Weekend Reading – AQR Destroys The 100% Equity Case: It’s Silly.

Weekend Reading is a collection of Investment Research and Lifestyle topics from all corners of the Web. We source the highest quality insights from Wall Street and Main Street that you may apply to your investment process. Unlike the rest of Bankeronwheels.com, this series is provided without additional guidance. As usual, everything is to be used at your own risk. Below is the type of content we shortlist:

When drinking with traders, stay one drink behind, and shut up.

Bob Pasani

Featured

DEGIRO stands out as an appealing option for those seeking an affordable broker. While it might slightly edge higher in costs compared to its rivals, it compensates with transparency— a rare find among many VC-backed direct competitors.

Want to diversify your Brokers? DEGIRO could be an option. Read our review below.

Portfolio Construction

Asset Allocation

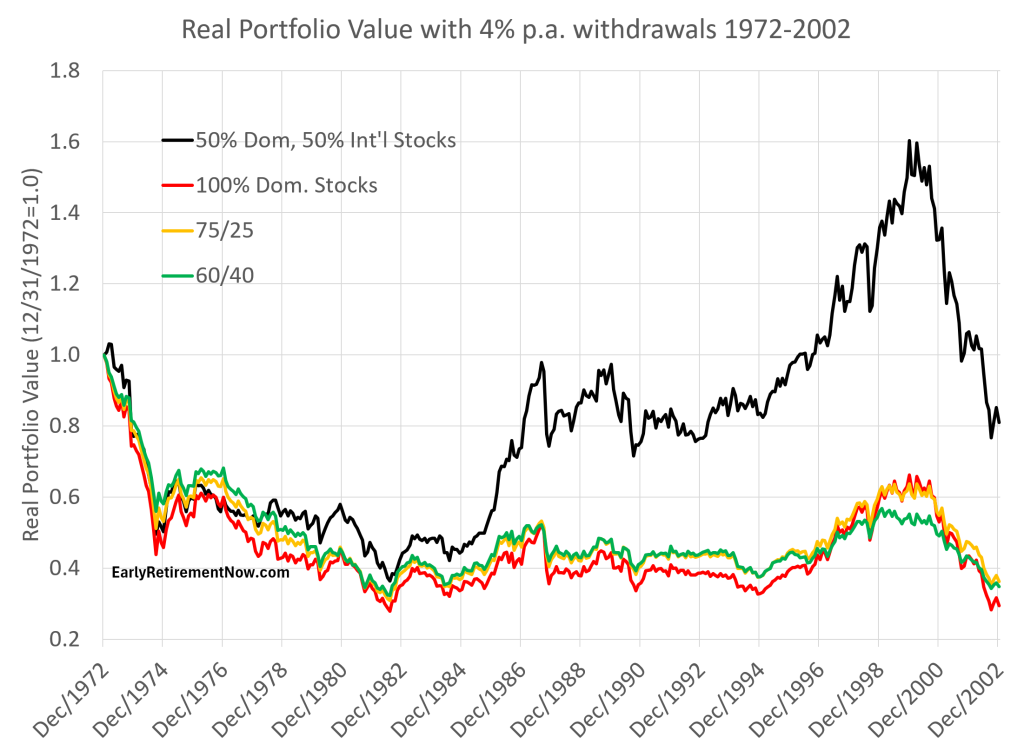

Three finance professors claim that a 100% stocks portfolio, 50% domestic and 50% international stocks, would have consistently outperformed all other conventional wisdom asset allocations, e.g., 60/40, glidepaths in target date funds, etc. Quite a sweeping claim! They claim they have the empirical evidence to prove it. I have my doubts, though. Let’s take a look.

Read more on Early Retirement Now

UNDERSTAND FINANCIAL MARKETS

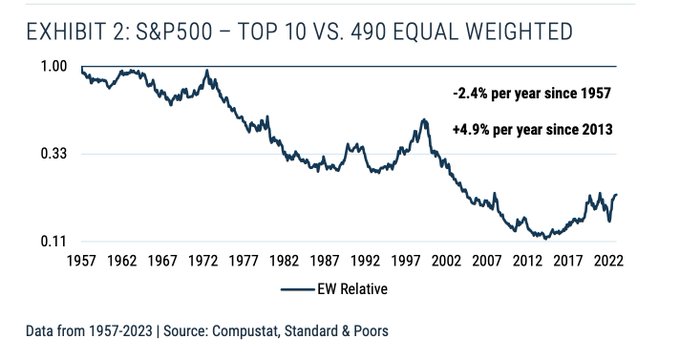

Since 1957, the 10 largest stocks underperformed the 490 stocks by 2.4% (GMO)

Since 1957, the 10 largest stocks in the S&P 500 have underperformed an equal-weighted index of the remaining 490 stocks by 2.4% per year. But the last decade has been a very notable departure from that trend, with the largest 10 outperforming by a massive 4.9% per year on average.

HOW TO INVEST

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

Active Investing

FACTOR investing

discretionary investing

ALTERNATIVE ASSET CLASSES

Phil sits down with Randall Zisler to discuss real estate and REITs. Randall is the co-founder of Zisler Capital Associates and a highly respected academic with a number of works on real estate investing, economics, and finance. In his conversation with Phil, he shares a wealth of knowledge pertaining to real estate valuations, REITs, public vs private real estate investment, and more.

WALL STREET

This week, we speak with David Einhorn. president of Greenlight Capital. He launched the value-oriented in 1996. Since inception, Greenlight has generated about 13% annually, and ~290o% total return versus the S&P500’s 1117% total and 9.5% annual returns. He famously shorted Allied Capital in the 2ooos and Lehman Brothers about a year before it collapsed into bankruptcy in 2008.

Crown to Dust - Downfall of America's Largest Bank | Citibank Documentary. (FinAIus - 46 min)

Citibank: once a kingmaker, now a cautionary tale. Welcome to Bailout Boulevard! We dig through the wreckage of America’s largest bank, tracing the greed from Wall Street penthouses to boarded-up Main Streets. “Crown to Dust” exposes the hubris that brought an empire to its knees, leaving a nation gasping for air. Buckle up, it’s a thrilling ride you won’t want to miss.

SUSTAINABLE investing

BAD BETS

UCITS ETFS

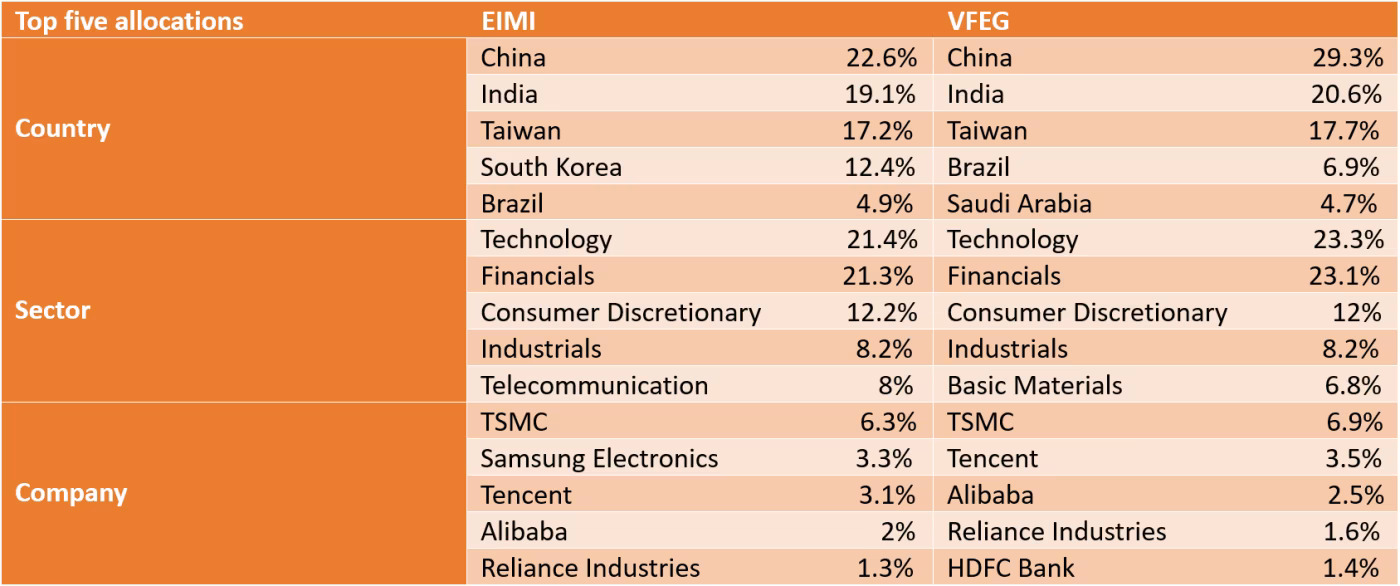

After a ‘lost decade’ spelled triple-digit underperformance for emerging markets, investors hunting for diversification and a comeback in developing economies may seek out ETFs such as those offered by BlackRock and Vanguard.

Read more on ETF Stream

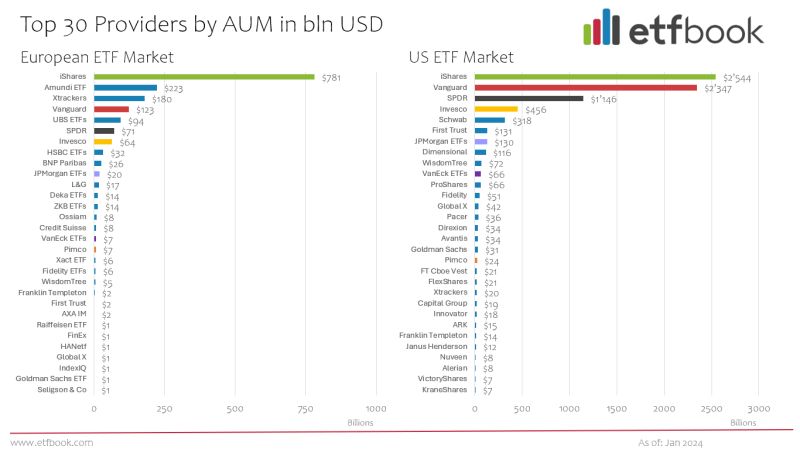

ETF Book Provided an updated overview of the US and European ETF markets by leading Issuers. US ETF market: AUM $7.96 trillion – European ETF market: AUM $1.81 trillion. iShares is leading in the US, but Vanguard is closing the gap. In Europe, iShares is much more dominant.

US ETFs

BlackRock is set to launch ten ETFs focused on Treasury inflation-protected securities (TIPS). Ranging in maturity from 2024 to 2033, these ETFs will seek to provide inflation protection to investors concerned with erosion of purchasing power. The new TIPS-defined maturity bond ETFs will carry an expense ratio of 0.1%. [ETF.com]

Wealth Management

Personal Finance

When choosing a broker, investors face a myriad of considerations, from safety measures to fee structures and beyond. Bankeronwheels.com takes a unique approach to broker comparison, designed with the discerning investor in mind. Here’s how we guide you through making an informed decision.

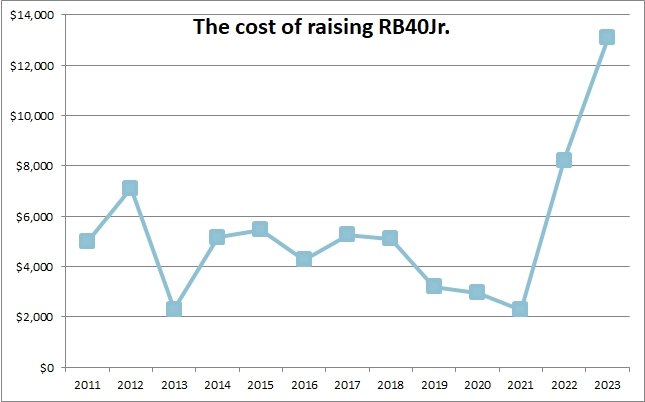

Early Retirement

Kids can be expensive, but don’t let that stop you. They might change your plan a bit, but FIRE won’t be out of reach. You just have to adapt your plan to include them. Many parents are inspired to work harder than ever after they have kids. However, I choose to go the frugal route instead.

Read more on Retire by 40

Personal Development

In this episode, we are joined, for the third time, by renowned author and commentator Morgan Housel. Many of you are familiar with Morgan’s bestseller, The Psychology of Money, and he is back to discuss his latest book, Same as Ever: A Guide to What Never Changes.

Health & Wellness

CAREERS & Entrepreneurship

Travel

“Nomadland” is a video from Ricard Calmet that takes viewers on a bikepacking journey through Mongolia’s serene mountains and painterly steppe. From feeling completely alone on remote tracks to being embraced by hospitable locals, their 1,800-kilometer ride was packed with unforgettable experiences. Find the 13-minute video with photos and a written perspective here.

Read more on Bikepacking.com

Tech & Economy

economy

TECH AND SCIENCE

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

And finally

Singapore’s Dirty Money Problem (Bloomberg )

Singapore has long been a haven for the super wealthy, with its low taxes, safety and stability.Threatening to upend that carefully crafted image, however, is a sprawling $2.2 billion money laundering scandal. Though the vast majority of investment in the city-state is above board, its famous openness to inflows is now under scrutiny.

Bankeronwheels.com, born during the COVID pandemic, began as a personal blog blending cycling with investing insights.

By 2023, the blog had exceeded any growth expectations we had. Today, we want to make the blog the most impactful to our readers.

And there was no better than asking your opinion on how to bring it to the next level. Here are some takeaways from our last month’s survey.

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – BlackRock Launches New iBonds, Truth About €1M Broker Insurance & BOW is 4 years old!

The Truth About €1 Million Broker Guarantees

4 Things I Learned In 4 Years Of Running A Finance Blog

Dodl By AJ Bell Review – AJ Bell’s Younger Brother

Vanguard LifeStrategy Review – A Retriever In A Babushka Doll

Why Do Portfolio Managers Care About Factors? It’s Not What You Think.

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.