Weekend Reading – Bonds Rollercoaster: Fear, Greed, and the Search for Safe Havens

Weekend Reading is a collection of Investment Research and Lifestyle topics from all corners of the Web.We source the highest quality insights from Wall Street and Main Street that you may apply to your investment process. Unlike the rest of Bankeronwheels.com, this series is provided without additional guidance. As usual, everything is to be used at your own risk. Below is the type of content we shortlist.

Invest Wisely section is dedicated to research on how to invest for the Long Run using Passive Investment Strategies. Read Topics related to (i) Portfolio Construction and Asset Allocation (ii) Acting wisely by avoiding behavioural traps and also (iii) publications that help understand how financial markets work.

Active Investing section relates to improving your knowledge about active investing. If you decide to sin, then sin only a little. Given ample evidence, combined active bets should be ideally a relatively small fraction of your portfolio. This section also includes Sustainable Investing. You can invest in a Socially Responsible way, but there are many ESG traps. Learn how to invest sustainably, and what it means for expected returns, with our definitive guide to sustainable investing.

Personal Finance section is dedicated to UK and European Products. It can also touch on other European jurisdictions outside the Euro-zone.

- Recommeded Reading

- Youtube (Required watch time)

- Podcast (Listening Time)

- Academic Research - May require intermediate/advanced knowledge

- Noteworthy Twitter Thread

'People do not decide their futures, they decide their habits and their habits decide their futures

F. M. Alexander

INVEST WISELY

CONSTRUCT YOUR PORTFOLIO

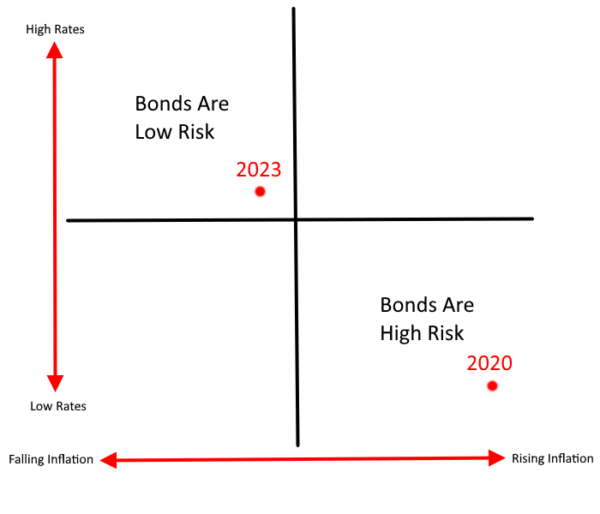

Bond Yields are at decade high, but Bonds are also a shield for your medium and long-term portfolios, including when deflation strikes. This makes them a mandatory component for any portfolio.

Explore how investment horizon, geographical diversification, risk & return tradeoff & the specific ETF characteristics are important pillars of selecting a long term Bond ETF for your portfolio.

We also have a list of Best ETFs.

In the 1970s overnight interest rates went from a low of 3% to a high of 20%. This was an especially tough time to be a bond investor as the surge in interest rates caused short-term principal losses and prolonged real losses. But there’s also an interesting and important lesson from the 1970s – higher bond yields create a sort of escape velocity at some point where the interest payments offset the interest rate risk

Read more on Discipline Funds

- Don't fret about lower bond prices. Bonds mature at par (Fortunes & Frictions)

- Sovereign Bonds: In search of safe havens (Aswath Damodaran)

- Keep calm and consider bonds (ETF Stream)

- Investing for immortals - how to invest if you have a long term horizon (Joachim Klement)

- The Cake/Fruit Salad Theory of Asset Allocation (Oblivious Investor)

UNDERSTAND FINANCIAL MARKETS

- Everything & Everyone Underperforms Eventually (A Wealth of Common Sense)

- Four Reasons Bond Yields Are Rising (Morningstar)

- The perils of long-term forecasts — GMO edition (FT.com - click on the first link)

- Visualizing $156 Trillion in U.S. Assets, by Generation (Visual Capitalist)

- The 4 big structural forces holding back China's economy (Bloomberg - 45 min)

- The investor sentiment cycle (Monevator)

HOW TO INVEST

Some cycling experiences profoundly changed me, but also my way of looking at investing. You may think that spending over a decade on Wall Street would teach me more about successful investing than cycling. Surprisingly, Wise Money is more about perspective than technicals. Here are 8 Investing lessons I learned from Cycling the World.

Active Investing

FACTOR investing

discretionary investing

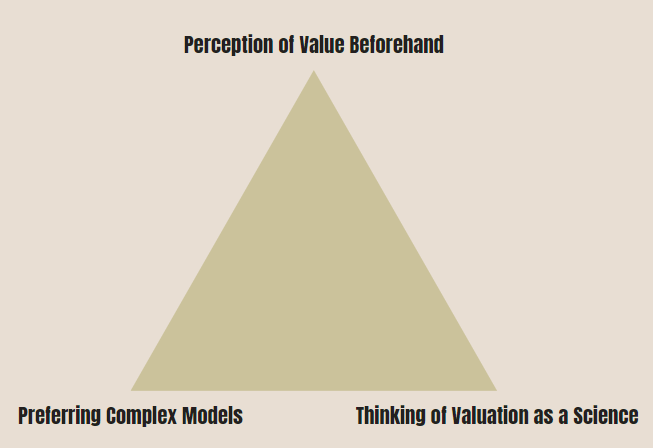

Aswath Damodaran is the ‘Dean of Valuation.’

For almost four decades, he has been teaching valuation at NYU. He also teaches millions of people online.

Here are 7 Key Valuation Lessons from him

Read more on Twitter

ALTERNATIVE ASSET CLASSES

WALL STREET

SUSTAINABLE investing

crypto

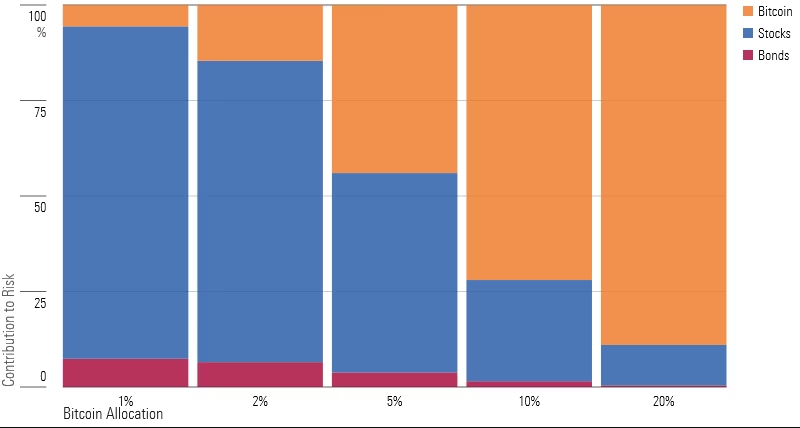

Bitcoin Index posted a 76.4% return through July 2023 in defiance of the gloomy narratives that haunt the rest of the cryptocurrency ecosystem. The trusty balanced portfolio has also beaten expectations as of late. So far in 2023, risk has paid handsomely. That fact may leave many investors wondering whether to add some extra firepower to their portfolio in the form of an allocation to bitcoin.

Read more on Morningstar

BAD BETS

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

PERSONAL FINANCE

Wealth Management

Early Retirement

While the thought of a mini-retirement can leave you feeling unstructured from your usual 9-5, it can usher in more time for hobbies, side hustles, or even new jobs! So, while your journey to FI may be filled with rules and guidelines set in place to help you reach your FI goal, remember that there is no harm in taking an active rest in order to restructure your goals and re-motivate you!

FINANCIAL PRODUCTS

COST OF LIVING

OUR Community

Question of the week

Personal Development

Justin Gary is an award-winning designer, author, speaker, and entrepreneur. He is CEO of Stone Blade Entertainment and creator of the innovative and award-winning Ascension deck-building game series. Explore the path less travelled, the phenomenon of magic, how analytical people can become creative people & much more!

- A journey through the treasures and trophies phase of life. (Indeedably)

- Are you are a part of the cult of never enough? If your children aren't already telling you, your body may well be (Morningstar)

- Textbook view of money and happiness (Humble Dollar)

- Your memory is lying to you. About handwritten journalling. (Infinite Loop)

Health & Wellness

CAREERS

Travel

Between 2019 and 2023, I spent close to a year in Japan. I cycled over 4,000 km from Hokkaido to Okinawa. Here are some tips on how you can make the best of your trip to the country of the rising sun. When to go, where to go (to avoid the touristy parts), navigation, avoiding natural disasters, and travelling cheaply.

Here are the best tips.

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

miscellaneous

OUR Community

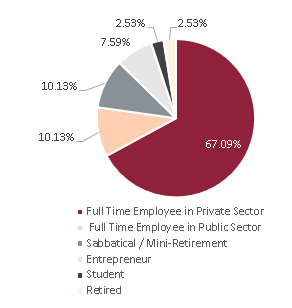

Last Week We asked you

How would you describe your current life situation?

SUGGEST AN ARTICLE

Thank you for reading.

Good Luck & keep’em* rolling!

(* Wheels & Dividends)

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – BlackRock Launches New iBonds, Truth About €1M Broker Insurance & BOW is 4 years old!

The Truth About €1 Million Broker Guarantees

4 Things I Learned In 4 Years Of Running A Finance Blog

Dodl By AJ Bell Review – AJ Bell’s Younger Brother

Vanguard LifeStrategy Review – A Retriever In A Babushka Doll

Why Do Portfolio Managers Care About Factors? It’s Not What You Think.

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.