Weekend Reading – Amundi Launches The Cheapest UCITS World ETF

Weekend Reading is a collection of Investment Research and Lifestyle topics from all corners of the Web. We source the highest quality insights from Wall Street and Main Street that you may apply to your investment process. Unlike the rest of Bankeronwheels.com, this series is provided without additional guidance. As usual, everything is to be used at your own risk. Below is the type of content we shortlist:

In investing, you get what you don't pay for. Costs matter. So intelligent investors will use low-cost index funds to build a diversified portfolio of stocks and bonds, and they will stay the course. And they won't be foolish enough to think that they can consistently outsmart the market.

John C. Bogle

Featured

A few years ago, SAXO wouldn’t be on our radar. It was a fairly expensive platform built mainly for traders. However, since their acquisition of the Dutch Bank BinckBank, part of the focus has shifted towards long-term investors. In January 2024, SAXO also reduced certain fees, making it an interesting Broker for investors in Europe. But, the fees still look prohibitive in the UK.

Portfolio Construction

Asset Allocation

If you haven’t read already, have a look at our article that has been picked up by the Financial Times this week.

Have a look why the Cederburg et al. paper’s recommendation can significantly reduce diversification for European investors, and why the way the study is designed should raise major concerns.

In this episode, we’re joined by Christine Benz, Director of Personal Finance at Morningstar, who shares fascinating insights from her latest co-authored paper: The State of Retirement Income 2023. Listen now and learn: Motivations for safe withdrawal rate research, Nuances of the 4% withdrawal rule.

UNDERSTAND FINANCIAL MARKETS

Dowtown Josh Brown is joined by Drew Dickinson of Albert Bridge Capital to discuss whether we are in a bubble, the rally in European stocks. Then, at 39:49, hear an all-new episode of What Are Your Thoughts with Josh and Michal Batnick ! They discuss inflation, permabears, Nvidia, the next Mag 7 stocks, the magazine cover indicator, and much more.

The Trillion Dollar Equation (Veritasium)

The most famous equation in finance, the Black-Scholes/Merton equation, came from physics. It launched an industry worth trillions of dollars and led to the world’s best investments. Featured in this video – The Man Who Solved the Market: How Jim Simons launched the quant revolution by Gregory Zuckerman.

HOW TO INVEST

Two decades ago, expense ratios among ETFs in a given category frequently differed by 10 to 20 basis points (bps).1 Today, the differences are often as little as 1 to 2 bps. As the range of expense ratios has narrowed, other cost-related factors have become increasingly important.

Read more on Vanguard

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

Active Investing

FACTOR investing

discretionary investing

On this episode of Lots More, we speak with Travis Lundy, a Japan markets expert and special situations analyst who publishes on SmartKarma. He walks us through the history of Japan Inc. and how we got to this point. We discuss just how investor-friendly have Japanese companies actually become.

ALTERNATIVE ASSET CLASSES

WALL STREET

Want to build influence with great ideas and simple writing? Look no further than Howard Marks. Most smart people use big words and plastic jargon to reinforce the barrier between themselves and “the common folk.” Howard, on the other hand, breaks down this barrier, and that’s why his ideas are so influential (and why he’s Warren Buffett’s favorite author).

SUSTAINABLE investing

BAD BETS

UCITS ETFS

New UCITS ETF launches

| # | ETF | TER | ISIN |

|---|---|---|---|

| 1 | Amundi Prime All Country World UCITS ETF | 0.07% | IE0009HF1MK9 |

| 2 | Xtrackers MSCI World ex USA UCITS ETF 1C | 0,16% | IE0006WW1TQ4 |

| 3 | AMUNDI PRIME USA UCITS ETF Acc | 0,05% | IE000FSN19U2 |

| 4 | AMUNDI PRIME USA UCITS ETF Dist | TBC | IE000IEGVMH6 |

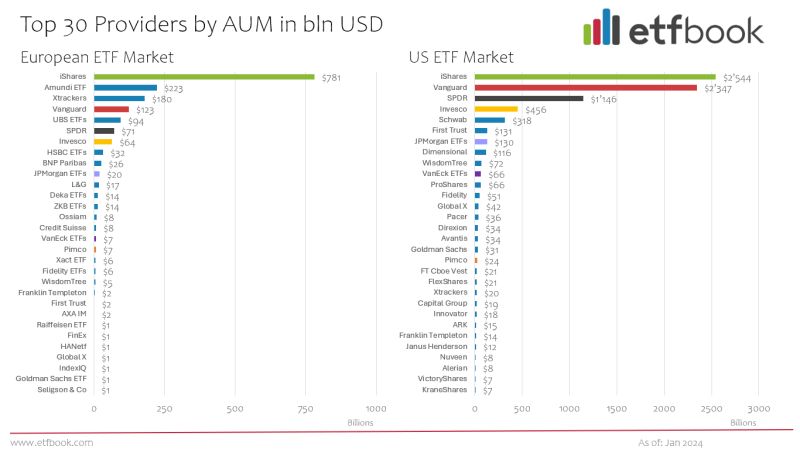

ETF Book Provided an updated overview of the US and European ETF markets by leading Issuers. US ETF market: AUM $7.96 trillion – European ETF market: AUM $1.81 trillion. iShares is leading in the US, but Vanguard is closing the gap. In Europe, iShares is much more dominant.

US ETFs

BlackRock is set to launch ten ETFs focused on Treasury inflation-protected securities (TIPS). Ranging in maturity from 2024 to 2033, these ETFs will seek to provide inflation protection to investors concerned with erosion of purchasing power. The new TIPS-defined maturity bond ETFs will carry an expense ratio of 0.1%. [ETF.com]

Wealth Management

Personal Finance

Vanguard Investor UK stands out as a great choice for hold and buy investors that are looking for a simple platform managed by one of the most reputable global asset managers. However, it may not be the cheapest, and more sophisticated investors may find limitations on both investment choice and advanced features.

Interactive Investor stands out as a great choice for UK investors with families, and looking for multicurrency accounts to reduce FX-fee frictions. However, advanced investors may find limitations depending on their sophistication and needs.

Is it suitable for you?

Early Retirement

Personal Development

- Being fired: ‘I was stronger and more resilient than I thought’ (FT.Com, Click on first Link)

- How to deal with the mid-life happiness slump. (A Wealth of Common Sense)

- Brett McKay talks with Ben Guttmann author of "Simply Put: Why Clear Messages Win—and How to Design Them." (Art of Manliness - 50 Min)

Health & Wellness

CAREERS & Entrepreneurship

- A unique idea need not a great business make. (Business Insider)

- Zach Conway and Kelsey McKenna talk with Michael Batnick about Ritholtz Wealth's discuss leading with culture, effective hiring strategies, and building a strong foundation for your business. (Seeds - 45 Min)

- A decade of sklar: building a bike brand (Bikepacking.com)

Travel

Tech & Economy

economy

What's Gone Wrong with Sweden's Economy? (TLDR - 10 Min)

Sweden’s NATO accession is dominating international headlines, but domestically the country is facing major economic and social problems. So in this video, we’ll break down the issues they face and whether Kristersson’s government can turn it around.

TECH AND SCIENCE

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

And finally

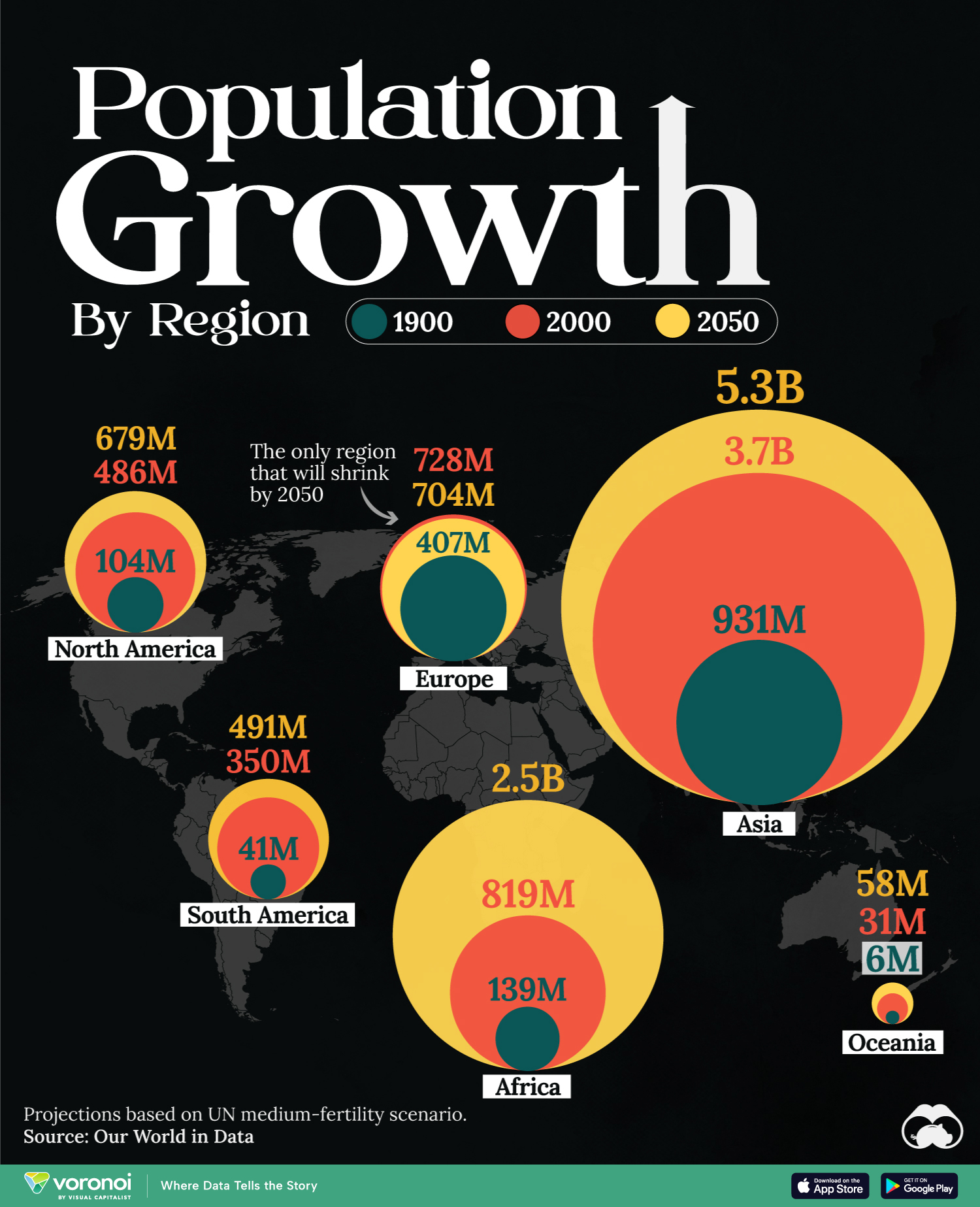

In fewer than 50 years, the world population has doubled in size, jumping from 4 to 8 billion.

In this visualization, we map the populations of major regions at three different points in time: 1900, 2000, and 2050 (forecasted).

Figures come from Our World in Data as of March 2023, using the United Nations medium-fertility scenario.

Asia was the biggest driver of global population growth over the course of the 20th century. In fact, the continent’s population grew by 2.8 billion people from 1900 to 2000, compared to just 680 million from the second on our list, Africa.

Read more on Visual Capitalist

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – BlackRock Launches New iBonds, Truth About €1M Broker Insurance & BOW is 4 years old!

The Truth About €1 Million Broker Guarantees

4 Things I Learned In 4 Years Of Running A Finance Blog

Dodl By AJ Bell Review – AJ Bell’s Younger Brother

Vanguard LifeStrategy Review – A Retriever In A Babushka Doll

Why Do Portfolio Managers Care About Factors? It’s Not What You Think.

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.