Hargreaves Lansdown Review

Overall Rating: CHEAPEST BIG THREE UK BROKER FOR BUY & HOLD Investors

4.3

/5

Overall Rating: CHEAPEST BIG THREE UK BROKER FOR BUY & HOLD investors

Our take: Hargreaves Lansdown projects an image of a premium, dependable service where no corners have been cut. In cycling terms it’s pitching you Trek or Specialized – big brand, high production quality. HL has everything you need to conduct a wide range of basic to fairly complex investing activities, but you’ll need to be smart to manage costs carefully, since these can be high versus competitors.

Is it suitable for you?

- UK Passive Investors: will find all of the products and tools they need to manage simple portfolios. The user interface and customer service are top quality and regular investing set-and-forget order execution is straightforward and very cheap.

- Semi-Active Investors: will find the wide range of ETFs, shares and funds helpful in their more complex portfolio construction. They’ll need to invest in a regular, systematic way to avoid taking a hit from fees outside auto-investing feature.

- Advanced Investors with International Portfolios: have access to a well run platform with large choice of funds and shares, but may find dealing fees, FX fees and lack of access to advanced tools like margin lending, or US ETFs frustrating.

This article contains affiliate links. We provide full transparency on how it works.

Pros & Cons and suitability

Pros & Cons

- Strong Brand, Long History

- Complete Range Of UK Specific Tax Advantaged Accounts

- User Friendly Web And Mobile Applications

- Regular Investing Commission-Free

- Avoid HL Active Funds

- Information overload on website

- Expensive for active trading

- Concerning past practices in recommending funds to customers.

Suitability

VERY Suitable

Reputable, ZERO-cost DEALING

Suitable

Large spectrum of tax wrappers, but high commissions outside automatic trading, high fx fees.

SOMEWHAT Suitable

no MARGIN lending, NO ACCESS TO US ETFS, limited derivatives

Availability

Hargreaves Lansdown is only Available in the UK

Hargreaves Lansdown is mostly available to investors resident in the UK and has no plans for international expansion. This intense focus on one market serves UK customers well but excludes the majority of non UK based investors.

European economic area investors can however open the General investment Account, although the process can take time. Online application are not accepted and paper forms and documentation have to be sent to the UK. In addition, documentation that is not in Latin alphabets need to be officially translated trough solicitors or equivalent.

Broker Snapshot

Why Is Hargreaves Lansdown A Tier 1 Broker?

Hargreaves Lansdown is a big name and well known in the UK. It has a long track record tracing back to its founding in 1985 and is by far the largest UK retail investment platform. It is listed on the LSE and a constituent of the FTSE 250 index with a market cap of £3.8 billion as of March 2024. These facts justify categorising HL as a Tier 1 broker. Only Interactive Brokers can claim more assets under administration in Europe amongst pure play investment platforms not associated with banks. Its main competitors are Tier 1 UK-only brokers that cater to relatively high net worth individuals like Interactive Investor or AJ Bell.

Long Standing, Transparent & Listed On The London Stock Exchange

Hargreaves Lansdown’s is the UK’s largest retail investor platform with approximately £143.7 billion of the savings across 1.8 million clients under administration across accounts with an average account size of around £80k. The sheer scale of assets under administration and 43-year history makes it a well-known name in the UK.

Company Info

| Characteristic | Hargreaves Lansdown |

|---|---|

| Inception Date | 🛈 1985 |

| Headquarters | 🛈 Bristol, UK |

| Key Owner | 🛈 Peter Hargreaves, Stephen Lansdown & staff own approximately 28% of the equity. |

| Bank Affiliated | ❌ No |

| Listed on Stock Exchange | ✅ LSE, £3.43bn |

| Parent Rating | ❌ No |

| Net Income | ✅ £402.7mn (2023) |

Regulation

| Feature | Hargreaves Lansdown |

|---|---|

| EU Entity | 🛈 None |

| UK Entity | 🛈 Hargreaves Lansdown PLC |

| Key Regulators | ✅ FCA, UK |

| EU Regulator | N/A |

| UK Regulator | ✅ FCA, UK |

| EU Guarantee | N/A |

| UK Guarantee | 🛈 Max. £85k |

Competitive Fees And Margin Accounts

Hargreaves Lansdown offers access to all major stock exchanges. They charge yearly percentage fees on your assets and have average ETFs dealing fees. The trick is to opt for an automatic investment plan where there are no charges. However, multicurrency accounts and Margin Loan are not available. FX remains expensive. Cash interest is remunerated, although rates are not very competitive, but in line with its main competitors.

Features

| Feature | Hargreaves Lansdown |

|---|---|

| Key Base Currencies | 🛈 GBP |

| ETF Availability | ✅ Good (1200) |

| Multicurrency | ❌ Not Available |

| Cash Interest | ✅ Yes |

| Margin Loans | ❌ No |

| Exchanges | ✅ All Major |

| External PFOF Reliance | ✅ None |

Fee Structure

| Feature | Hargreaves Lansdown |

|---|---|

| Custody Fees | ✅ Competitive |

| Inactivity Fees | ✅ None |

| ETFs Dealing Fees | ↔️ Average |

| FX Fees | ❌ High |

| Deposit Fees | ✅ None |

| Withdrawal Fees | ✅ None |

| Security Lending | ✅ No |

I. Company

Hargreaves Lansdown has a long presence in the market, with relatively vanilla business model, and high profitability. Although there are no known regulatory and compliance issues, their reputation has been tarnished by the association with Woodford Equity Income Fund.

Business Profile

The majority of its account types are carefully aligned to be UK-tax advantaged and efficient. Its business model involves offering personal financial advice to UK residents through advisors in approximately 40 towns and cities across the UK.

Ownership and Transparency

The founders, Peter Hargraves and Stephen Lansdown own 19.8% and 5.72% of the company respectively, meaning that they hold approximately 25% of the company, followed up by active mutual fund houses Lindsell Train and Baillie Gifford at 12.7% and 4.6%. The board of directors includes significant experience at the highest levels of the asset management, risk management, insurance, audit and private banking industries.

Safety Considerations

HL is a consistently profitable company, posting pre-tax profits of £403 million in 2023. It is not listed as one of the UK’s systemically important financial institutions but with 1.8 million active clients (for context 1.8 million people represents 4.8% percent of the entire working age population) is a good candidate for a standout platform which might attract special treatment from the Financial Conduct Authority (FCA) in event of crisis, although this is by no mean certain. The company is not rated by a rating agency.

Regulation & Investor Compensation Schemes

The FCA Financial Services Compensation Scheme protects up to £85,000 per institution in event of firm failure. Importantly this is not per customer per institution, rather than per account held by a customer. A customer with £85,000 in an ISA and £85,000 in a SIPP would only be able to seek up to £85,000 total compensation in case of firm failure. Learn more about broker bankruptcy protections.

Share & Cash Custodians

Customer cash is held in major banks including Lloyds, Barclays, Goldman Sachs and HSBC. Customer stocks are held in the name of Hargreaves Lansdown Nominees Limited.

Reputation & Caution related to HL Funds

HL is well known and widely used in the UK with a long track record measured in decades rather than years. It continues to increase client numbers, an indication that as far consumer sentiment goes, HL is viewed positively. HL has a good reputation for customer service and has a large, UK based, call centre to deal with customer issues, this in person rather than robo service aspect compliments HL’s in person planning and advice services. HL seems tailored to fit the needs and aspirations of middle-aged investors, perhaps with families of their own and an eye on their children’s future as much as their own.

One issue negatively impacting HL in our assessment is its association with the Woodford fund crisis. An active fund (Woodford Equity Income Fund) underwent significant style drift into illiquid positions in small companies, ultimately leading to massive, unrecoverable losses for investors. HL had promoted this fund on its best buys list and continued to recommend it to customers (130,000 accounts held the fund) until the day trading was suspended. HL also runs an in house set of equity and multi asset mutual funds known as HL Funds. These have relatively high costs from 90 to 121 basis point. Investors are likely to be better off choosing cheaper alternatives. Read more about this in the Geeky Section.

Woodford Legal Issues

This resulted in a four-year legal battle over regaining what remained of the funds which has only recently come to an end. This philosophy of backing and promoting hot fund managers appears to be ingrained in the founder’s mindset: “I think it’s important to practice the investment philosophy that one preaches. To invest in individual shares, you have to do a lot of research, and frankly, most people don’t have the time. I would rather leave it to the likes of experts like Neil Woodford, Anthony Bolton and William Littlewood.”

Banker on Wheels does not find the evidence of likely existence of star managers nor retail investor skill in selecting them ahead of time persuasive, and instead advocates empirically informed passive investment strategies.

HL also runs an in house set of equity and multi asset mutual funds known as HL Funds. These have relatively high costs from 90 to 121 basis points, and given both the concerns noted above regarding the viability of selecting successful active managers and the fact that HL is not a firm with substantial equity research activities in the first place, these seem like a poor option for wise investors. Even HL’s own compliance department have raised concerns about the value that these funds represent to consumers. These funds have significantly better profit margins for HL than merely acting as execution only for other funds on its platform.

II. Fee structure

Hargreaves Lansdown has very competitive fees for General Accounts (where there is no custody charge) and is a leading ISA provider, mostly for investors that take advantages of the automatic investment features. However, their FX fees are high and do not make the broker competitive for international trading.

Platform fees

While Hargreaves Lansdown does not charge explicit inactivity fees, for non-trading portfolios you still have to pay a monthly fee.

Hargreaves Lansdown‘s fee structure is designed as follows:

- General Account – For ETFs there is no charge.

- ISAs – ETF charge is 0.45% up to a maximum of £45 per year.

- SIPPs – ETF charge is 0.45% up to a maximum is £200 per year.

Monthly fees

| Account Type | Fee Type | Up £250K | £250K to £1m | £1m-2m | Maximum |

|---|---|---|---|---|---|

| Fund and Share Account | Custody: Funds | 0.45% | 0.25% | 0.1% | £45 |

| Fund and Share Account | Custody: Shares, Trusts, ETFs | 0 | 0 | 0 | 0 |

| ISA Accounts | Custody: Funds | 0.45% | 0.25% | 0.1% | £45 |

| ISA Accounts | Custody: Shares, Trusts, ETFs | 0.45% | 0.45% | 0.45% | £45 |

| Self-Invested Private Pension | Custody: Funds | 0.45% | 0.25% | 0.1% | £200 |

| Self-Invested Private Pension | Custody: Shares, Trusts, ETFs | 0.45% | 0.45% | 0.45% | £200 |

Trading Commisions

- Regular Investing (FREE for ETFs on LSE) – Regular buying investing instructions funded by direct debit are free of charge across many ETFs, which is strongly preferable to the relatively high fees for spontaneous trades in ETFs. Please note that when you sell, the standard trading fees always apply (£11.95). Hargreaves Lansdown has no fees for trading funds.

- Ad hoc trades – Across shares, bonds, gilts and trusts involve a £11.95 fee for the first if 9 or fewer deals in the previous month.

- Reinvestment of dividends – Automatic reinvestment of dividends is free when those payments rise to £10 or above.

Trading fees for all account types

| Number of Trade | Preferred ETFs – Buy (Regular Investment) | Preferred ETFs – Sell | Other ETFs – Buy & Sell | |

|---|---|---|---|---|

| Up to 9 | No Charge | £11.95 | £11.95 | |

| 10 to 19 | No Charge | £8.95 | £8.95 | |

| 20+ | No Charge | £5.95 | £5.95 |

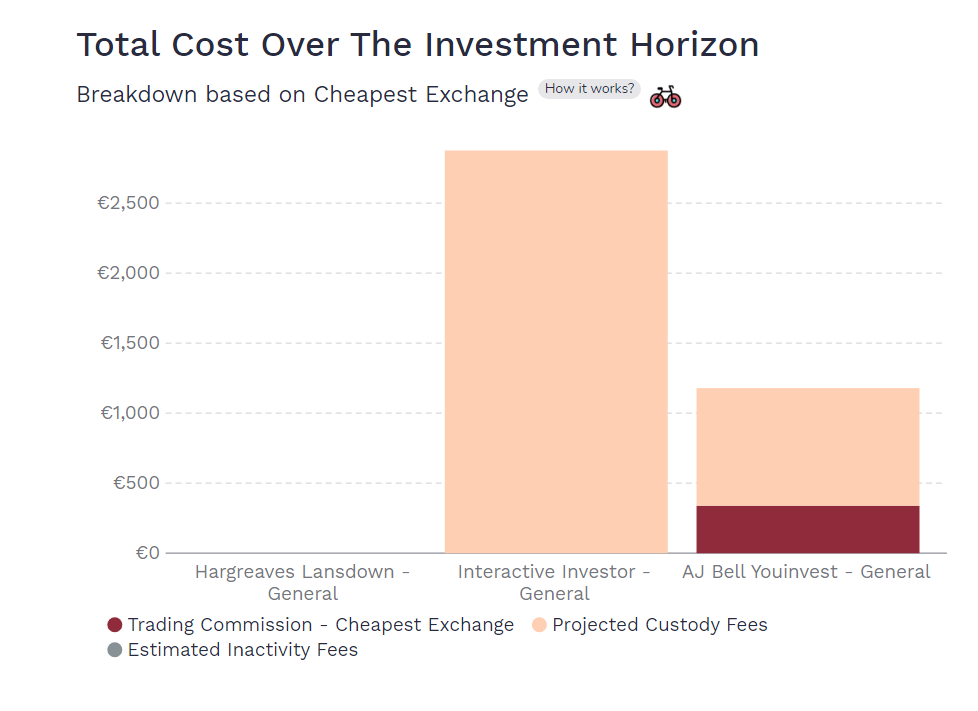

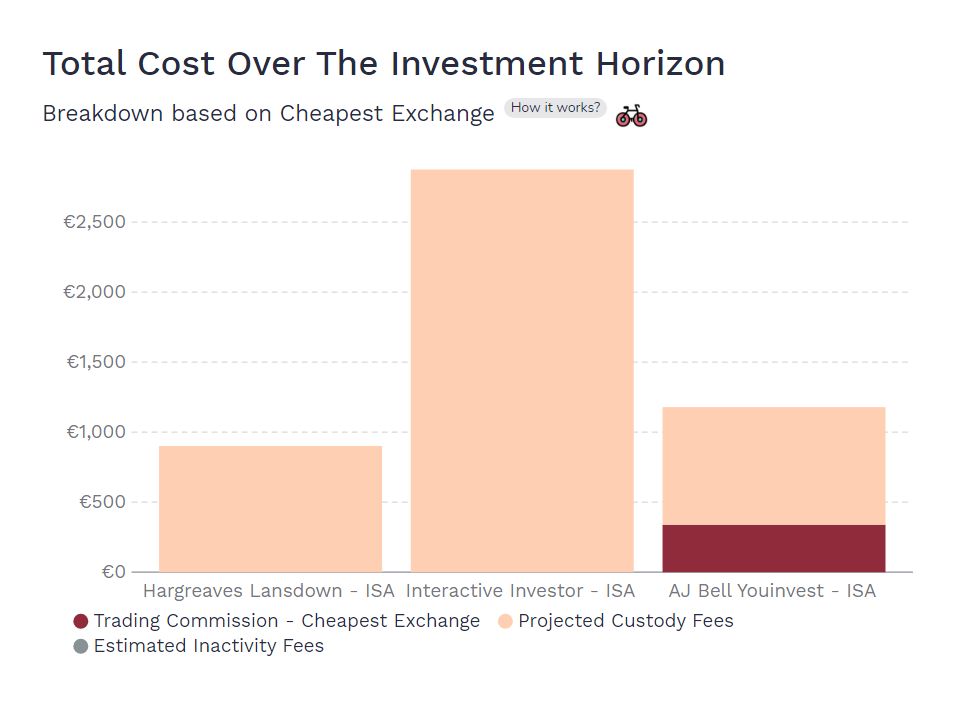

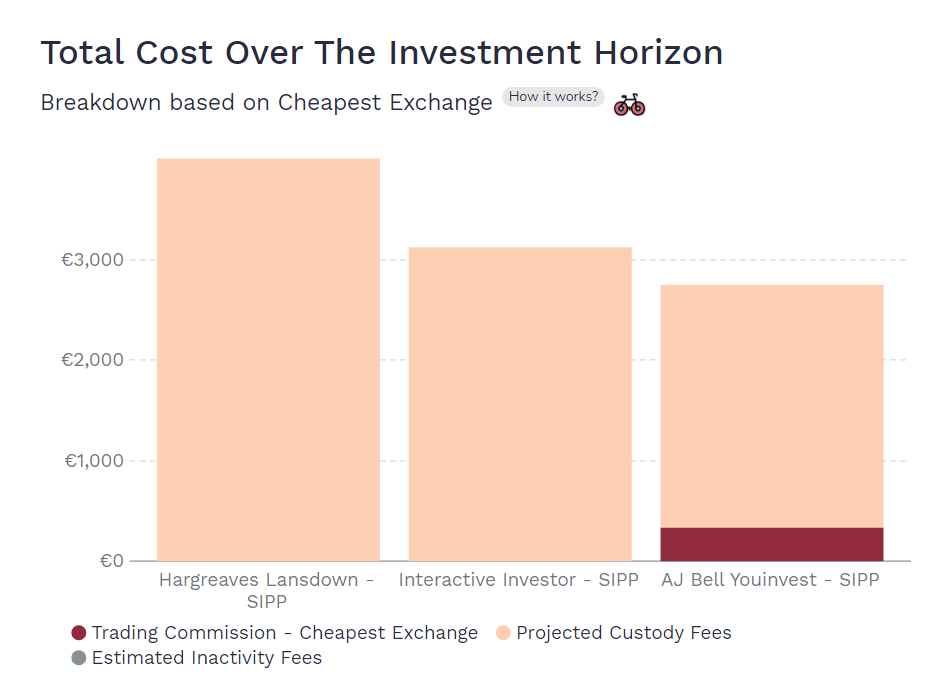

Overall Fee Simulation vs UK Tier 1 Competitors

Most of our readers have simple Index portfolios. Using our Broker Total cost calculator, you can estimate the total cost of holding ETFs throughout the investment period. For our simulated scenarios:

- General Accounts – Hargreaves Lansdown comes out the cheapest

- ISAs – Hargreaves Lansdown comes out the cheapest

- SIPPs – Hargreaves Lansdown is competitive

Fee Simulation For General Accounts

In the below simulation, a 20-year accumulation period broker bill for a General Trading account comes out at £0 for Hargreaves Lansdown (the calculator assumes the use of its free regular investing service) as the broker does not charge any custody fees for ETFs. Two of its direct Tier 1 UK competitors are much more expensive. The cost is £1,182 for AJ Bell, that charges £1.50 for regular investing, and £2,878 for Interactive Investor (please note Investor Plan fees are used since the initial investment is above £50K). Please note that ISAs and General accounts have the same cost for both Interactive Investor and AJ Bell Youinvest.

Investor assumptions

| Model Feature | Assumption |

|---|---|

| Investor | UK |

| Instrument | UCITS ETF |

| Account | General |

| Initial Investment | £ 100,000 |

| Monthly | £ 1,000 |

| Time Horizon | 20 years |

| Gross Return | 8% |

Total Fees

Fee Simulation For ISAs

In the below simulation, a 20-year accumulation period broker bill for an ISA account comes out as the cheapest option for Hargreaves Lansdown at £900 (the calculator assumes the use of free regular investing service), due to yearly custody fees capped at £45. Two of its competitors in the same category are more expensive, £1,182 for AJ Bell, that charges £1.50 for regular investing transactions) and £2,878 for Interactive Investor (please note Investor Plan fees are used since the initial investment is above £50K).

Investor assumptions

| Model Feature | Assumption |

|---|---|

| Investor | UK |

| Instrument | UCITS ETF |

| Account | ISA |

| Initial Investment | £ 100,000 |

| Monthly | £ 1,000 |

| Time Horizon | 20 years |

| Gross Return | 8% |

Total Fees

Fee Simulation For SIPPs

In the below simulation, a 20-year accumulation period broker bill for a SIPP account comes outa as the most expensive option, charging £4,000 (assuming the use of free regular investing service). Two of its direct competitors are cheaper with Interactive Investor billing £3,118 (Pension Builder fees) and AJ Bell £2,742 (using the regular investing transaction service that bills any transaction £1.50).

Investor assumptions

| Model Feature | Assumption |

|---|---|

| Investor | UK |

| Instrument | UCITS ETF |

| Account | SIPP |

| Initial Investment | £ 100,000 |

| Monthly | £ 1,000 |

| Time Horizon | 20 years |

| Gross Return | 8% |

Total Fees

Currency Exchange fees

Currency fees are high to average, with 1.0% on up to £5,000. 0.50% to convert dividend income / corporate action into sterling from foreign currency. High FX fees are a widespread feature of UK based platforms, perhaps facilitating home country bias for these investors. Although you can buy shares listed on exchanges beyond just the LSE, you cannot hold US listed ETFs.

FX Fees

| Value of trade | FX charge |

|---|---|

| First £5,000 | 1.00% |

| Next £5,000 | 0.75% |

| Next £10,000 | 0.50% |

| Over £20,000 | 0.25% |

Other fees

Deposits and withdrawal are free of charge.

III. Platform & Features

Hargreaves Lansdown‘s platform has an intuitive and user-friendly interface. Hargreaves Lansdown provides access to all major exchanges for ETF investors. HL offers you the possibility to open accounts for your children. However, advanced trading instruments are fairly limited.

Account Opening Process

To open an account at Hargreaves Lansdown you need proof of ID, a national insurance number and a bank account in your name. It took me approximately 15 minutes to open an account with Hargreaves Lansdown.

account Features

- Hargreaves Lansdown’s website and app have all the basic tools needed to find and execute investments across various asset classes while managing a portfolio.

- Hargreaves Lansdown has a large in house research team on funds, ETFs and single stocks which published frequent analysis for customers, so you have access to recent, fairly serious research on markets and trends.

- For those investing with younger family members in mind, Junior SIPP and Junior ISA options are very useful.

- For those saving for a first home, LISA account is advantageous.

Internalisation and PFOF

There is no reliance on PFOF since it is not legally allowed in the UK.

Cash Interest

Hargreaves Lansdown offers relatively low interest rates on cash held in its stocks and shares ISA accounts, 3.04% AER between £0 and £9,999,99. This does not compare favourably to the risk-free rate in sterling, SONIA, currently standing at 5.2%. For investors with longer timelines between depositing cash and dealing securities, this represents an opportunity cost. HL were named in a recent FCA letter criticising poor value being delivered to customers on their cash holdings within investment accounts.

Advanced Features

Hargreaves Lansdown do not offer margin loan, derivatives, futures and options. However, the customers can engage in CFDs. Below is a summary of the available investment types:

Features

| Investment Type | Availability |

|---|---|

| ETFs | ✅ |

| Stocks | ✅ |

| Bonds | ✅ |

| Funds | ✅ |

| Options | ❌ |

| Derivative | ❌ |

| Futures | ❌ |

| CFDs | ❌ |

| Forex | ❌ |

| Crypto | ❌ |

| Commodities | ❌ |

IV. Taxes

Tax Wrappers

HL offers the full range of UK tax efficient accounts for those aiming for tax relief (SIPP) or capital gains and income tax shielding (ISA, LISA).

- ISA

- LISA

- SIPP

- Junior ISA

- Junior SIPP

- Cash ISA

Tax Reporting

For those clients who invest outside tax wrapper accounts, HL will provide consolidated tax certificates to help with filing tax reports annually

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – BlackRock Launches New iBonds, Truth About €1M Broker Insurance & BOW is 4 years old!

The Truth About €1 Million Broker Guarantees

4 Things I Learned In 4 Years Of Running A Finance Blog

Dodl By AJ Bell Review – AJ Bell’s Younger Brother

Vanguard LifeStrategy Review – A Retriever In A Babushka Doll

Why Do Portfolio Managers Care About Factors? It’s Not What You Think.

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.