SAXO Review

Overall Rating: Good in europe

(but not recommended in the uk)

4.2

/5

Reviewed by:

Share:

Overall Rating: good in europe

(but not recommended in the uk)

A few years ago, SAXO wouldn’t be on our radar. It was a fairly expensive platform built mainly for traders. However, since their acquisition of the Dutch Bank BinckBank, part of the focus has shifted towards long-term investors. In January 2024, SAXO also reduced certain fees, making it an interesting Broker for investors in Europe. But, the fees still look prohibitive in the UK.

SAXO may satisfy most EU investors:

- Passive Investors – Will appreciate very competitive ETF trading commissions. FX rates are industry-average, and in some countries you need to allow security lending to remove custody fees. In most countries, long-term investors may use the SAXOInvestor interface designed for ETFs or Mutual Funds – easier to handle for beginners than IBKR’s platform.

- Semi-active Investors – Saxo Bank gives you access to a large set of stocks, ETFs, mutual funds, bonds as well as more sophisticated market across 50 different exchanges and 71,000 instruments, making it very comprehensive as you scale the learning curve. The SAXOTrader Interface will allow you to access more features.

- Advanced Investors – For investing geeks, SAXOTraderPRO competes with the best platforms in unlocking access to U.S. ETFs – subject to qualifying as an elective professional client – advanced portfolio management techniques including synthetic leverage or margin loans.

This article contains affiliate links. We provide full transparency on how it works.

Pros & Cons and suitability

Pros & Cons

- Systemic Bank in Denmark

- Reporting On Par with listed companies

- Multiple Banking Licences

- Competitive Transaction fees

- Automatic Investing Not Yet Rolled Out

- Fees/Features Not unified across EU

- Security Lending Required To Waive Custody Fees In Certain EU Countries

- Prohibitive Custody Fees In The UK

Suitability

Suitable

When SAXOINVESTOR IS AVAILABLE. check custody fees. Not suitable in the UK.

Suitable

versatile VIA SAXOTRADER. Not suitable in the uk.

VEry Suitable

SAXOTRADERPRO with U.S. ETFs, Derivatives and reduced pricing for large accounts. Not suitable in the uk.

CHECK AVAILABILITY & OPEN ACCOUNT

Check Your Local SAXO Website

Broker Snapshot

Why SAXO is A Tier 1 Broker?

We view SAXO Bank as a Tier 1 Broker. We justify this Broker classification by its long track-record, three Banking licences in key European jurisdictions including Denmark, the Netherlands and Switzerland, presence on multiple continents, good reputation and an Institutional Franchise with Professional Investors representing close to 30% of its revenues. In June 2023, Saxo was designated a systemically important bank by the Danish Financial Supervisory Authority.

A Trading Platform That Now also Services Long-Term Investors

In terms of estimated market value (c. $2bn in 2023), SAXO is much smaller than its rival Interactive Brokers, but has a strong reputation for its risk control culture. Its Trading Systems were originally designed for Traders. In 2019, SAXO acquired the Dutch Bank BinckBank for €430m and expanded into the Long-Term Investor segment, which in 2022 accounted for c. 30% of its revenues. SAXO has a high standard of reporting. It also has an Investment Grade Rating from S&P Global Ratings. It is regulated across the EU and Asia. In the EU, customers sign up through their local or the Danish entity, and benefit from a €20k Investment Compensation Scheme on securities and €100k on cash. In the UK, customers benefit from a £85k Financial Services Compensation Scheme.

Company Info

| Characteristic | SAXO |

|---|---|

| Inception Date | 🛈 1992 |

| Headquarters | 🛈 Copenhagen, Denmark |

| Key Owner | 🛈 Geely Group, SAXO Founder, Sampo Plc. |

| Bank Affiliated | ✅ Yes |

| Listed on Stock Exchange | 🛈 No But Good Public Reporting |

| Parent Rating | ✅ S&P: BBB |

| Net Income | ✅ DKK 700m |

Regulation

| Feature | SAXO |

|---|---|

| EU Entity | 🛈 Danish, Dutch, UK, French or Swiss |

| UK Entity | 🛈 Saxo Capital Markets UK Limited |

| Key Regulators | ✅ Denmark, Netherlands, Switzerland |

| EU Regulator | ✅ Multiple Regulators |

| UK Regulator | ✅ UK (FCA) |

| EU Guarantee | 🛈 Varies (Read Safety Section) |

| UK Guarantee | 🛈 Max. £85k |

Fees are country-specific

SAXO provides access to all major exchanges and does not rely on PFOF. Transaction fees are competitive, FX rates are average, and custody fees depend on the country, but can be waived for most of Europe provided you opt-in for Security Lending. In the UK, the broker remains a trading platform (as its fees are prohibitive for investors), and can’t compete with Tier 1 brokers.

Features

| Feature | SAXO |

|---|---|

| Key Base Currencies | 🛈 All Major Currencies |

| ETF Availability | ✅ Very high |

| Multicurrency | ✅ Available |

| Cash Interest | ✅ Competitive |

| Margin Loans | ❌ Not Available |

| Exchanges | ✅ All Major |

| External PFOF Reliance | ✅ Low |

Fee Structure

| Feature | SAXO |

|---|---|

| Custody Fees | ⚠️Country Specific |

| Inactivity Fees | ⚠️Country Specific |

| ETFs Dealing Fees | ✅ Low |

| FX Fees | ↔️ Average |

| Deposit Fees | ✅ None |

| Withdrawal Fees | ✅ Low |

| Security Lending | ⚠️Country Specific |

OPEN an ACCOUNT

Check Your Local SAXO Website

I. Company

Our score is justified by a good reputation, transparent reporting and stringent regulatory requirements in the Netherlands, Denmark and Switzerland. The company also has an IG rating from a rating agency.

Ownership and Transparency

Saxo Bank, established in Denmark in 1992, is renowned for its online trading platform. In 2023, it was estimated to be worth over $2 bn. It maintains a good reputation for risk management. Saxo Bank A/S is a privately owned company, but has plans to be listed on a Stock Exchange in the future as a mean for existing shareholders to reduce their holdings. Currently, there are no majority shareholders, but key holders include the Chinese group Zhejiang Geely (49.9%), Saxo Bank Founder and CEO Kim Fournais (28%) and Sampo Plc – a leading Nordic financial services group (20%). While SAXO is not listed its financial reporting is on par with listed companies.

Safety Considerations

In 2022, its TIER 1 Ratio stood at 24%. SAXO also posted solid profits. It is regulated as a Bank in three European Countries. The company is rated BBB by S&P Ratings, which means the estimated probability of default is very low, as measured by 10-year peer cohort probability of default. For comparison – based on historical data, a couple of 100 similarly rated financial companies went out of business over a 10-year period. In 2023, SAXO Bank was also assigned a systemically important bank status in Denmark, which may increase chances of some form of state intervention in case of bankruptcy, but it is not a guarantee.

Regulation & Investor Compensation Schemes

- Most EU Clients (SAXO Bank A/S, regulated by Denmark’s FSA) – the protection is up to €20,000 for securities and €100,000 for cash.

- UK Investors (Saxo Capital Markets UK Limited, regulated by the FCA) – clients are protected up to £85,000.

Cash Custodian

Cash is held with Reputable Banks, including Citibank.

Reputation

SAXO has a good reputation, as one of the most sophisticated brokers. However, the track record is not perfect, as it did have a few regulatory fines in the past, including in 2023 due to lack of certain measures and procedures.

II. Fee structure

Transaction fees are competitive, but the platform fee structure is dependent on the country you invest from. We don’t like the lack of a uniform EU-wide pricing. Central and Eastern Europe platform fees are waived, if you decide to allow SAXO to lend your securities. Some Western European countries don’t require security lending. The broker is attractive in Switzerland, but is very expensive in the UK.

Platform fees

Investing with SAXO has always been problematic because of fees. Before 2024, SAXO also had 6-month inactivity fees. These were removed in the UK, Switzerland, Central & Eastern Europe, the Nordics and the Middle East. SAXO had very high (up to 0.15% + VAT) custody fees that made the platform cost-prohibitive. In January 2024 SAXO announced changes in its custody fee structure:

- Waived Custody In Central and Eastern Europe – on the condition to activate Security Lending, in line with practices by Tier 2 Brokers like DEGIRO. To compete with the best in-class Tier 1 Brokers, and ensure more safety for its clients, we’d expect SAXO to drop the Security Lending opt-in requirement in the future as well.

- Capped Custody In Switzerland – Introduced a max. charge of CHF 10 /month in Switzerland, which is much more affordable.

- Removed Minimum Custody Fess – in the UK, Central & Eastern Europe, the Nordics and the Middle East

UK Customers still face significant custody fees, which in today’s competitive environment is unacceptable (e.g. Vanguard FTSE All-World is charged 0.12+20% VAT per year). In the UK, SAXO positioning remains as a trading platform and not an investing platform. For buy & hold investors, local Tier 1 Brokers offer much better value.

Summary - Platform fees in europe & UK

| Country | Custody | Security Lending | FX |

|---|---|---|---|

| Belgium | None | Optional | 0.50% |

| Denmark | None | Optional | 0.25% |

| France | None | Optional | 0.25% |

| Netherlands | €3.50/month, +0.01%, Max. €48.50 | Optional | 0.65% |

| Poland | None | Optional | 0.25% |

| Any other EU | 0.15% or Security Lending | Removes custody fee | 0.25% |

| Switzerland | 0.22% / year (max 10 CHF per month) | Optional | 0.25% |

| UK | 0.12% + VAT | Optional | 0.25% |

Trading Commisions

SAXO trading commissions are very competitive. It offers three pricing plans, depending on your assets. Post its price revision, trading on popular ETF Exchanges involves a 0.08% charge with low minimums. On some Exchanges (e.g. EuroNext), the minimum is even lower than for leaders like Interactive Brokers. Check the 🤓 Geeky Section below to understand the cost structure.

Trading Fees vary based on your account type

There are three types of accounts:

- Classic – You can open it with as low as $1 Equivalent in your currency

- Platinum – With $200k Minimum

- VIP – With $1m minimum

ACCOUNT TYPES

| Minimum | Classic | Platinum | VIP | |

|---|---|---|---|---|

| Account Balance | - | $1 | $200k | $1m |

| US Markets | $1 | 0.08% | 0.05% | 0.03% |

| EuroNext | € 2 | 0.08% | 0.05% | 0.03% |

| Xetra | € 3 | 0.08% | 0.05% | 0.03% |

| Six Swiss | 3 CHF | 0.08% | 0.05% | 0.03% |

| Milan | € 3 | 0.08% | 0.05% | 0.03% |

Overall Fee Simulation vs Competitors

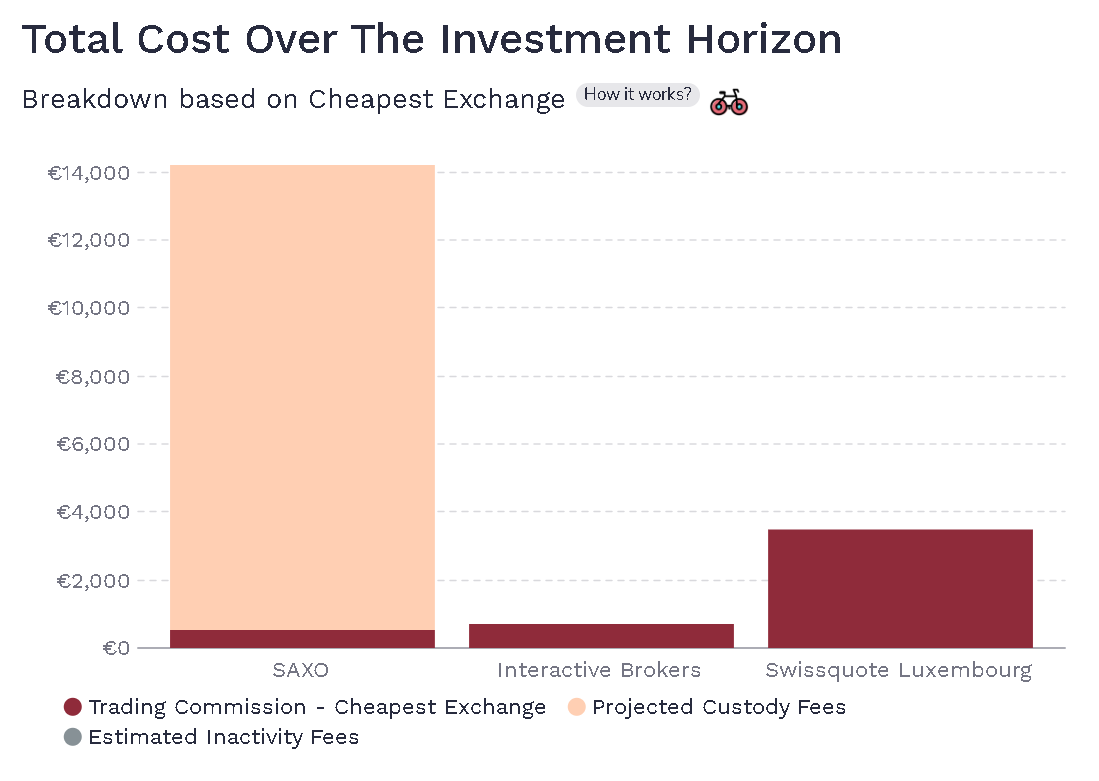

Most of our readers have simple Index portfolios. Using our Broker Total cost calculator, you can estimate the total cost of holding ETFs throughout the investment period. In the below simulation, a 20-year accumulation period broker bill comes out at €14,204 for SAXO in case you do not opt in for Security Lending (certain EU countries). Without Security Lending opt-in, two of its competitors in the same category are less expensive. The cost is €3,500 for Swissquote Luxembourg, and €731 for Interactive Brokers.

However, if you opt-in for Security Lending (or are not required to in some countries – see optional in table above), the overall cost drops to €534, as EuroNext pricing is very competitive (€2 minimum fee is lower than IBKR’s EuroNext Fixed Plan charge).

Scenario assumptions

| Model Feature | Assumption |

|---|---|

| Investor | EU Country |

| Instrument | UCITS ETF |

| Plan | Fixed Pricing |

| Initial Investment | € 100,000 |

| Monthly | € 1,000 |

| Time Horizon | 20 years |

| Gross Return | 8% |

Total Fees vs ibkr & Swissqute

Currency Exchange fees

SAXO generally charges 0.25% fee for FX, which is average for the industry. Most Brokers in Europe and the UK have similar charges. But, the leader is Interactive brokers that charges only 0.2 bps (0.002%). Spreads are fairly tight – you can use this estimator to get more detail.

Other fees

Deposits and withdrawals are free of charge.

III. Platform & Features

SAXO has a very sophisticated platform catering not only to Investors, but also traders, wealth management boutiques and other institutional investors. But, for the vast majority of investors, most of its sophisticated features are not necessary to be successful in achieving their financial goals. For these goals, a simple interface like SAXOInvestor is preferred. It is available in most, but not all countries. Advanced investors may explore a few of them, including the ones listed in the Geeky section below – Margin Accounts, or Derivatives.

Account Opening Process

Opening an account with Saxo is a straightforward and quick process, taking about 15 minutes and completed entirely online, mirroring the simplicity found with most brokers today. The application involves three main steps: providing personal data, account approval through proof of identity and residency, and funding, which is exclusively done via wire transfer and may be the only time-consuming part due to potential delays in fund transfers. Notably, Saxo does not require a minimum deposit to open an account, making it accessible for individuals looking to start trading with minimal financial commitment.

account Features

In most European countries, you sign up with SAXO using a single account but can use three different interfaces.

Most ETF Investors may prefer SaxoInvestor, if available:

- SaxoInvestor – is an intuitive and user-friendly platform tailored to Long Term Investors, making it easy to build a diversified portfolio across global equities, bonds, ETFs, or mutual funds. It is available in most of Europe except Switzerland and the UK.

- SaxoTraderGO – is an advanced platform with additional access to margin products and advanced trading tools.

- SaxoTraderPRO – most advanced platform.

How To Choose The ETF-friendly SaxoInvestor Platform

For most countries, you will have the option to select the SaxoInvestor platform. If no such option is available, choose SAXOTraderGo or Open the account by default.

PFOF

SAXO follows best practices, as it does not rely on external PFOF. This is not the case for smaller brokers that may send all orders to one small single-market maker quote-driven venue without given the customer the option to opt out, or giving the option to trade through a large transparent multilateral Exchange.

Cash Interest

Interest on cash is not the most generous in the market. For SAXO the rates are fairly average.

Running A Small Hedge Fund

SAXO is fairly sophisticated. It serves as a gateway for smaller institutional players and wealth management boutiques. It provides access to U.S. ETFs, Bonds, Asian Markets, or Synthetic leverage through options.

Margin Accounts

Interactive Brokers offers two main account types – Cash or Margin:

- Cash Accounts – Cash accounts restrict trading to the funds you have available in the account. This is the account type we would suggest for the vast majority of individuals – including all Golden Retrievers and Cyclists.

- Margin Accounts – You may purchase securities using funds loaned by the broker. For example, with $10,000 in cash and a 5:1 margin ratio, you could trade with up to $50,000. Margin trading involves significant risks. In rare cases, it may be attractive for Banker-style Investors, e.g. with Risk Parity Portfolios. Margin financing rates are very competitive, e.g. 100k-1M has a total cost of Benchmark Rate +1%.

Access to U.S. Markets

PRIIPs is an EU rule that prohibits buying US-listed ETFs, including Factor ETFs from e.g. Avantis or Dimensional Fund Advisors. One of the reasons is tax implications. This rule also applies to UK Investors. In theory, high-net-worth or professional investors can bypass PRIIPs, allowing them to buy US-listed ETFs. This exemption is related to your ‘MiFID status’ being an Elective Professional Client. In practice, most brokers don’t give clients this option. Interactive Brokers is the only broker that effectively facilitates this.

To apply for an Elective Professional Client Status, you must meet two out of three criteria below:

- Professional Experience – Work in financial sector for at least one year in a professional position, which requires knowledge of the transaction or services envisaged.

- €500k+ Portfolio – The size of the financial instrument portfolio in investment accounts, defined as including cash deposits and financial instruments, exceeds €500k.

- High Volume Trades – (€200k+) on the relevant market at an average frequency of 10 per quarter over the previous 4 quarters; and at least €50k account equity at present.

Derivatives

Interactive Brokers provides access to Options and Future Markets, including the ability to create complex strategies or synthetic leverage using Box Spreads. Selling In The Money Puts may also allow indirect access to US ETFs through physical delivery.

IV. Taxes

Tax Wrappers

SAXO started offering tax-advantaged accounts in certain jurisdictions. This includes the UK or France.

Tax Reporting

For the vast majority of European Investors, taxes are managed through the reporting tool available with SAXO.

OPEN an ACCOUNT

Check Your Local SAXO Website

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – BlackRock Launches New iBonds, Truth About €1M Broker Insurance & BOW is 4 years old!

The Truth About €1 Million Broker Guarantees

4 Things I Learned In 4 Years Of Running A Finance Blog

Dodl By AJ Bell Review – AJ Bell’s Younger Brother

Vanguard LifeStrategy Review – A Retriever In A Babushka Doll

Why Do Portfolio Managers Care About Factors? It’s Not What You Think.

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.