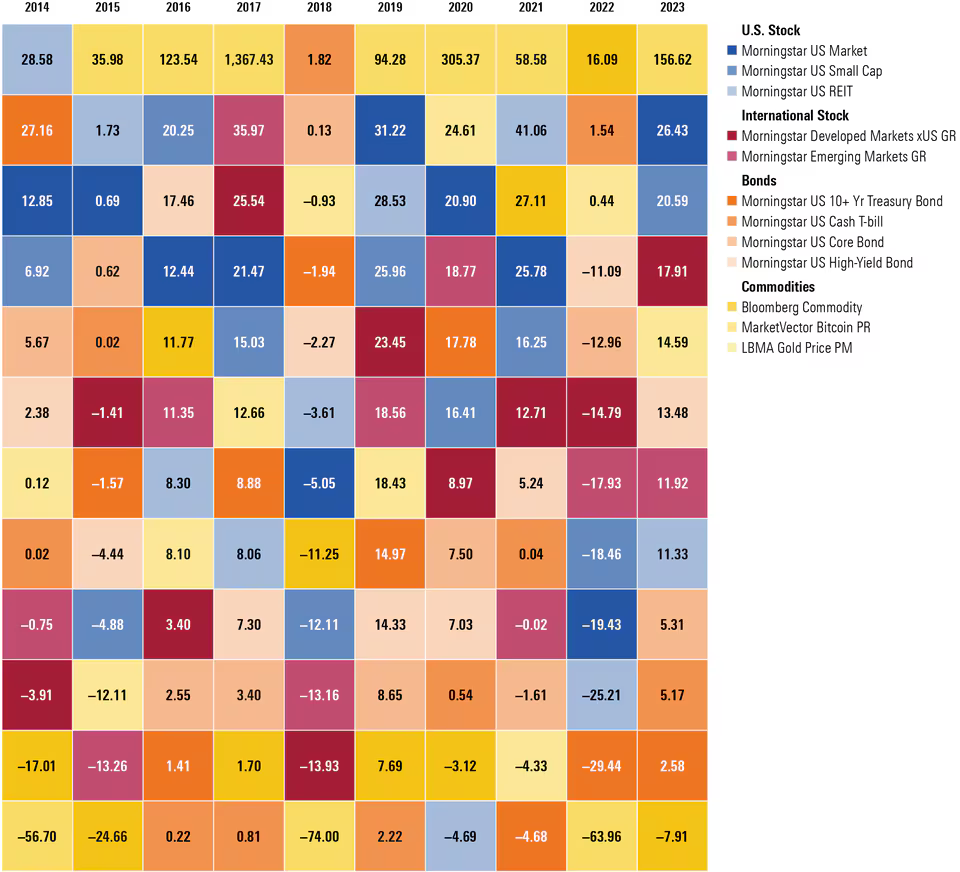

Diversification is a core principle of sound investing. A portfolio that includes assets with different performance characteristics often leads to better risk-adjusted returns than one that relies on a single asset class. But building a diversified portfolio can be easier in theory than practice. In our recently published 2024 Diversification Landscape report, my colleagues Christine Benz, Karen Zaya, and I took a deep dive into the diversification potential of several major asset classes.

Read more on Morningstar

UNDERSTAND FINANCIAL MARKETS

Rolf Agather has been in the indexing industry since the 1980s. He started Russell, moved around the industry a bit, then went back to Russell Investments and in 2002 became the Managing Director, Research and Innovation, Russell Indexes. He remained there after a merger with FTSE and became the FTSE Russell Managing Director, Research, North America. Rolf moved to Morningstar in 2020 as Morningstar’s Head of Research and Product, Indexes.

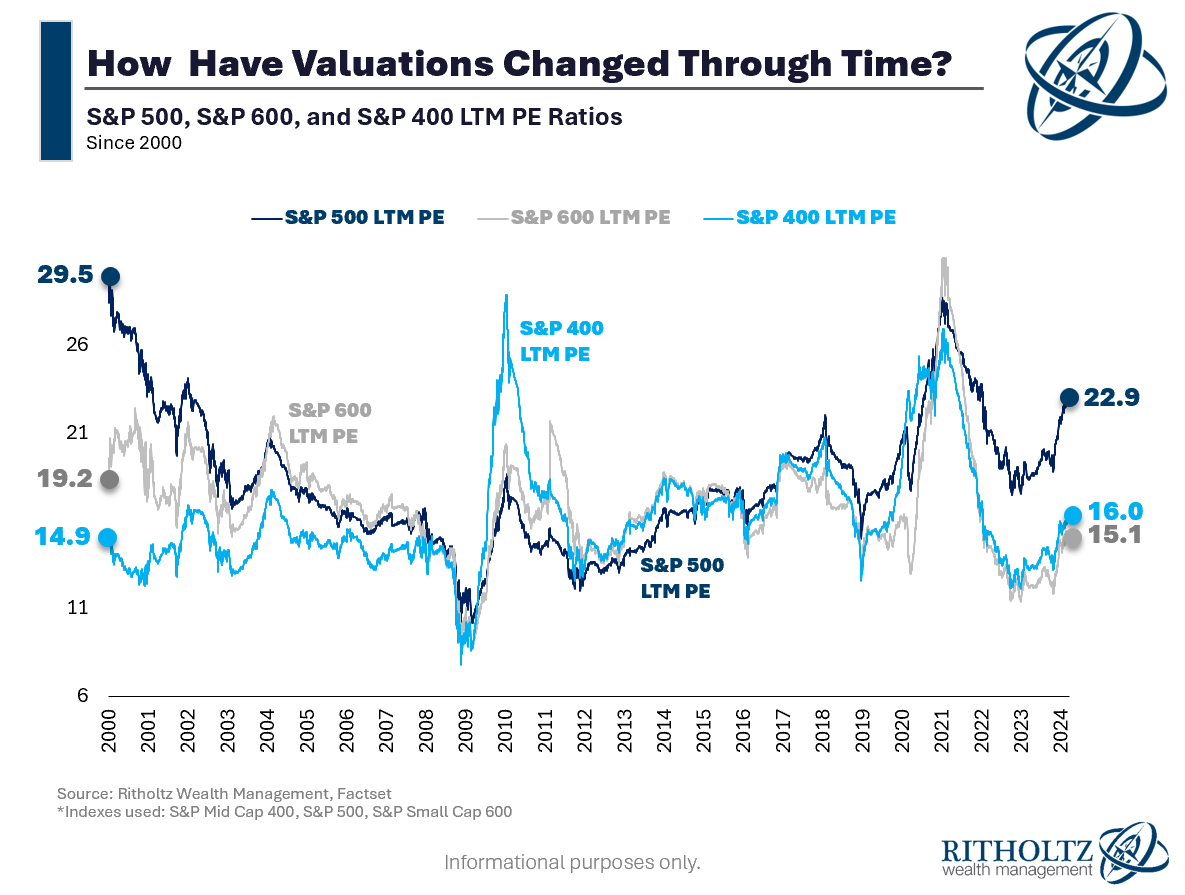

I’ve always thought the worries about index funds wreaking havoc on stock prices were overblown. If all the money flowing into index funds is propping up stock prices, why are large caps growing even faster than small and mid-caps? Wouldn’t it be easier to push up the prices of the smaller companies? When you buy a market cap weighted index fund you buy those stocks in proportion to their current weights.

Read more on A Wealth of Common Sense

HOW TO INVEST

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

Active Investing

FACTOR investing

Throughout history, investing has been a lot more “Art” than “Science.” But today, data is widely available and it’s a key tool you can use to enhance your portfolio returns. About this week’s guest: Jim O’Shaughnessy, former chairman and founder of O’Shaughnessy Asset Management (now part of Franklin Templeton) and author of the New York Times bestselling book, “What Works on Wall Street” — the first quantitative investing book available to the general public.

discretionary investing

ALTERNATIVE ASSET CLASSES

WALL STREET

- Who are the World’s Richest People in Finance? (Visual Capitalist)

- Benjamin Gilbert and David Rosenthal take a deep dive into the success that is Renaissance Technologies. (Acquired.fm - 3 Hr 10 Min)

- Should CalPERS Fire Everyone And Just Buy Some ETFs? (Meb Faber - 19 Min)

- Visualizing the World’s Largest Sovereign Wealth Fund (Visual Capitalist)

SUSTAINABLE investing

BAD BETS

UCITS ETFS

Invesco has slashed the fees of four equity and bond ETFs including its $65m Russell 2000 ETF as it looks to boost demand. The US giant reduced the fees on the Invesco Russell 2000 UCITS ETF (RTYS) from 0.45% to 0.25%, making it Europe’s lowest cost ETF to track the US small-cap index, undercutting rivals State Street Global Advisors (SSGA), DWS and Amundi.

Read more on ETF Stream

New UCITS ETF launches

| # | ETF | TER | ISIN |

|---|---|---|---|

| 1 | Amundi Prime All Country World UCITS ETF | 0.07% | IE0009HF1MK9 |

| 2 | Xtrackers MSCI World ex USA UCITS ETF 1C | 0,16% | IE0006WW1TQ4 |

| 3 | AMUNDI PRIME USA UCITS ETF Acc | 0,05% | IE000FSN19U2 |

| 4 | AMUNDI PRIME USA UCITS ETF Dist | TBC | IE000IEGVMH6 |

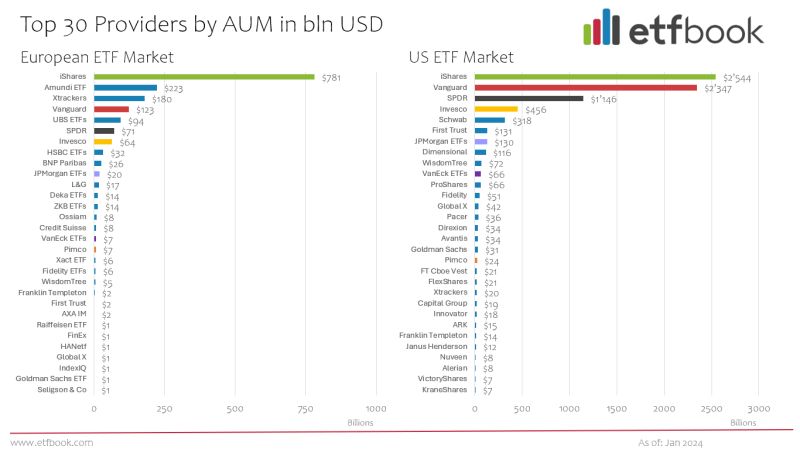

ETF Book Provided an updated overview of the US and European ETF markets by leading Issuers. US ETF market: AUM $7.96 trillion – European ETF market: AUM $1.81 trillion. iShares is leading in the US, but Vanguard is closing the gap. In Europe, iShares is much more dominant.

US ETFs

iMGP DBi Managed Futures Strategy ETF Update with Andrew Beer (iMGP Funds)

We’ve had a very strong start to the year – up about 6%, in line with both the SocGen CTA Index (hereinafter the “Hedge Fund Index”) and the Morningstar US Trend Systematic Category (hereinafter the “Morningstar Category”). Since inception we’ve handily outperformed both. Perhaps more importantly to the model portfolio world, the S&P 500 has returned around 7% this year, but the Bloomberg Agg is down close to 2%.

Read more on iMGP Funds

BlackRock is set to launch ten ETFs focused on Treasury inflation-protected securities (TIPS). Ranging in maturity from 2024 to 2033, these ETFs will seek to provide inflation protection to investors concerned with erosion of purchasing power. The new TIPS-defined maturity bond ETFs will carry an expense ratio of 0.1%. [ETF.com]

Wealth Management

Personal Finance

Fidelity International stands out as a great choice for investors with families, and looking for a reputable and competitive choice. However, advanced investors may find limitations depending on their sophistication and needs.

Interactive Investor stands out as a great choice for UK investors with families, and looking for multicurrency accounts to reduce FX-fee frictions. However, advanced investors may find limitations depending on their sophistication and needs.

Is it suitable for you?

- Peter Lazaroff talks with Manisha Thakor author of “MoneyZen: The Secret to Finding Your “Enough.” (Peter Lazaroff - 32 Min)

- Compounding your investments is great, but at some point you need to spend it. (Morningstar)

- We don't notice when things are getting better. (A Wealth of Common Sense)

- You Can’t Succeed In Life Without This Skill (Ryan Holiday)

InvestEngine offers competitive trading for ISA and General accounts, as well as a good range of ETFs. It caters well to buy-and-hold investors who want a simple portfolio. More advanced investors will quickly be very limited in their choices, as they can only trade LSE-listed ETFs.

Early Retirement

Personal Development

- 40 Life Lessons I Know at 40 (That I Wish I Knew at 20) (Mark Manson)

- Unwinding Anxiety: New Science Shows How to Break the Cycles of Worry and Fear to Heal Your Mind (Good Life Project)

- Scott Barry Kaufman talks with Columbia business professor Shena Lyengar on how we make choices and innovate. (The Psychology Podcast - 44 Min)

CAREERS & Entrepreneurship

- Noah Kagan about building a side hustle without losing your mind (The examined life - 1 Hr)

- Are Remote Tech Careers Still Relevant In 2024? (ChooseFi - 34 Min)

- Founders’ warm welcome in Barcelona (FT.Com, Click on First link)

- Top start-up hubs reinvent the model for European tech sector needs (FT.Com, Click on First Link)

- The Jobs Most Impacted by AI (Visual Capitalist)

DESIGN YOUR LIFESTYLE

Travel

On March 13th, 27-year-old Ana Jager rolled into Nome, Alaska, finishing a harrowing 19-day solo ride on the Iditarod Trail. Conditions this year were extraordinarily difficult and slow, but she maintained a pace that was in step with the fastest ITI racers. After the ride, author and fellow endurance athlete Jill Homer caught up with Ana to discuss her monumental effort.

Read more on Bikepacking.com

Tech & Economy

economy

TECH AND SCIENCE

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

And finally

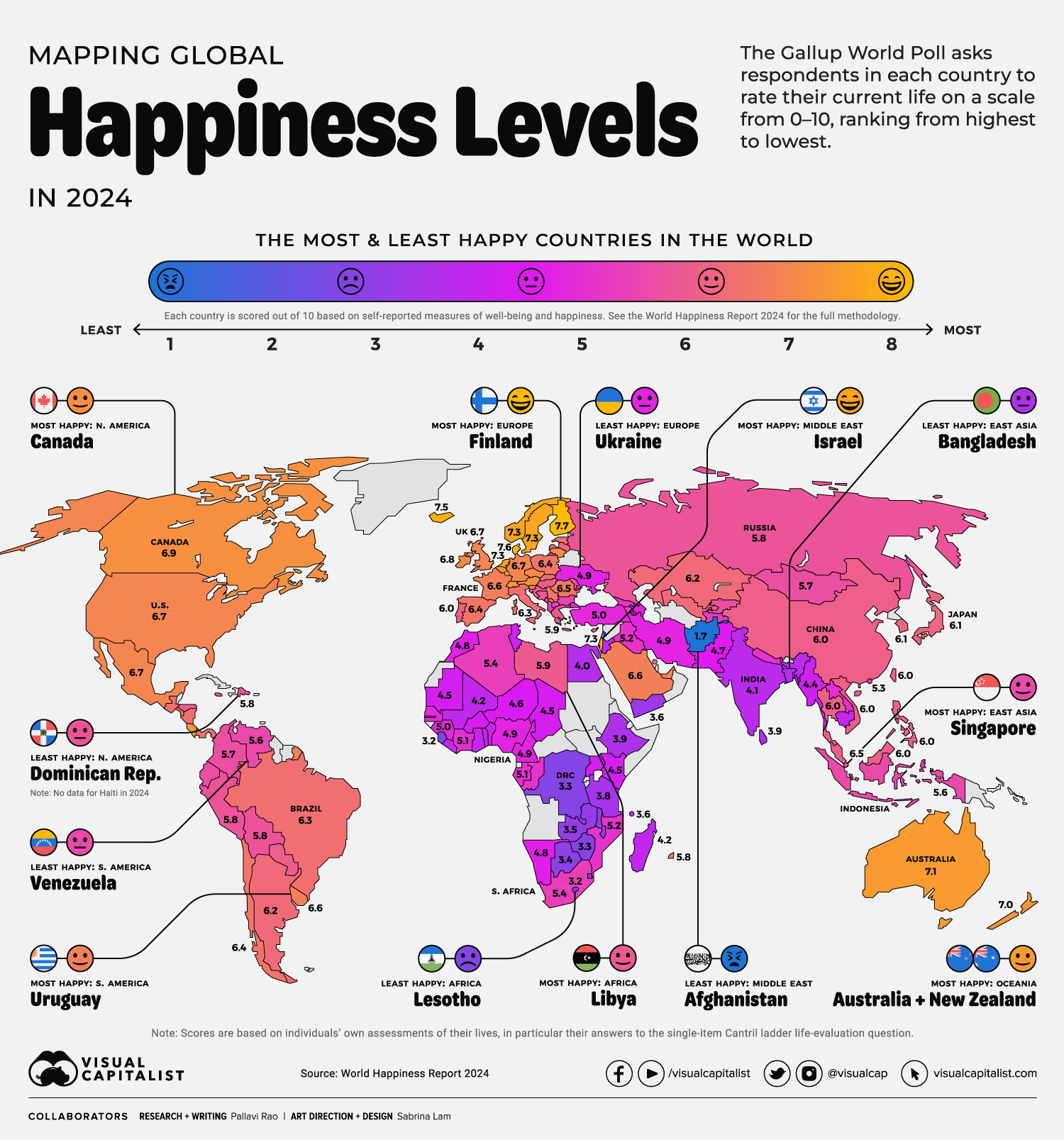

Happiness, like love, is perhaps one of the least understood and most sought-after emotions and experiences in human life. And while many inspiring teachings exist about attaining individual happiness, it’s worthwhile to consider how happy entire countries are on a collective scale.

We visualize the findings from the World Happiness Report 2024, an enduring attempt to measure, quantify, and compare happiness levels around the world, sourcing data from Gallup.The Gallup World Poll surveys approximately 1,000 respondents in nearly every country on a variety of issues, one of which is to evaluate their current life on a scale from 0–10.

Read more on Visual Capitalist

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – BlackRock Launches New iBonds, Truth About €1M Broker Insurance & BOW is 4 years old!

The Truth About €1 Million Broker Guarantees

4 Things I Learned In 4 Years Of Running A Finance Blog

Dodl By AJ Bell Review – AJ Bell’s Younger Brother

Vanguard LifeStrategy Review – A Retriever In A Babushka Doll

Why Do Portfolio Managers Care About Factors? It’s Not What You Think.

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.