Vanguard Investor UK Review

Overall Rating: Leader in Hands-Off Investing

4.0

/5

Overall Rating: Leader in Hands-Off Investing

Our take: Vanguard Investor UK stands out as a great choice for hold and buy investors that are looking for a simple platform managed by one of the most reputable global asset managers. However, it may not be the cheapest, and more sophisticated investors may find limitations on both investment choice and advanced features.

Is it suitable for you?

- Passive Investors: The simplicity of the platform and the limited choice of products maybe ideal for Golden Retriever and investors that want to choose a simple buy and hold strategy aligned with the principle of John Bogle. The company’s reputation and convenience of setting up automated investments through monthly standing orders makes it the best choice for set-and-forget investors.

- Semi-Active Investors: they may like the possibility to manage junior accounts for the family and the business model focused on maximising the return for the retail investors. However, they may be limited in the choices of products, mostly in currencies other than GBP. Given the limited flexibility, the account fees may seem a bit steep compared to its competitors.

- Advanced Investors: Vanguard Investor UK falls short in providing intermediate and advanced features like access to shares and bonds for those looking to push their investment strategies further.

Pros & Cons and suitability

Pros & Cons

- User Friendly and Straightforward

- Strong Reputation & Transparent Business Model

- Junior Accounts

- Can be expensive for smaller portfolios

- No Mobile App

- Vanguard ETFs and Funds only

- Lacks advanced features

Suitability

VERY Suitable

SIMPLE, reputable, transparent

Suitable

Junior Accounts, BUT LIMITED ETF RANGE

SOMEWHAT Suitable

Lack of Advanced Features

Availability

Vanguard investor UK is only Available in the UK

Vanguard Direct to Consumer Business (not to be confused with Vanguard Asset Management) had a branch in Germany for approximately two years but decided to close it after failing to reach “necessary scale to operate efficiently”. Vanguard ETFs and Funds are available in several European markets through brokerage firms, or financial/wealth managers.

Broker Snapshot

Why Is Vanguard Investor UK A Tier 1 Broker?

Vanguard Investor UK stands as a leading brokerage in the UK. Its parent company is a global asset management firm, the Vanguard Group, with Assets Under Management of $8.1 trillion and a global revenues of $6.93 billion. As an ETF and mutual funds’ provider, Vanguard Group competes directly with BlackRock, the world leader. Vanguard Group serves over 50 million customers worldwide; as of 2023, the company has roughly 550K customers in the UK and £15bn in Assets Under Administration through its direct to consumer business. Its fee structure is incredibly transparent. It competes with major UK-focused competitors like AJ Bell, Interactive Investor, and Hargreaves Lansdown.

A globally leading asset manager Parent

Vanguard Investor UK launched its retail offering in the UK in 2017. Owned by the US-based Vanguard Group, which is in turn owned by its investors, the company is neither listed on stock exchanges nor affiliated with a bank. The UK branch’s profitability has remained stable over the last two years. Vanguard UK is regulated by the FCA and, as of March 2024, and does not have a direct market presence in Europe.

Company Info

| Characteristic | Vanguard Investment UK |

|---|---|

| Inception Date | 🛈 2017 |

| Headquarters | 🛈 London, UK |

| Key Owner | 🛈 Vanguard Group |

| Bank Affiliated | 🛈 No, but Tier 1 Asset Manager |

| Listed on Stock Exchange | ❌ No |

| Parent Rating | ❌ No |

| Revenues (parent) | ✅ $6.93 bn |

Regulation

| Feature | Vanguard Investment UK |

|---|---|

| EU Entity | 🛈 None |

| UK Entity | 🛈 Vanguard Investment UK |

| Key Regulators | ✅ UK |

| EU Regulator | N/A |

| UK Regulator | ✅ UK (FCA) |

| EU Guarantee | N/A |

| UK Guarantee | 🛈 Max. £85k |

competitive Dealing fees, Low ETFs choice but still high diversification

The platform prioritises simplicity and low cost, targeting buy-and-hold investors. It doesn’t support multicurrency accounts and primarily facilitates trading on the LSE. Vanguard’s offering is limited to its own ETFs and funds, which, while restricting investment choice, still provides ample diversification opportunities. Vanguard upholds UK regulations by avoiding Payment for Order Flow and internalization, promoting transparency in order execution. The account fees are considered average, with the benefit of no transaction, FX, withdrawal, or deposit fees.

Features

| Feature | Vanguard Investment UK |

|---|---|

| Key Base Currencies | 🛈 GBP |

| ETF Availability | ❌ Below Average |

| Multicurrency | ❌ Not Available |

| Cash Interest | ✅ Competitive |

| Margin Loans | ❌ Not Available |

| Exchanges | ⚠️ LSE Only |

| External PFOF Reliance | ✅ None |

Fee Structure

| Feature | Vanguard Investment UK |

|---|---|

| Custody Fees | ↔️ Average |

| Inactivity Fees | ✅ None |

| ETFs Dealing Fees | ✅ None |

| FX Fees | 🛈 None |

| Deposit Fees | ✅ None |

| Withdrawal Fees | ✅ None |

| Security Lending | 🛈 Not Available |

I. Company

Vanguard Investor UK, known for its transparency, focuses on maximizing returns for investors, aligning with John Bogle’s philosophy. Despite its strong reputation, the parent company in the US has faced minor regulatory challenges in recent years.

Ownership and Transparency

Vanguard has a unique ownership structure that distinguishes it from other investment companies. Founded in the United States in 1975 by John C. Bogle, Vanguard operates under a client-owned structure, meaning the company is owned by its US-domiciled funds and ETFs, which are, in turn, owned by their investors. Vanguard aims to align its interests with those of its clients, focusing on low-cost investments. As a result, instead of paying dividends to external shareholders, Vanguard redirects its profits back to its investors in the form of lower fees. This structure is a key factor in its growth and reputation as one of the largest asset managers globally, with a strong presence in the UK since opening its office there in 2009.

In addition, the company offers just its own ETFs and Mutual Funds products. Vanguard ETFs and mutual funds embody the company’s long-standing belief in index investing, the power of compounding returns through low costs, and the importance of long-term, disciplined investing. Vanguard advocates for broad diversification and a steady approach to investing, rather than trying to outguess market movements.

Safety Considerations

Despite Vanguard being a private entity, without ratings and analyst coverage, we view their simple business model and scale as very positive aspects. While Vanguard is certainly large and interconnected, its primary role as an asset manager, rather than a bank or insurer, might influence its classification regarding systemic importance. Regulations and designations can change, and entities such as Vanguard are closely monitored by financial regulatory authorities around the world. Asset management firms like Vanguard have not been designated as SIFIs in the United States, but being a TOP 3 Asset Manager it is critical to the financial system.

Regulation & Investor Compensation Schemes

Share & Cash Custodians

State Street serves as the direct custodian for your shares as well as your cash when you invest with Vanguard Investment UK. Personal CREST accounts are not supported.

Reputation

Overall, Vanguard has a stellar reputation in the investment industry. While Vanguard Investor UK was never fined from the regulatory authority, Vanguard US had a few minor disputes in the last few years.

One notable instance involved the Financial Industry Regulatory Authority (FINRA) fining Vanguard for errors in approximately 8.5 million customer account statements. These errors included overstating projected yield and projected annual income for nine money market funds from November 2019 to September 2020, leading to an $800,000 fine. In another case in 2022, Vanguard agreed to a $6.25 million settlement to resolve regulatory charges in Massachusetts. The issue was related to Vanguard’s target-date retirement funds, where fund investors faced unexpectedly large tax bills due to Vanguard’s decision to lower the minimum investments in lower-cost funds. This led to a significant number of outflows from higher-cost funds, generating capital gains on which investors had to pay taxes. While Vanguard did not admit wrongdoing in these settlements, the company took steps to address the issues and reimbursed affected investors in the case of the tax bill incident.

II. Fee structure

Vanguard Investor UK has a simple fee structure that is more convenient for higher asset accounts, since it is capped at £375 for accounts above 250K. Typically, it also does not charge any transaction fees. It remains the most expensive option among the UK Tier 1 competitors, particularly for smaller accounts. Investors have to consider that Vanguard fees are applied across all accounts, whereas its competitors bill separately for each account type. However, Vanguard can be competitive in a decumulation (retirement phase), due to lack of transaction fees.

Platform fees

Vanguard Investor UK fee structure is same for all types of accounts and designed as follows:

- Account Charge: 0.15% per year, however for accounts above £250K the cost is capped at £375 per year.

- Managed Accounts: since 2022, Vanguard Investment UK offer a managed account service that it is charged 0.3% on top of the account fees.

There are no Inactivity fees.

Estimated Fees

| Accounts Value | £50K | £100K | £150K | £200K | >£250K |

|---|---|---|---|---|---|

| Account Fee | £75 | £150 | £225 | £300 | £375 |

Trading Commisions

Vanguard Investor UK trading fees are as follows:

- ETF Trading Fees: ETFs are traded without charge at the next available price. There is an option to use the Quote and Deal service, which provides a real market price quote, but it incurs a fee of £7.50 per transaction.

- Mutual Fund Trading Fees: traded without charge at the next available price.

Overall Fee Simulation vs UK Tier 1 Competitors

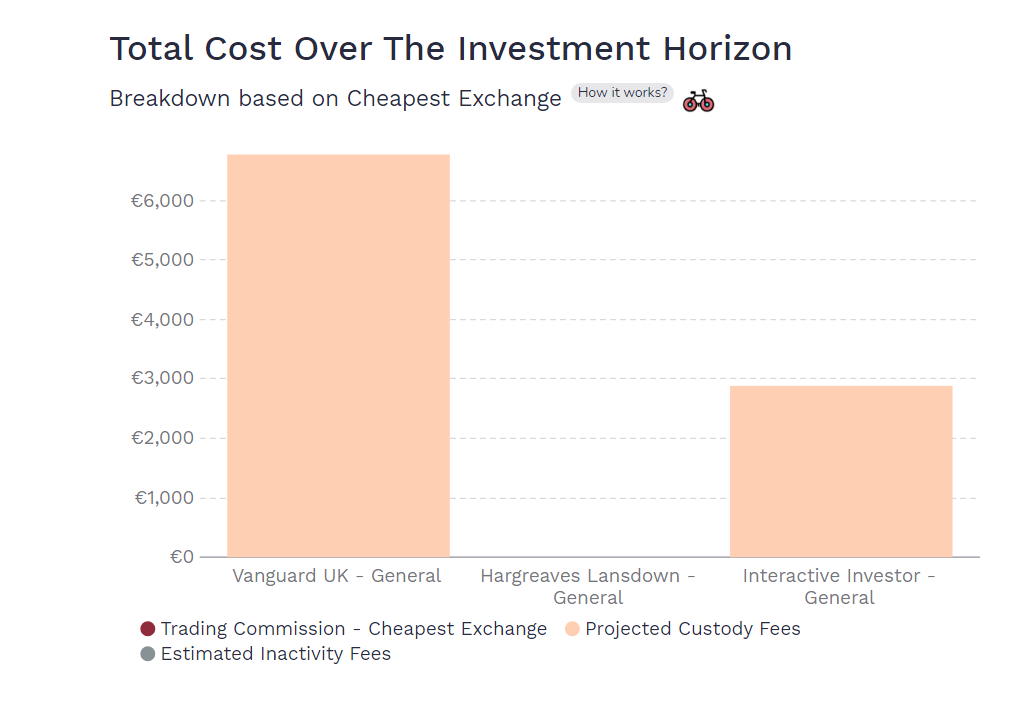

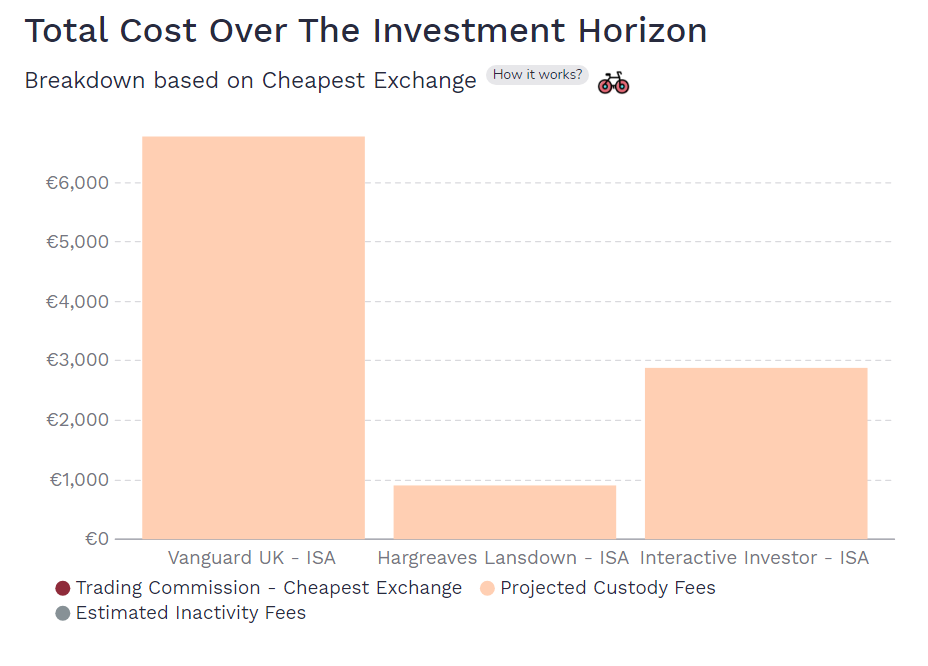

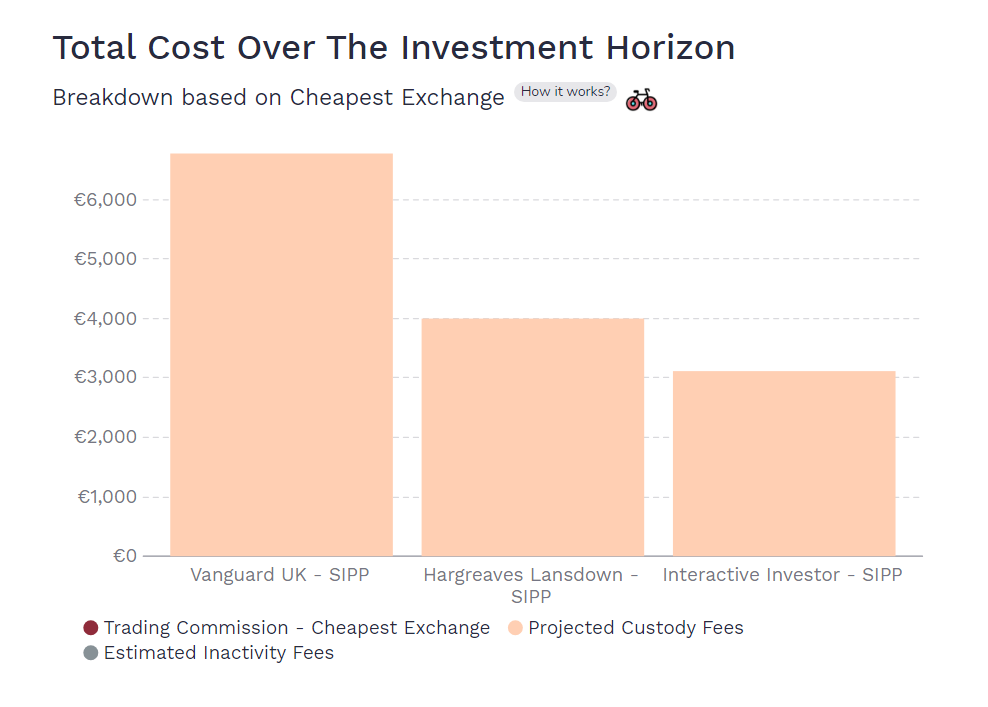

Most of our readers have simple Index portfolios. Using our Broker Total cost calculator, you can estimate the total cost of holding ETFs throughout the investment period. For all our simulated scenarios, Vanguard comes out as the most expensive option:

- General Accounts – Vanguard Investor UK comes out more expensive

- ISAs – Vanguard Investor UK comes out more expensive

- SIPPs – Vanguard Investor UK comes out more expensive

Fee Simulation For General Accounts

In the below simulation, a 20-year accumulation period broker bill for a General Trading account comes out at £6,769 for Vanguard Investor UK, much higher than for two of its direct competitors. Indeed, the cost is £0 for Hargreaves Lansdown (the calculator assumes the use of its free regular investing service) as the broker does not charge any custody fees for ETFs and £2,878 for Interactive Investor, that does not charge for regular investing. Vanguard charges the same for all three types of accounts.

Investor assumptions

| Model Feature | Assumption |

|---|---|

| Investor | UK |

| Instrument | UCITS ETF |

| Account | General |

| Initial Investment | £ 100,000 |

| Monthly | £ 1,000 |

| Time Horizon | 20 years |

| Gross Return | 8% |

Total Fees

Fee Simulation For ISAs

In the below simulation, a 20-year accumulation period broker bill for an ISA account comes out at £6,769 for Vanguard, as for the general account significantly above the two competitors. For Interactive Investor is £2,878 (assuming the use of the free regular investing service). For Hargreaves Lansdown the cost is even lower stopping at £900 due to yearly custody fees capped at £45 (the calculator assumes the use of free regular investing service).

Investor assumptions

| Model Feature | Assumption |

|---|---|

| Investor | UK |

| Instrument | UCITS ETF |

| Account | ISA |

| Initial Investment | £ 100,000 |

| Monthly | £ 1,000 |

| Time Horizon | 20 years |

| Gross Return | 8% |

Total Fees

Fee Simulation For SIPPs

In the below simulation, a 20-year accumulation period broker bill for a SIPP account comes out still at £6,769. The two competitors are still cheaper although less than for the previous accounts. Interactive Investor charges £3,118 (Pension Builder fees are used since the initial investment is above £50K). Hargreaves Lansdown comes in between, charging £4,000 (assuming the use of free regular investing service).

Investor assumptions

| Model Feature | Assumption |

|---|---|

| Investor | UK |

| Instrument | UCITS ETF |

| Account | SIPP |

| Initial Investment | £ 100,000 |

| Monthly | £ 1,000 |

| Time Horizon | 20 years |

| Gross Return | 8% |

Total Fees

Currency Exchange fees

Vanguard Investor UK does not charge any FX fees since all funds are traded in pounds. There are international securities within the funds however any charges related to the FX would be built into the fund charges.

Other fees

Deposits and withdrawals are free of charge.

III. Platform & Features

Vanguard Investor UK offers a simple and intuitive website for trading ETFs and mutual funds, the only two investment types available in the UK market. While the site’s ease of use is notable, its basic design may not appeal to all investors, particularly due to the absence of a dedicated investment app. Additionally, the ETF selection is restricted to Vanguard’s own products, limiting diversification options for investors looking for a broader range of ETFs.

Account Opening Process

Opening a Vanguard account is straightforward and takes about 5 to 10 minutes. You’ll start by selecting your investment goal and the type of account you want. The process involves providing personal information, reviewing details for accuracy, creating a username and password, setting up security questions, and adding a bank account for transactions. You can fund your account immediately or later, although some products require a minimum investment.

account Features

Vanguard Investor UK offers limited functionalities due to their focus on low cost and simplicity:

- No Multicurrency Accounts

- No Mobile or Web App interface: Vanguard UK, conversely to Vanguard US, does not offer an app therefore the investors need to trade on the website of the company.

- Vanguard ETFs and Mutual Funds only – in alignment with their global strategy focused on low cost and simplicity. Check the geeky section below for the full list.

- Regular Periodic Investing Feature – available on all accounts and free of charge.

Available Mutual Funds and ETFs

| Product Name | Product Type | OCF |

|---|---|---|

| ESG Developed Asia Pacific All Cap UCITS ETF | ETF | 0.17% |

| ESG Developed Europe All Cap UCITS ETF | ETF | 0.12% |

| ESG Emerging Markets All Cap UCITS ETF | ETF | 0.24% |

| ESG EUR Corporate Bond UCITS ETF | ETF | 0.16% |

| ESG Global All Cap UCITS ETF | ETF | 0.24% |

| ESG Global Corporate Bond UCITS ETF | ETF | 0.15% |

| ESG North America All Cap UCITS ETF | ETF | 0.12% |

| ESG USD Corporate Bond UCITS ETF | ETF | 0.16% |

| EUR Corporate Bond UCITS ETF | ETF | 0.09% |

| EUR Eurozone Government Bond UCITS ETF | ETF | 0.07% |

| FTSE 100 UCITS ETF | ETF | 0.09% |

| FTSE 250 UCITS ETF | ETF | 0.10% |

| FTSE All-World High Dividend Yield UCITS ETF | ETF | 0.29% |

| FTSE All-World UCITS ETF | ETF | 0.22% |

| FTSE Developed Asia Pacific ex Japan UCITS ETF | ETF | 0.15% |

| FTSE Developed Europe ex UK UCITS ETF | ETF | 0.10% |

| FTSE Developed Europe UCITS ETF | ETF | 0.10% |

| FTSE Developed World UCITS ETF | ETF | 0.12% |

| FTSE Emerging Markets UCITS ETF | ETF | 0.22% |

| FTSE Japan UCITS ETF | ETF | 0.15% |

| FTSE North America UCITS ETF | ETF | 0.10% |

| Germany All Cap UCITS ETF | ETF | 0.10% |

| Global Aggregate Bond UCITS ETF | ETF | 0.10% |

| S&P 500 UCITS ETF | ETF | 0.07% |

| U.K. Gilt UCITS ETF | ETF | 0.07% |

| USD Corporate 1-3 Year Bond UCITS ETF | ETF | 0.09% |

| USD Corporate Bond UCITS ETF | ETF | 0.14% |

| USD Emerging Markets Government Bond UCITS ETF | ETF | 0.25% |

| USD Treasury Bond UCITS ETF | ETF | 0.07% |

| SustainableLife 40-50% Equity Fund | Mutual Fund | 0.48% |

| SustainableLife 60-70% Equity Fund | Mutual Fund | 0.48% |

| SustainableLife 80-90% Equity Fund | Mutual Fund | 0.48% |

| Active U.K. Equity Fund | Mutual Fund | 0.45% |

| Emerging Markets Bond Fund | Mutual Fund | 0.60% |

| Emerging Markets Stock Index Fund | Mutual Fund | 0.23% |

| ESG Developed World All Cap Equity Index Fund | Mutual Fund | 0.20% |

| ESG Developed World All Cap Equity Index Fund (UK) | Mutual Fund | 0.20% |

| ESG Emerging Markets All Cap Equity Index Fund | Mutual Fund | 0.25% |

| ESG Global Corporate Bond Index Fund | Mutual Fund | 0.20% |

| Euro Government Bond Index Fund | Mutual Fund | 0.12% |

| Euro Investment Grade Bond Index Fund | Mutual Fund | 0.12% |

| FTSE 100 Index Unit Trust | Mutual Fund | 0.06% |

| FTSE Developed Europe ex-U.K. Equity Index Fund | Mutual Fund | 0.12% |

| FTSE Developed World ex-U.K. Equity Index Fund | Mutual Fund | 0.14% |

| FTSE Global All Cap Index Fund | Mutual Fund | 0.23% |

| FTSE U.K. All Share Index Unit Trust | Mutual Fund | 0.06% |

| FTSE U.K. Equity Income Index Fund | Mutual Fund | 0.14% |

| Global Bond Index Fund | Mutual Fund | 0.15% |

| Global Corporate Bond Index Fund | Mutual Fund | 0.18% |

| Global Credit Bond Fund | Mutual Fund | 0.35% |

| Global Emerging Markets Fund | Mutual Fund | 0.78% |

| Global Equity Fund | Mutual Fund | 0.48% |

| Global Equity Income Fund | Mutual Fund | 0.48% |

| Global Short-Term Bond Index Fund | Mutual Fund | 0.15% |

| Global Short-Term Corporate Bond Index Fund | Mutual Fund | 0.18% |

| Global Small-Cap Index Fund | Mutual Fund | 0.29% |

| Global Sustainable Equity Fund | Mutual Fund | 0.48% |

| Japan Government Bond Index Fund | Mutual Fund | 0.12% |

| Japan Stock Index Fund | Mutual Fund | 0.16% |

| Pacific ex-Japan Stock Index Fund | Mutual Fund | 0.16% |

| SRI European Stock Fund | Mutual Fund | 0.14% |

| Sterling Short-Term Money Market Fund | Mutual Fund | 0.12% |

| U.K. Government Bond Index Fund | Mutual Fund | 0.12% |

| U.K. Inflation-Linked Gilt Index Fund | Mutual Fund | 0.12% |

| U.K.Investment Grade Bond Index Fund | Mutual Fund | 0.12% |

| U.K. Long Duration Gilt Index Fund | Mutual Fund | 0.12% |

| U.K. Short-Term Investment Grade Bond Index Fund | Mutual Fund | 0.12% |

| U.S. Equity Index Fund | Mutual Fund | 0.10% |

| U.S. Government Bond Index Fund | Mutual Fund | 0.12% |

| U.S. Investment Grade Credit Index Fund | Mutual Fund | 0.12% |

Internalisation and PFOF

PFOF is not allowed in the UK therefore Vanguard Investor UK does not engage in this practice.

Cash Interest

Vanguard Investor UK offers average interest rates on cash balances at 2.6%, which does not compete favourably with more attractive rates offered by some competitors and is not aligned with the risk-free rate in sterling, SONIA, currently standing at 5.2%.

Advanced Features

Vanguard Investor UK prioritizes simplicity and low cost, with a focus on traditional investment products. As such, it does not offer advanced trading features like Futures, Options, Derivatives, and Margin Loans, catering more to investors looking for straightforward investment options. Vanguard UK offers Bond ETFs and Mutual Funds, but you cannot trade bonds directly. Likewise, there is no possibility to trade directly individual company shares. Below is a summary of the available investment types:

Features

| Investment Type | Availability |

|---|---|

| ETFs | ✅ |

| Stocks | ❌ |

| Bonds | ❌ |

| Funds | ✅ |

| Options | ❌ |

| Derivative | ❌ |

| Futures | ❌ |

| CFDs | ❌ |

| Forex | ❌ |

| Crypto | ❌ |

| Commodities | ❌ |

IV. Taxes

Tax Wrappers

Vanguard Investment UK started offers the most common tax-advantaged accounts available in the UK. This includes:

- ISA

- Junior ISA

- SIPP

Tax Reporting

Vanguard Investment UK provides tax reports, however the reporting functionality to the tax authority is not automated and is responsibility of the individual investor.

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – BlackRock Launches New iBonds, Truth About €1M Broker Insurance & BOW is 4 years old!

The Truth About €1 Million Broker Guarantees

4 Things I Learned In 4 Years Of Running A Finance Blog

Dodl By AJ Bell Review – AJ Bell’s Younger Brother

Vanguard LifeStrategy Review – A Retriever In A Babushka Doll

Why Do Portfolio Managers Care About Factors? It’s Not What You Think.

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.